3 Reasons to Sell BARK and 1 Stock to Buy Instead

Bark has been on fire lately. In the past six months alone, the company’s stock price has rocketed 77.4%, reaching $2.20 per share. This run-up might have investors contemplating their next move.

Is now the time to buy Bark, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.Despite the momentum, we don't have much confidence in Bark. Here are three reasons why there are better opportunities than BARK and a stock we'd rather own.

Why Is Bark Not Exciting?

Making a name for itself with the BarkBox, Bark (NYSE: BARK) specializes in subscription-based, personalized pet products.

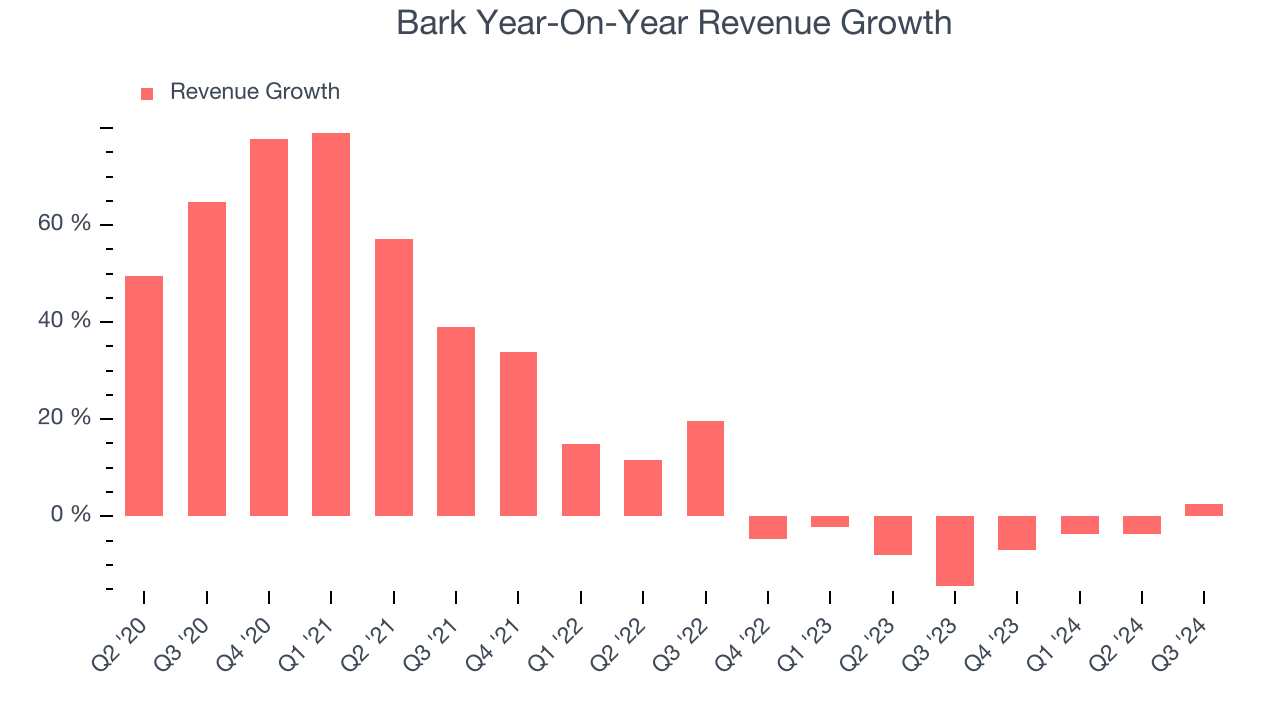

1. Revenue Tumbling Downwards

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Bark’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 5.3% over the last two years.

