Johnson Controls (JCI): Buy, Sell, or Hold Post Q3 Earnings?

Johnson Controls has had an impressive run over the past six months as its shares have beaten the S&P 500 by 7.8%. The stock now trades at $81.14, marking a 15.6% gain. This run-up might have investors contemplating their next move.

Is now the time to buy Johnson Controls, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

We’re happy investors have made money, but we don't have much confidence in Johnson Controls. Here are three reasons why you should be careful with JCI and a stock we'd rather own.

Why Do We Think Johnson Controls Will Underperform?

Founded after patenting the electric room thermostat, Johnson Controls (NYSE: JCI) specializes in building products and technology solutions, including HVAC systems, fire and security systems, and energy storage.

1. Slow Organic Growth Suggests Waning Demand In Core Business

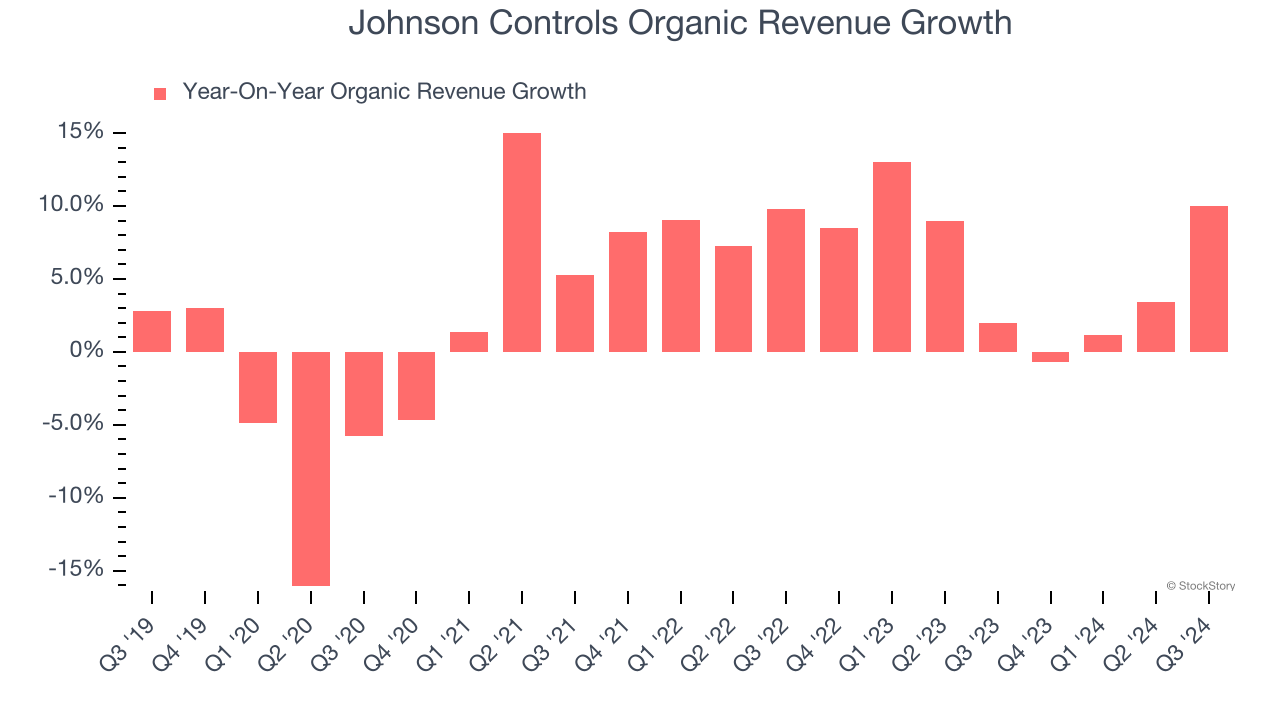

In addition to reported revenue, organic revenue is a useful data point for analyzing Commercial Building Products companies. This metric gives visibility into Johnson Controls’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Johnson Controls’s organic revenue averaged 5.8% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

