Three Reasons to Avoid DDD and One Stock to Buy Instead

3D Systems trades at $3.53 and has moved in lockstep with the market. Its shares have returned 8% over the last six months while the S&P 500 has gained 9.2%.

Is now the time to buy 3D Systems, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.We don't have much confidence in 3D Systems. Here are three reasons why there are better opportunities than DDD and a stock we'd rather own.

Why Do We Think 3D Systems Will Underperform?

Founded by the inventor of stereolithography, 3D Systems (NYSE: DDD) engineers, manufactures, and sells 3D printers and other related products to the aerospace, automotive, healthcare, and consumer goods industries.

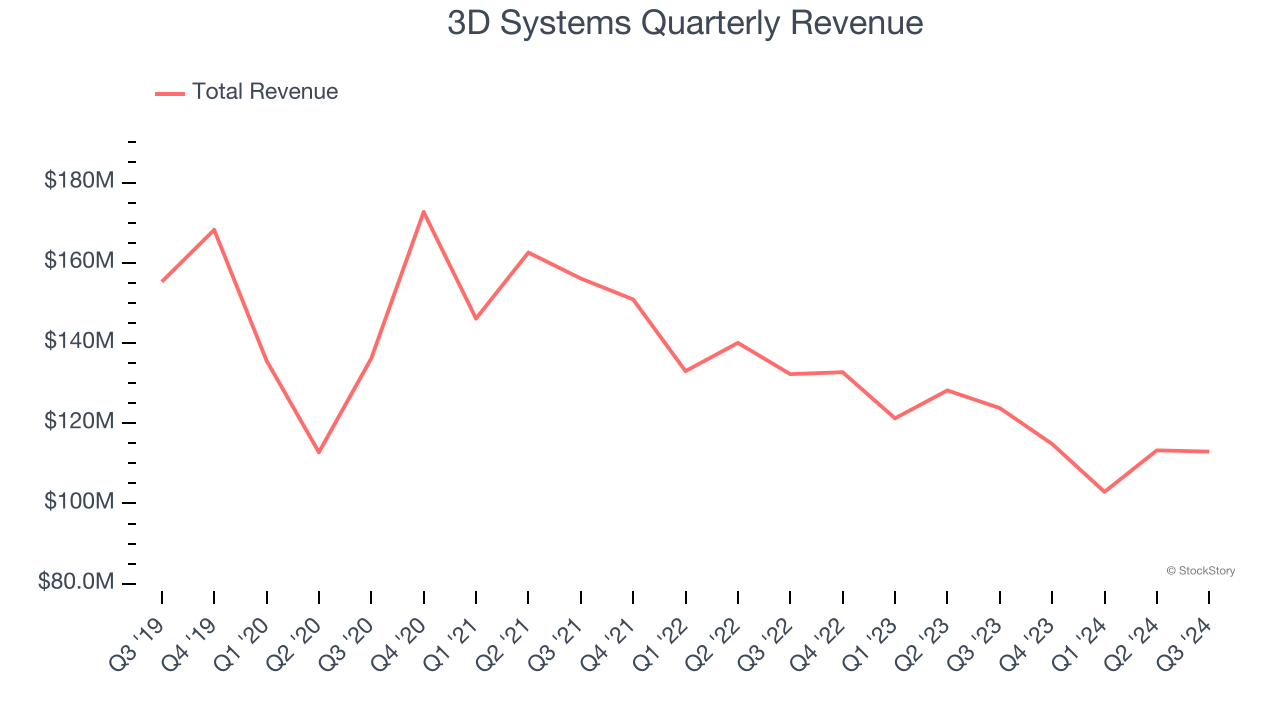

1. Revenue Spiraling Downwards

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. 3D Systems’s demand was weak over the last five years as its sales fell at a 7.2% annual rate. This was below our standards and signals it’s a low quality business.

