Q3 Rundown: ON24 (NYSE:ONTF) Vs Other Sales And Marketing Software Stocks

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how sales and marketing software stocks fared in Q3, starting with ON24 (NYSE: ONTF).

The Internet and the exploding amount of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, and sales and marketing software providers are becoming the tools of evolving customer interaction.

The 23 sales and marketing software stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 2% while next quarter’s revenue guidance was in line.

Luckily, sales and marketing software stocks have performed well with share prices up 12.3% on average since the latest earnings results.

ON24 (NYSE: ONTF)

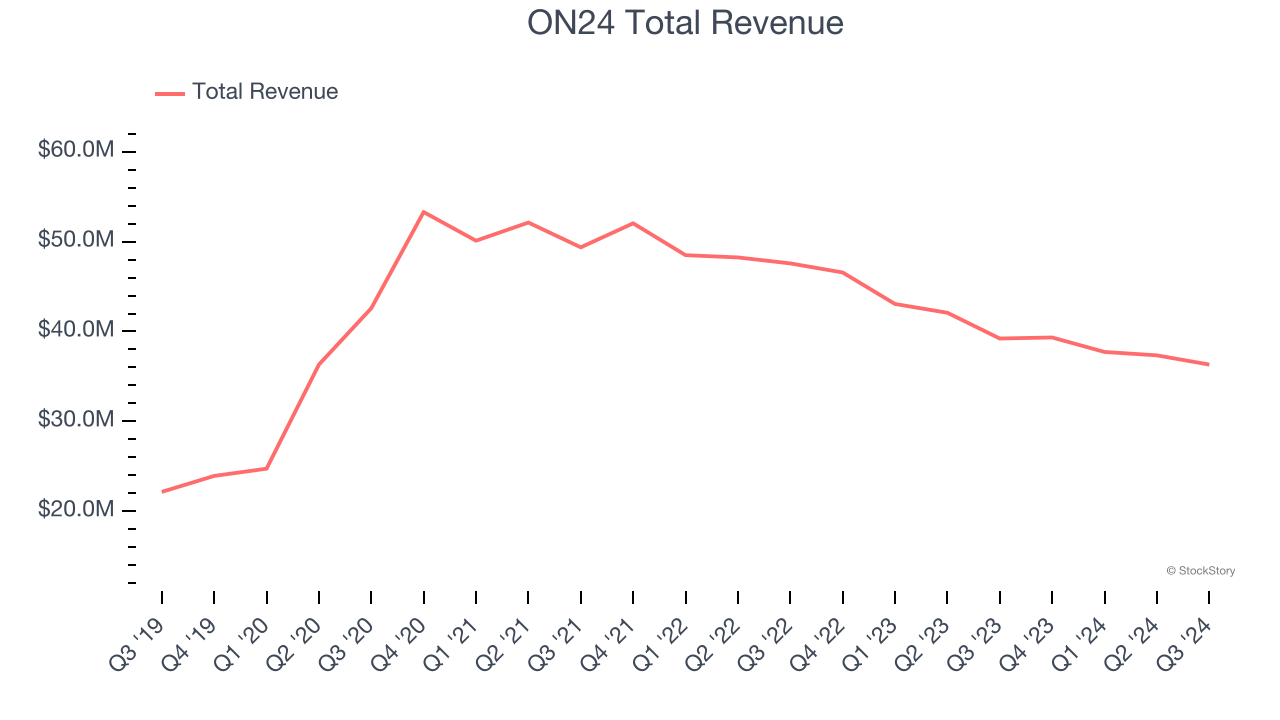

Started in 1998 as a platform to broadcast press conferences, ON24’s (NYSE: ONTF) software helps organizations organize online webinars and other virtual events and convert prospects into customers.

ON24 reported revenues of $36.33 million, down 7.4% year on year. This print exceeded analysts’ expectations by 2%. Overall, it was a very strong quarter for the company with EPS guidance for next quarter exceeding analysts’ expectations and a solid beat of analysts’ EBITDA estimates.

“Our third quarter results reflected an improved retention profile, operating expense discipline, and positive free cash flow,” said Sharat Sharan, co-founder and CEO of ON24.

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $6.56.

Is now the time to buy ON24? Access our full analysis of the earnings results here, it’s free.