2. Free Cash Flow Margin Dropping

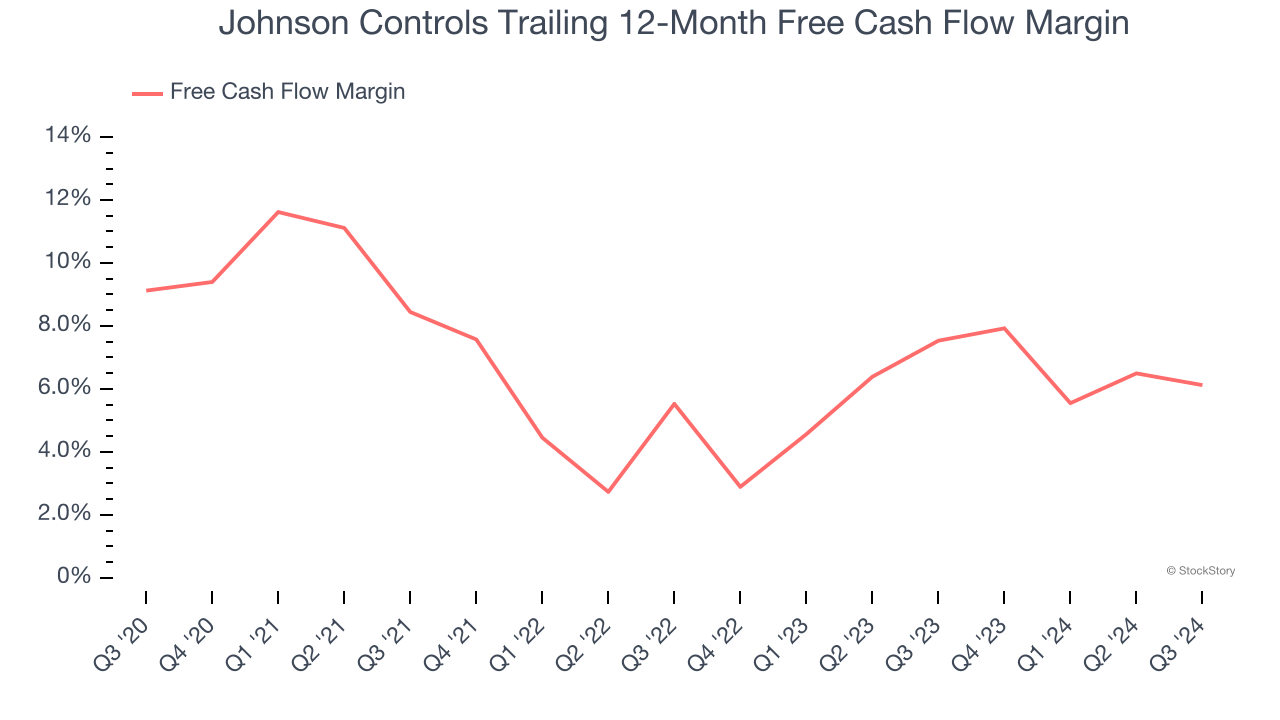

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Johnson Controls’s margin dropped by 3 percentage points over the last five years. If its declines continue, it could signal higher capital intensity. Johnson Controls’s free cash flow margin for the trailing 12 months was 6.1%.

3. Previous Growth Initiatives Haven’t Paid Off Yet

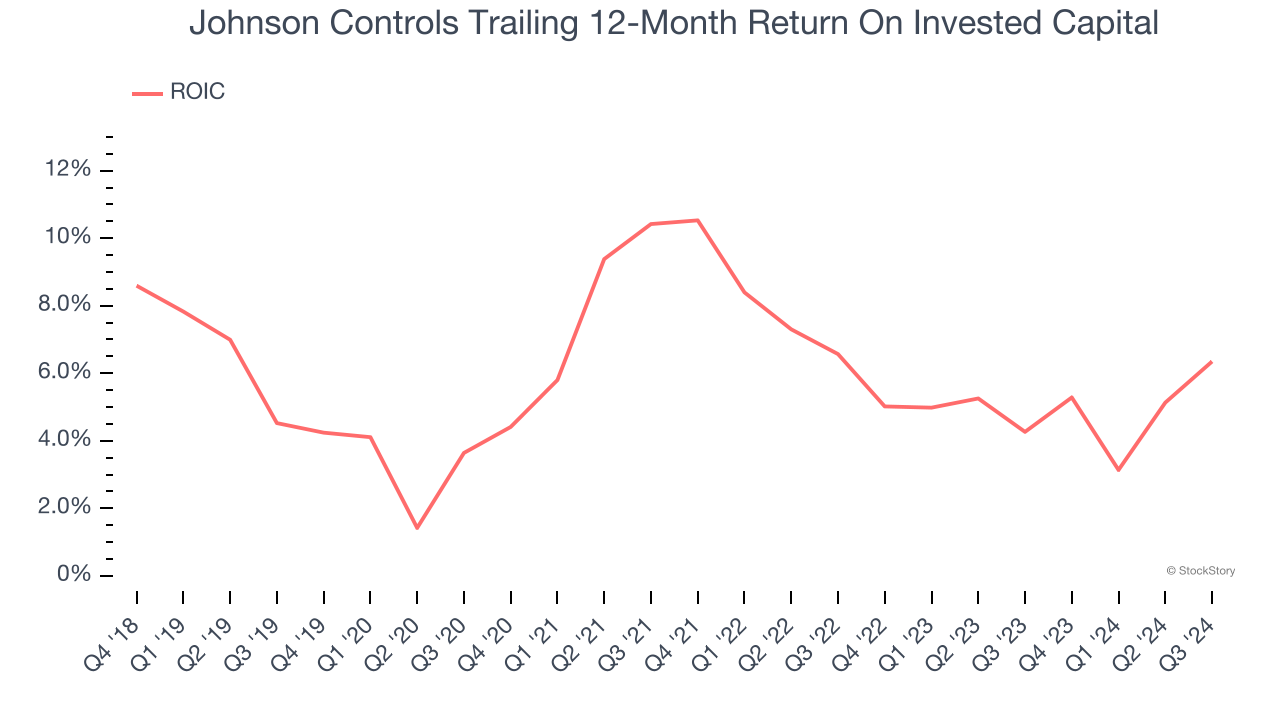

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Johnson Controls historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.2%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

Final Judgment

Johnson Controls falls short of our quality standards. With its shares beating the market recently, the stock trades at 22.6× forward price-to-earnings (or $81.14 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better stocks to buy right now. We’d suggest looking at TransDigm, a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than Johnson Controls

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.