Two Reasons to Like CALM (and One Not So Much)

What a fantastic six months it’s been for Cal-Maine. Shares of the company have skyrocketed 81.6%, setting a new 52-week high of $106.88. This performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Cal-Maine, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.We’re happy investors have made money, but we're cautious about Cal-Maine. Here are one reason why you should be careful with CALM and a stock we'd rather own.

Why Does Cal-Maine Spark Debate?

Known for brands such as Egg-Land’s Best and Land O’ Lakes, Cal-Maine (NASDAQ: CALM) produces, packages, and distributes eggs.

Two Things to Like:

1. Skyrocketing Revenue Shows Strong Momentum

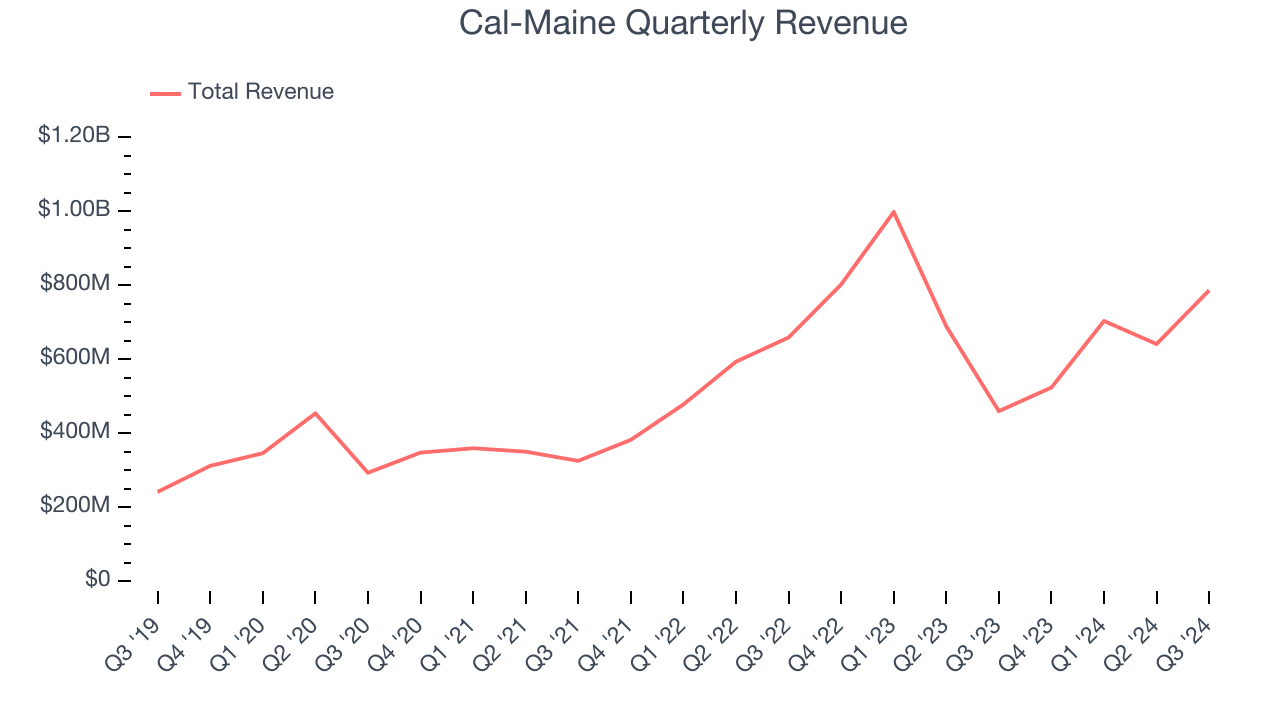

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Thankfully, Cal-Maine’s 24.3% annualized revenue growth over the last three years was excellent. Its growth surpassed the average consumer staples company and shows its offerings resonate with customers.

