Q3 Earnings Outperformers: Box (NYSE:BOX) And The Rest Of The Productivity Software Stocks

The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Box (NYSE: BOX) and the rest of the productivity software stocks fared in Q3.

Rising employee costs and the shift to more remote work has increased the ever-present pressure to improve corporate productivity, which in turn has driven rising demand for productivity software that enables remote work, streamline project management and automate business tasks.

The 17 productivity software stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 1.4% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 7.7% on average since the latest earnings results.

Box (NYSE: BOX)

Founded in 2005 by Aaron Levie and Dylan Smith, Box (NYSE: BOX) provides organizations with software to securely store, share and collaborate around work documents in the cloud.

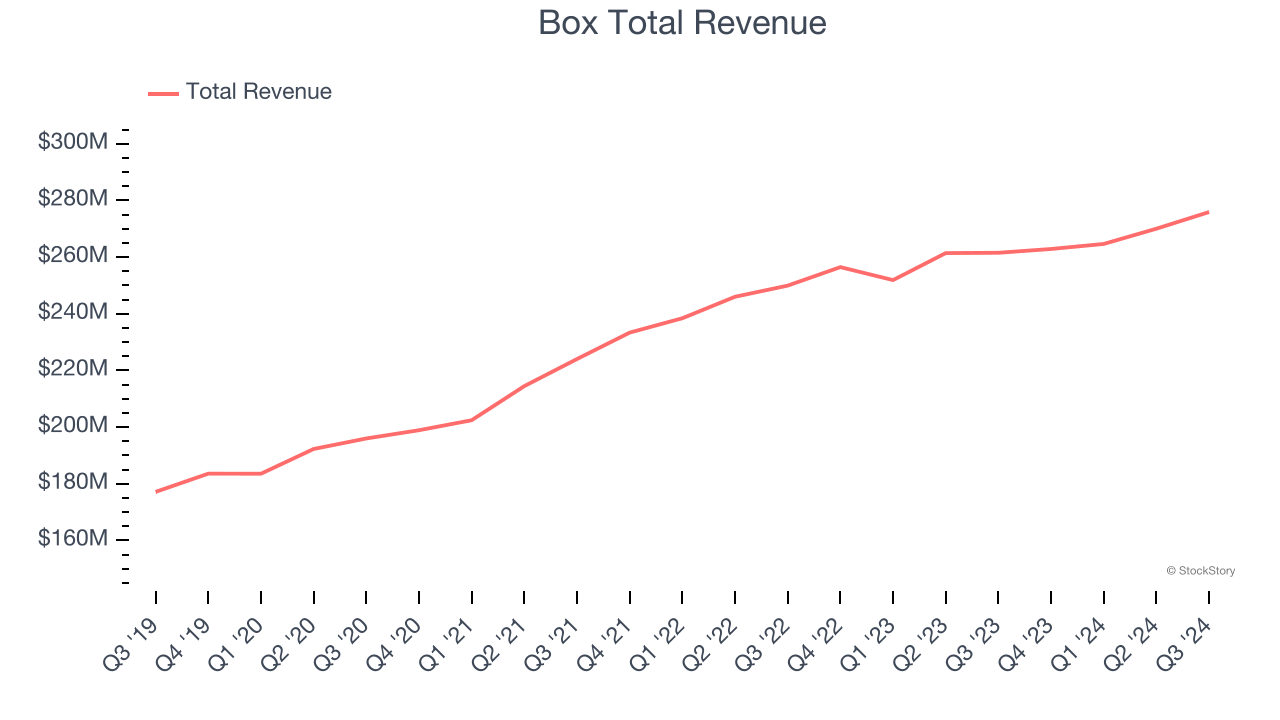

Box reported revenues of $275.9 million, up 5.5% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with full-year EPS guidance beating analysts’ expectations but a slight miss of analysts’ billings estimates.

“We delivered strong Q3 financial results and unveiled the most transformational product line-up in Box history,” said Aaron Levie, co-founder and CEO of Box.

Unsurprisingly, the stock is down 6.3% since reporting and currently trades at $32.20.

Is now the time to buy Box? Access our full analysis of the earnings results here, it’s free.

Best Q3: Five9 (NASDAQ: FIVN)

Started in 2001, Five9 (NASDAQ: FIVN) offers software-as-a-service that makes it easier for companies to set up and efficiently run call centers to offer more tailored customer support.

