Three Reasons Why CMCO is Risky and One Stock to Buy Instead

Over the past six months, Columbus McKinnon’s shares (currently trading at $39.10) have posted a disappointing 11% loss, well below the S&P 500’s 13% gain. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Columbus McKinnon, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.Even though the stock has become cheaper, we don't have much confidence in Columbus McKinnon. Here are three reasons why there are better opportunities than CMCO and a stock we'd rather own.

Why Do We Think Columbus McKinnon Will Underperform?

With 19 different brands across the globe, Columbus McKinnon (NASDAQ: CMCO) offers material handling equipment for the construction, manufacturing, and transportation industries.

1. Slow Organic Growth Suggests Waning Demand In Core Business

In addition to reported revenue, organic revenue is a useful data point for analyzing General Industrial Machinery companies. This metric gives visibility into Columbus McKinnon’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Columbus McKinnon’s organic revenue averaged 2.4% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

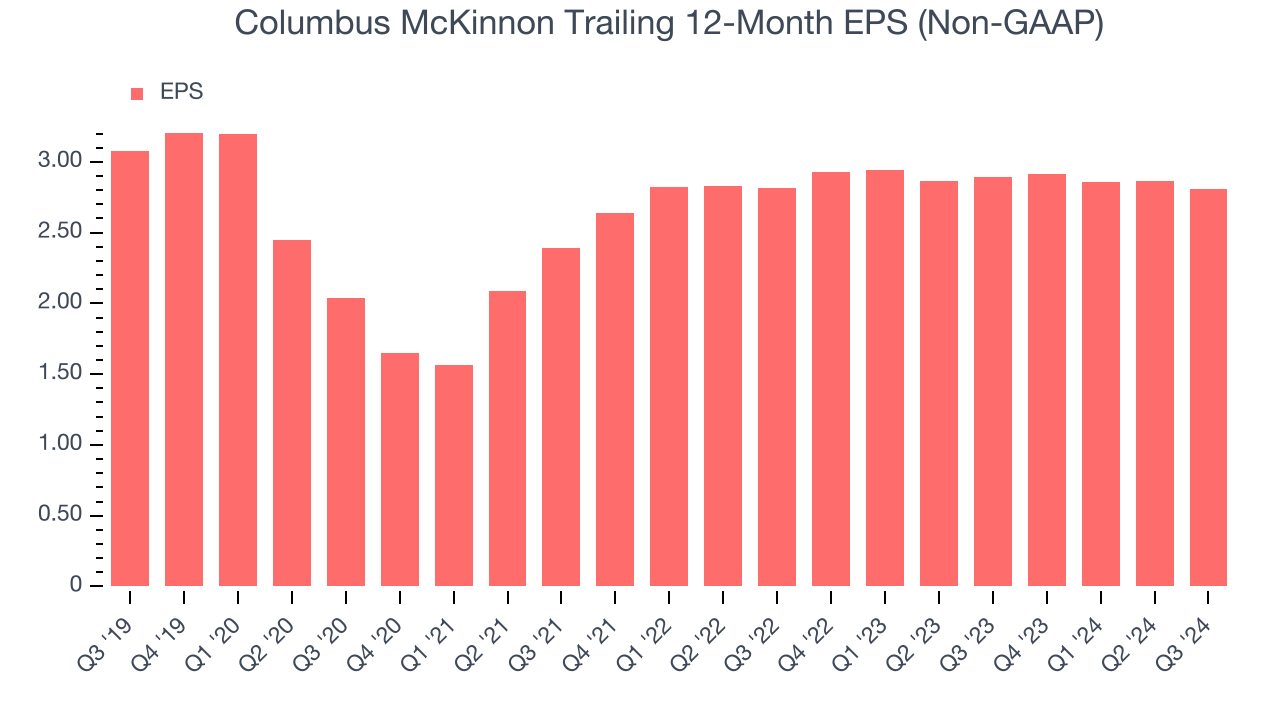

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Columbus McKinnon, its EPS declined by 1.8% annually over the last five years while its revenue grew by 3.2%. This tells us the company became less profitable on a per-share basis as it expanded.

