3 Reasons to Sell INTC and 1 Stock to Buy Instead

Intel’s stock price has taken a beating over the past six months, shedding 42.3% of its value and falling to $19.81 per share. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Intel, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons why you should be careful with INTC and a stock we'd rather own.

Why Do We Think Intel Will Underperform?

Inventor of the x86 processor that powered decades of technological innovation in PCs, data centers, and numerous other markets, Intel (NASDAQ: INTC) is a leading manufacturer of computer processors and graphics chips.

1. Revenue Spiraling Downwards

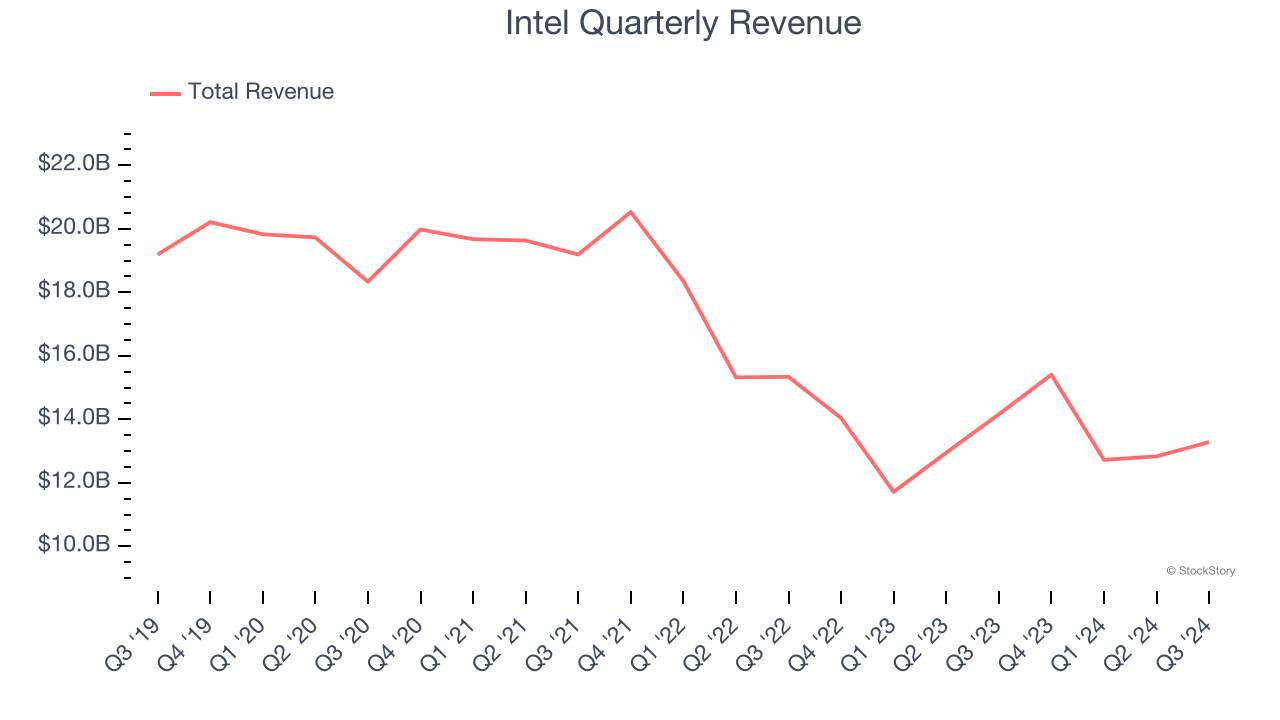

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Intel struggled to consistently generate demand over the last five years as its sales dropped at a 5.1% annual rate. This fell short of our benchmarks and signals it’s a low quality business. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