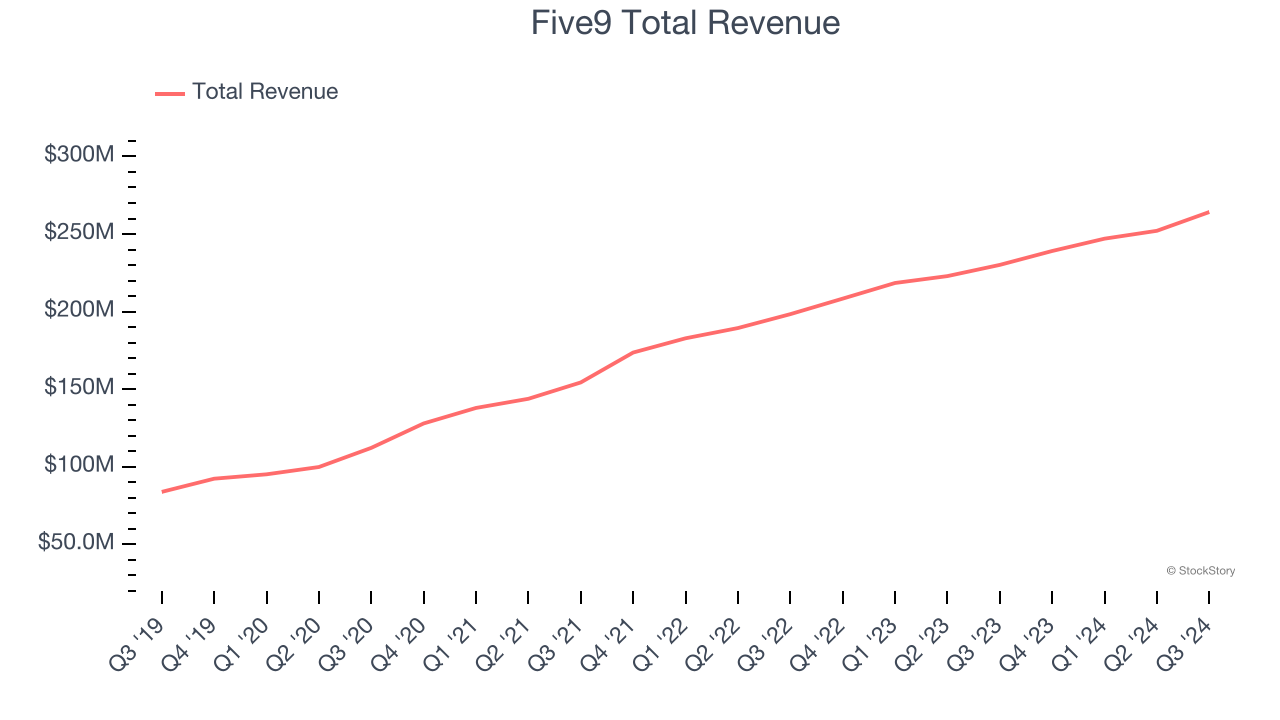

Five9 reported revenues of $264.2 million, up 14.8% year on year, outperforming analysts’ expectations by 3.6%. The business had a very strong quarter with a solid beat of analysts’ EBITDA estimates and full-year EPS guidance exceeding analysts’ expectations.

Five9 scored the biggest analyst estimates beat and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 28.6% since reporting. It currently trades at $42.23.

Is now the time to buy Five9? Access our full analysis of the earnings results here, it’s free.

Slowest Q3: Pegasystems (NASDAQ: PEGA)

Founded by Alan Trefler in 1983, Pegasystems (NASDAQ: PEGA) offers a software-as-a-service platform to automate and optimize workflows in customer service and engagement.

Pegasystems reported revenues of $325.1 million, down 2.9% year on year, falling short of analysts’ expectations by 0.8%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and billings estimates.

Pegasystems delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 37.7% since the results and currently trades at $96.

Read our full analysis of Pegasystems’s results here.

DocuSign (NASDAQ: DOCU)

Founded by Seattle-based entrepreneur Tom Gonser, DocuSign (NASDAQ: DOCU) is the pioneer of e-signature and offers software as a service that allows people and organisations to sign legally binding documents electronically.

DocuSign reported revenues of $754.8 million, up 7.8% year on year. This number beat analysts’ expectations by 1.3%. It was a strong quarter as it also produced an impressive beat of analysts’ billings estimates and a decent beat of analysts’ EBITDA estimates.

The stock is up 13.6% since reporting and currently trades at $95.05.

Read our full, actionable report on DocuSign here, it’s free.

8x8 (NASDAQ: EGHT)

Founded in 1987, 8x8 (NYSE: EGHT) provides software for organizations to efficiently communicate and collaborate with their customers, employees, and partners.

8x8 reported revenues of $181 million, down 2.2% year on year. This result surpassed analysts’ expectations by 1.5%. Zooming out, it was a mixed quarter as it also recorded an impressive beat of analysts’ EBITDA estimates but a slight miss of analysts’ annual recurring revenue estimates.

8x8 had the weakest full-year guidance update among its peers. The stock is up 22.8% since reporting and currently trades at $2.85.

Read our full, actionable report on 8x8 here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.