Three Reasons We Love General Electric

General Electric trades at $184.79 per share and has stayed right on track with the overall market, gaining 9.6% over the last six months while the S&P 500 has returned 13.4%.

Is now a good time to buy GE? Find out in our full research report, it’s free.

Why Is GE a Good Business?

One of the original 12 companies on the Dow Jones Industrial Average, General Electric (NYSE: GE) is a multinational conglomerate providing technologies for various sectors including aviation, power, renewable energy, and healthcare.

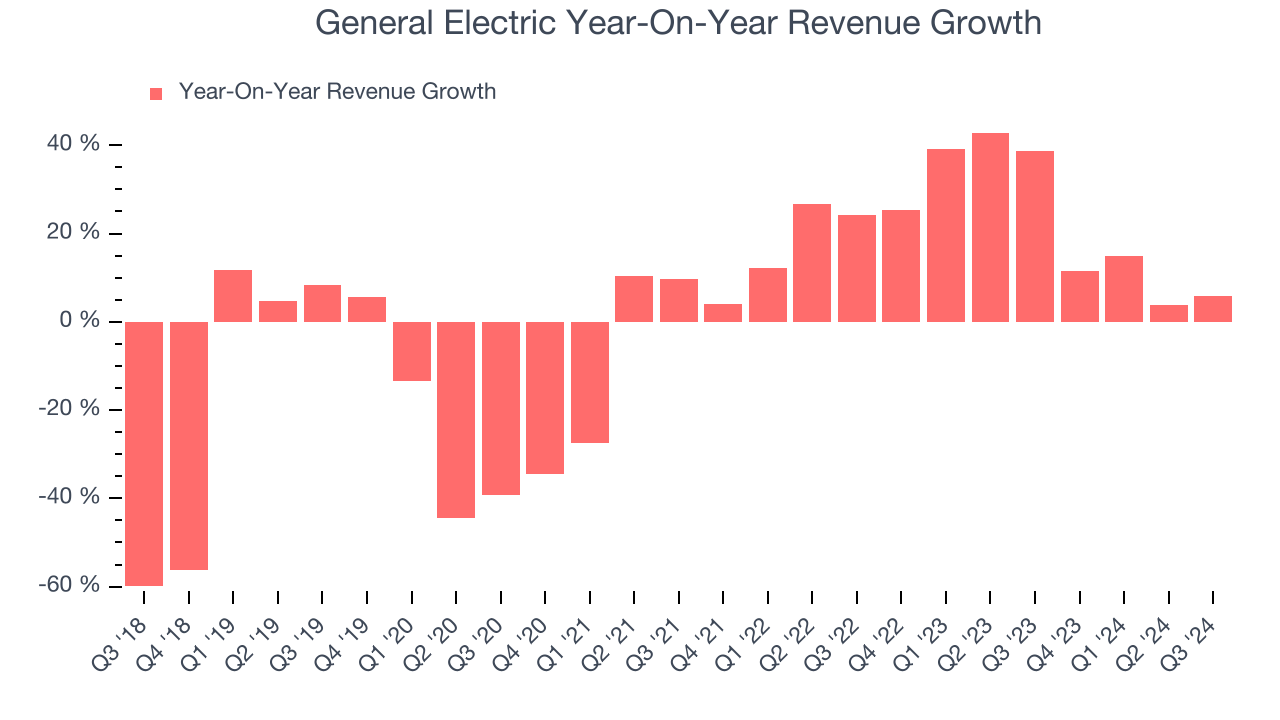

1. Skyrocketing Revenue Shows Strong Momentum

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. General Electric’s annualized revenue growth of 21.8% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

