3 Reasons to Avoid PRDO and 1 Stock to Buy Instead

Perdoceo Education trades at $28.10 and has moved in lockstep with the market. Its shares have returned 16.8% over the last six months while the S&P 500 has gained 12.6%.

Is there a buying opportunity in Perdoceo Education, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

We don't have much confidence in Perdoceo Education. Here are three reasons why there are better opportunities than PRDO and a stock we'd rather own.

Why Is Perdoceo Education Not Exciting?

Formerly known as Career Education Corporation, Perdoceo Education (NASDAQ: PRDO) is an educational services company that specializes in postsecondary education.

1. Long-Term Revenue Growth Disappoints

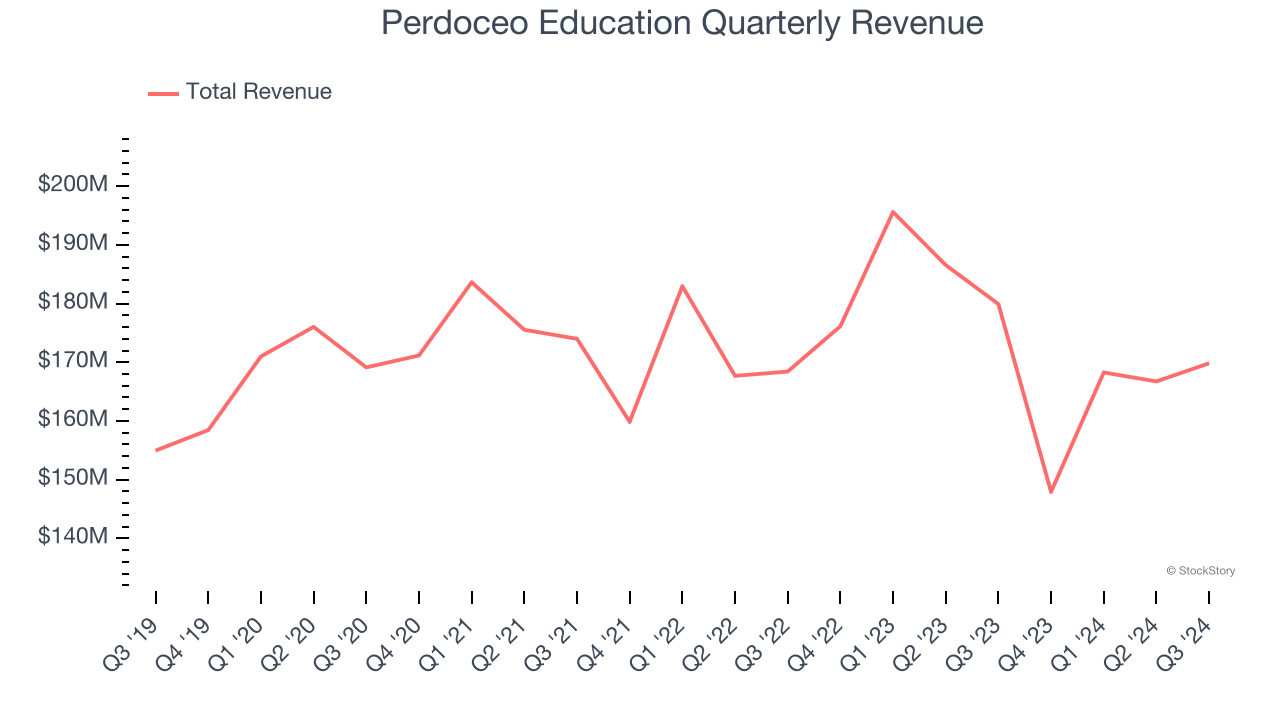

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Over the last five years, Perdoceo Education grew its sales at a weak 1.2% compounded annual growth rate. This was below our standards.

