Three Reasons Why VSH is Risky and One Stock to Buy Instead

Shareholders of Vishay Intertechnology would probably like to forget the past six months even happened. The stock dropped 20.4% and now trades at $17.54. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Vishay Intertechnology, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.Even though the stock has become cheaper, we're swiping left on Vishay Intertechnology for now. Here are three reasons why VSH doesn't excite us and a stock we'd rather own.

Why Do We Think Vishay Intertechnology Will Underperform?

Named after the founder's ancestral village in present-day Lithuania, Vishay Intertechnology (NYSE: VSH) manufactures simple chips and electronic components that are building blocks of virtually all types of electronic devices.

1. Long-Term Revenue Growth Disappoints

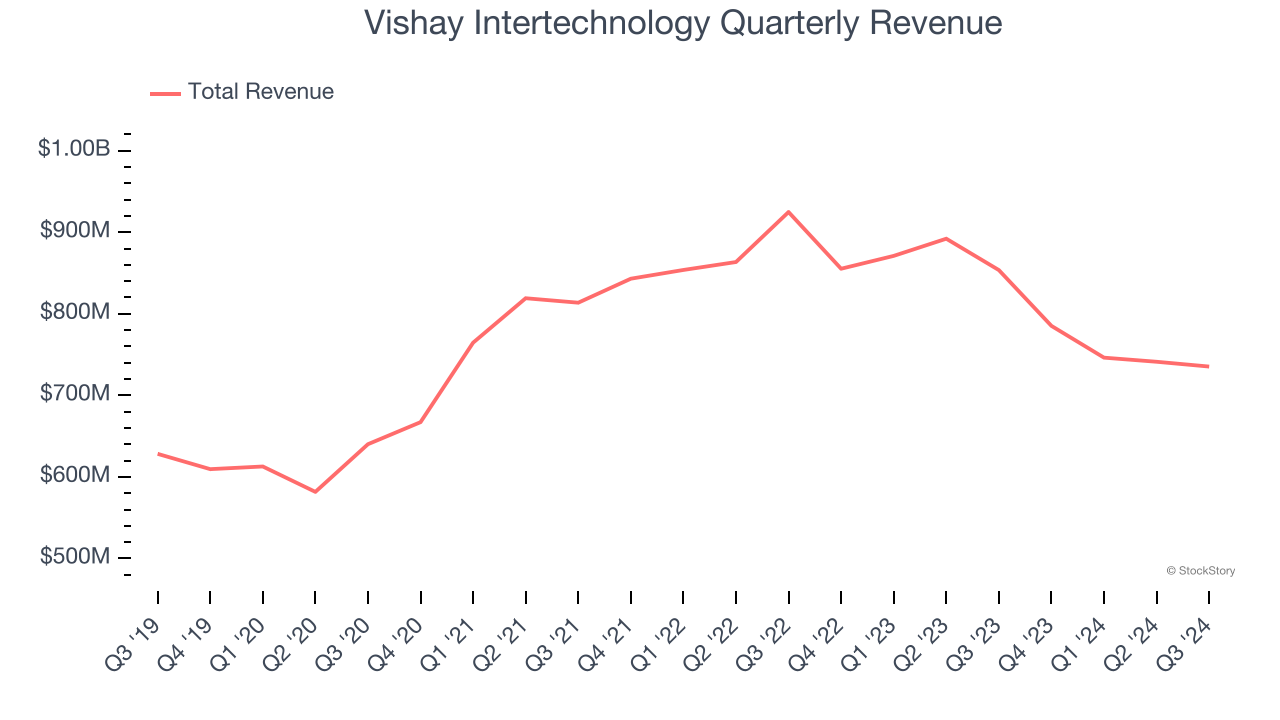

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Vishay Intertechnology grew its sales at a weak 1.2% compounded annual growth rate. This was below our standards. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

