Xylem (XYL): Buy, Sell, or Hold Post Q3 Earnings?

Over the last six months, Xylem’s shares have sunk to $123.38, producing a disappointing 12.3% loss - a stark contrast to the S&P 500’s 12.1% gain. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Given the weaker price action, is now a good time to buy XYL? Find out in our full research report, it’s free.

Why Does XYL Stock Spark Debate?

Formed through a spinoff, Xylem (NYSE: XYL) manufactures and services engineered products across a wide variety of applications primarily in the water sector.

Two Things to Like:

1. Core Business Firing on All Cylinders

Investors interested in Water Infrastructure companies should track organic revenue in addition to reported revenue. This metric gives visibility into Xylem’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Xylem’s organic revenue averaged 11% year-on-year growth. This performance was impressive and shows it can expand quickly without relying on expensive (and risky) acquisitions.

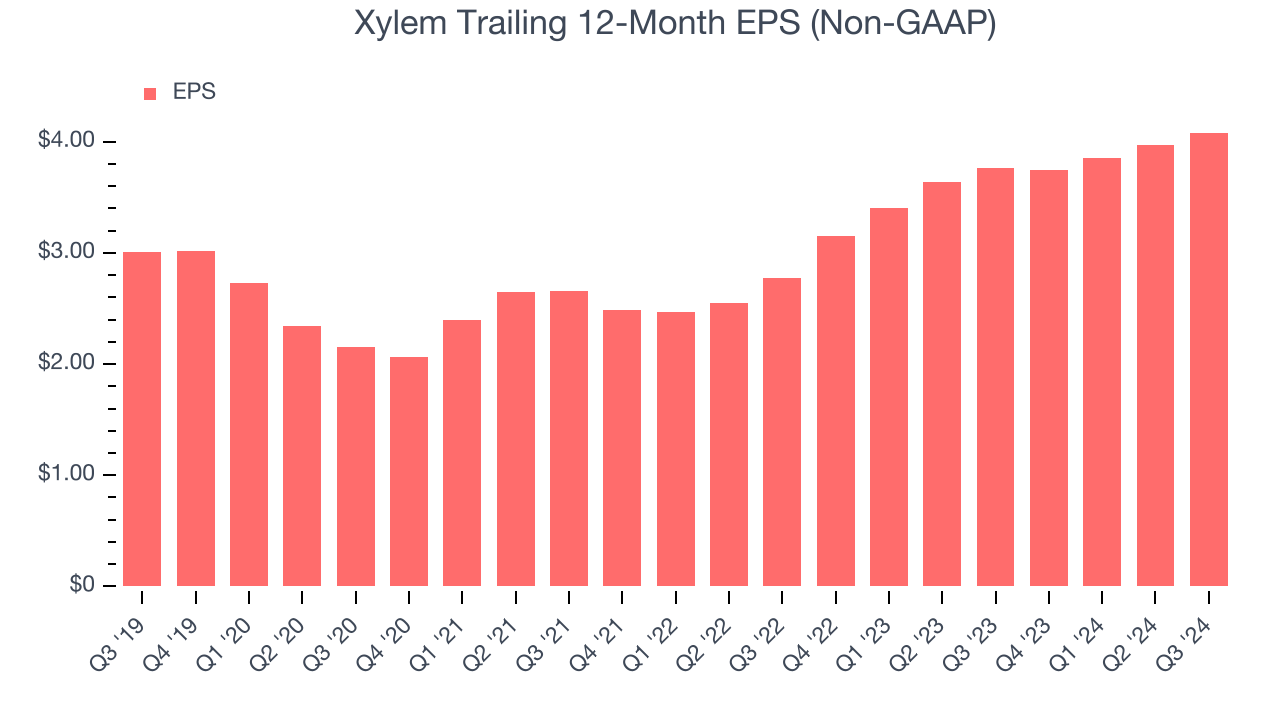

2. EPS Surges Higher Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Xylem’s EPS grew at an astounding 21.2% compounded annual growth rate over the last two years. This performance was better than most industrials businesses.

One Reason to be Careful:

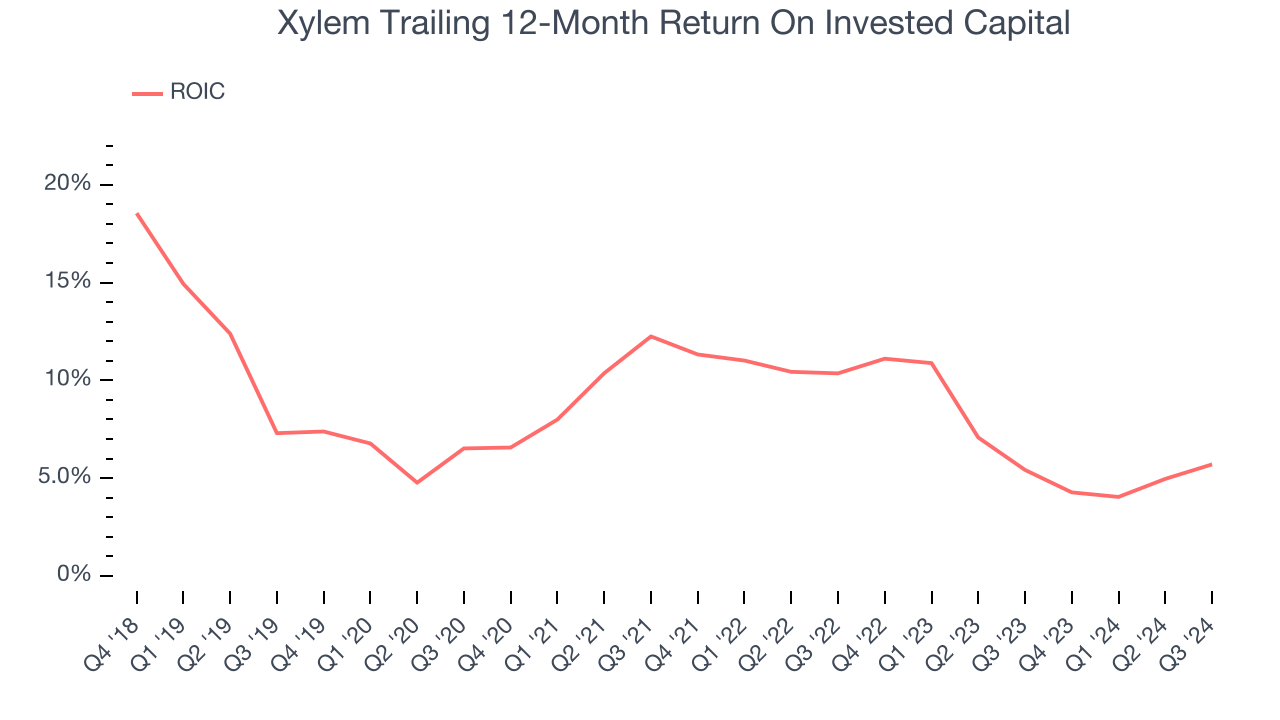

New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Unfortunately, Xylem’s ROIC averaged 3.8 percentage point decreases over the last few years. If its returns keep falling, it could suggest its profitable growth opportunities are drying up. We’ll keep a close eye.

Final Judgment

Xylem’s positive characteristics outweigh the negatives. After the recent drawdown, the stock trades at 26.6× forward price-to-earnings (or $123.38 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Xylem

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.