3 Reasons to Sell HNST and 1 Stock to Buy Instead

The past six months have been a windfall for The Honest Company’s shareholders. The company’s stock price has jumped 145%, hitting $6.88 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy The Honest Company, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.We’re glad investors have benefited from the price increase, but we don't have much confidence in The Honest Company. Here are three reasons why HNST doesn't excite us and a stock we'd rather own.

Why Do We Think The Honest Company Will Underperform?

Co-founded by actress Jessica Alba, The Honest Company (NASDAQ: HNST) sells diapers and wipes, skin care products, and household cleaning products.

1. Long-Term Revenue Growth Disappoints

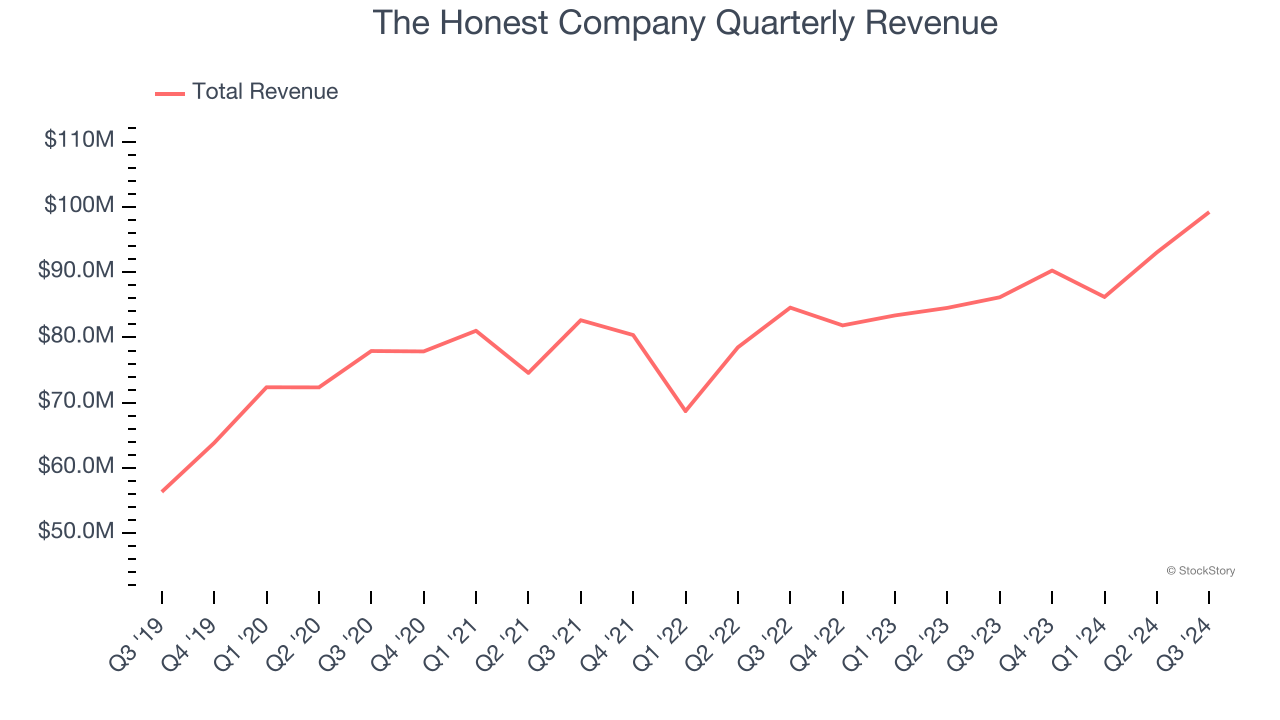

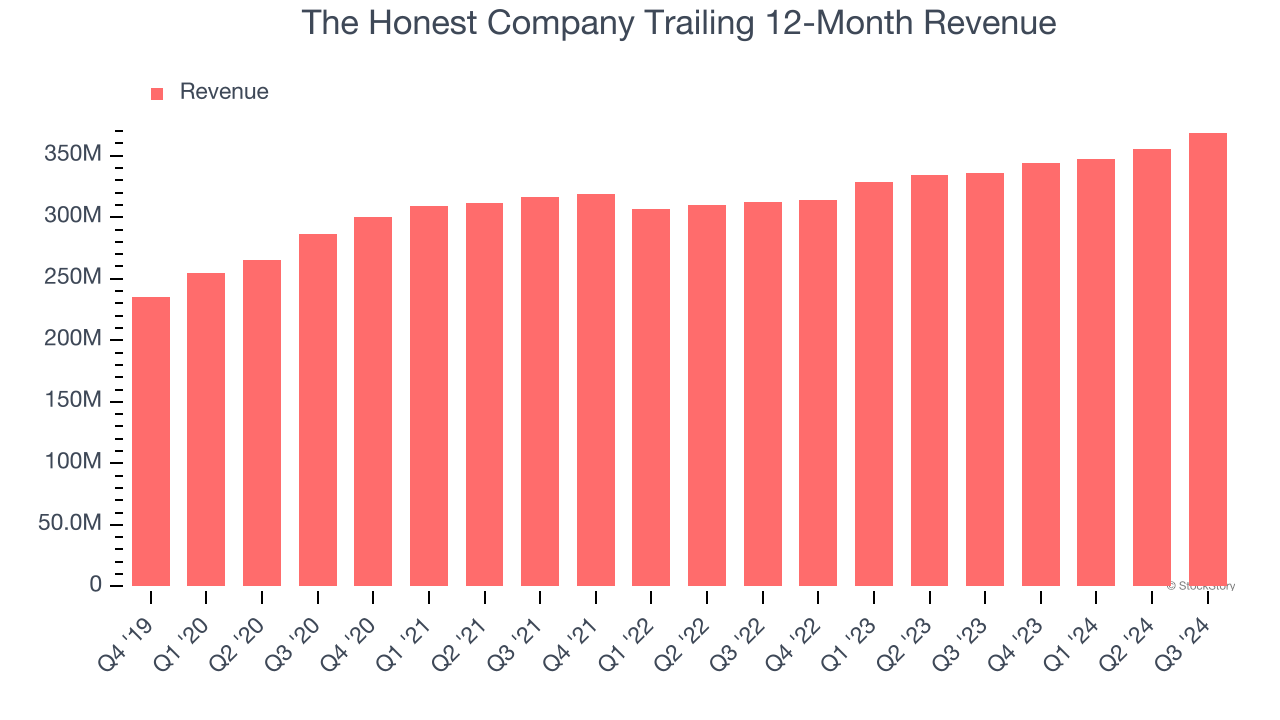

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, The Honest Company’s 5.3% annualized revenue growth over the last three years was tepid. This fell short of our benchmark for the consumer staples sector.

