Three Reasons to Avoid SBUX and One Stock to Buy Instead

Starbucks has had an impressive run over the past six months as its shares have beaten the S&P 500 by 23.1%. The stock now trades at $92.68, marking a 27.8% gain. This performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Starbucks, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.We’re glad investors have benefited from the price increase, but we're sitting this one out for now. Here are three reasons why you should be careful with SBUX and a stock we'd rather own.

Why Is Starbucks Not Exciting?

Started by three friends in Seattle’s historic Pike Place Market, Starbucks (NASDAQ: SBUX) is a globally-renowned coffeehouse chain that offers a wide selection of high-quality coffee, beverages, and food items.

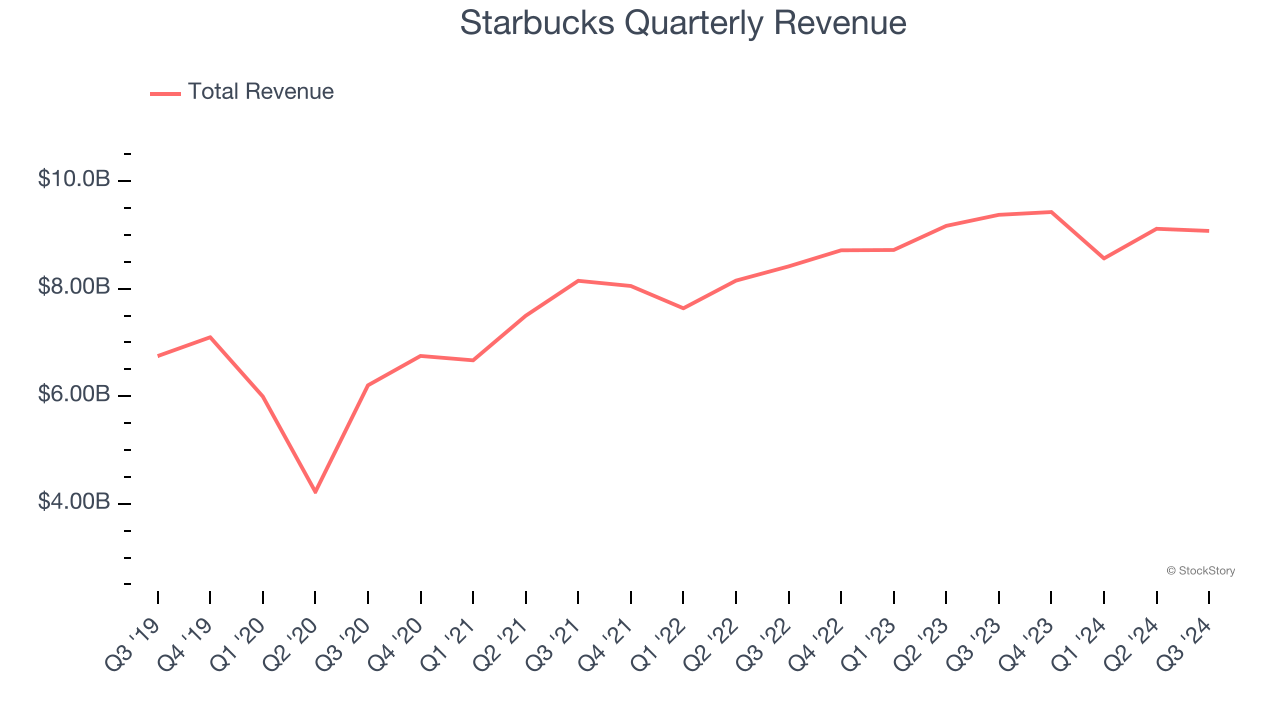

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Starbucks grew its sales at a mediocre 6.4% compounded annual growth rate. This fell short of our benchmark for the restaurant sector.

