Dutch Bros (BROS): Buy, Sell, or Hold Post Q3 Earnings?

Dutch Bros has had an impressive run over the past six months as its shares have beaten the S&P 500 by 22.4%. The stock now trades at $52.23, marking a 32.8% gain. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now still a good time to buy BROS? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Does Dutch Bros Spark Debate?

Started in 1992 by two brothers as a single pushcart, Dutch Bros (NYSE: BROS) is a dynamic coffee chain that’s captured the hearts of coffee enthusiasts across the United States.

Two Positive Attributes:

1. New Restaurants Opening at Breakneck Speed

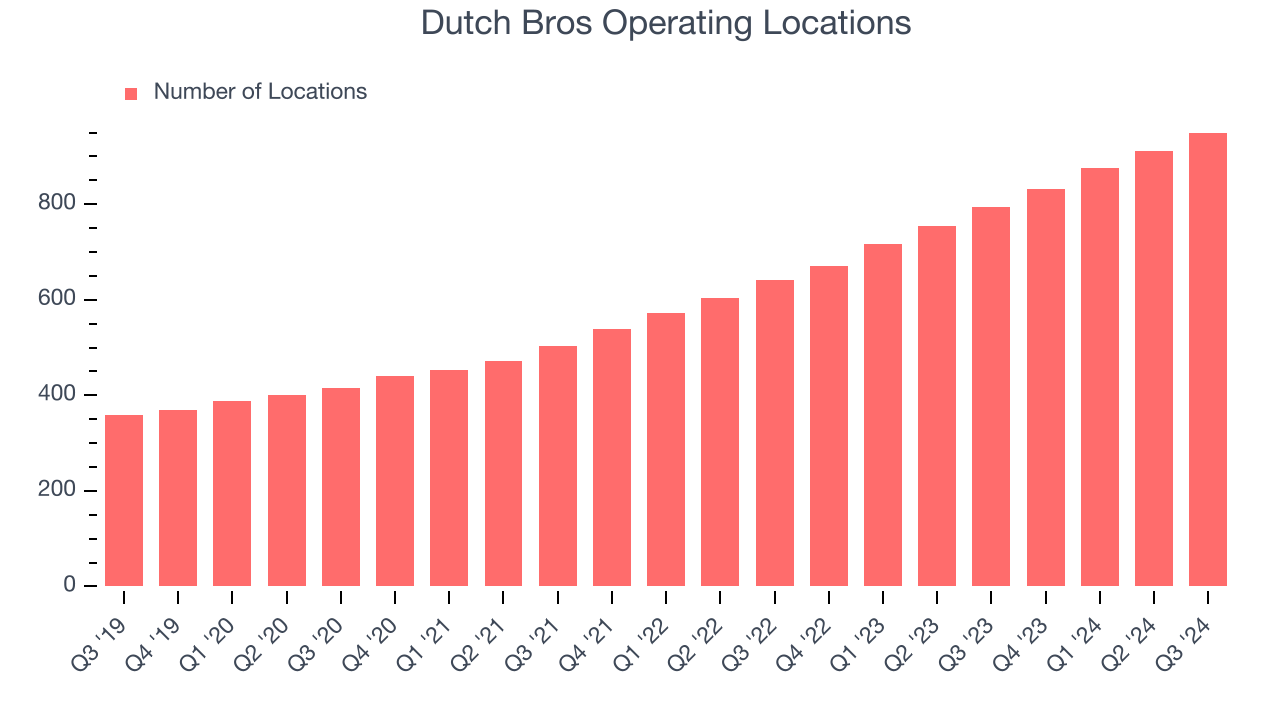

A restaurant chain’s total number of dining locations often determines how much revenue it can generate.

Dutch Bros sported 950 locations in the latest quarter. Over the last two years, it has opened new restaurants at a rapid clip by averaging 23.2% annual growth, among the fastest in the restaurant sector. This gives it a chance to become a large, scaled business over time.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

