Fastenal (NASDAQ:FAST) Misses Q4 Sales Targets, Stock Drops

Industrial supplier Fastenal (NASDAQ: FAST) missed Wall Street’s revenue expectations in Q4 CY2024 as sales rose 3.7% year on year to $1.82 billion. Its GAAP profit of $0.46 per share was 3.8% below analysts’ consensus estimates.

Is now the time to buy Fastenal? Find out by accessing our full research report, it’s free.

Fastenal (FAST) Q4 CY2024 Highlights:

- Revenue: $1.82 billion vs analyst estimates of $1.84 billion (3.7% year-on-year growth, 0.9% miss)

- Adjusted EPS: $0.46 vs analyst expectations of $0.48 (3.8% miss)

- Operating Margin: 18.9%, down from 20.1% in the same quarter last year

- Free Cash Flow Margin: 12.2%, down from 18.1% in the same quarter last year

- Sales Volumes rose 12.2% year on year (10.8% in the same quarter last year)

- Market Capitalization: $42.83 billion

Company Overview

Founded in 1967, Fastenal (NASDAQ: FAST) provides industrial and construction supplies, including fasteners, tools, safety products, and many other product categories to businesses globally.

Maintenance and Repair Distributors

Supply chain and inventory management are themes that grew in focus after COVID wreaked havoc on the global movement of raw materials and components. Maintenance and repair distributors that boast reliable selection and quickly deliver products to customers can benefit from this theme. While e-commerce hasn’t disrupted industrial distribution as much as consumer retail, it is still a real threat, forcing investment in omnichannel capabilities to serve customers everywhere. Additionally, maintenance and repair distributors are at the whim of economic cycles that impact the capital spending and construction projects that can juice demand.