2. EPS Barely Growing

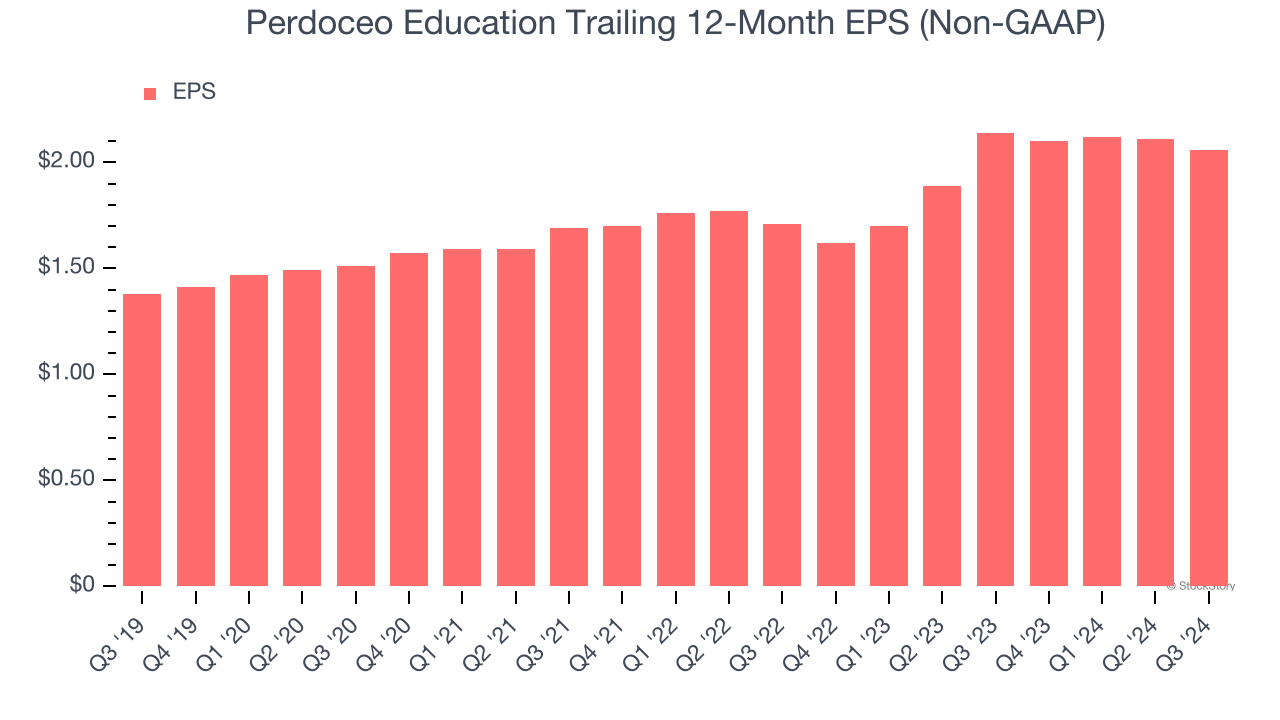

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Perdoceo Education’s EPS grew at an unimpressive 8.3% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 1.2% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

3. New Investments Fail to Bear Fruit as ROIC Declines

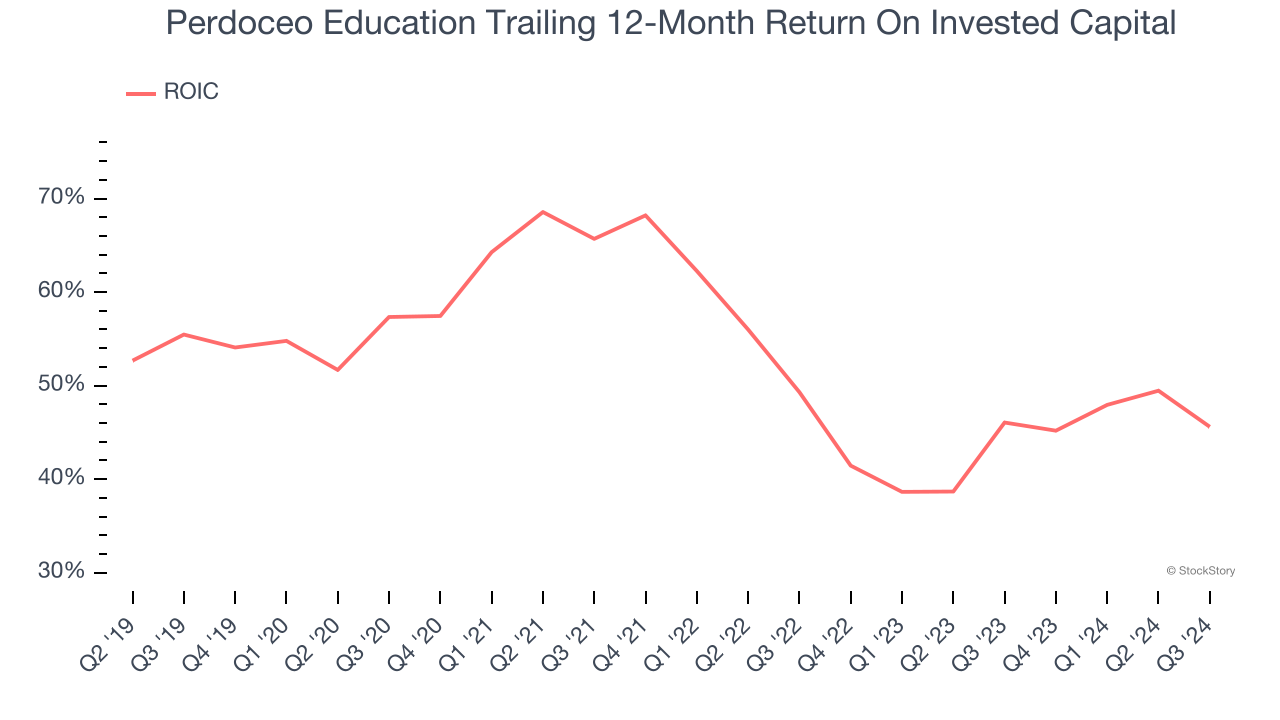

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Perdoceo Education’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

Perdoceo Education isn’t a terrible business, but it doesn’t pass our bar. That said, the stock currently trades at 48.1× forward EV-to-EBITDA (or $28.10 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - you can find better investment opportunities elsewhere. Let us point you toward one of our top software and edge computing picks.

Stocks We Would Buy Instead of Perdoceo Education

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.