Solo Brands’s (NYSE:DTC) Q3: Beats On Revenue But Stock Drops

Outdoor lifestyle and recreational products company Solo Brands (NYSE: DTC) reported Q3 CY2024 results beating Wall Street’s revenue expectations, but sales fell 14.7% year on year to $94.14 million. The company’s full-year revenue guidance of $480 million at the midpoint came in 1.1% above analysts’ estimates. Its non-GAAP profit of $0.02 per share was 21.4% below analysts’ consensus estimates.

Is now the time to buy Solo Brands? Find out by accessing our full research report, it’s free.

Solo Brands (DTC) Q3 CY2024 Highlights:

- Revenue: $94.14 million vs analyst estimates of $92.61 million (1.7% beat)

- Adjusted EPS: $0.02 vs analyst expectations of $0.03 (21.4% miss)

- EBITDA: $6.50 million vs analyst estimates of $8.17 million (20.5% miss)

- The company reconfirmed its revenue guidance for the full year of $480 million at the midpoint

- Gross Margin (GAAP): 41.8%, down from 61.9% in the same quarter last year

- Operating Margin: -122%, down from -1.2% in the same quarter last year

- EBITDA Margin: 6.9%, down from 13.6% in the same quarter last year

- Free Cash Flow was -$5.91 million compared to -$16.11 million in the same quarter last year

- Market Capitalization: $85.48 million

"Our third quarter results were in line with our expectations despite a continued challenging macroeconomic backdrop for big ticket consumer durable items," said Chris Metz, Chief Executive Officer of Solo Brands.

Company Overview

Started through a Kickstarter campaign, Solo Brands (NYSE: DTC) is a provider of outdoor and recreational products.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Sales Growth