Best Q3: Zeta (NYSE: ZETA)

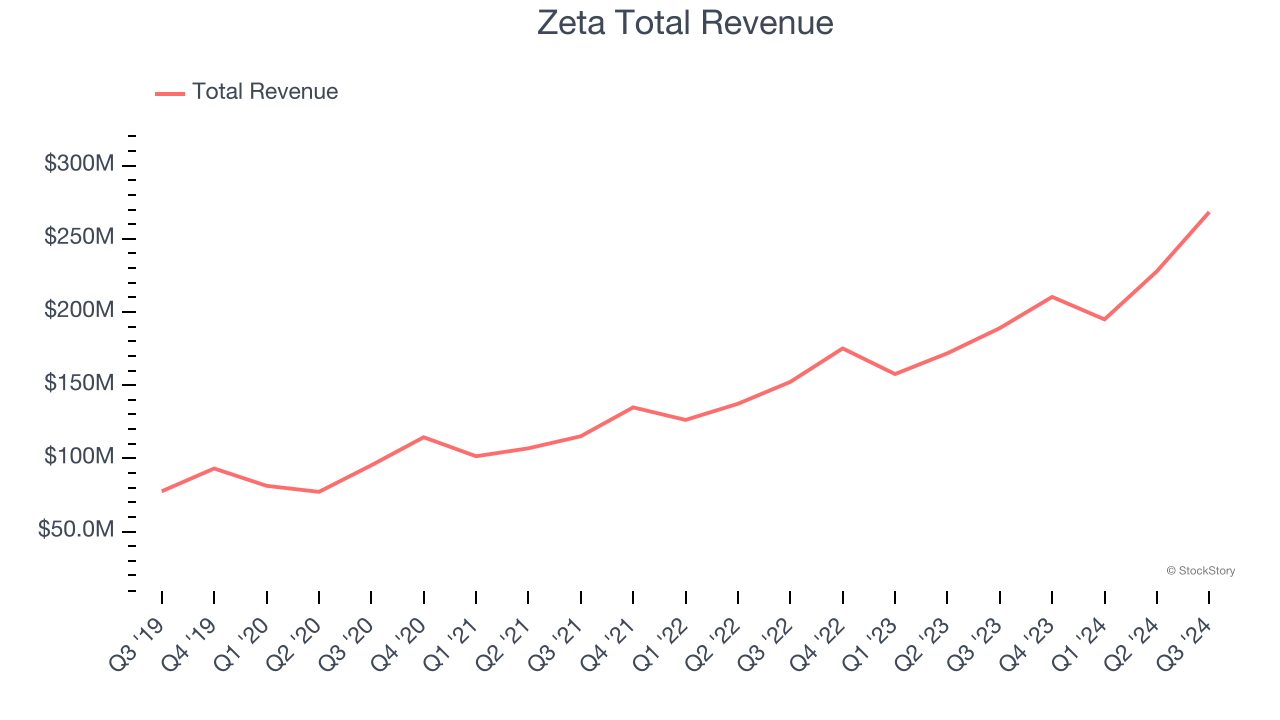

Co-founded by former Apple CEO John Sculley, Zeta Global (NYSE: ZETA) provides software and data analytics tools that help companies market their products to billions of customers.

Zeta reported revenues of $268.3 million, up 42% year on year, outperforming analysts’ expectations by 6.3%. The business had a stunning quarter with a solid beat of analysts’ billings estimates and EBITDA guidance for next quarter exceeding analysts’ expectations.

Zeta achieved the fastest revenue growth and highest full-year guidance raise among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 48.3% since reporting. It currently trades at $19.

Is now the time to buy Zeta? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Integral Ad Science (NASDAQ: IAS)

Founded in 2009, Integral Ad Science (NASDAQ: IAS) provides digital advertising verification and optimization solutions, ensuring that ads are viewable by real people in brand-safe environments across various platforms and devices.

Integral Ad Science reported revenues of $133.5 million, up 11% year on year, falling short of analysts’ expectations by 3.3%. It was a slower quarter as it posted revenue guidance for next quarter missing analysts’ expectations significantly.

Integral Ad Science delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. As expected, the stock is down 19.9% since the results and currently trades at $10.11.

Read our full analysis of Integral Ad Science’s results here.

DoubleVerify (NYSE: DV)

When Oren Netzer saw a digital ad for US-based Target while sitting in his Tel Aviv apartment, he knew there was an unsolved problem, so he started DoubleVerify (NYSE: DV), a provider of advertising solutions to businesses that helps with ad verification, fraud prevention, and brand safety.

DoubleVerify reported revenues of $169.6 million, up 17.8% year on year. This number met analysts’ expectations. Aside from that, it was a mixed quarter as it also recorded a solid beat of analysts’ EBITDA estimates but revenue guidance for next quarter missing analysts’ expectations significantly.

The stock is flat since reporting and currently trades at $19.74.

Read our full, actionable report on DoubleVerify here, it’s free.

Shopify (NYSE: SHOP)

Originally created as an internal tool for a snowboarding company, Shopify (NYSE: SHOP) provides a software platform for building and operating e-commerce businesses.

Shopify reported revenues of $2.16 billion, up 26.1% year on year. This result surpassed analysts’ expectations by 2.2%. Overall, it was a very strong quarter as it also put up an impressive beat of analysts’ EBITDA estimates and revenue guidance for next quarter beating analysts’ expectations.

The stock is up 17.7% since reporting and currently trades at $105.93.

Read our full, actionable report on Shopify here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.