Two Reasons to Watch TH and One to Stay Cautious

Target Hospitality has gotten torched over the last six months - since May 2024, its stock price has dropped 28.1% to $8.25 per share. This may have investors wondering how to approach the situation.

Given the weaker price action, is now the time to buy TH? Find out in our full research report, it’s free.

Why Does Target Hospitality Spark Debate?

Essentially a builder of mini communities, Target Hospitality (NASDAQ: TH) is a provider of specialty workforce lodging accommodations and services.

Two Positive Attributes:

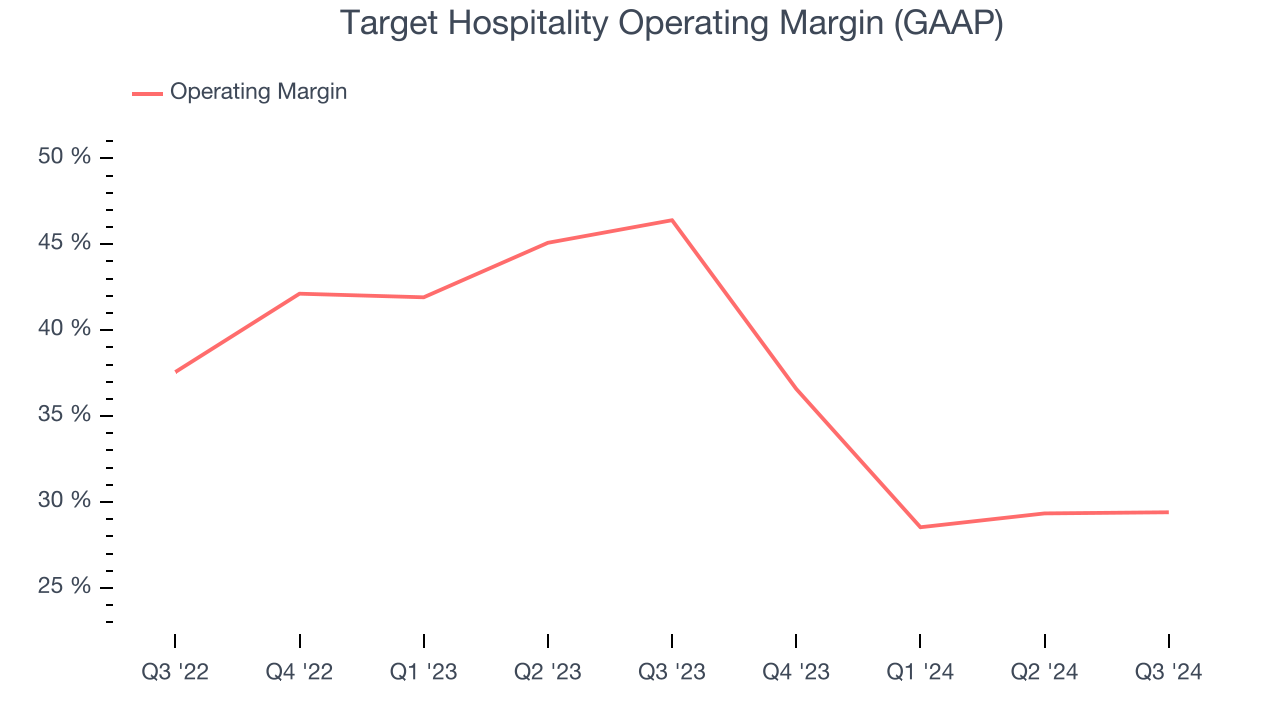

1. Operating Margin Reveals a Well-Run Organization

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Target Hospitality’s operating margin has shrunk over the last 12 months, but it still averaged 38.6% over the last two years, elite for a consumer discretionary business. This shows it’s an optimally-run company with an efficient cost structure, and we wouldn’t weigh the short-term trend too heavily.

2. New Investments Bear Fruit as ROIC Jumps

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Fortunately, Target Hospitality’s ROIC has increased significantly over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

One Reason to be Careful:

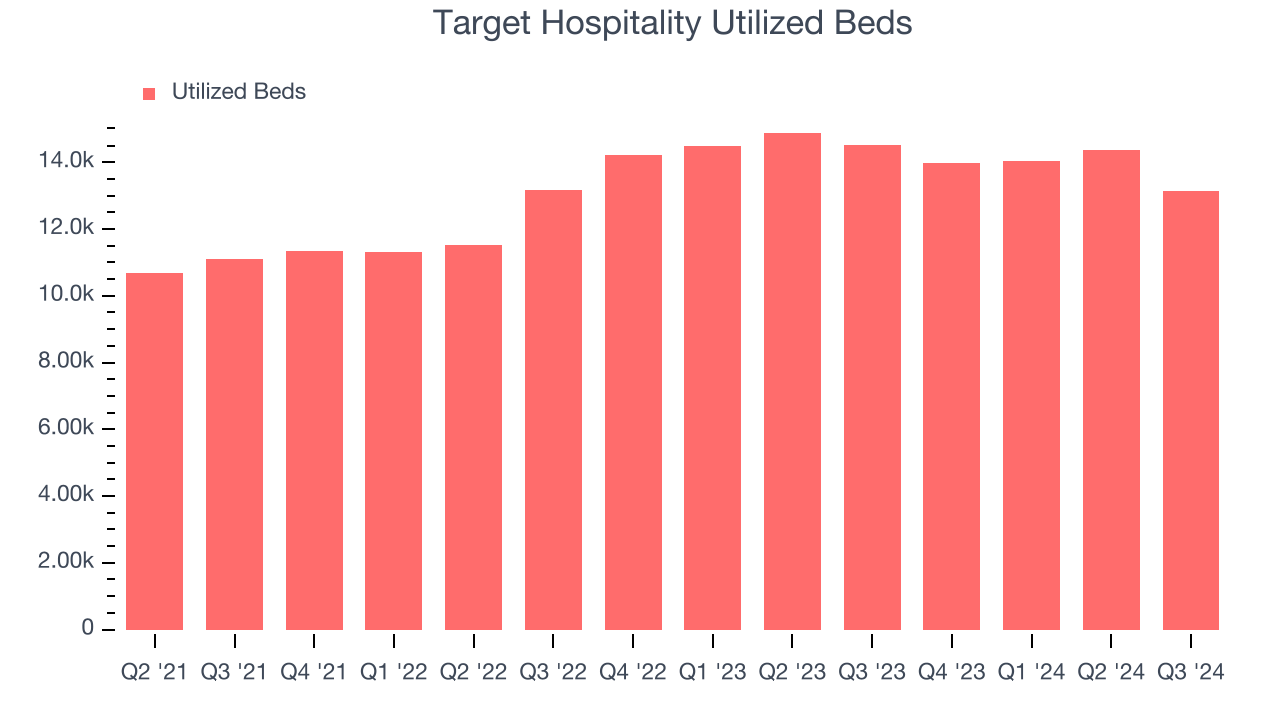

Weak Growth in Utilized Beds Points to Soft Demand

Revenue growth can be broken down into changes in price and volume (for companies like Target Hospitality, our preferred volume metric is utilized beds). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Target Hospitality’s utilized beds came in at 13,138 in the latest quarter, and over the last two years, averaged 9.4% year-on-year growth. This performance was underwhelming and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

Final Judgment

Target Hospitality’s positive characteristics outweigh the negatives. After the recent drawdown, the stock trades at 5.2x forward EV-to-EBITDA (or $8.25 per share). Is now a good time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Target Hospitality

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.