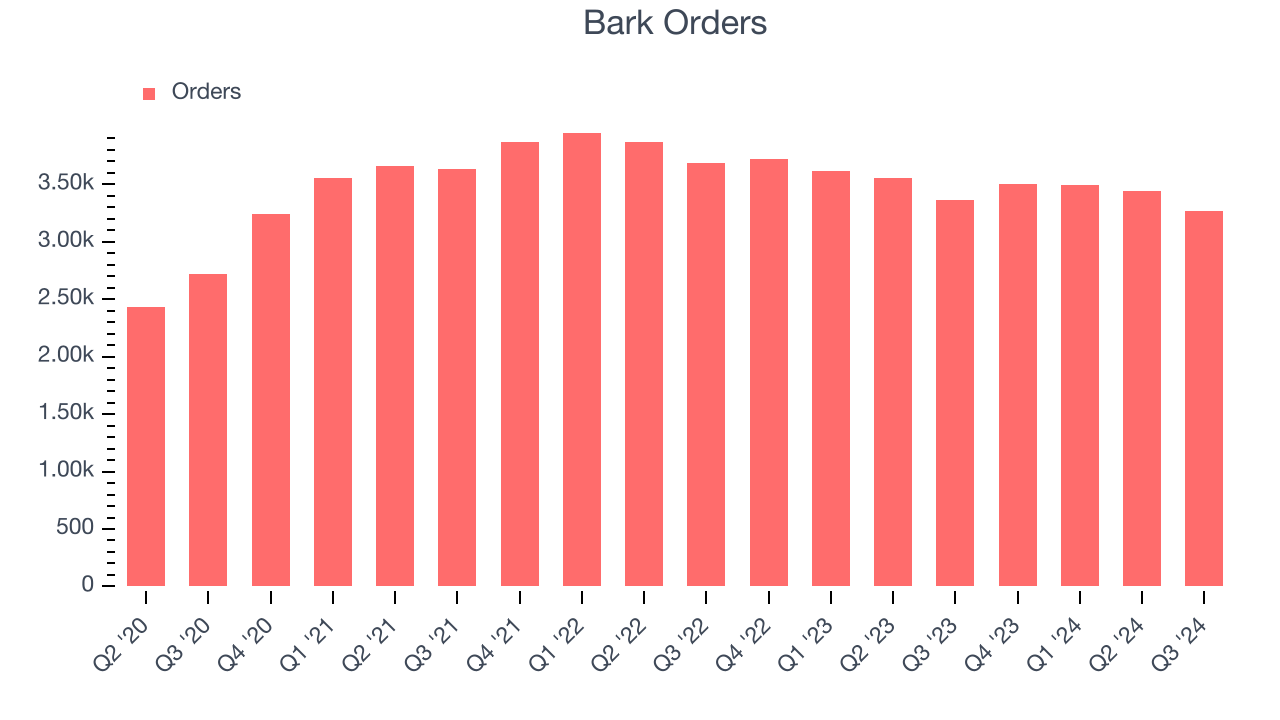

2. Decline in Orders Points to Weak Demand

Revenue growth can be broken down into changes in price and volume (for companies like Bark, our preferred volume metric is orders). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Bark’s orders came in at 3,270 in the latest quarter, and over the last two years, averaged 5.5% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Bark might have to lower prices or invest in product improvements to grow, factors that can hinder near-term profitability.

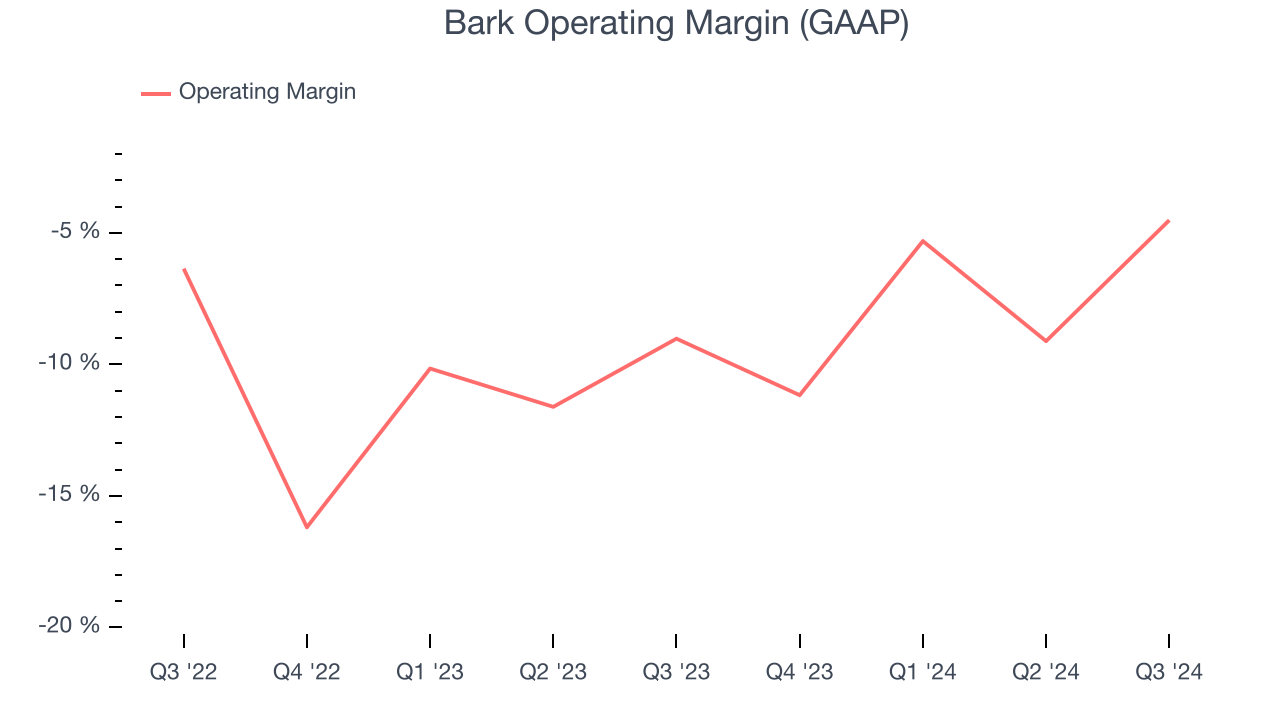

3. Operating Losses Sound the Alarms

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Bark’s operating margin has risen over the last 12 months, but it still averaged negative 9.7% over the last two years. This is due to its large expense base and inefficient cost structure.

Final Judgment

Bark isn’t a terrible business, but it doesn’t pass our quality test. After the recent rally, the stock trades at 88.1x forward EV-to-EBITDA (or $2.20 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better opportunities elsewhere. We’d recommend looking at The Trade Desk, the nucleus of digital advertising.

Stocks We Would Buy Instead of Bark

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.