Three Reasons to Avoid DAL and One Stock to Buy Instead

Delta Air Lines’s 29.8% return over the past six months has outpaced the S&P 500 by 19.9%, and its stock price has climbed to $62.56 per share. This run-up might have investors contemplating their next move.

Is now the time to buy Delta Air Lines, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.We’re glad investors have benefited from the price increase, but we're swiping left on Delta Air Lines for now. Here are three reasons why you should be careful with DAL and a stock we'd rather own.

Why Do We Think Delta Air Lines Will Underperform?

One of the ‘Big Four’ airlines in the US, Delta Air Lines (NYSE: DAL) is a major global air carrier that serves both business and leisure travelers through its domestic and international flights.

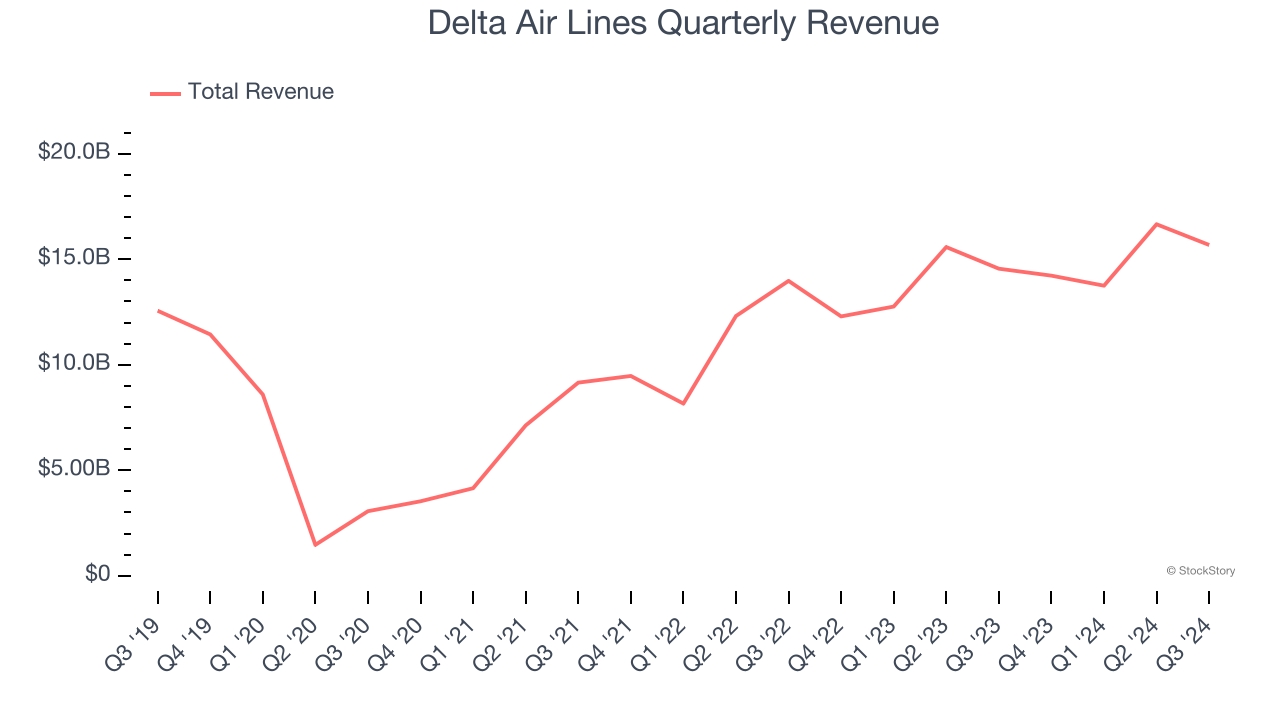

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Delta Air Lines grew its sales at a sluggish 5.4% compounded annual growth rate. This fell short of our benchmark for the consumer discretionary sector.

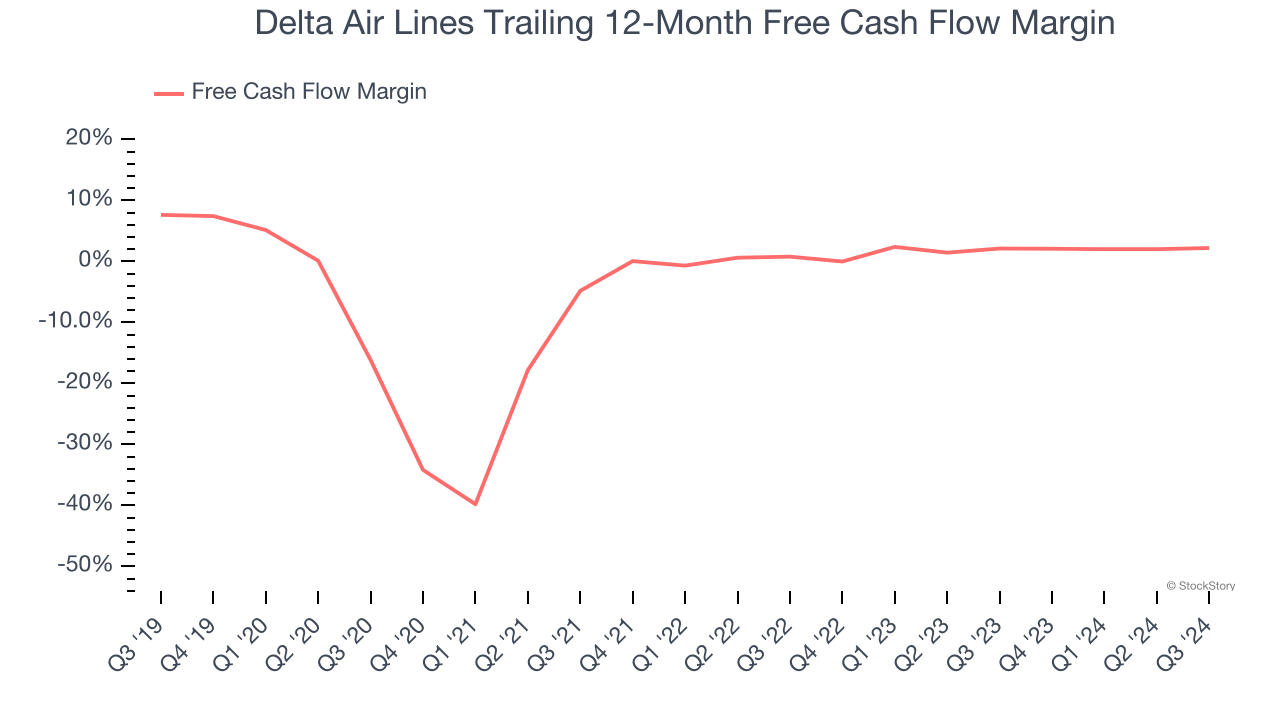

2. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Delta Air Lines has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.2%, lousy for a consumer discretionary business.

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Delta Air Lines historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 2.5%, lower than the typical cost of capital (how much it costs to raise money) for consumer discretionary companies.

Final Judgment

Delta Air Lines falls short of our quality standards. With its shares outperforming the market lately, the stock trades at 9.6× forward price-to-earnings (or $62.56 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better investments elsewhere. We’d recommend looking at TransDigm, a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of Delta Air Lines

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.