Sales Growth

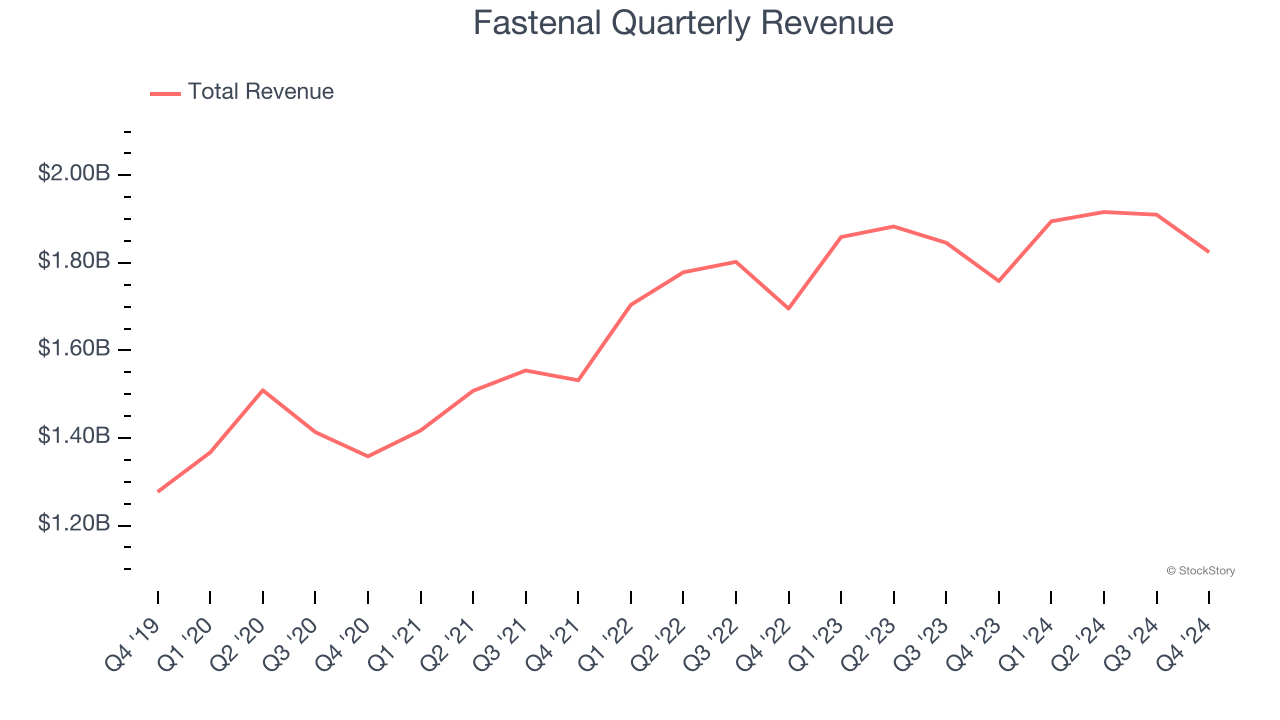

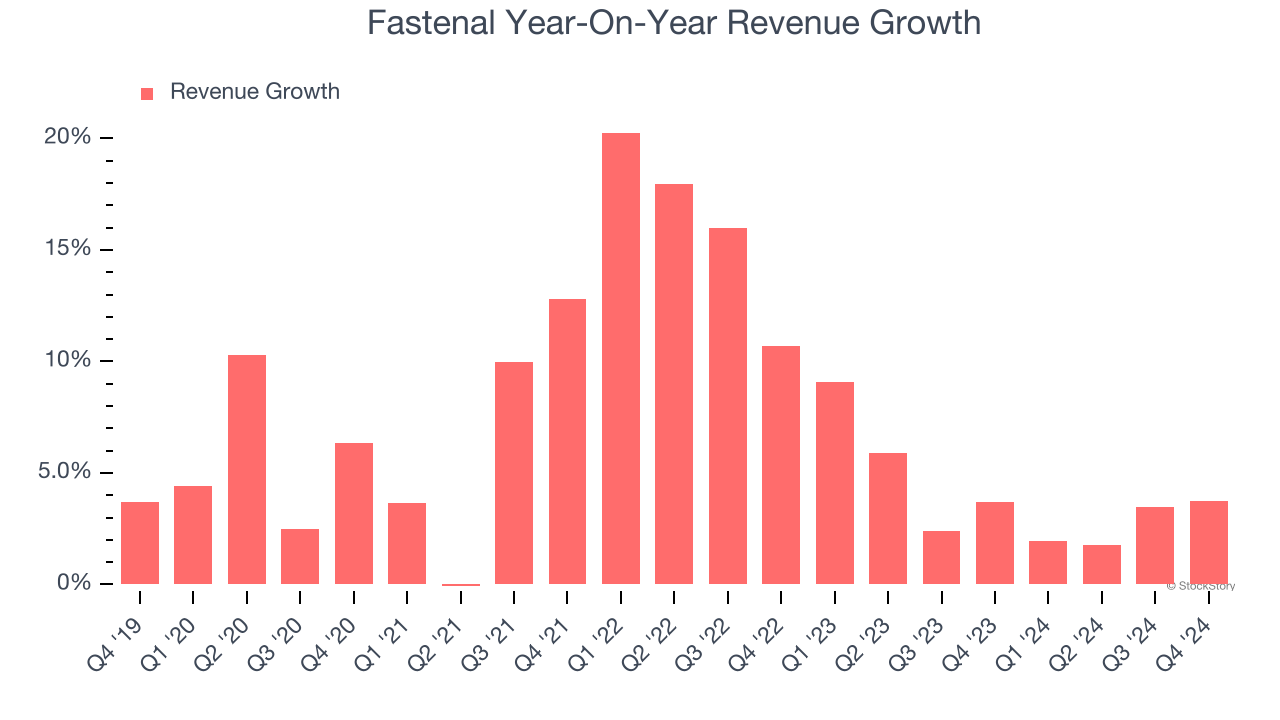

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Fastenal’s 7.2% annualized revenue growth over the last five years was mediocre. This was below our standard for the industrials sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Fastenal’s recent history shows its demand slowed as its annualized revenue growth of 4% over the last two years is below its five-year trend. We also note many other Maintenance and Repair Distributors businesses have faced declining sales because of cyclical headwinds. While Fastenal grew slower than we’d like, it did perform better than its peers.

