3 Reasons to Sell HD and 1 Stock to Buy Instead

Home Depot’s 30.4% return over the past six months has outpaced the S&P 500 by 17.4%, and its stock price has climbed to $428.67 per share. This performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Home Depot, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.We’re glad investors have benefited from the price increase, but we don't have much confidence in Home Depot. Here are three reasons why there are better opportunities than HD and a stock we'd rather own.

Why Is Home Depot Not Exciting?

Founded and headquartered in Atlanta, Georgia, Home Depot (NYSE: HD) is a home improvement retailer that sells everything from tools to building materials to appliances.

1. Long-Term Revenue Growth Disappoints

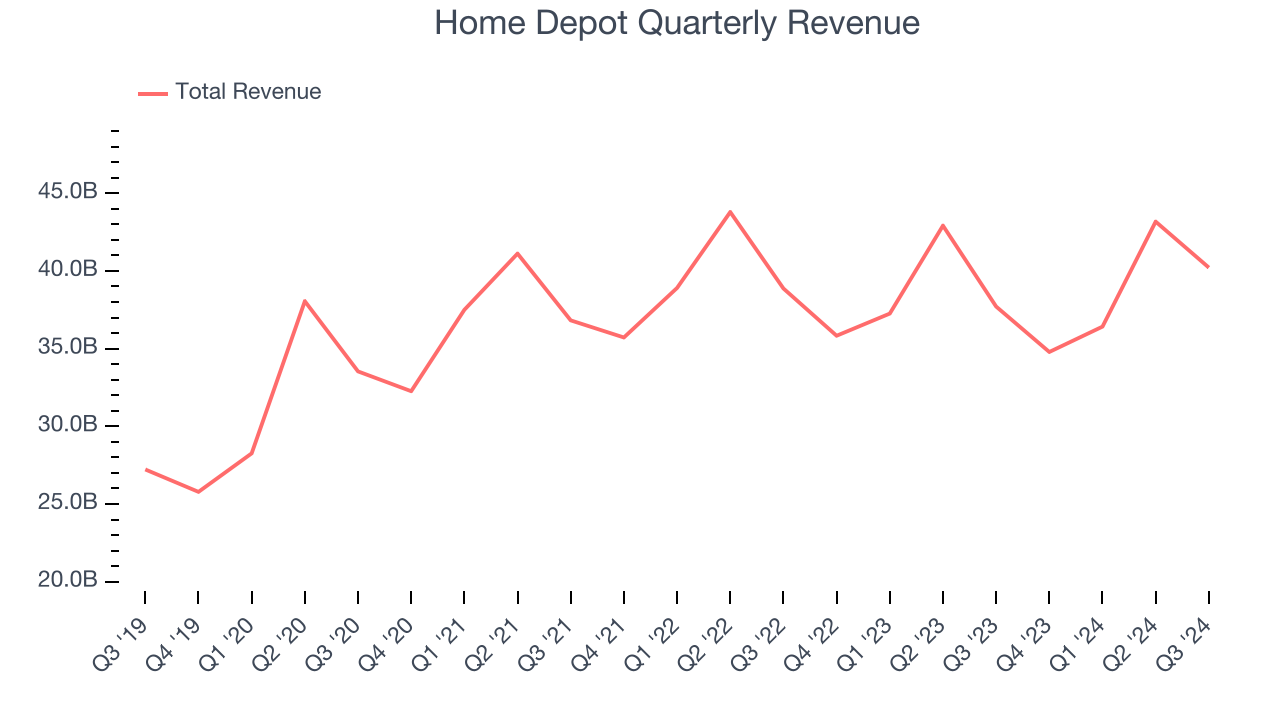

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Home Depot’s 6.9% annualized revenue growth over the last five years was tepid. This was below our standard for the consumer retail sector.

