Three Reasons to Avoid SMR and One Stock to Buy Instead

What a fantastic six months it’s been for NuScale. Shares of the company have skyrocketed 91.2%, hitting $18.18. This performance may have investors wondering how to approach the situation.

Is now the time to buy NuScale, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.We’re glad investors have benefited from the price increase, but we're cautious about NuScale. Here are three reasons why there are better opportunities than SMR and a stock we'd rather own.

Why Is NuScale Not Exciting?

Founded by a team of nuclear scientists, NuScale (NYSE: SMR) specializes in small modular reactor technology, providing scalable nuclear power solutions.

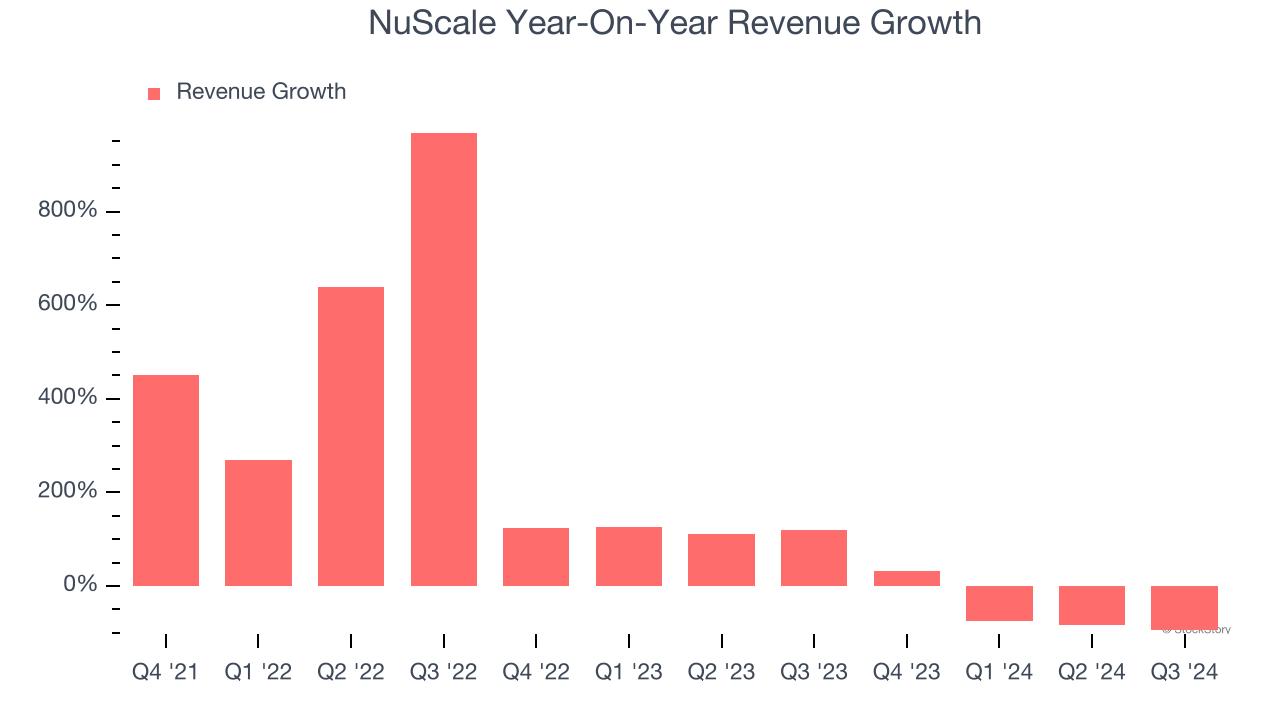

1. Revenue Tumbling Downwards

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. NuScale’s recent history marks a sharp pivot from its three-year trend as its revenue has shown annualized declines of 13.6% over the last two years.

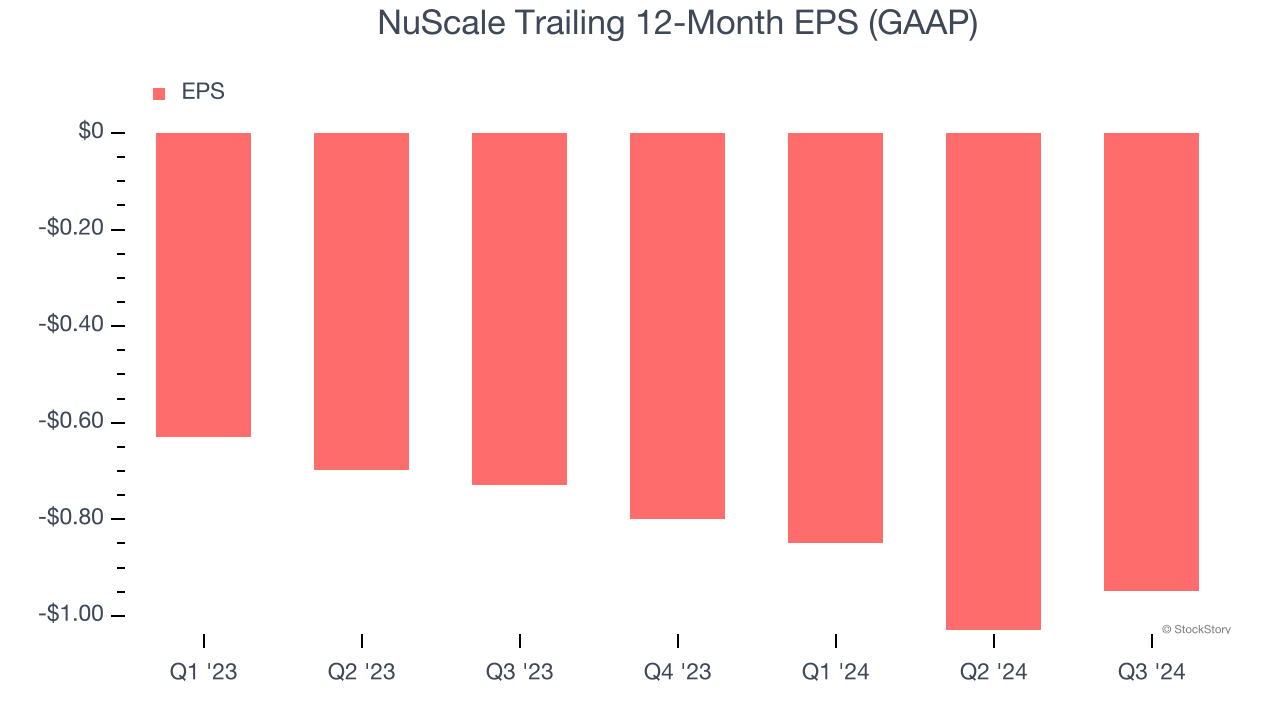

2. EPS Trending Down

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

NuScale’s earnings losses deepened over the last two years as its EPS dropped 29.4% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, NuScale’s low margin of safety could leave its stock price susceptible to large downswings.

3. Cash Burn Ignites Concerns

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

NuScale’s demanding reinvestments have drained its resources over the last four years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 1,322%, meaning it lit $1,322 of cash on fire for every $100 in revenue.

Final Judgment

NuScale isn’t a terrible business, but it doesn’t pass our quality test. After the recent rally, the stock trades at $18.18 per share (or 84.8× forward price-to-sales). The market typically values companies like NuScale based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy. Let us point you toward Cloudflare, one of our top software picks that could be a home run with edge computing.

Stocks We Would Buy Instead of NuScale

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.