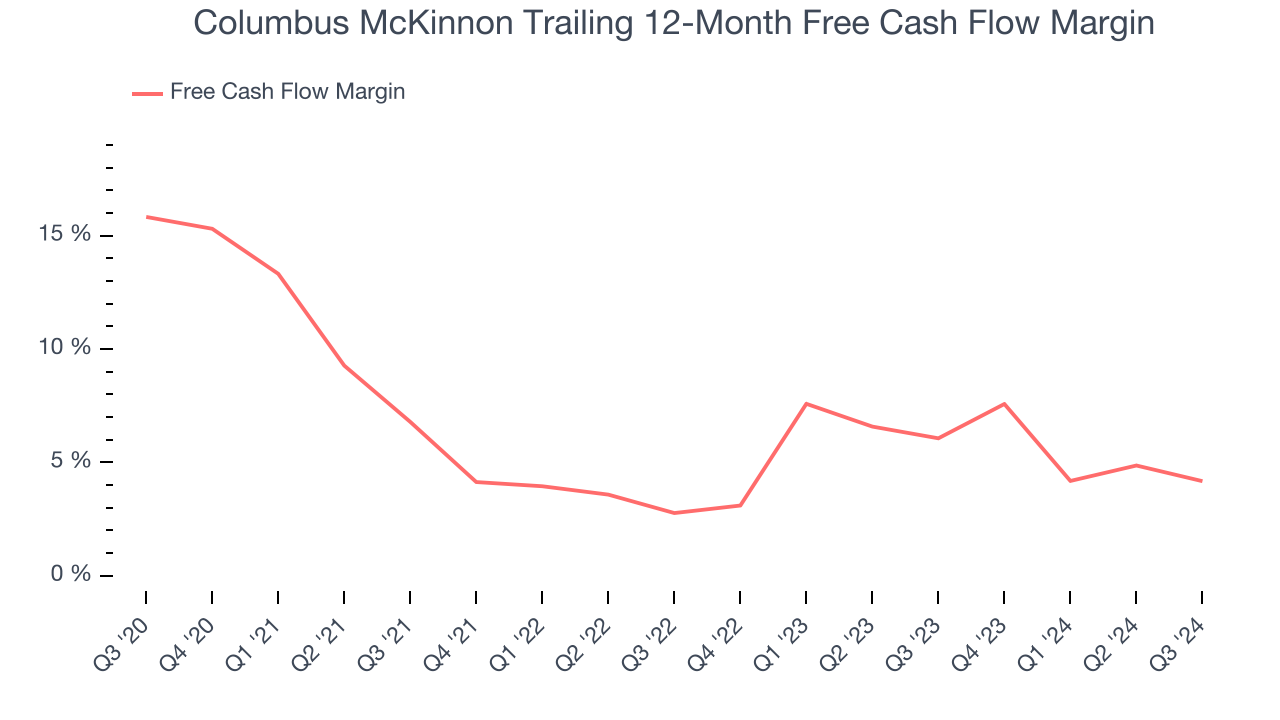

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Columbus McKinnon’s margin dropped by 11.7 percentage points over the last five years. Columbus McKinnon’s five-year free cash flow profile was compelling, but shareholders are surely hoping for its trend to reverse. Continued declines could signal that the business is becoming more capital-intensive. Its free cash flow margin for the trailing 12 months was 4.2%.

Final Judgment

Columbus McKinnon doesn’t pass our quality test. After the recent drawdown, the stock trades at 11.9x forward price-to-earnings (or $39.10 per share). This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are more exciting stocks to buy at the moment. We’d suggest looking at Uber, whose profitability just reached an inflection point.

Stocks We Would Buy Instead of Columbus McKinnon

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.