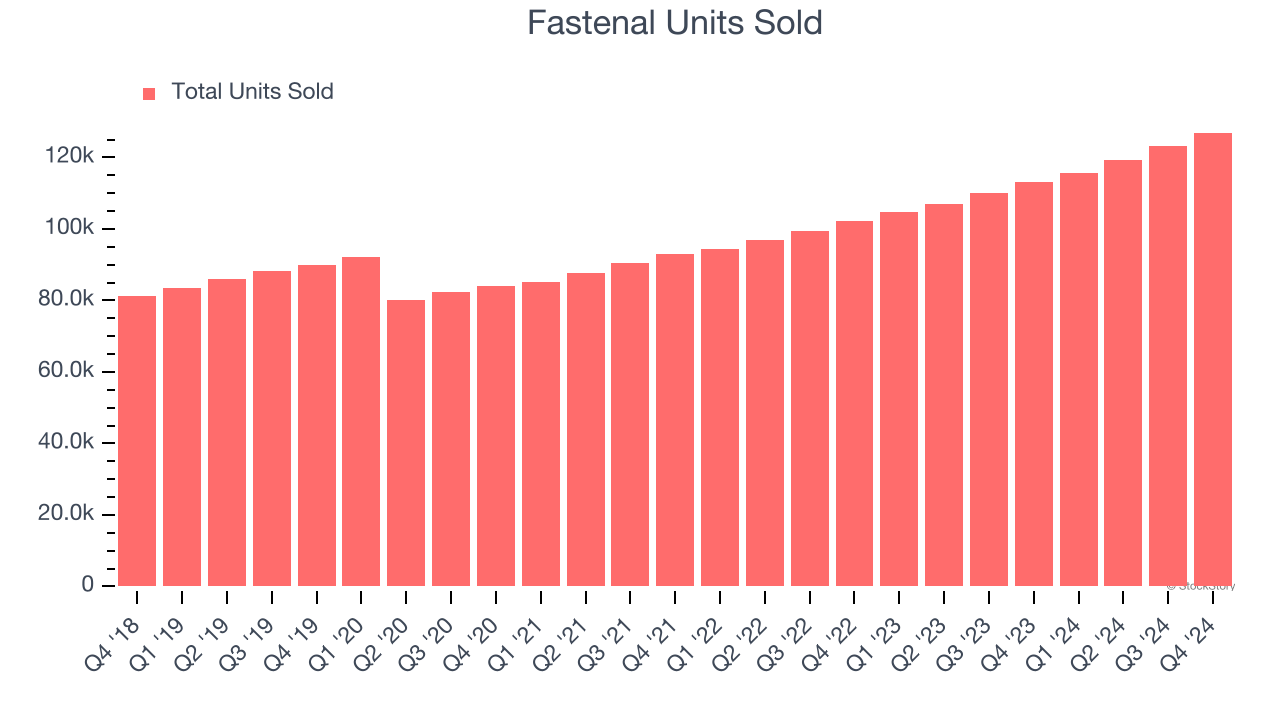

Fastenal also reports its units sold, which reached 126,957 in the latest quarter. Over the last two years, Fastenal’s units sold averaged 11.1% year-on-year growth. Because this number is better than its revenue growth, we can see the company’s average selling price decreased.

This quarter, Fastenal’s revenue grew by 3.7% year on year to $1.82 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 7.7% over the next 12 months, an improvement versus the last two years. This projection is above average for the sector and indicates its newer products and services will fuel better top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

