Zscaler (ZS) Post Q2 Earnings: Buy, Sell, or Hold?

Zscaler currently trades at $206.71 and has been a dream stock for shareholders. It’s returned 355% since November 2019, blowing past the S&P 500’s 90.5% gain. The company has also beaten the index over the past six months as its stock price is up 16.8%.

Is it too late to buy ZS? Find out in our full research report, it’s free.

Why Is Zscaler a Good Business?

After successfully selling all four of his previous cybersecurity companies, Jay Chaudhry's fifth venture, Zscaler (NASDAQ: ZS) offers software-as-a-service that helps companies securely connect to applications and networks in the cloud.

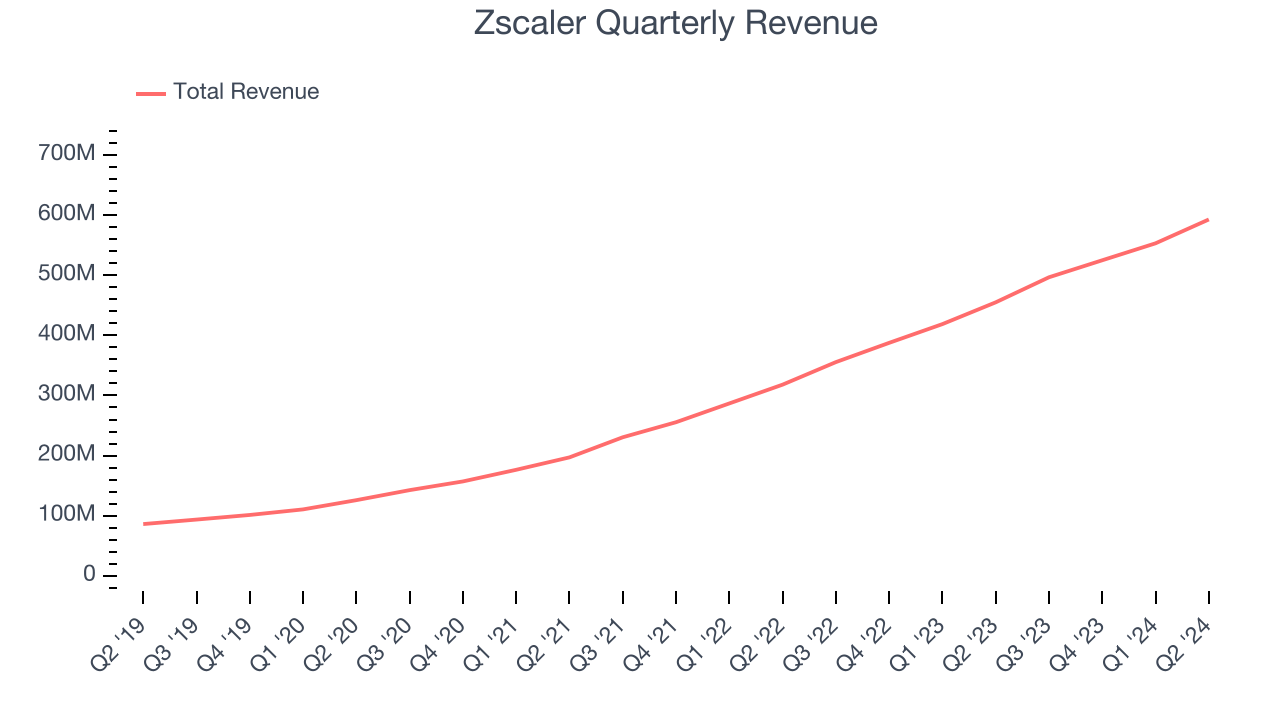

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Zscaler’s 47.7% annualized revenue growth over the last three years was incredible. Its growth surpassed the average software company and shows its offerings resonate with customers.

