Q3 Earnings Highs And Lows: Teladoc (NYSE:TDOC) Vs The Rest Of The Online Marketplace Stocks

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how online marketplace stocks fared in Q3, starting with Teladoc (NYSE: TDOC).

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

The 13 online marketplace stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 2.5% while next quarter’s revenue guidance was 1.4% above.

Luckily, online marketplace stocks have performed well with share prices up 31% on average since the latest earnings results.

Teladoc (NYSE: TDOC)

Founded to help people in rural areas get online medical consultations, Teladoc Health (NYSE: TDOC) is a telemedicine platform that facilitates remote doctor’s visits.

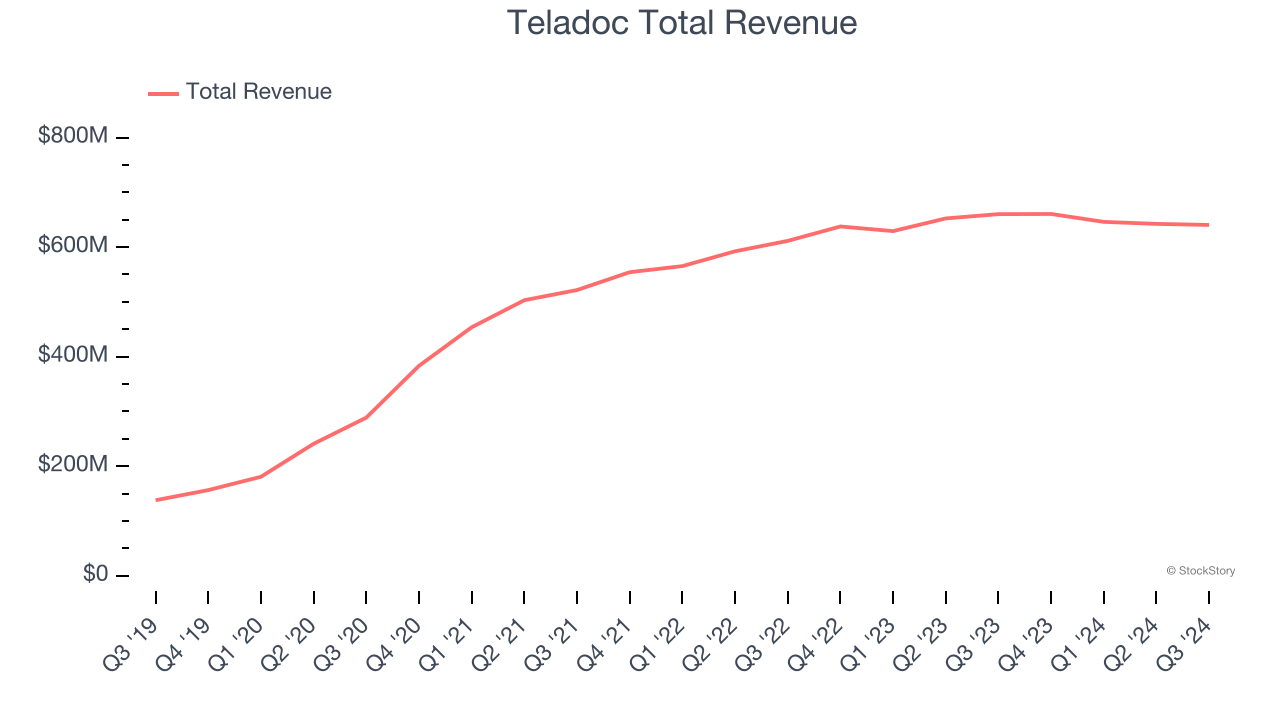

Teladoc reported revenues of $640.5 million, down 3% year on year. This print exceeded analysts’ expectations by 1.4%. Overall, it was a strong quarter for the company with revenue guidance for next quarter exceeding analysts’ expectations and a narrow beat of analysts’ EBITDA estimates.

“I am pleased with our third quarter results, which demonstrate our commitment to consistent execution, and I remain excited about our potential. I see many strengths to build upon as we advance initiatives aimed at strengthening our business and unlocking future growth opportunities,” said Chuck Divita, Chief Executive Officer of Teladoc Health.

Interestingly, the stock is up 15.4% since reporting and currently trades at $10.21.

Is now the time to buy Teladoc? Access our full analysis of the earnings results here, it’s free.

