Three Reasons We Love AZZ

AZZ has been treading water for the past six months, recording a small return of 2.5% while holding steady at $86.20. The stock also fell short of the S&P 500’s 10.9% gain during that period.

Given the weaker price action, is now a good time to buy AZZ? Or should investors expect a bumpy road ahead? Find out in our full research report, it’s free.

Why Are We Positive On AZZ?

Responsible for projects like nuclear facilities, AZZ (NYSE: AZZ) is a provider of metal coating and power infrastructure solutions.

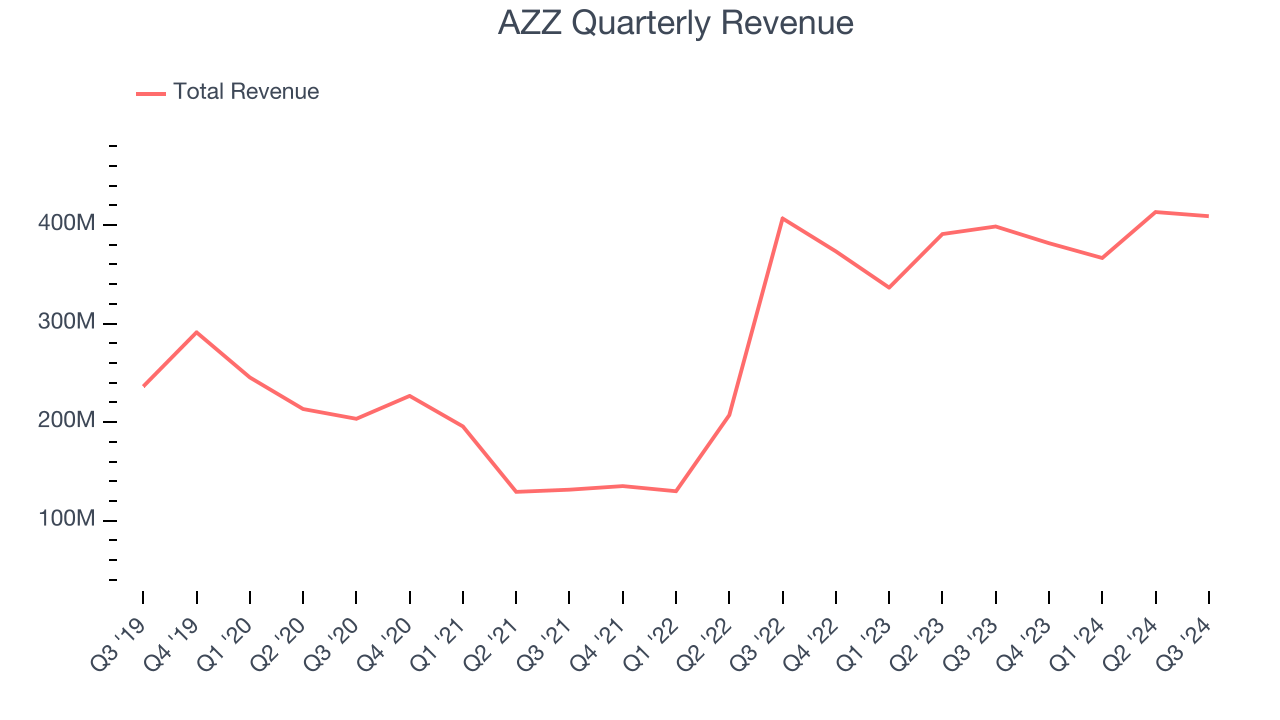

1. Long-Term Revenue Growth Shows Strong Momentum

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one sustains growth for years. Thankfully, AZZ’s 10.3% annualized revenue growth over the last five years was solid. Its growth beat the average industrials company and shows its offerings resonate with customers.

