3 Reasons to Sell GNK and 1 Stock to Buy Instead

Genco’s stock price has taken a beating over the past six months, shedding 33.3% of its value and falling to $14.04 per share. This may have investors wondering how to approach the situation.

Is now the time to buy Genco, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.Despite the more favorable entry price, we don't have much confidence in Genco. Here are three reasons why GNK doesn't excite us and a stock we'd rather own.

Why Is Genco Not Exciting?

Headquartered in NYC, Genco (NYSE: GNK) is a shipping company that transports dry bulk cargo along worldwide maritime routes.

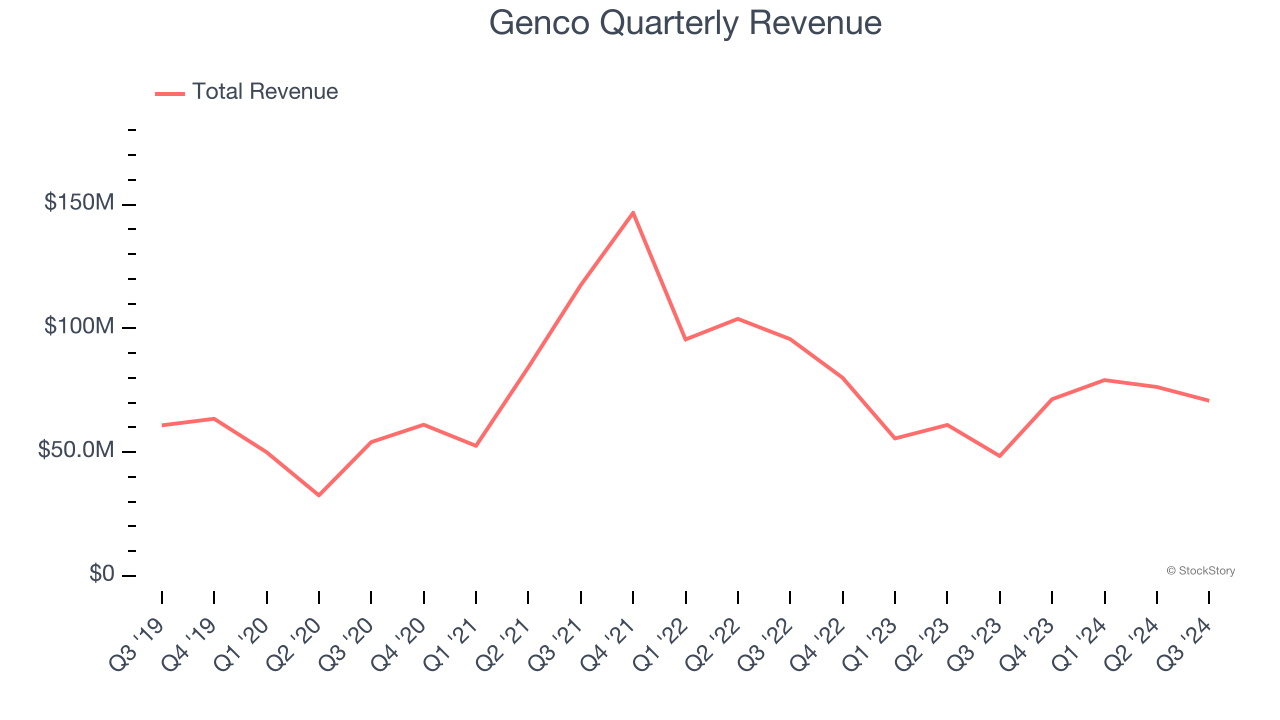

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Regrettably, Genco’s sales grew at a tepid 5.5% compounded annual growth rate over the last five years. This was below our standard for the industrials sector.