2. Low Gross Margin Reveals Weak Structural Profitability

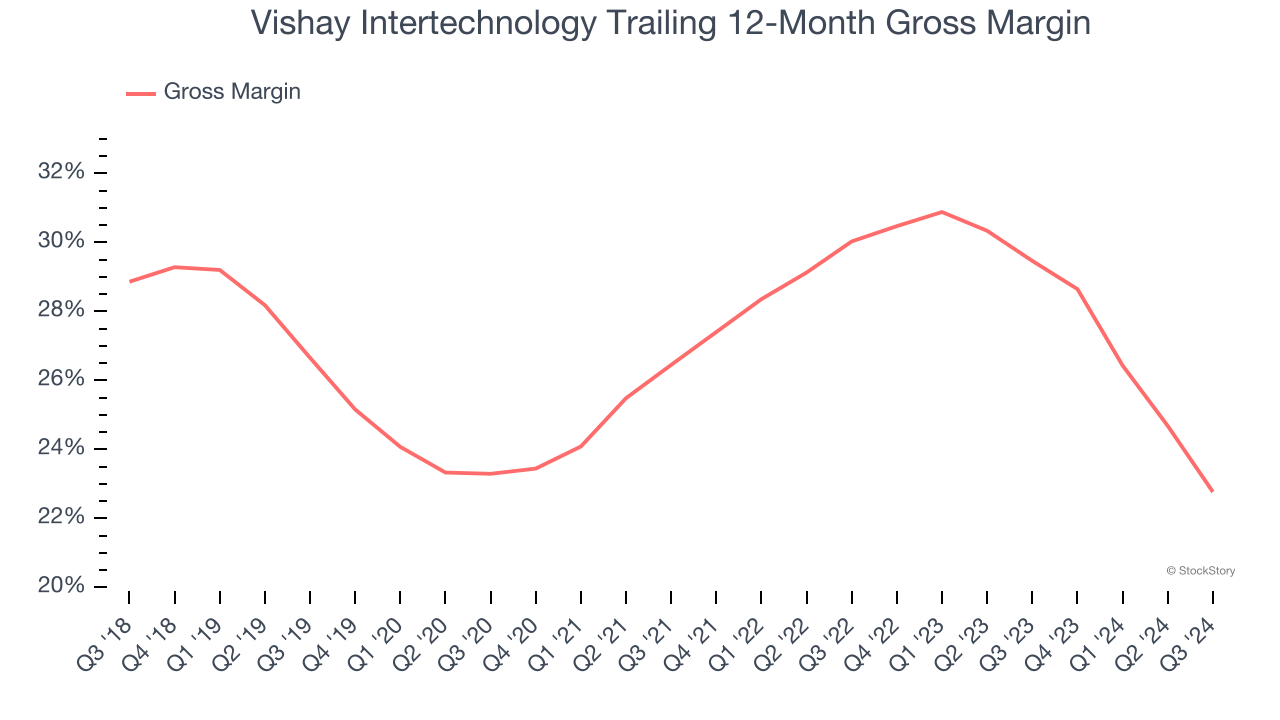

Gross profit margin is a key metric to track because it shows how much money a semiconductor company gets to keep after paying for its raw materials, manufacturing, and other input costs.

Vishay Intertechnology’s gross margin is one of the worst in the semiconductor industry, signaling it operates in a competitive market and lacks pricing power. As you can see below, it averaged a 26.4% gross margin over the last two years. Said differently, Vishay Intertechnology had to pay a chunky $73.65 to its suppliers for every $100 in revenue.

3. Free Cash Flow Margin Dropping

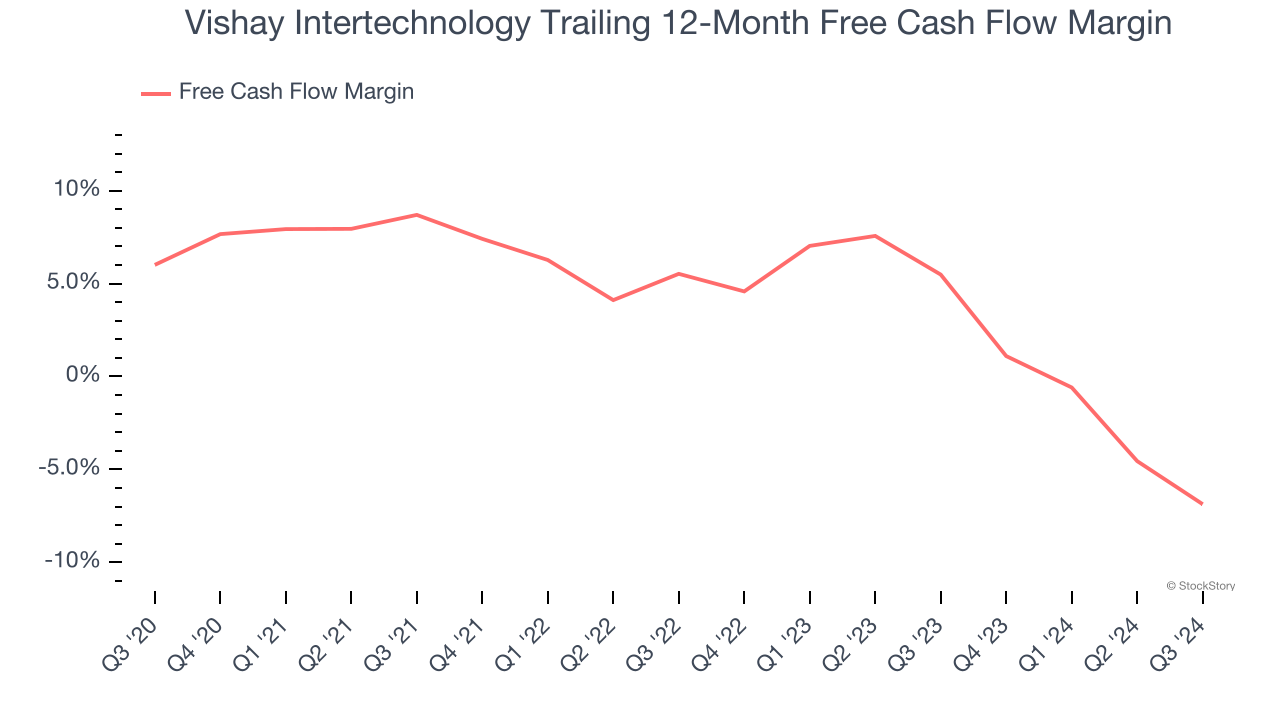

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Vishay Intertechnology’s margin dropped by 12.9 percentage points over the last five years. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business. Vishay Intertechnology’s free cash flow margin for the trailing 12 months was negative 6.9%.

Final Judgment

We cheer for all companies solving complex technology issues, but in the case of Vishay Intertechnology, we’ll be cheering from the sidelines. Following the recent decline, the stock trades at 14.8× forward price-to-earnings (or $17.54 per share). This multiple tells us a lot of good news is priced in - you can find better investment opportunities elsewhere. Let us point you toward The Trade Desk, the nucleus of digital advertising.

Stocks We Like More Than Vishay Intertechnology

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.