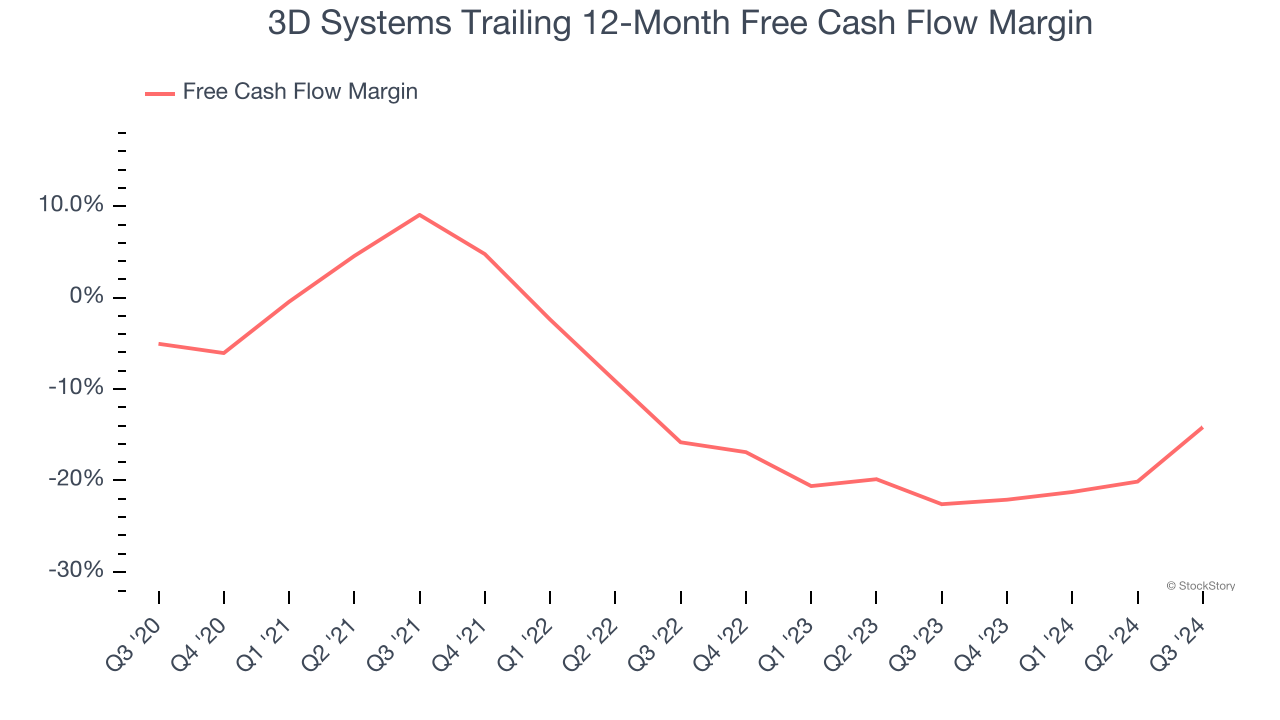

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, 3D Systems’s margin dropped by 9.1 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. Almost any movement in the wrong direction is undesirable because it’s already burning cash. 3D Systems’s free cash flow margin for the trailing 12 months was negative 14.2%.

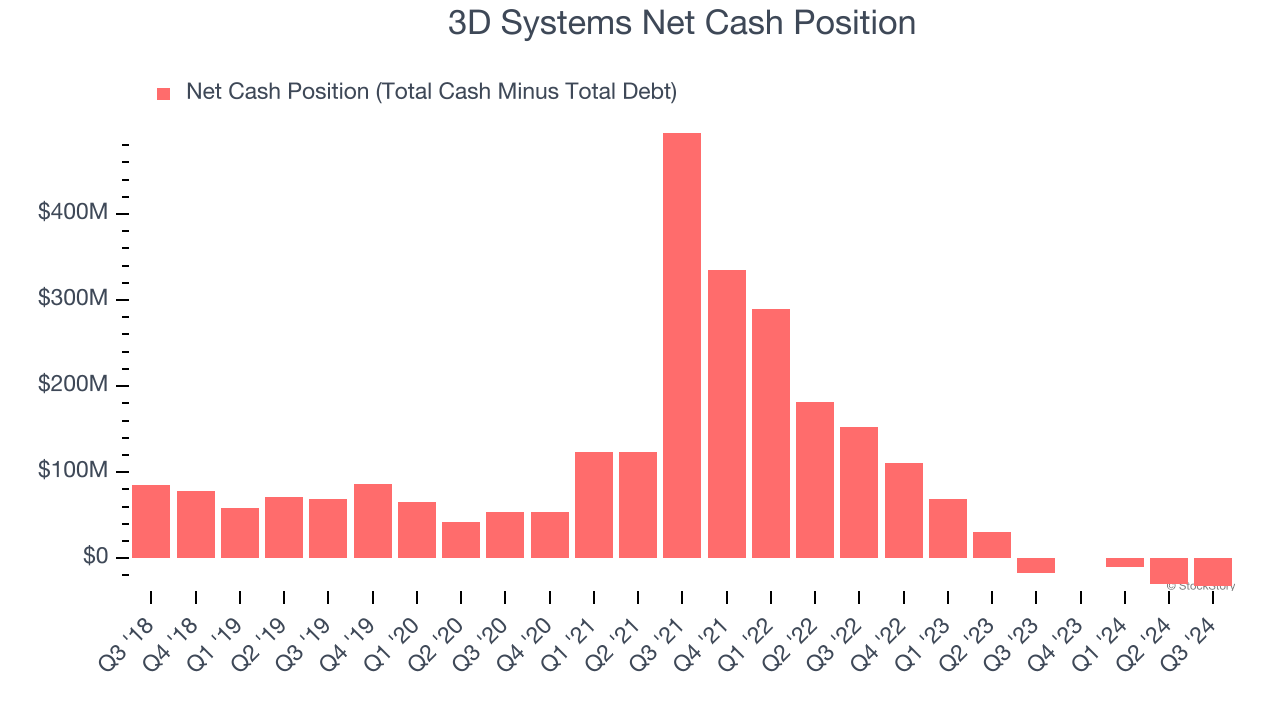

3. Short Cash Runway Exposes Shareholders to Potential Dilution

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

3D Systems burned through $62.9 million of cash over the last year, and its $222.8 million of debt exceeds the $190 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the 3D Systems’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of 3D Systems until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

Final Judgment

We cheer for all companies making their customers lives easier, but in the case of 3D Systems, we’ll be cheering from the sidelines. That said, the stock currently trades at $3.53 per share (or 1× forward price-to-sales). The market typically values companies like 3D Systems based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy. Let us point you toward TransDigm, a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than 3D Systems

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.