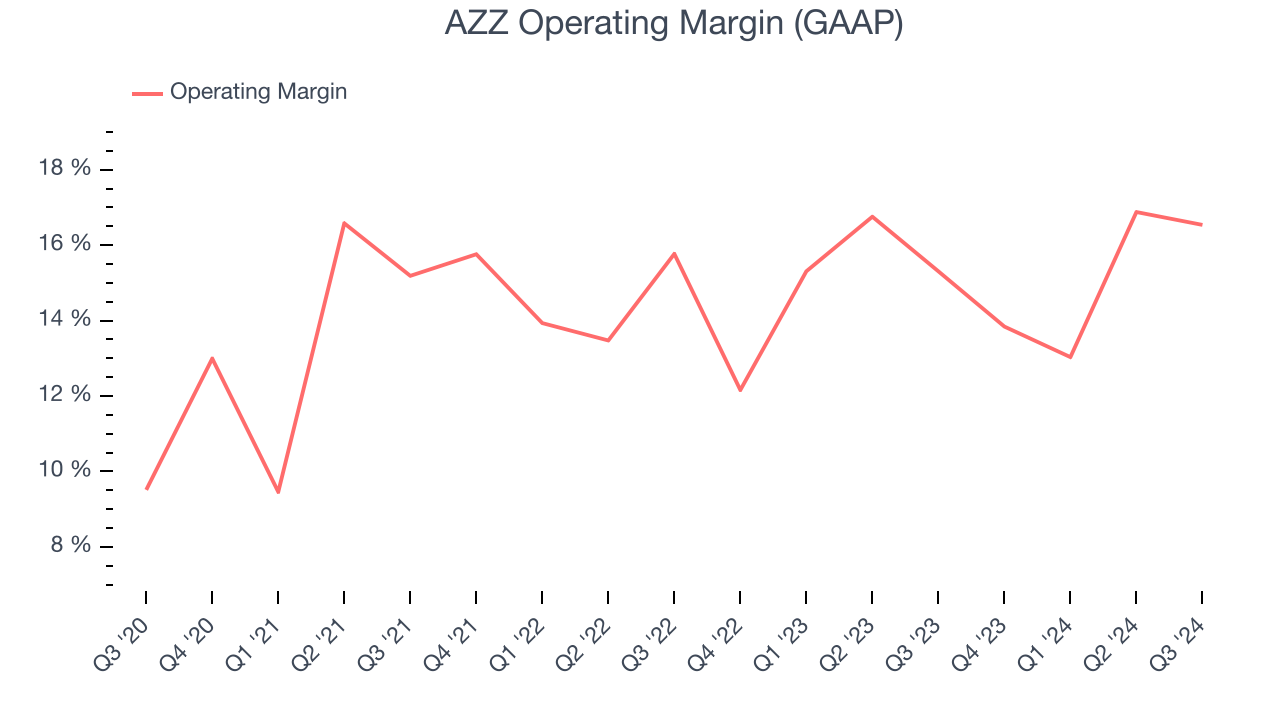

2. Operating Margin Rising, Profits Up

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Looking at the trend in its profitability, AZZ’s annual operating margin rose by 6 percentage points over the last five years, as its sales growth gave it immense operating leverage. Its operating margin for the trailing 12 months was 15.2%.

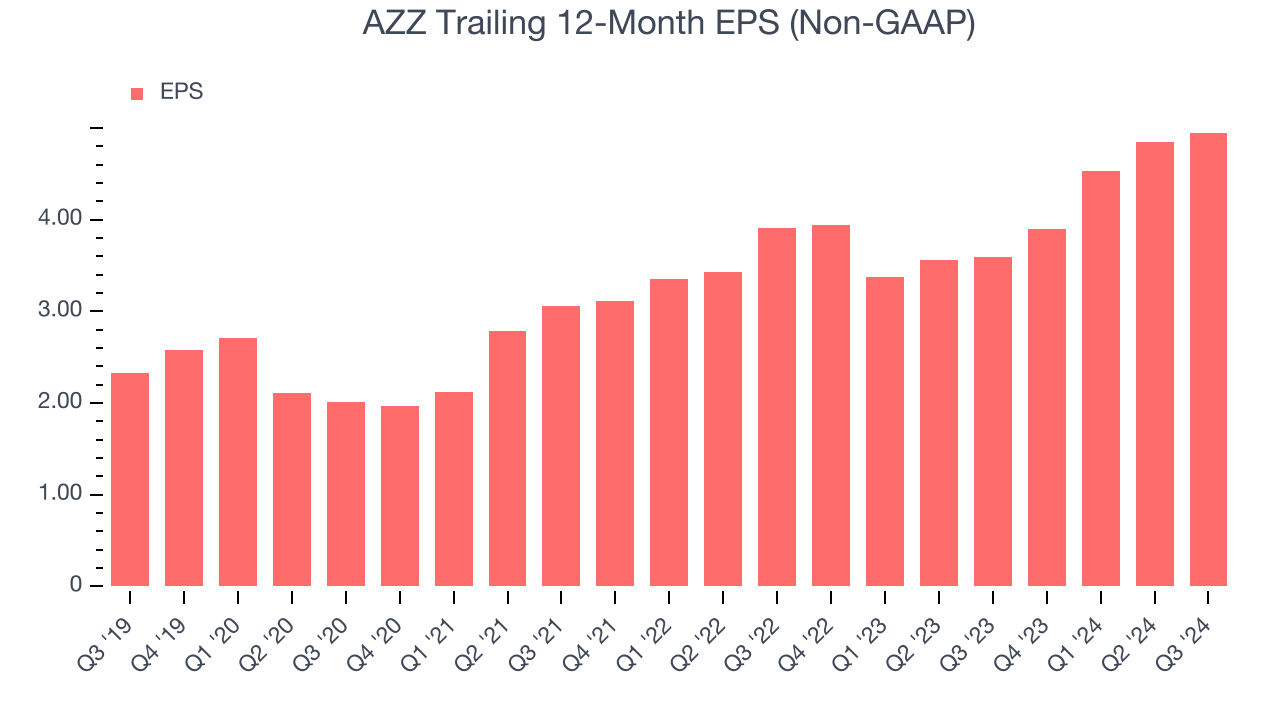

3. Long-Term EPS Growth Is Outstanding

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

AZZ’s EPS grew at a spectacular 16.3% compounded annual growth rate over the last five years, higher than its 10.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

These are just a few reasons why we think AZZ is a high-quality business. With its shares trailing the market in recent months, the stock trades at 16.9x forward price-to-earnings (or $86.20 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than AZZ

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.