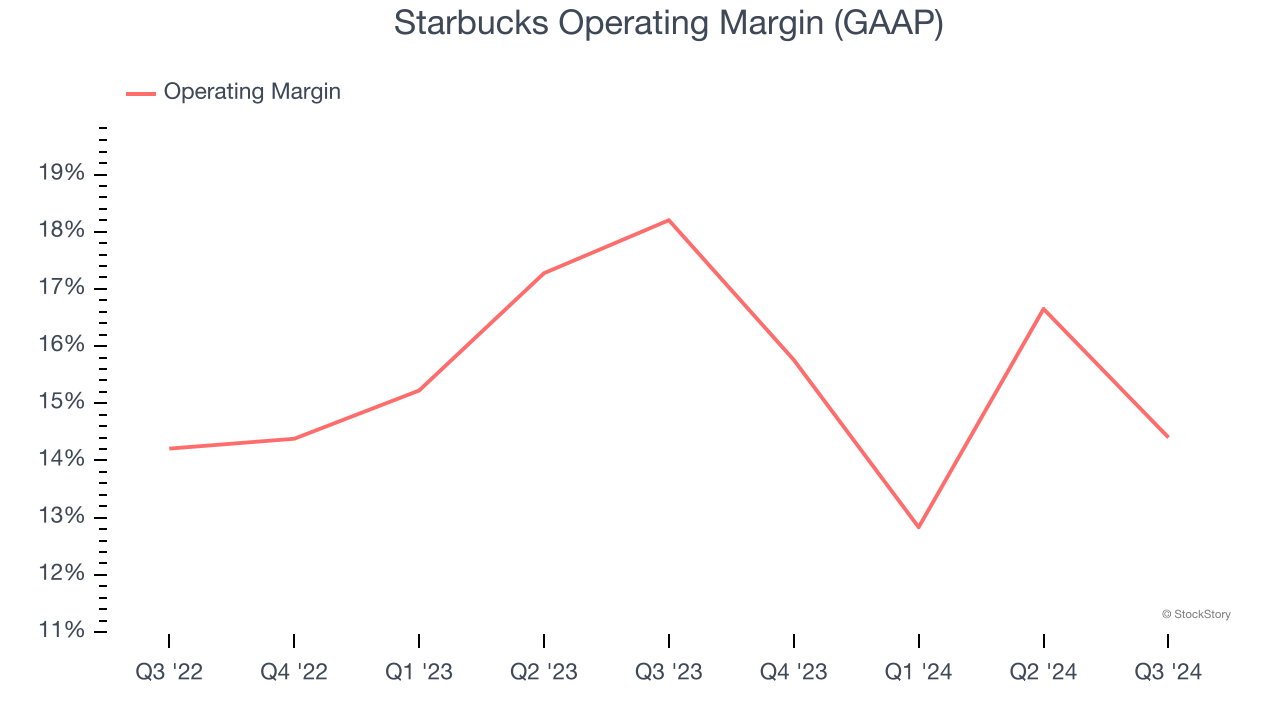

2. Operating Margin Falling

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Analyzing the trend in its profitability, Starbucks’s operating margin decreased by 1.4 percentage points over the last year. Even though its historical margin is high, shareholders will want to see Starbucks become more profitable in the future. Its operating margin for the trailing 12 months was 15%.

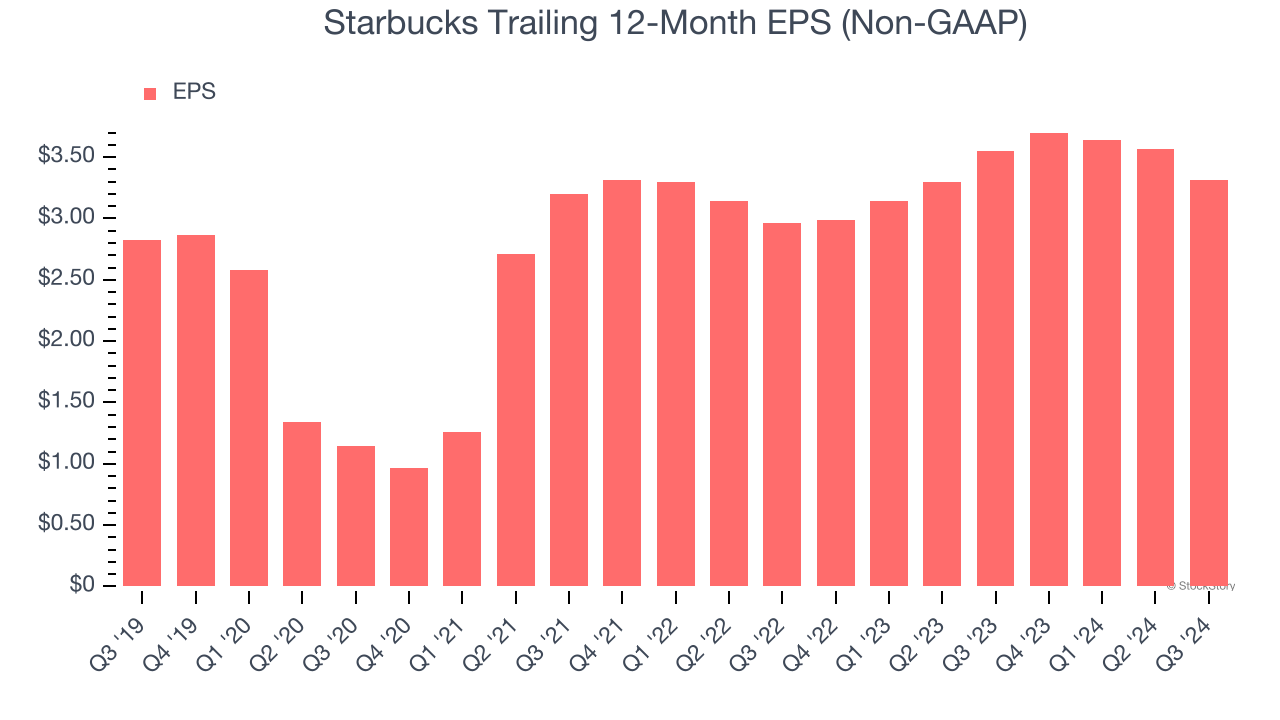

3. EPS Barely Growing

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Starbucks’s EPS grew at an unimpressive 3.2% compounded annual growth rate over the last five years, lower than its 6.4% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Starbucks isn’t a terrible business, but it doesn’t pass our quality test. With its shares topping the market in recent months, the stock trades at 26× forward price-to-earnings (or $92.68 per share). This valuation tells us a lot of optimism is priced in - we think there are better investment opportunities out there. We’d recommend looking at Wabtec, a leading provider of locomotive services benefiting from an upgrade cycle.

Stocks We Would Buy Instead of Starbucks

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.