Three Reasons to Avoid BJ and One Stock to Buy Instead

BJ's trades at $94.92 per share and has stayed right on track with the overall market, gaining 8.4% over the last six months. At the same time, the S&P 500 has returned 9.7%.

Is now the time to buy BJ's, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.We're sitting this one out for now. Here are three reasons why you should be careful with BJ and a stock we'd rather own.

Why Is BJ's Not Exciting?

Appealing to the budget-conscious individual shopping for a household, BJ’s Wholesale Club (NYSE: BJ) is a membership-only retail chain that sells groceries, appliances, electronics, and household items, often in bulk quantities.

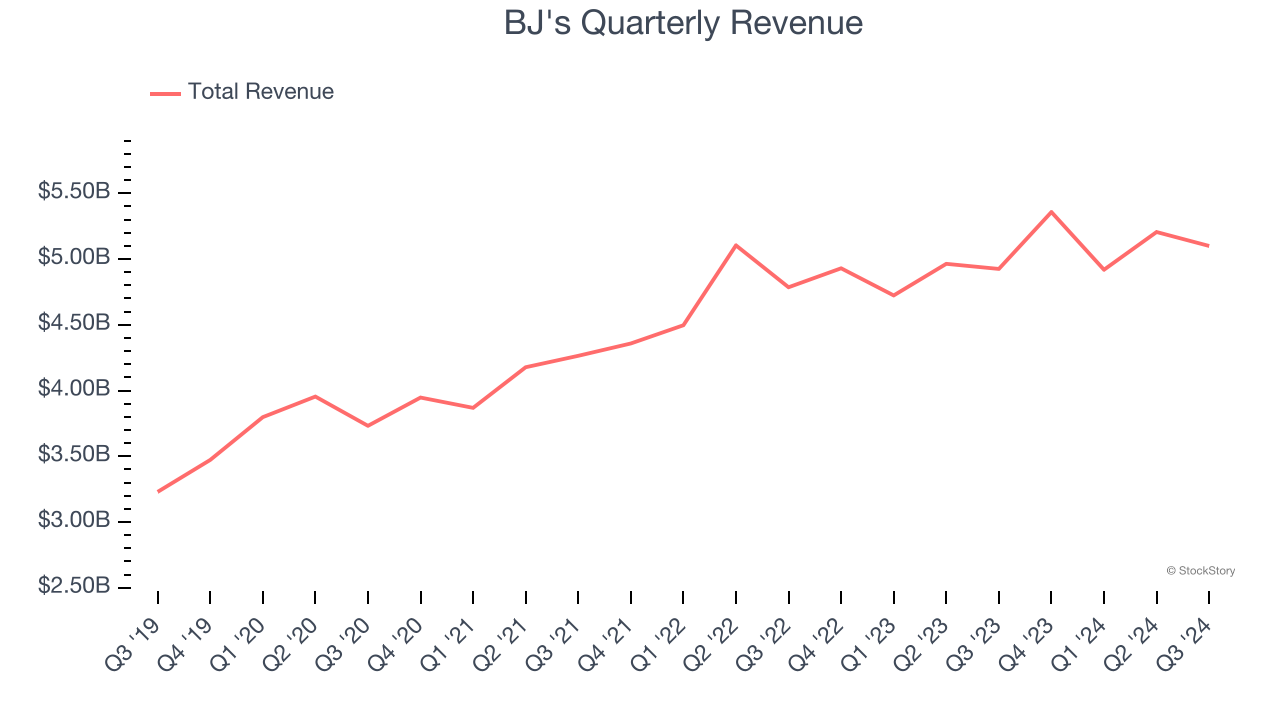

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, BJ’s 9.4% annualized revenue growth over the last five years was mediocre. This was below our standard for the consumer retail sector.