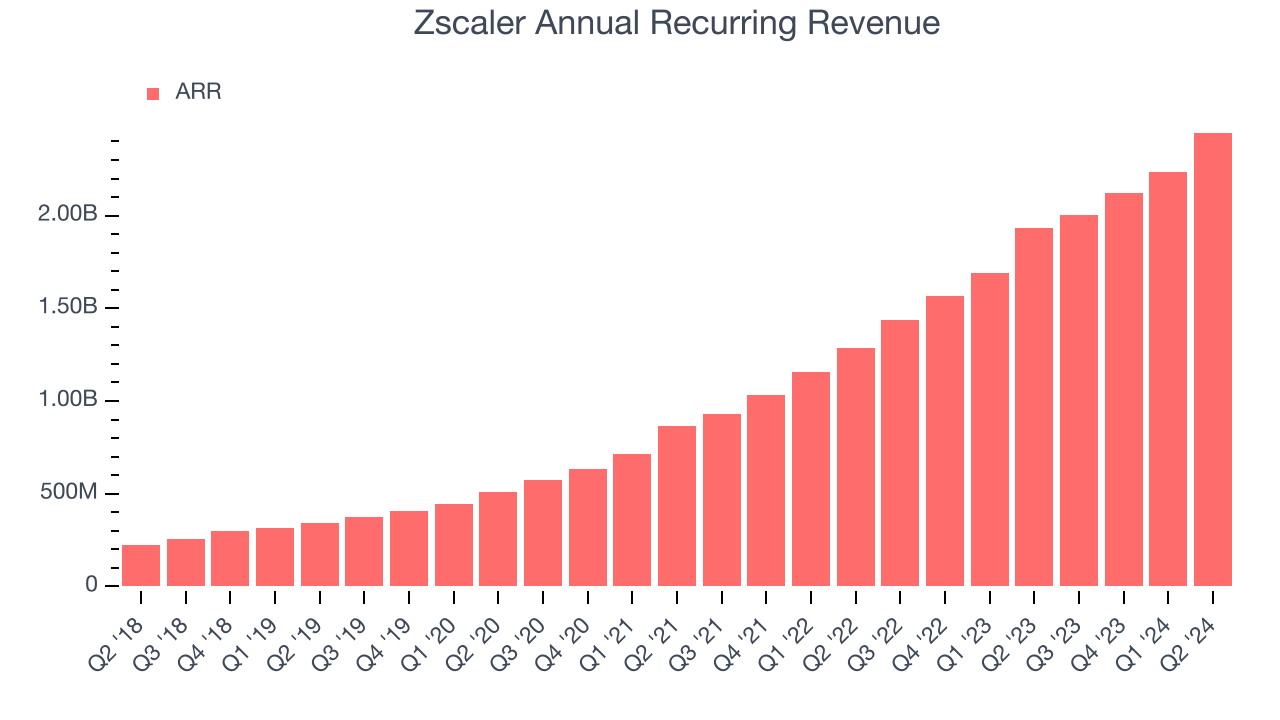

2. ARR Surges as Recurring Revenue Flows In

Investors interested in Zscaler should track its annual recurring revenue (ARR) in addition to reported revenue. While reported revenue for a SaaS company can include low-margin items like implementation fees, ARR is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Zscaler’s ARR punched in at $2.45 billion in Q2, and over the last four quarters, its growth averaged 33.4% year-on-year increases. This performance was fantastic and shows that customers are willing to take multi-year bets on the company’s technology. Its growth also makes Zscaler a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

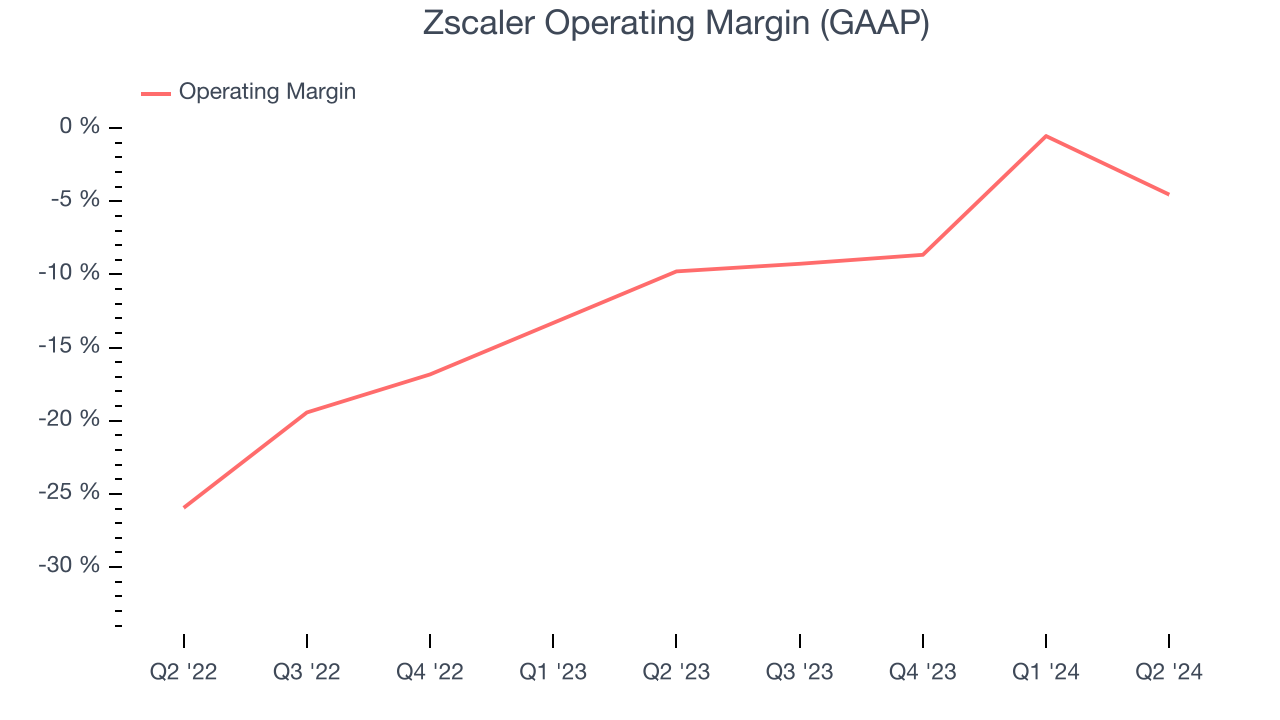

3. Operating Margin Rising, Profits Up

While many software businesses point investors to their adjusted operating margin, which excludes stock-based compensation (SBC), we prefer GAAP reporting because SBC is a legitimate expense used to attract and retain engineering and sales talent. This metric is a key measure of profitability reflecting a company's earnings before taxes and interest on debt.

Over the last year, Zscaler’s expanding sales gave it operating leverage as its margin rose by 8.9 percentage points. Although its operating margin for the trailing 12 months was negative 5.6%, we’re confident it can one day reach sustainable profitability.

Final Judgment

These are just a few reasons why we're bullish on Zscaler, and with its shares topping the market in recent months, the stock trades at 11.7x forward price-to-sales (or $206.71 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Zscaler

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.