Denny's (DENN): Buy, Sell, or Hold Post Q3 Earnings?

Over the past six months, Denny’s stock price fell to $5.80. Shareholders have lost 18.5% of their capital, which is disappointing considering the S&P 500 has climbed by 6.2%. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Denny's, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.Even though the stock has become cheaper, we don't have much confidence in Denny's. Here are three reasons why you should be careful with DENN and a stock we'd rather own.

Why Is Denny's Not Exciting?

Open around the clock, Denny’s (NASDAQ: DENN) is a chain of diner restaurants serving breakfast and traditional American fare.

1. Restaurants Are Closing, a Headwind for Revenue

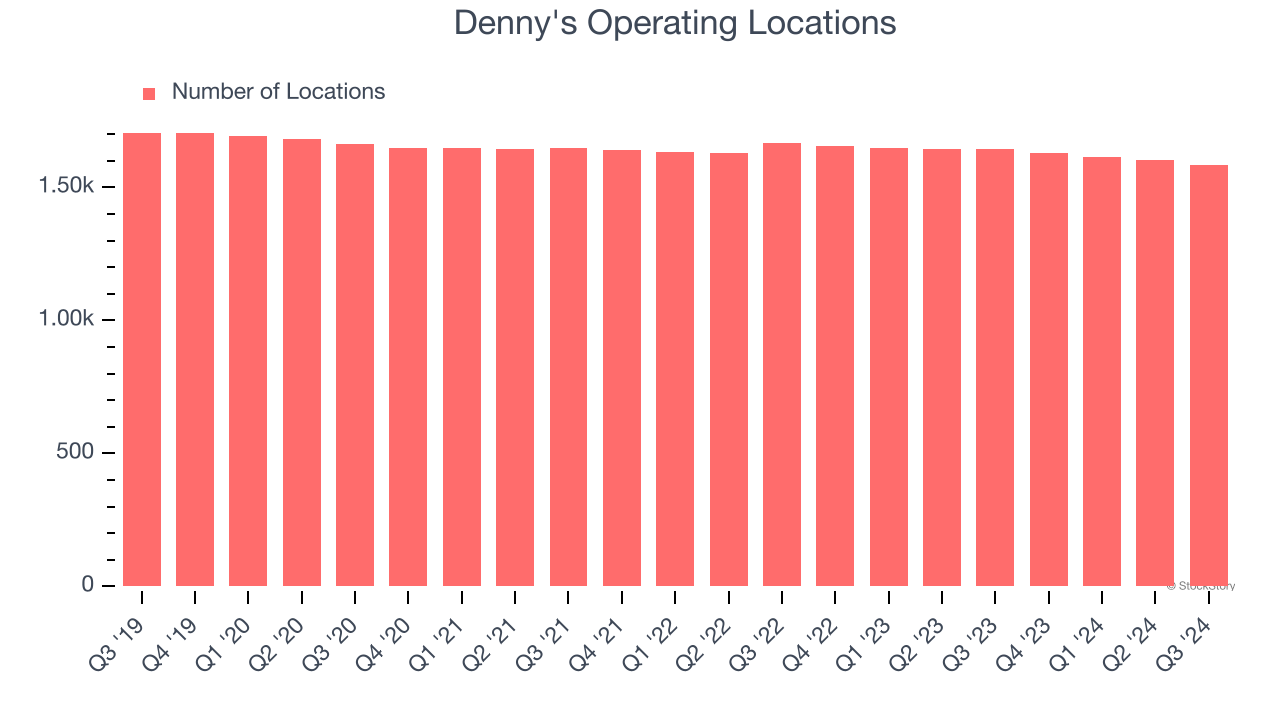

A restaurant chain’s total number of dining locations influences how much it can sell and how quickly revenue can grow.

Denny's listed 1,586 locations in the latest quarter and has generally closed its restaurants over the last two years, averaging 1% annual declines.

When a chain shutters restaurants, it usually means demand for its meals is waning, and it is responding by closing underperforming locations to improve profitability.