2. Fading Same-Store Sales Indicate Waning Demand

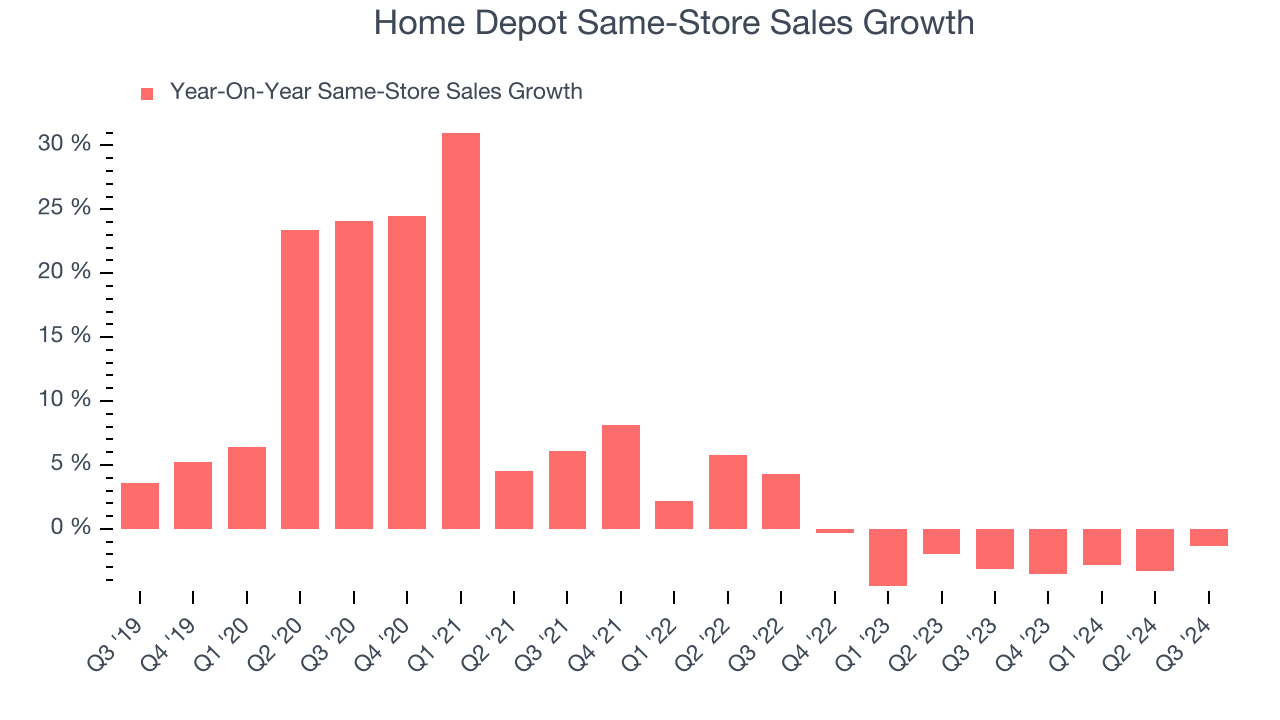

Same-store sales is a key performance indicator used to measure organic growth at brick-and-mortar shops for at least a year.

Home Depot’s demand has been shrinking over the last two years as its same-store sales have averaged 2.6% annual declines.

3. Low Gross Margin Limits Options

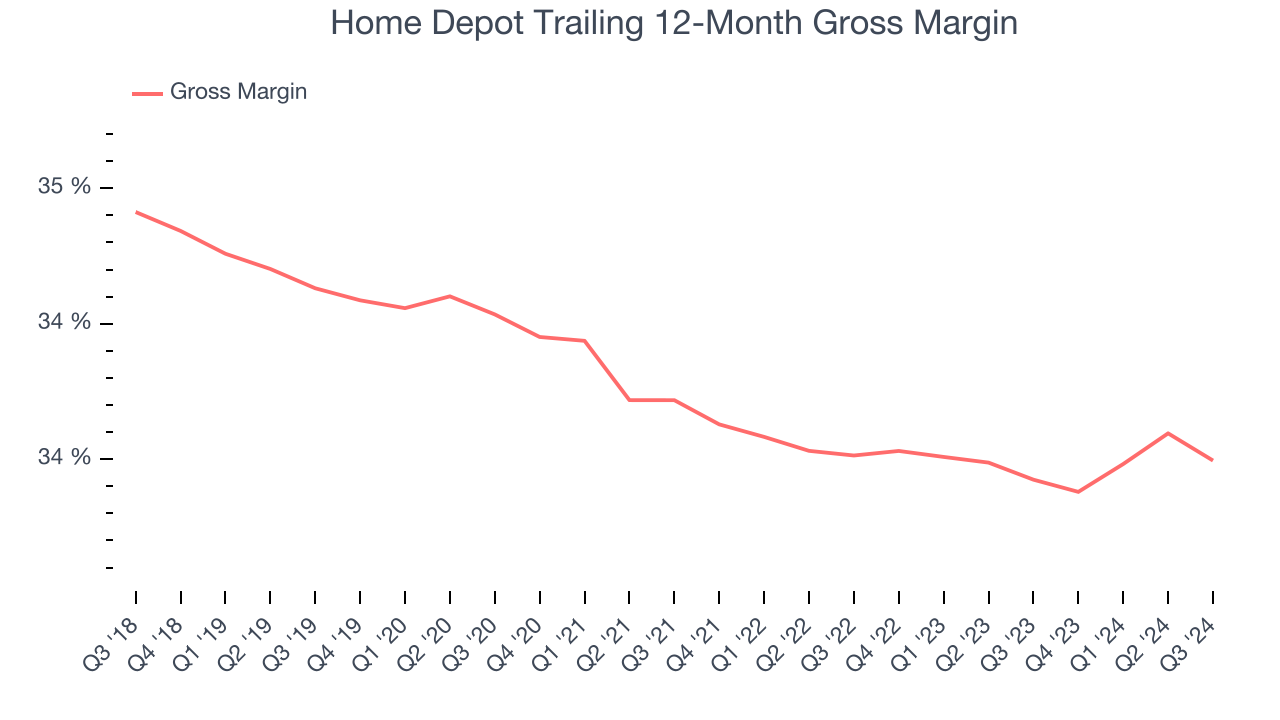

At StockStory, we prefer high gross margin businesses because they indicate pricing power or differentiated products, giving the company a chance to generate higher operating profits.

Home Depot’s gross margin is slightly below the average retailer, giving it less room to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged a 33.5% gross margin over the last two years. That means Home Depot paid its suppliers a lot of money ($66.54 for every $100 in revenue) to run its business.

Final Judgment

Home Depot isn’t a terrible business, but it doesn’t pass our bar. With its shares topping the market in recent months, the stock trades at 27.6x forward price-to-earnings (or $428.67 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better opportunities elsewhere. We’d suggest looking at Chipotle, which surprisingly still has a long runway for growth.

Stocks We Would Buy Instead of Home Depot

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.