2. EPS Trending Down

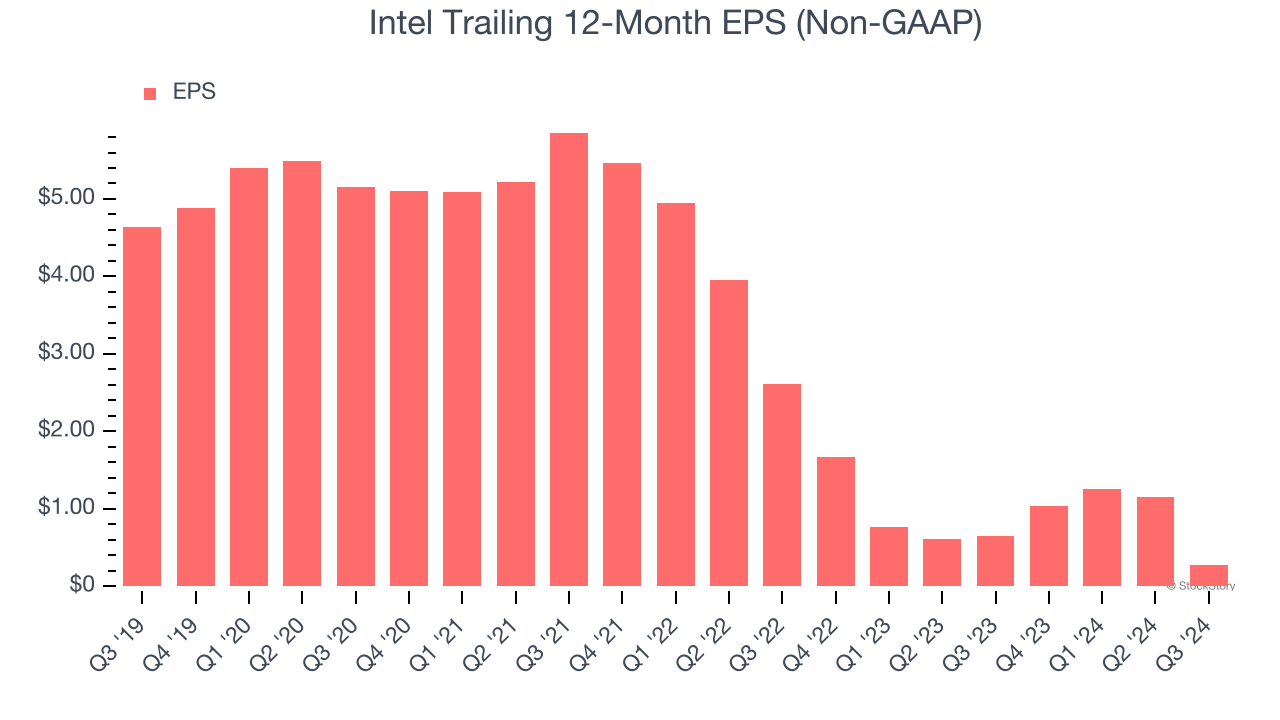

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Intel, its EPS declined by more than its revenue over the last five years, dropping 43% annually. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

3. Free Cash Flow Margin Dropping

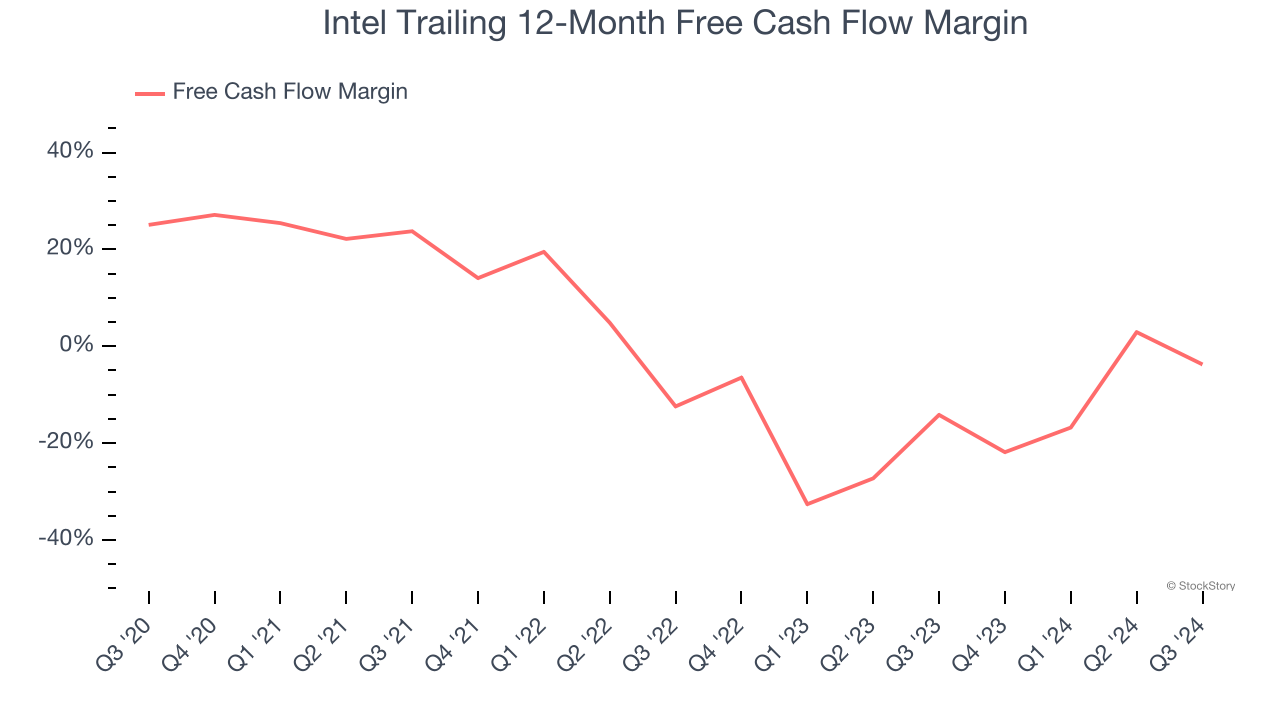

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Intel’s margin dropped by 28.8 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. Almost any movement in the wrong direction is undesirable because it’s already burning cash. Intel’s free cash flow margin for the trailing 12 months was negative 3.7%.

Final Judgment

We cheer for all companies solving complex technology issues, but in the case of Intel, we’ll be cheering from the sidelines. Following the recent decline, the stock trades at 28.3× forward price-to-earnings (or $19.81 per share). This multiple tells us a lot of good news is priced in - we think there are better investment opportunities out there. We’d recommend looking at FTAI Aviation, an aerospace company benefiting from Boeing and Airbus’s struggles.

Stocks We Like More Than Intel

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.