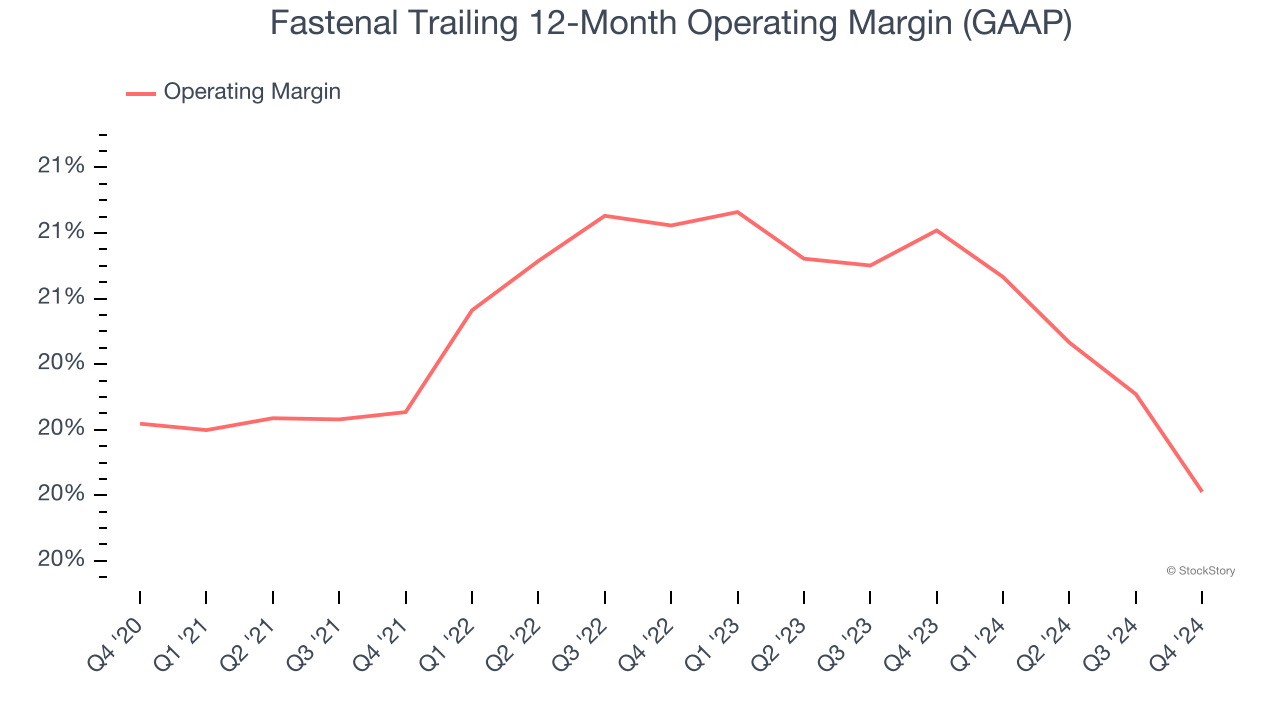

Fastenal has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 20.4%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Fastenal’s operating margin might have seen some fluctuations but has generally stayed the same over the last five years, highlighting the long-term consistency of its business.

In Q4, Fastenal generated an operating profit margin of 18.9%, down 1.2 percentage points year on year. Since Fastenal’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

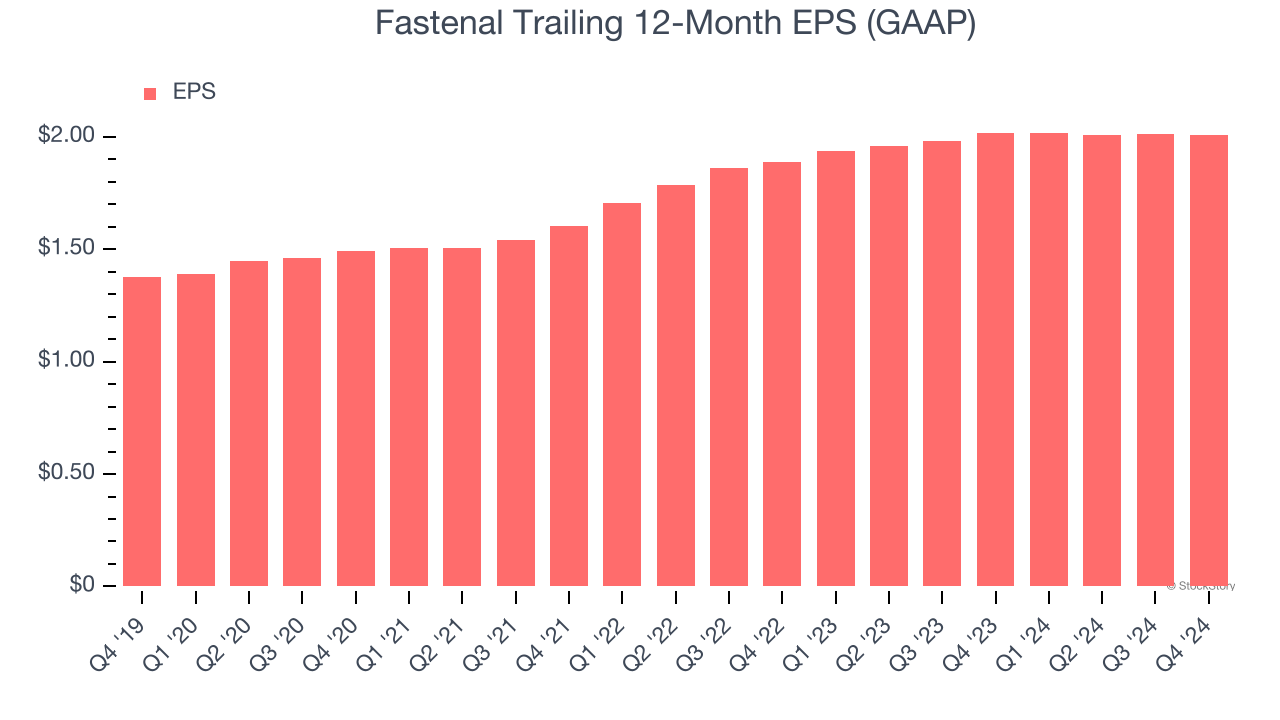

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Fastenal’s unimpressive 7.8% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Fastenal, its two-year annual EPS growth of 3.1% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Fastenal reported EPS at $0.46, in line with the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Fastenal’s full-year EPS of $2.01 to grow 8.3%.

Key Takeaways from Fastenal’s Q4 Results

Fastenal's revenue and EPS both missed, making for a bad quarter. The stock traded down 6.3% to $70.05 immediately after reporting.

Should you buy the stock or not? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.