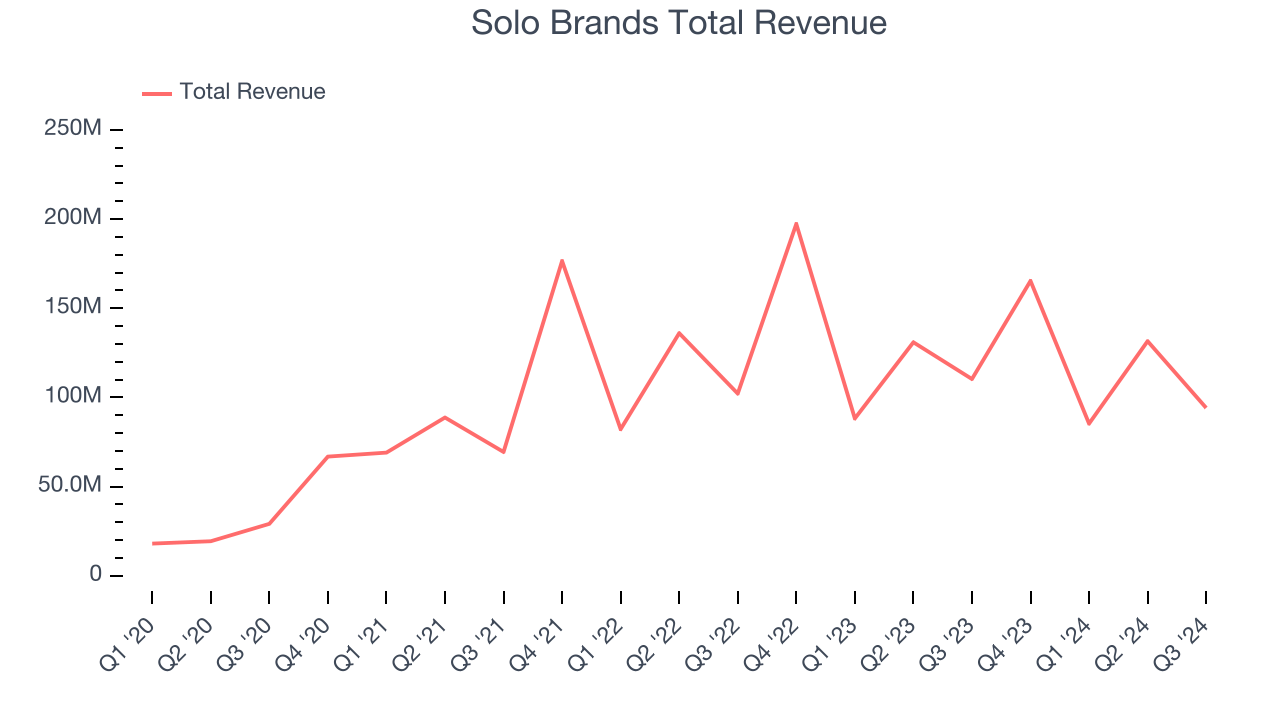

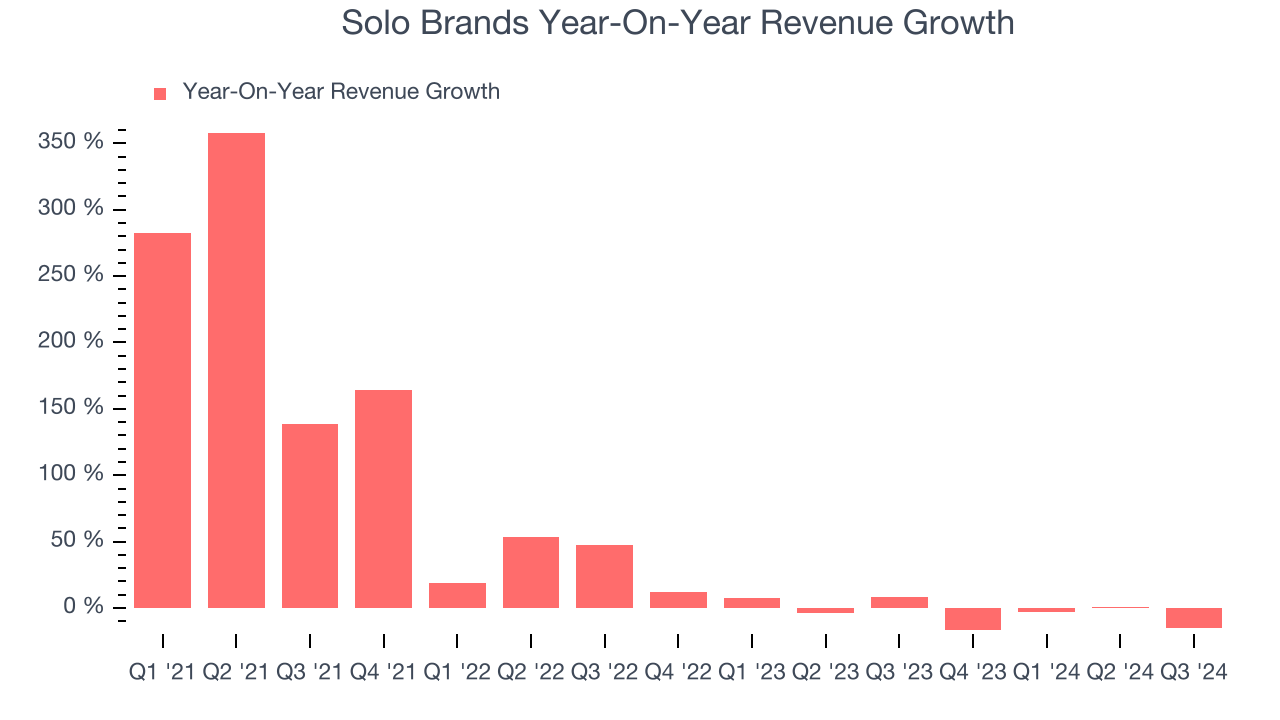

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last four years, Solo Brands grew its sales at an incredible 47% compounded annual growth rate. This is a useful starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Solo Brands’s recent history marks a sharp pivot from its four-year trend as its revenue has shown annualized declines of 2.1% over the last two years.

Solo Brands also breaks out the revenue for its most important segments, Direct-to-Consumer and Wholesale, which are 68.5% and 31.5% of revenue. Over the last two years, Solo Brands’s Direct-to-Consumer revenue (direct sales to customers) averaged 10.1% year-on-year declines. On the other hand, its Wholesale revenue (sales to retailers) averaged 52.4% growth.