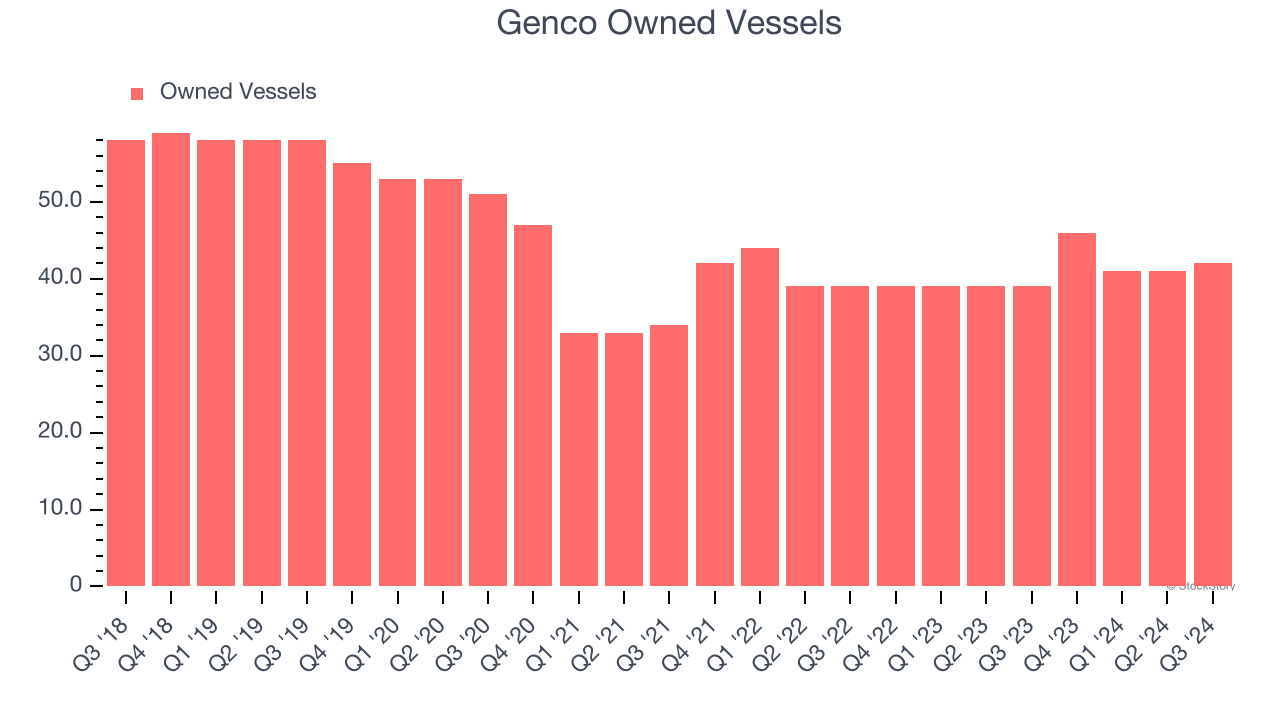

2. Weak Growth in owned vessels Points to Soft Demand

Revenue growth can be broken down into changes in price and volume (for companies like Genco, our preferred volume metric is owned vessels). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Genco’s owned vessels came in at 42 in the latest quarter, and over the last two years, averaged 2.2% year-on-year growth. This performance was underwhelming and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

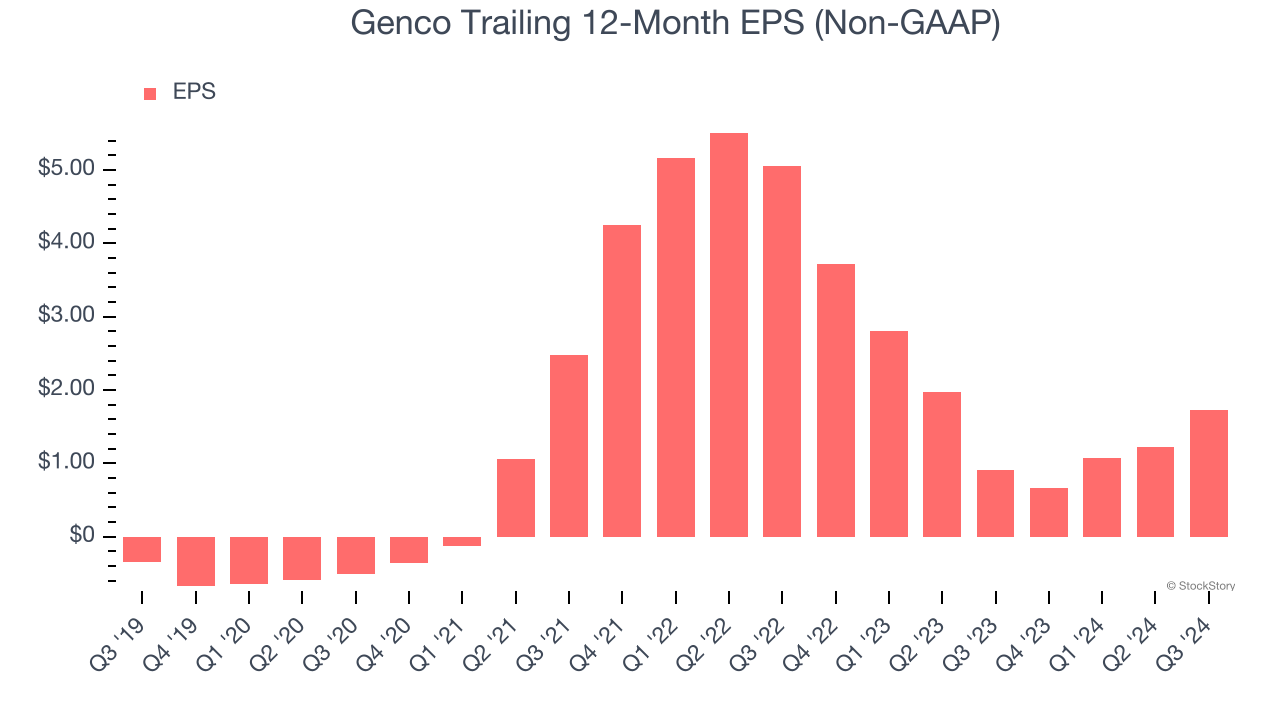

3. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for Genco, its EPS declined by more than its revenue over the last two years, dropping 41.4%. This tells us the company struggled to adjust to shrinking demand.

Final Judgment

Genco isn’t a terrible business, but it isn’t one of our picks. Following the recent decline, the stock trades at 7.5× forward price-to-earnings (or $14.04 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment. We’d recommend looking at Costco, one of Charlie Munger’s all-time favorite businesses.

Stocks We Like More Than Genco

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.