2 Reasons to Sell SXI and 1 Stock to Buy Instead

Standex has had an impressive run over the past six months as its shares have beaten the S&P 500 by 11.9%. The stock now trades at $186.01, marking a 18.2% gain. This run-up might have investors contemplating their next move.

Is there a buying opportunity in Standex, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.Despite the momentum, we're swiping left on Standex for now. Here are two reasons why we avoid SXI and a stock we'd rather own.

Why Is Standex Not Exciting?

Holding over 500 patents globally, Standex (NYSE: SXI) is a manufacturer and distributor of industrial components for various sectors.

1. Long-Term Revenue Growth Disappoints

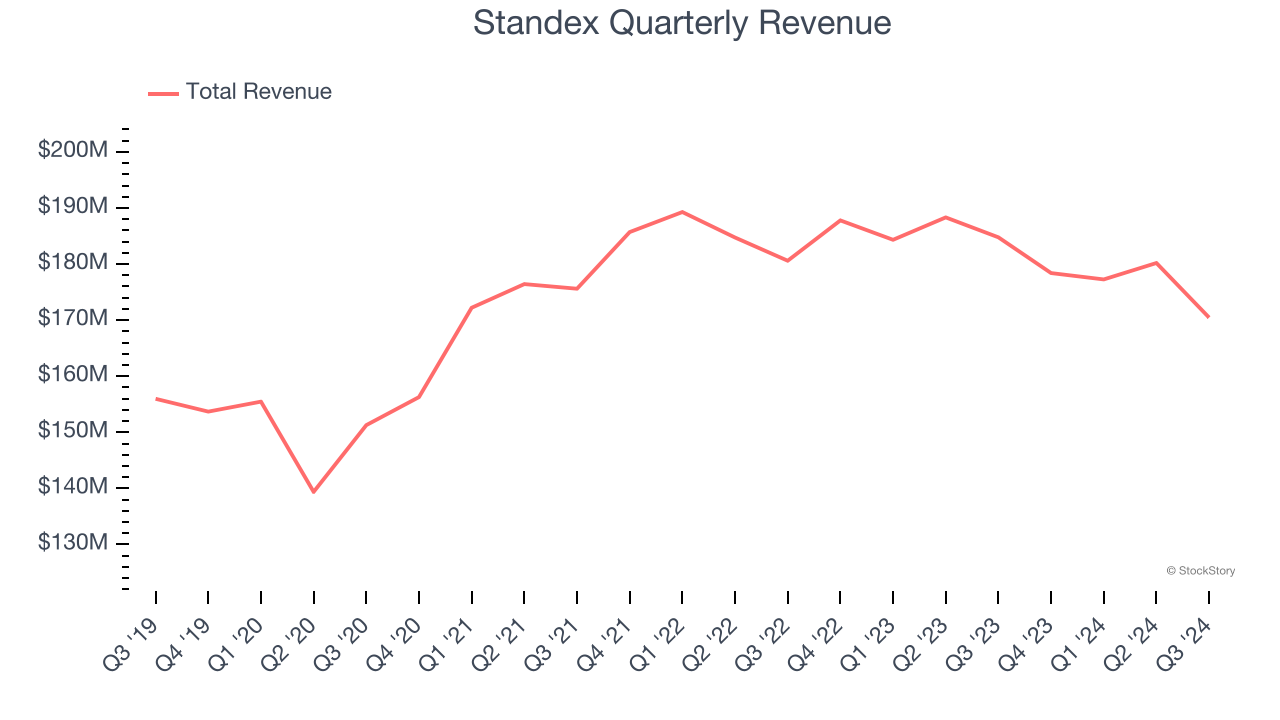

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Standex’s 3.2% annualized revenue growth over the last five years was sluggish. This fell short of our benchmark for the industrials sector.

2. Recent EPS Growth Below Our Standards

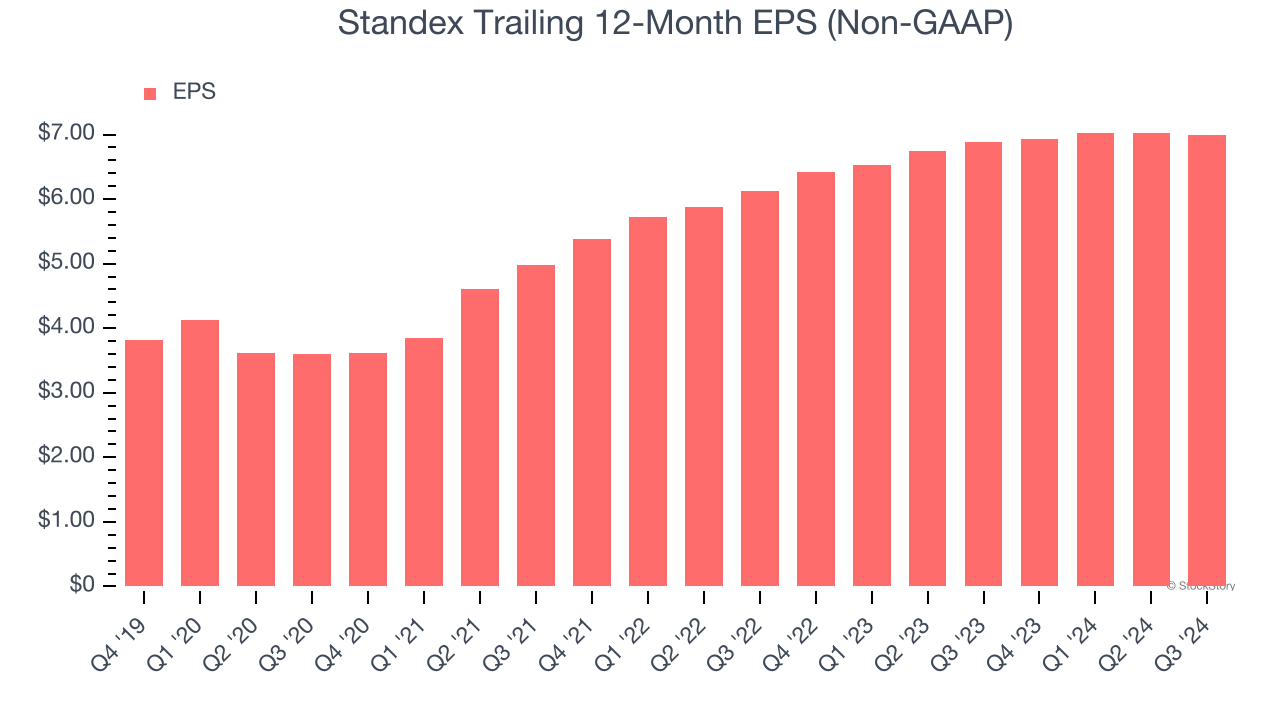

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Standex’s EPS grew at an unimpressive 6.9% compounded annual growth rate over the last two years. On the bright side, this performance was higher than its 2.3% annualized revenue declines and tells us management adapted its cost structure in response to a challenging demand environment.

Final Judgment

Standex’s business quality ultimately falls short of our standards. With its shares outperforming the market lately, the stock trades at 24.1× forward price-to-earnings (or $186.01 per share). This multiple tells us a lot of good news is priced in - you can find better investment opportunities elsewhere. We’d recommend looking at TransDigm, a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of Standex

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.