Three Reasons to Avoid INTC and One Stock to Buy Instead

What a brutal six months it’s been for Intel. The stock has dropped 23.9% and now trades at $23.63, rattling many shareholders. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Intel, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.Even though the stock has become cheaper, we're sitting this one out for now. Here are three reasons why we avoid INTC and a stock we'd rather own.

Why Do We Think Intel Will Underperform?

Inventor of the x86 processor that powered decades of technological innovation in PCs, data centers, and numerous other markets, Intel (NASDAQ: INTC) is a leading manufacturer of computer processors and graphics chips.

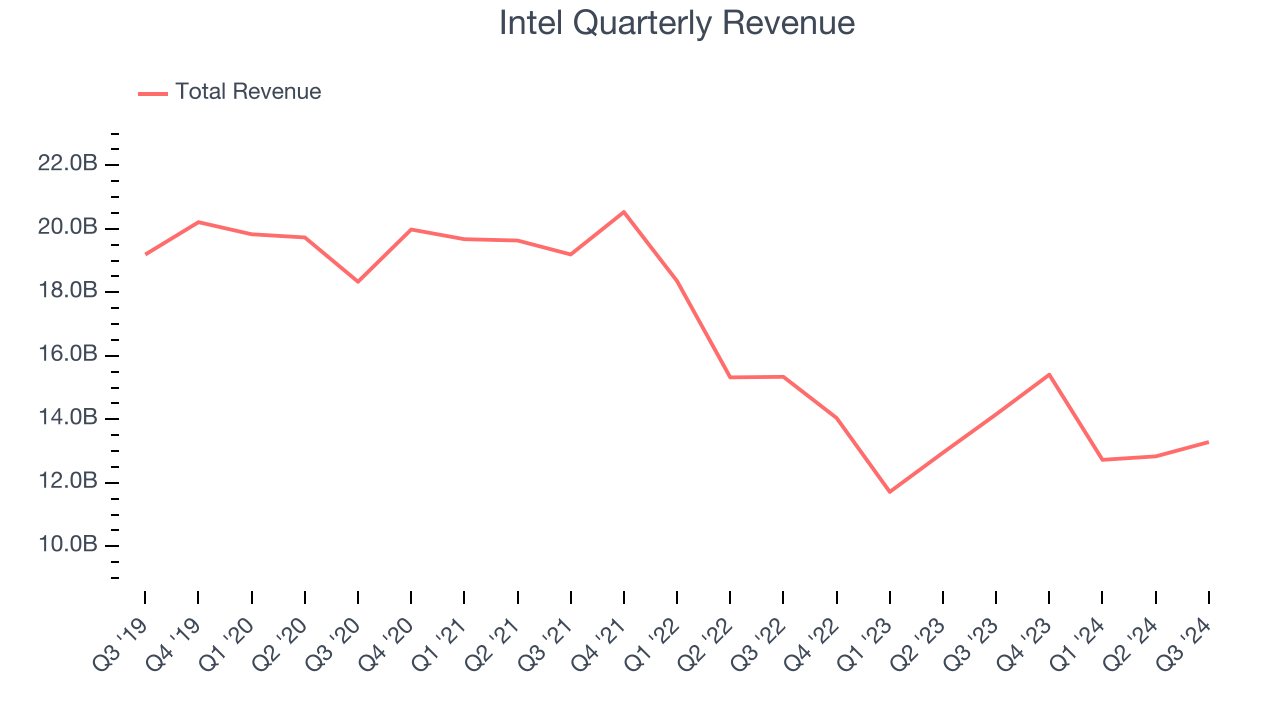

1. Revenue Spiraling Downwards

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Intel’s demand was weak and its revenue declined by 5.1% per year. This was below our standards and signals it’s a low quality business. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