Best Q3: EverQuote (NASDAQ: EVER)

Aiming to simplify a once complicated process, EverQuote (NASDAQ: EVER) is an online insurance marketplace where consumers can compare and purchase various types of insurance from different providers

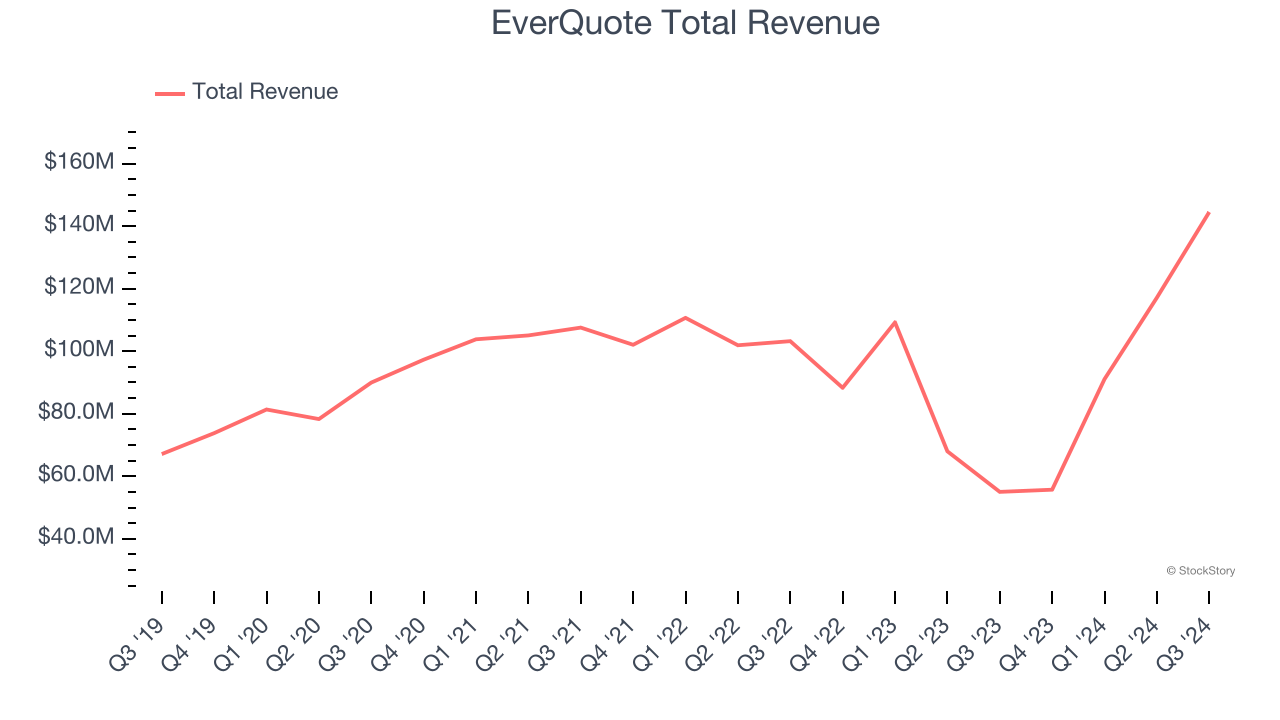

EverQuote reported revenues of $144.5 million, up 163% year on year, outperforming analysts’ expectations by 3%. The business had a stunning quarter with EBITDA guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ EBITDA estimates.

EverQuote scored the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 20.5% since reporting. It currently trades at $20.89.

Is now the time to buy EverQuote? Access our full analysis of the earnings results here, it’s free.

Slowest Q3: eHealth (NASDAQ: EHTH)

Aiming to address a high-stakes and often confusing decision, eHealth (NASDAQ: EHTH) guides consumers through health insurance enrollment and related topics.

eHealth reported revenues of $58.41 million, down 9.7% year on year, falling short of analysts’ expectations by 0.8%. It was a softer quarter as it posted full-year EBITDA guidance missing analysts’ expectations significantly.

eHealth delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 100% since the results and currently trades at $10.22.

Read our full analysis of eHealth’s results here.

eBay (NASDAQ: EBAY)

Originally known as the first online auction site, eBay (NASDAQ: EBAY) is one of the world’s largest online marketplaces.

eBay reported revenues of $2.58 billion, up 3% year on year. This result beat analysts’ expectations by 1.2%. Taking a step back, it was a slower quarter as it produced full-year revenue guidance slightly missing analysts’ expectations.

eBay had the weakest full-year guidance update among its peers. The company reported 133 million active buyers, up 0.8% year on year. The stock is up 6.8% since reporting and currently trades at $66.90.

Read our full, actionable report on eBay here, it’s free.

Etsy (NASDAQ: ETSY)

Founded by a struggling amateur furniture maker Robert Kalin and his two friends, Etsy (NASDAQ: ETSY) is one of the world’s largest online marketplaces, focusing on handmade or vintage items.

Etsy reported revenues of $662.4 million, up 4.1% year on year. This print topped analysts’ expectations by 1.5%. Aside from that, it was a mixed quarter as it also recorded a solid beat of analysts’ EBITDA estimates but number of active buyers in line with analysts’ estimates.

The company reported 96.71 million active buyers, down 0.7% year on year. The stock is up 12.5% since reporting and currently trades at $54.01.

Read our full, actionable report on Etsy here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.