2. Free Cash Flow Margin Dropping

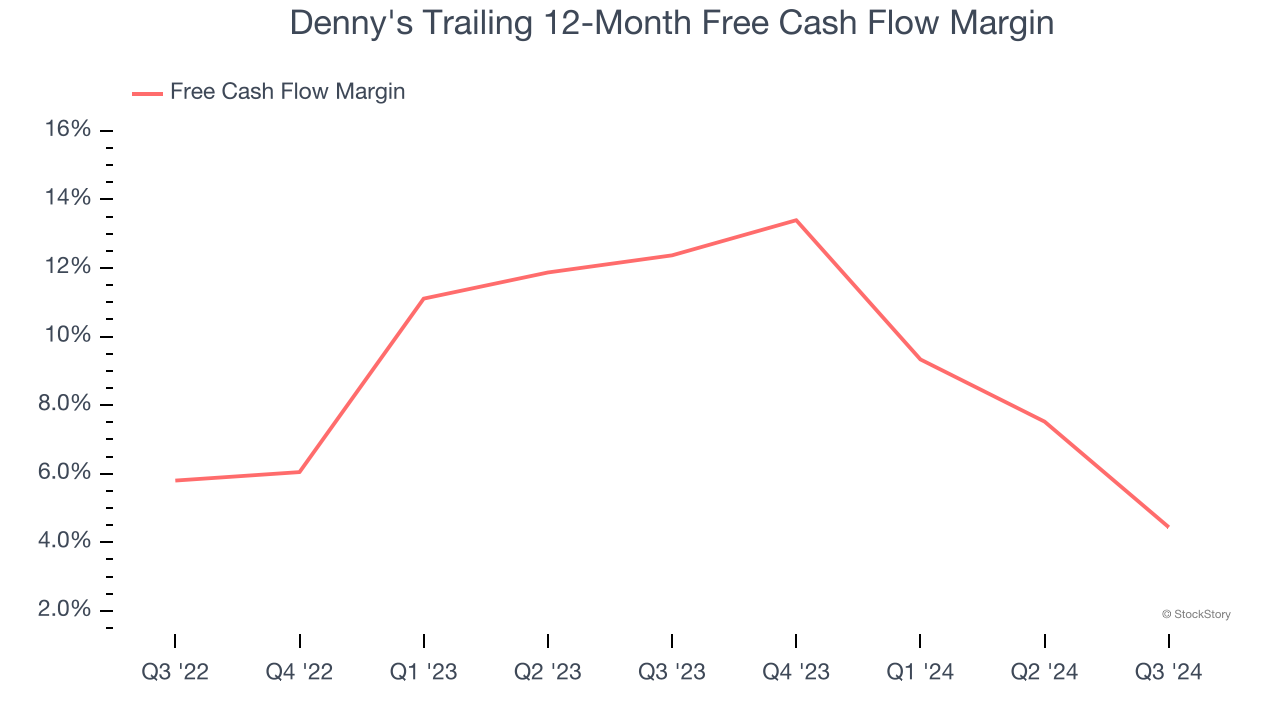

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Denny’s margin dropped by 7.9 percentage points over the last year. If its declines continue, it could signal higher capital intensity. Denny’s free cash flow margin for the trailing 12 months was 4.4%.

3. High Debt Levels Increase Risk

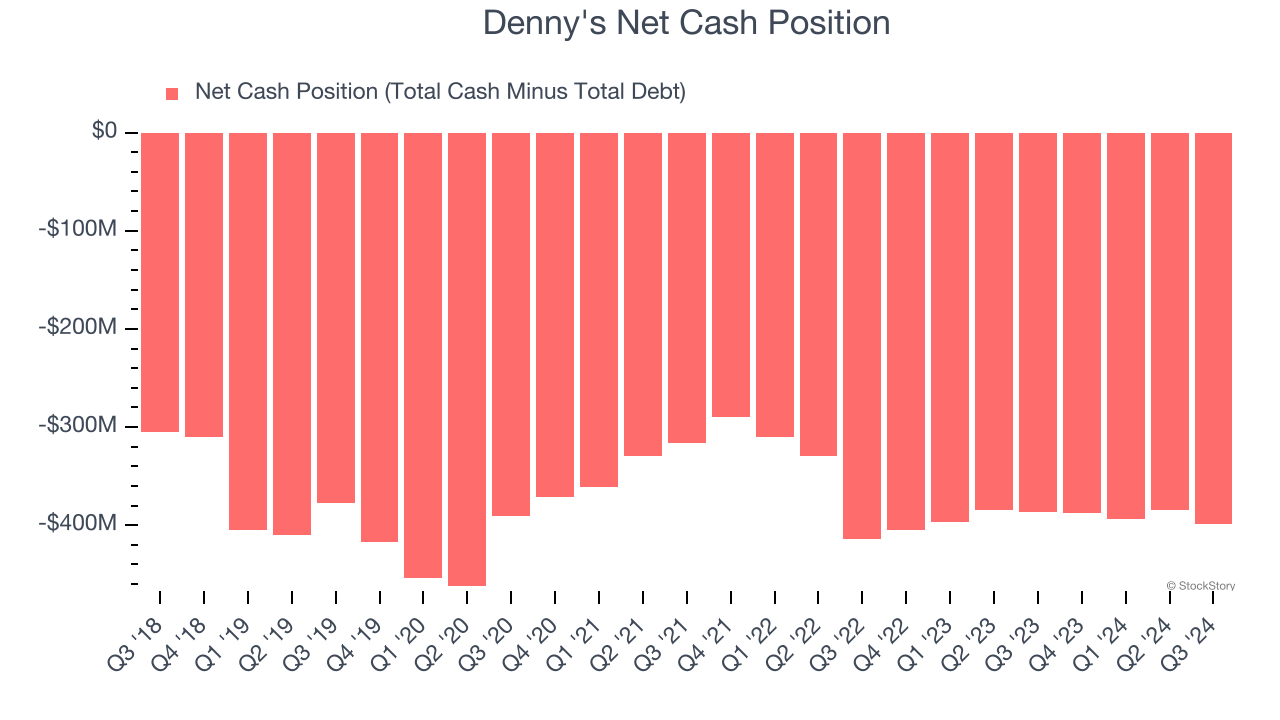

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

Denny’s $403 million of debt exceeds the $4.37 million of cash on its balance sheet. Furthermore, its 5× net-debt-to-EBITDA ratio (based on its EBITDA of $77.3 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Denny's could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Denny's can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

Denny's isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 9.7× forward price-to-earnings (or $5.80 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're fairly confident there are better stocks to buy right now. We’d suggest looking at Chipotle, which surprisingly still has a long runway for growth.

Stocks We Would Buy Instead of Denny's

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.