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

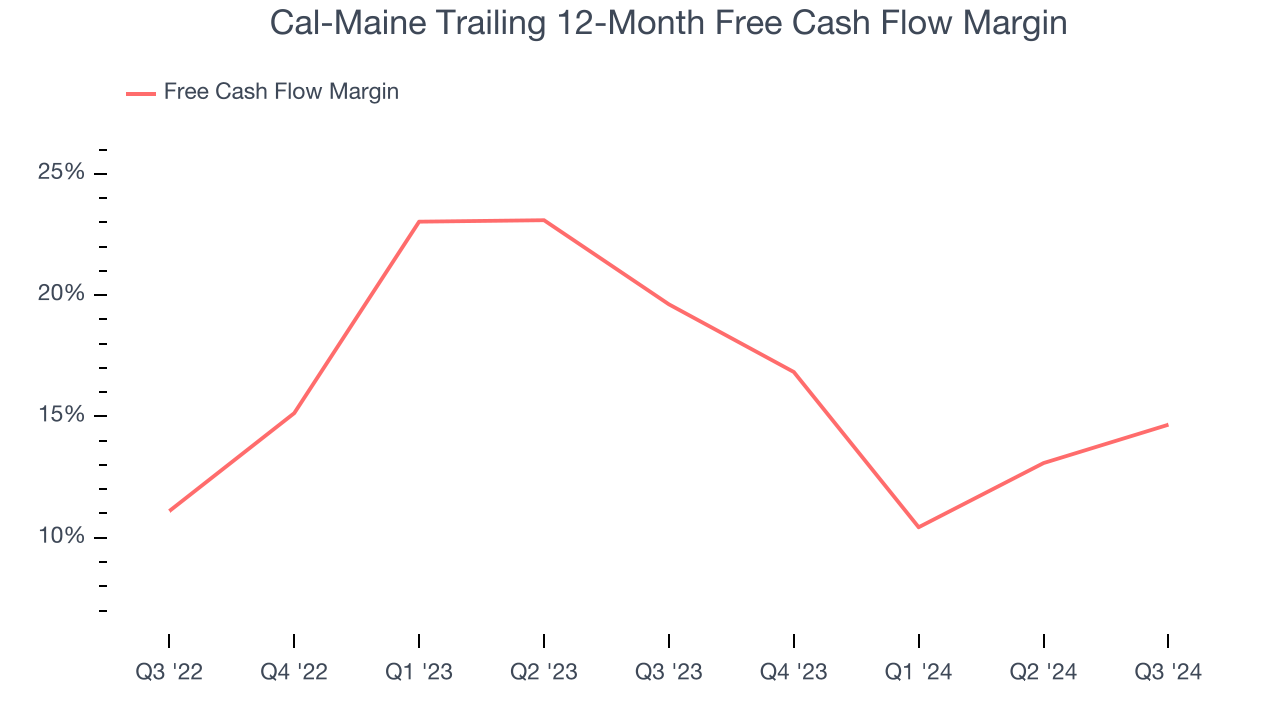

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Cal-Maine has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the consumer staples sector, averaging 17.3% over the last two years.

One Reason to be Careful:

Operating Margin Falling

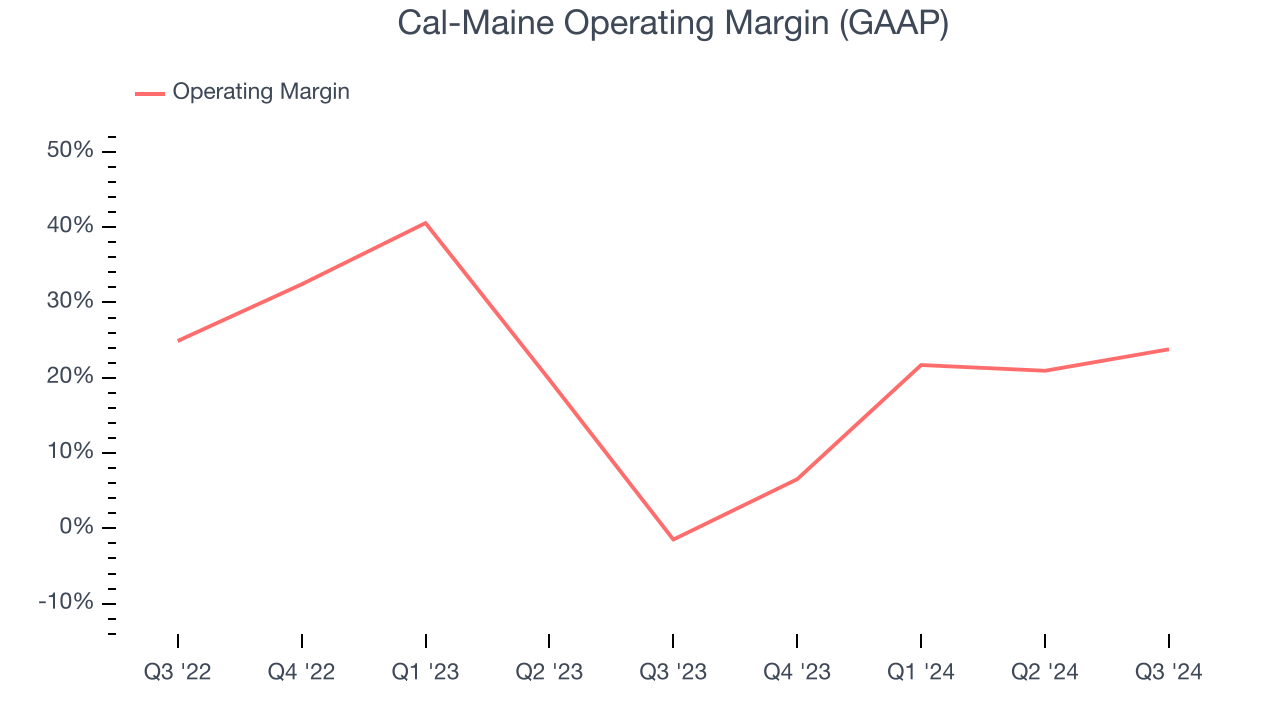

Operating margin is a key profitability metric because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

Looking at the trend in its profitability, Cal-Maine’s operating margin decreased by 7.8 percentage points over the last year. Even though its historical margin is high, shareholders will want to see Cal-Maine become more profitable in the future. Its operating margin for the trailing 12 months was 19.1%.

Final Judgment

Cal-Maine isn’t a terrible business, but it doesn’t pass our quality test. After the recent surge, the stock trades at $106.88 per share (or a 2× trailing 12-month price-to-sales ratio). The market typically values companies like Cal-Maine based on their anticipated profits for the next 12 months, but there aren’t enough published estimates to arrive at a reliable number. You should avoid this stock for now - better opportunities lie elsewhere. We’d suggest looking at Microsoft, the most dominant software business in the world.

Stocks We Would Buy Instead of Cal-Maine

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.