2. Surging Same-Store Sales Show Increasing Demand

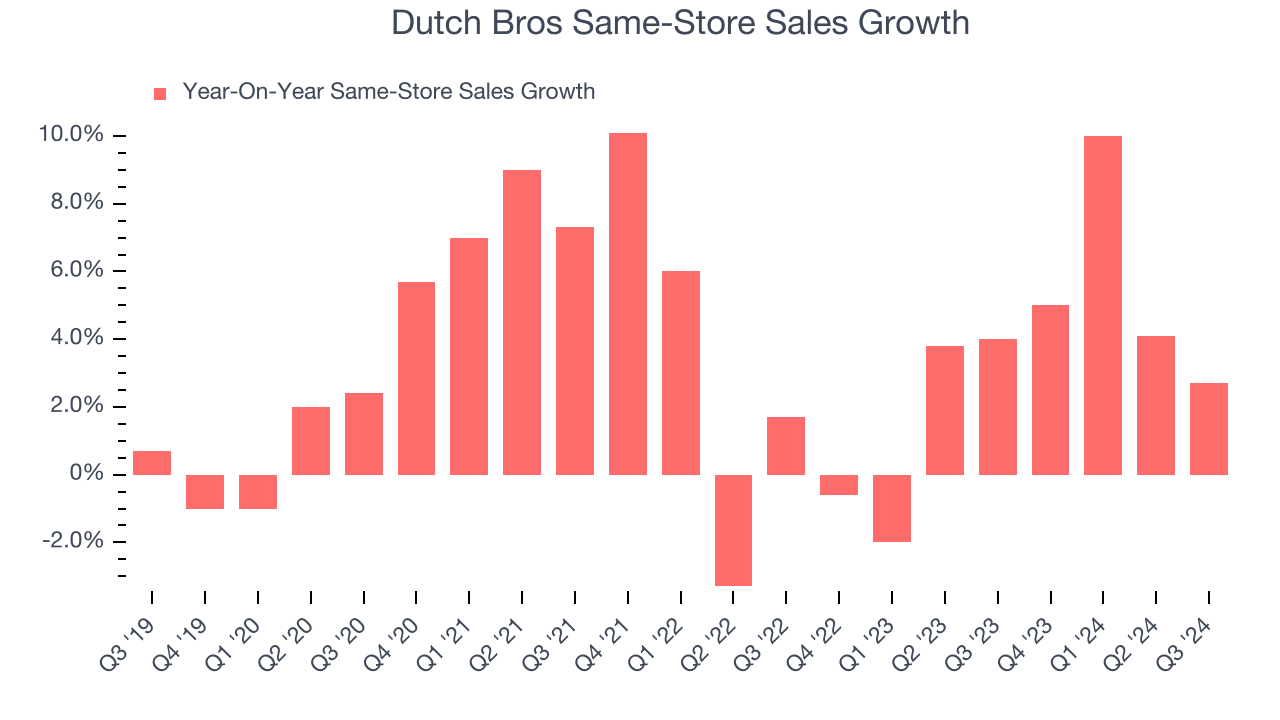

Same-store sales is a key performance indicator used to measure organic growth at restaurants open for at least a year.

Dutch Bros’s demand has been spectacular for a restaurant chain over the last two years. On average, the company has increased its same-store sales by an impressive 3.4% per year.

One Reason to be Careful:

Cash Burn Ignites Concerns

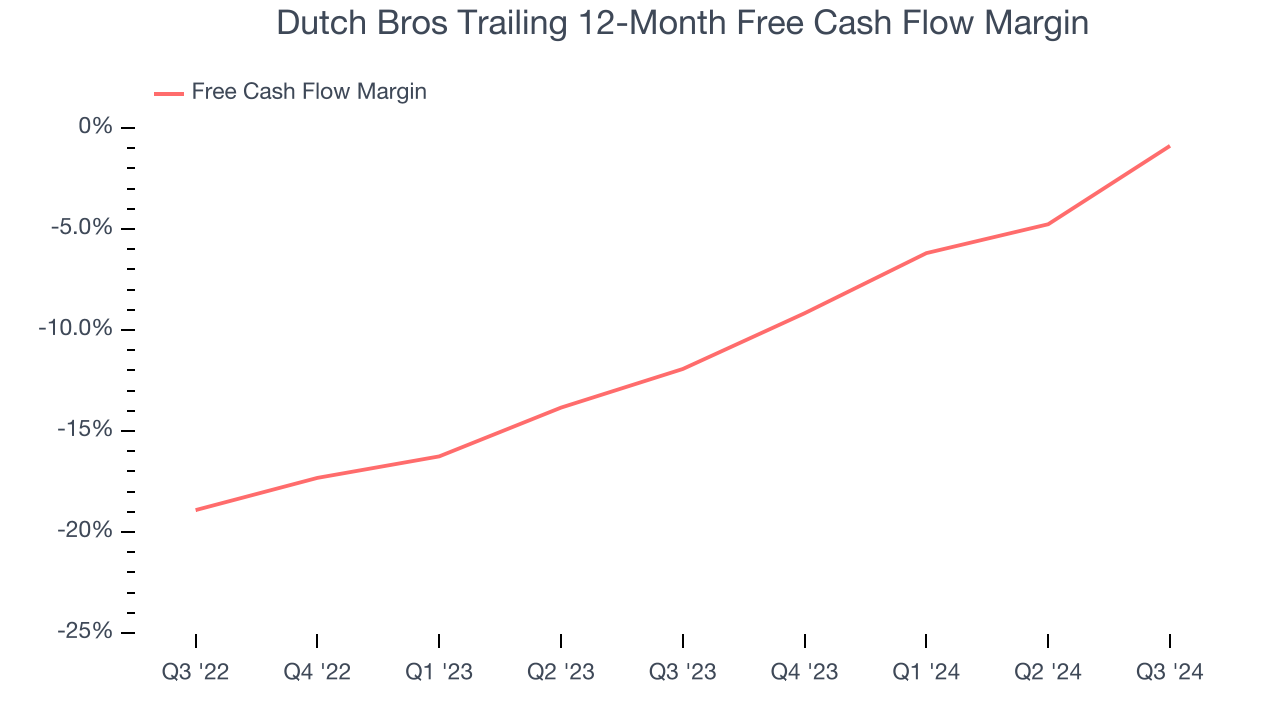

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

While Dutch Bros posted positive free cash flow this quarter, the broader story hasn’t been so clean. Over the last two years, Dutch Bros’s capital-intensive business model and large investments in new physical locations have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 5.7%, meaning it lit $5.67 of cash on fire for every $100 in revenue.

Final Judgment

Dutch Bros’s positive characteristics outweigh the negatives, and with its shares beating the market recently, the stock trades at 113.8× forward price-to-earnings (or $52.23 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Dutch Bros

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.