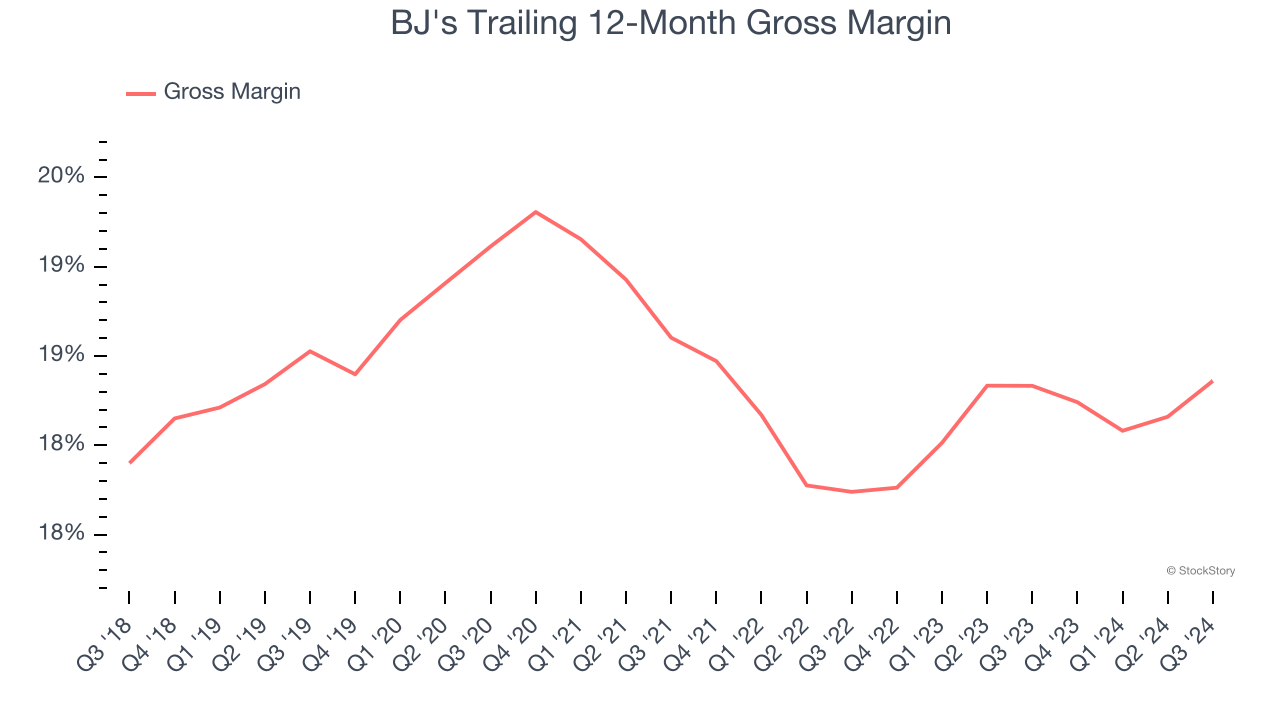

2. Low Gross Margin Reveals Weak Structural Profitability

Gross profit margins are an important measure of a retailer’s pricing power, product differentiation, and negotiating leverage.

BJ's has bad unit economics for a retailer, signaling it operates in a competitive market and lacks pricing power because its inventory is sold in many places. As you can see below, it averaged a 18.3% gross margin over the last two years. Said differently, BJ's had to pay a chunky $81.65 to its suppliers for every $100 in revenue.

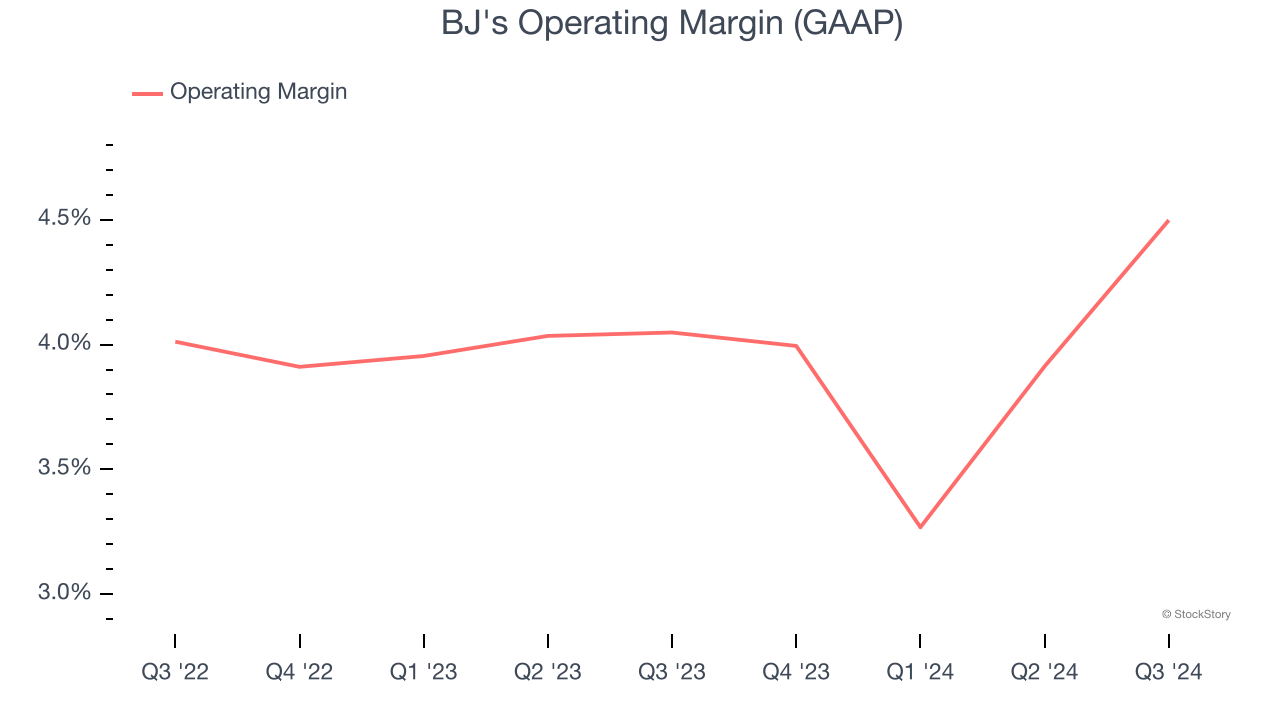

3. Weak Operating Margin Could Cause Trouble

Operating margin is a key profitability metric because it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

BJ's was profitable over the last two years but held back by its large cost base. Its average operating margin of 4% was weak for a consumer retail business. This result isn’t too surprising given its low gross margin as a starting point.

Final Judgment

BJ's isn’t a terrible business, but it doesn’t pass our bar. That said, the stock currently trades at 23× forward price-to-earnings (or $94.92 per share). This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now. We’d recommend looking at Chipotle, which surprisingly still has a long runway for growth.

Stocks We Like More Than BJ's

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.