2. Less Negotiating Power with Suppliers

The Honest Company is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage.

3. Operating Losses Sound the Alarms

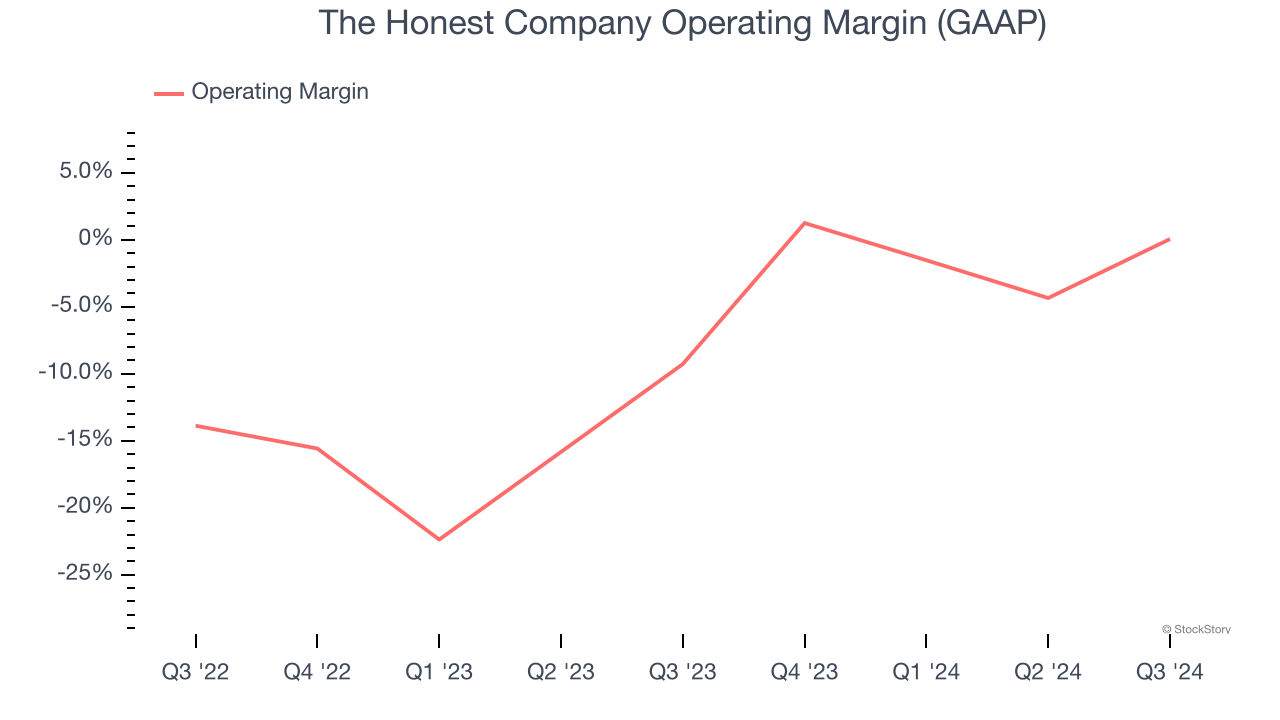

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Although The Honest Company broke even this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 8.1% over the last two years. Unprofitable public companies are rare in the defensive consumer staples industry, so this performance certainly caught our eye.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of The Honest Company, we’ll be cheering from the sidelines. Following the recent surge, the stock trades at 40.9× forward EV-to-EBITDA (or $6.88 per share). At this valuation, there’s a lot of good news priced in - we think there are better stocks to buy right now. We’d suggest looking at ServiceNow, one of our all-time favorite software stocks with a durable competitive moat.

Stocks We Like More Than The Honest Company

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.