3 Reasons to Sell GPC and 1 Stock to Buy Instead

Over the last six months, Genuine Parts’s shares have sunk to $116.96, producing a disappointing 12.6% loss - a stark contrast to the S&P 500’s 8.8% gain. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Genuine Parts, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.Even though the stock has become cheaper, we're cautious about Genuine Parts. Here are three reasons why we avoid GPC and a stock we'd rather own.

Why Is Genuine Parts Not Exciting?

Largely targeting the professional customer, Genuine Parts (NYSE: GPC) sells auto and industrial parts such as batteries, belts, bearings, and machine fluids.

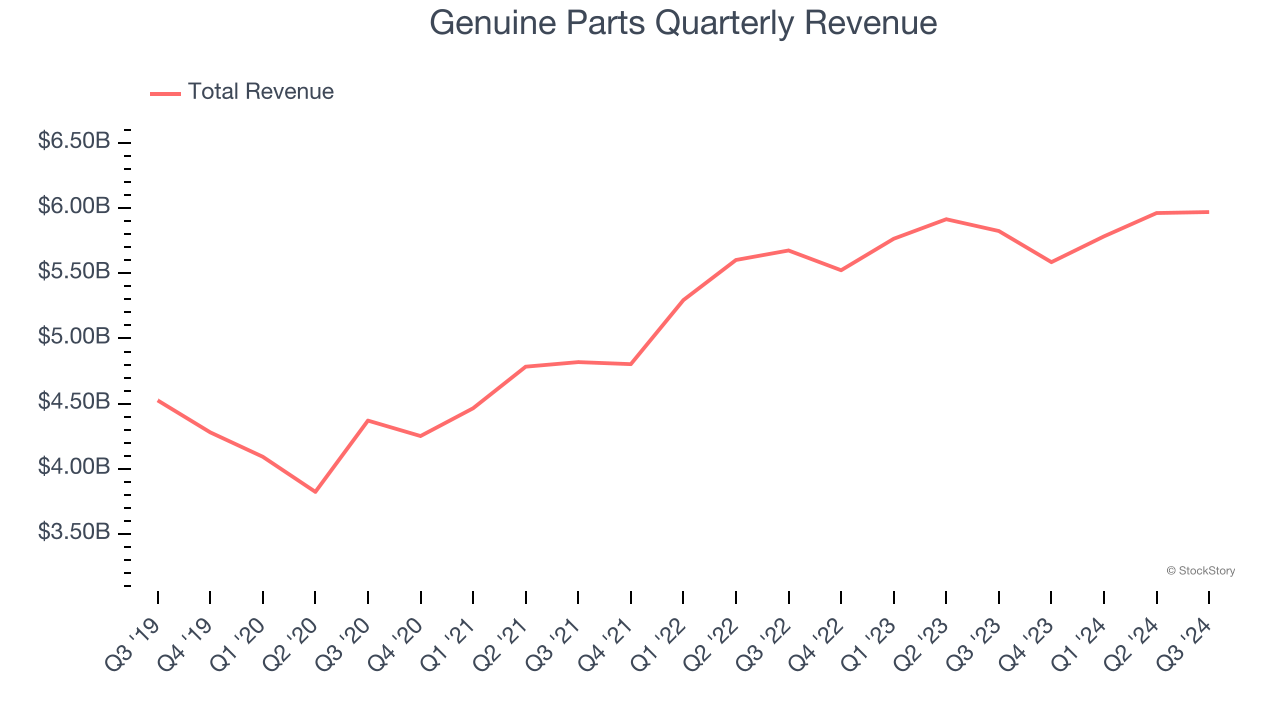

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Unfortunately, Genuine Parts’s 5.5% annualized revenue growth over the last five years was tepid. This fell short of our benchmark for the consumer retail sector.

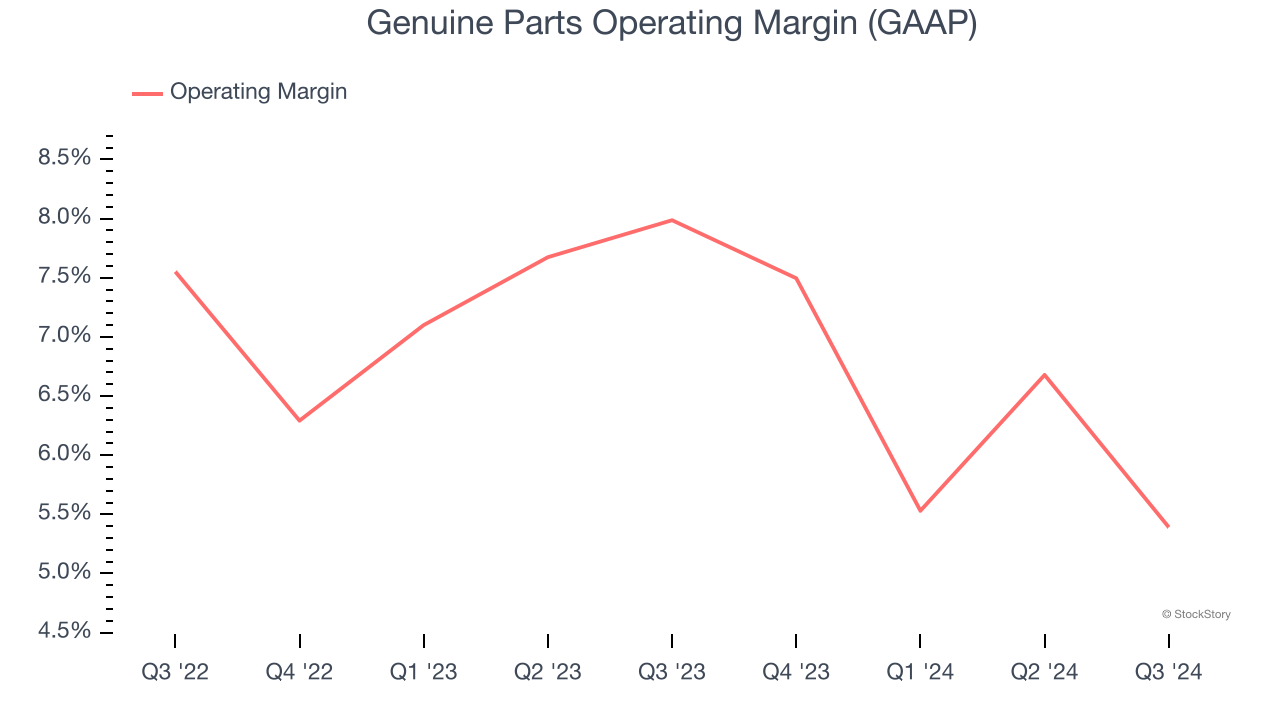

2. Weak Operating Margin Could Cause Trouble

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Genuine Parts was profitable over the last two years but held back by its large cost base. Its average operating margin of 6.8% was weak for a consumer retail business.

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Genuine Parts historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 14.8%, somewhat low compared to the best consumer retail companies that consistently pump out 25%+.

Final Judgment

Genuine Parts isn’t a terrible business, but it doesn’t pass our bar. Following the recent decline, the stock trades at 11.9× forward price-to-earnings (or $116.96 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment. We’d recommend looking at Microsoft, the most dominant software business in the world.

Stocks We Would Buy Instead of Genuine Parts

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.