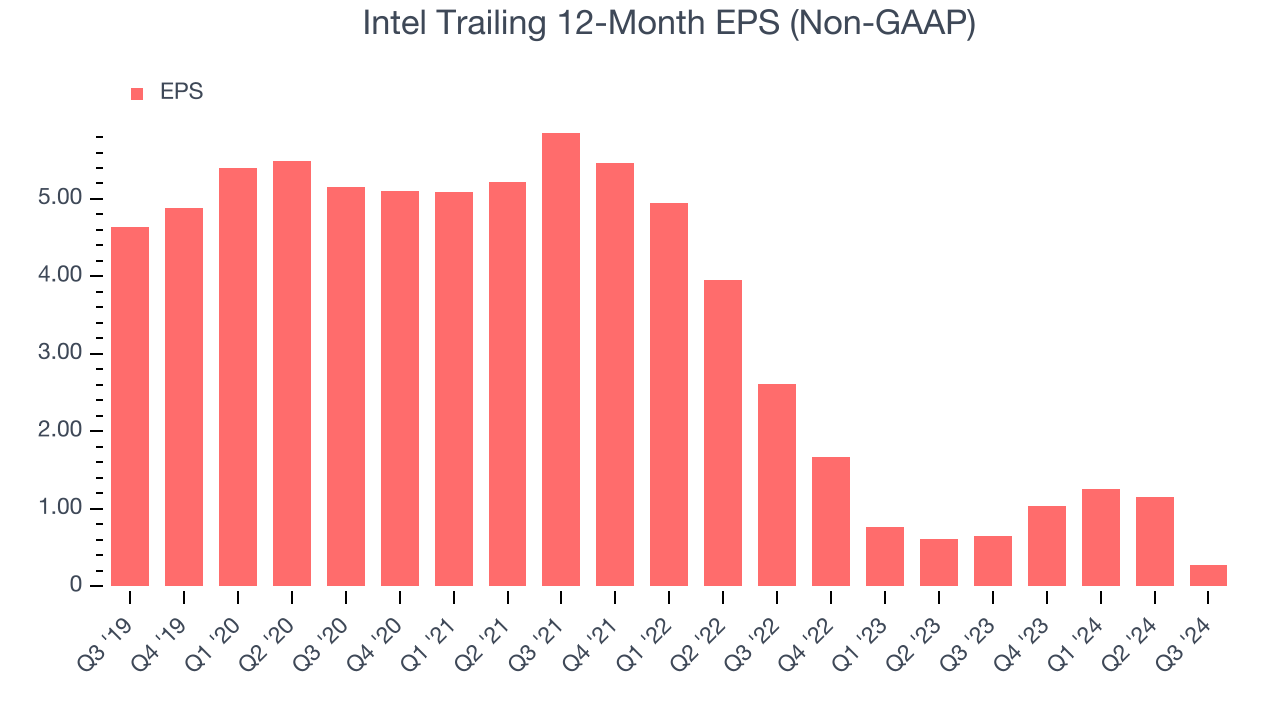

2. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Intel, its EPS declined by more than its revenue over the last five years, dropping 43% annually. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

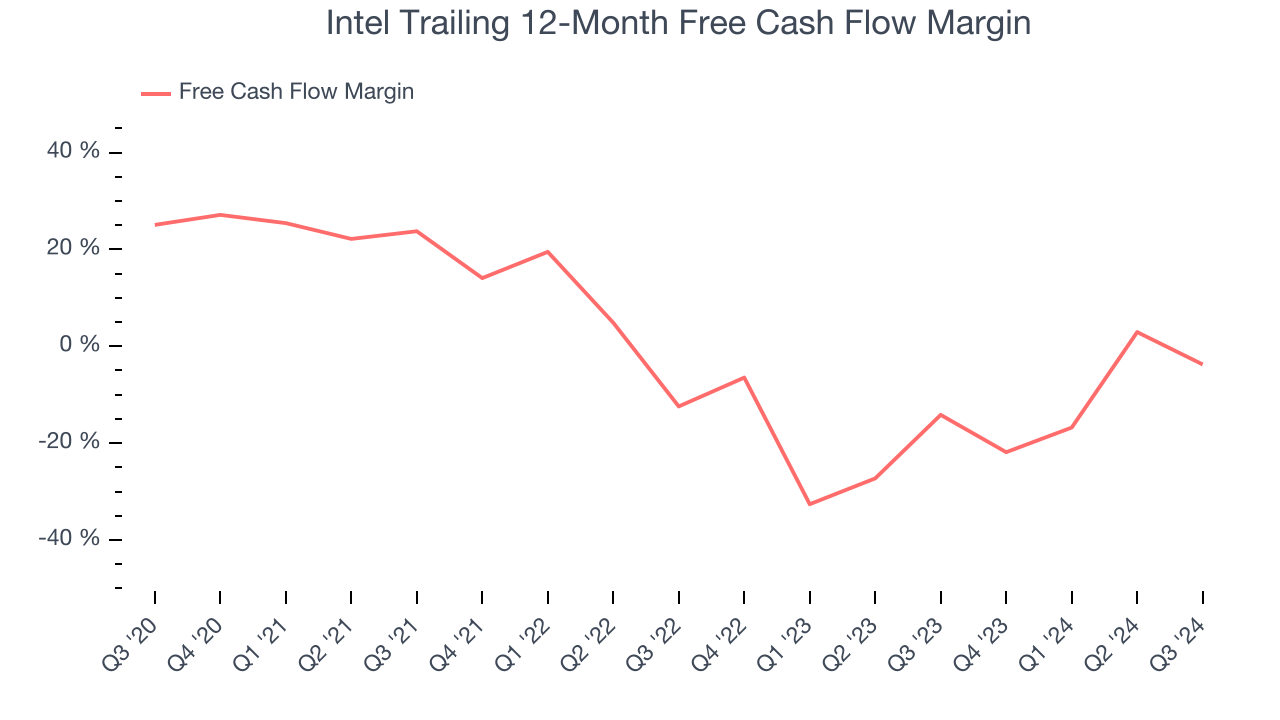

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Intel’s margin dropped by 28.8 percentage points over the last five years. Its unexciting margin and trend put the company in a tough spot, and shareholders are likely hoping it can reverse course. Intel’s free cash flow margin for the trailing 12 months was negative 3.7%.

Final Judgment

Intel falls short of our quality standards. Following the recent decline, the stock trades at 33.9x forward price-to-earnings (or $23.63 per share). This valuation tells us a lot of optimism is priced in - we think there are better opportunities elsewhere. Let us point you toward Wabtec, a leading provider of locomotive services benefiting from an upgrade cycle.

Stocks We Like More Than Intel

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.