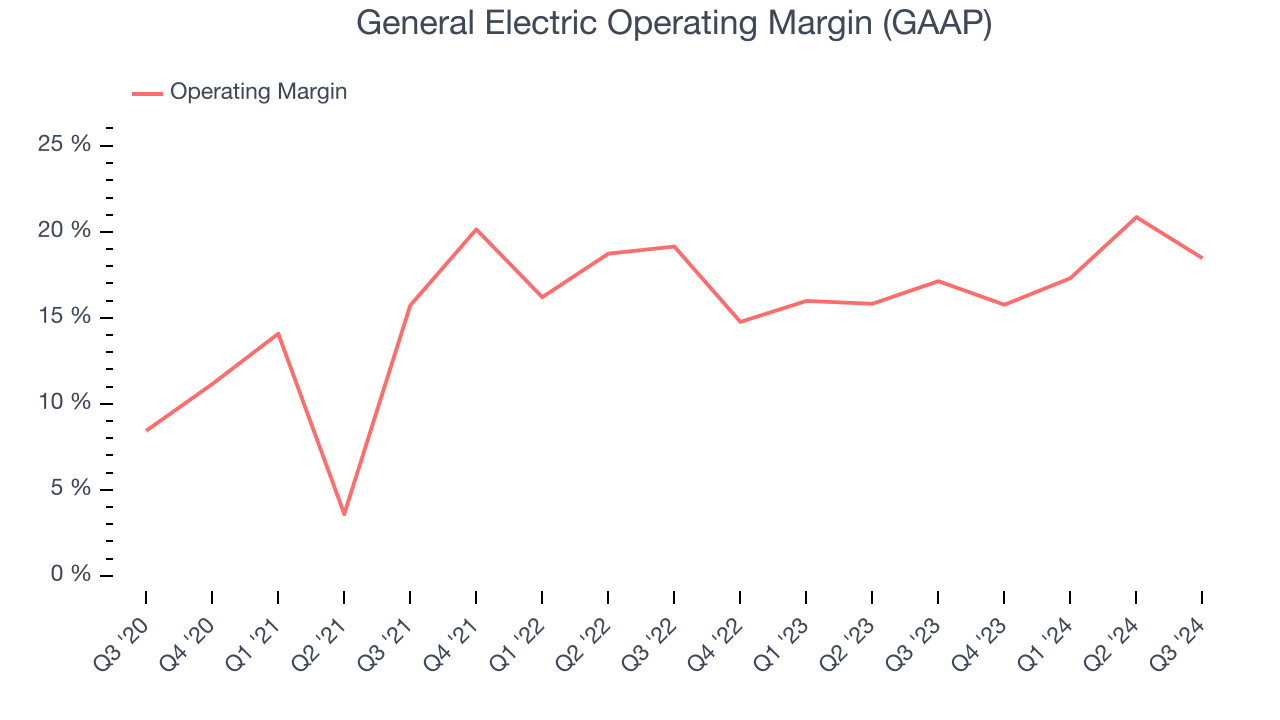

2. Operating Margin Rising, Profits Up

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Analyzing the trend in its profitability, General Electric’s annual operating margin rose by 5.6 percentage points over the last five years, showing its efficiency has meaningfully improved. Its operating margin for the trailing 12 months was 18.2%.

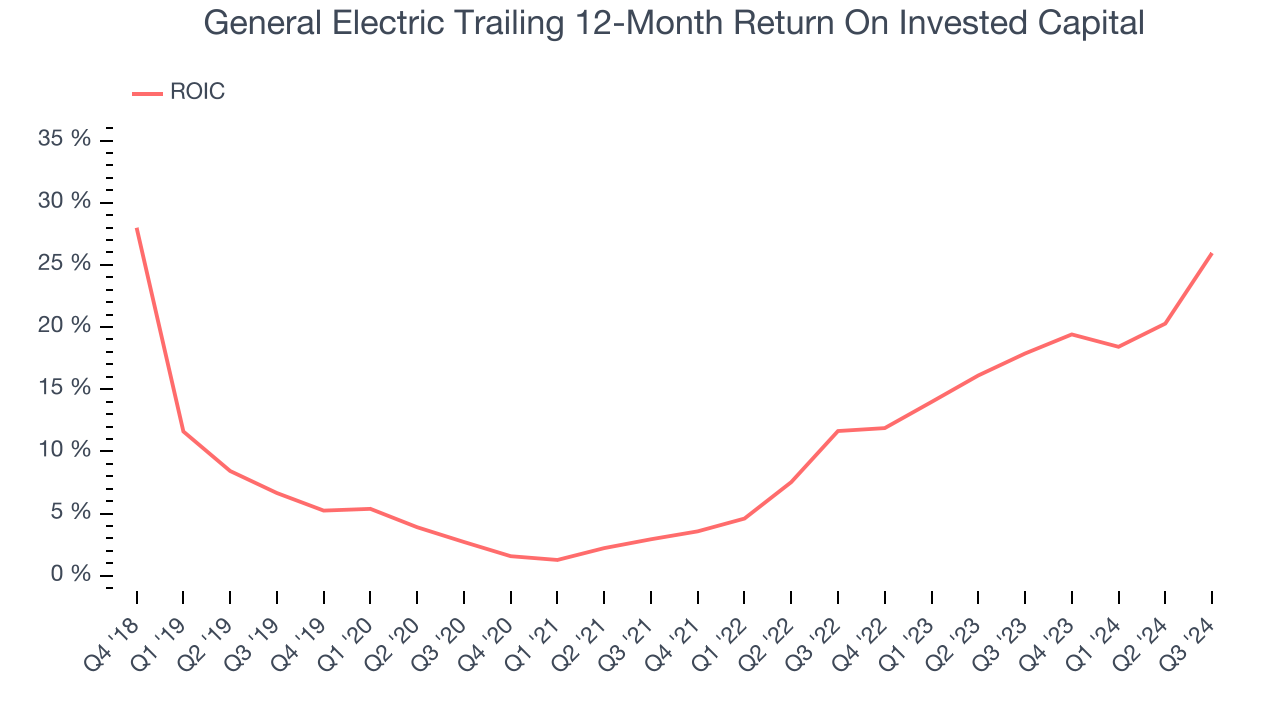

3. New Investments Bear Fruit as ROIC Jumps

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Fortunately, General Electric’s ROIC has increased significantly over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

Final Judgment

These are just a few reasons why we think General Electric is a great business, but at $184.79 per share (or 38.5x forward price-to-earnings), is now the right time to buy the stock? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than General Electric

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.