This quarter, Solo Brands’s revenue fell 14.7% year on year to $94.14 million but beat Wall Street’s estimates by 1.7%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, an improvement versus the last two years. While this projection indicates the market believes its newer products and services will fuel better performance, it is still below average for the sector.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

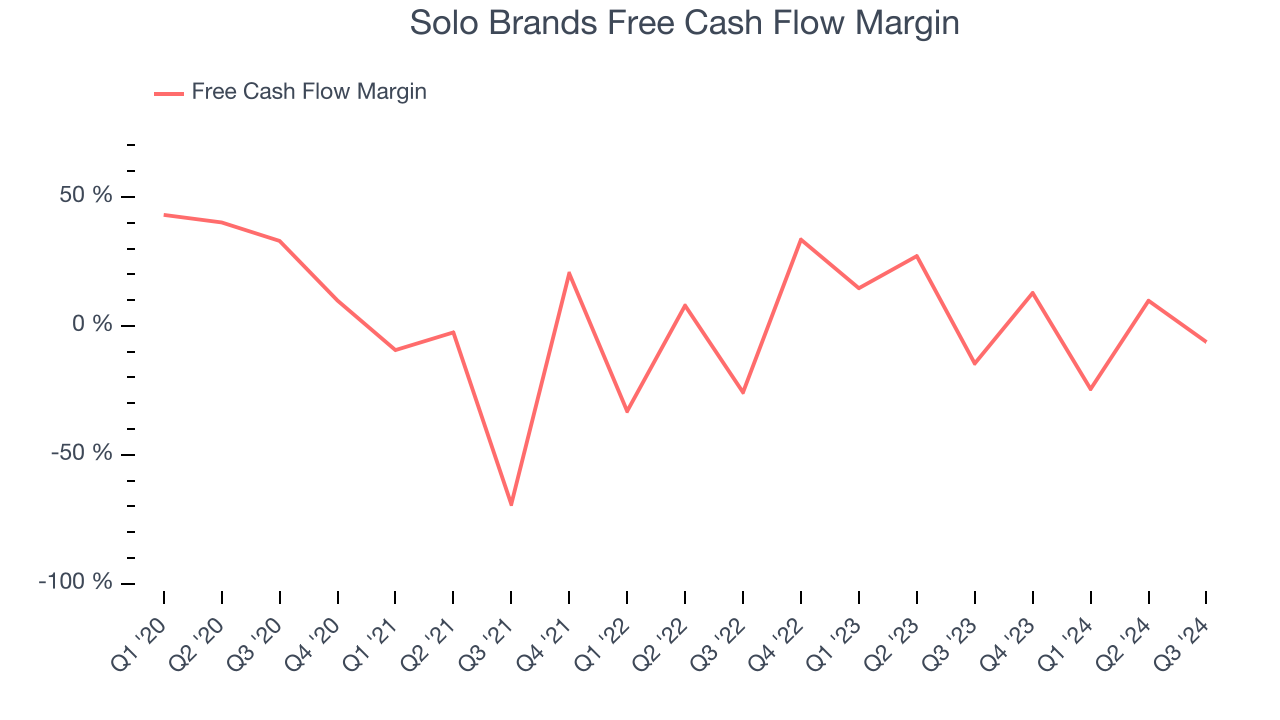

Solo Brands has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 10.5% over the last two years, slightly better than the broader consumer discretionary sector.

Solo Brands burned through $5.91 million of cash in Q3, equivalent to a negative 6.3% margin. The company’s cash burn was similar to its $16.11 million of lost cash in the same quarter last year . These numbers deviate from its longer-term margin, raising some eyebrows.

Key Takeaways from Solo Brands’s Q3 Results

It was good to see Solo Brands’s full-year revenue forecast beat analysts’ expectations. On the other hand, its EPS and EBITDA fell short of Wall Street’s estimates because its higher-margin DTC segment underperformed. Overall, this was a weaker quarter. The stock traded down 7.9% to $1.34 immediately following the results.

Solo Brands’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.