Q3 Earnings Highs And Lows: Kulicke and Soffa (NASDAQ:KLIC) Vs The Rest Of The Semiconductor Manufacturing Stocks

Wrapping up Q3 earnings, we look at the numbers and key takeaways for the semiconductor manufacturing stocks, including Kulicke and Soffa (NASDAQ: KLIC) and its peers.

The semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers, and data storage. The need for technologies like artificial intelligence, 5G networks, and smart cars is also creating the next wave of growth for the industry. Keeping up with this dynamism requires new tools that can design, fabricate, and test chips at ever smaller sizes and more complex architectures, creating a dire need for semiconductor capital manufacturing equipment.

The 14 semiconductor manufacturing stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 2% while next quarter’s revenue guidance was 1.3% below.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Kulicke and Soffa (NASDAQ: KLIC)

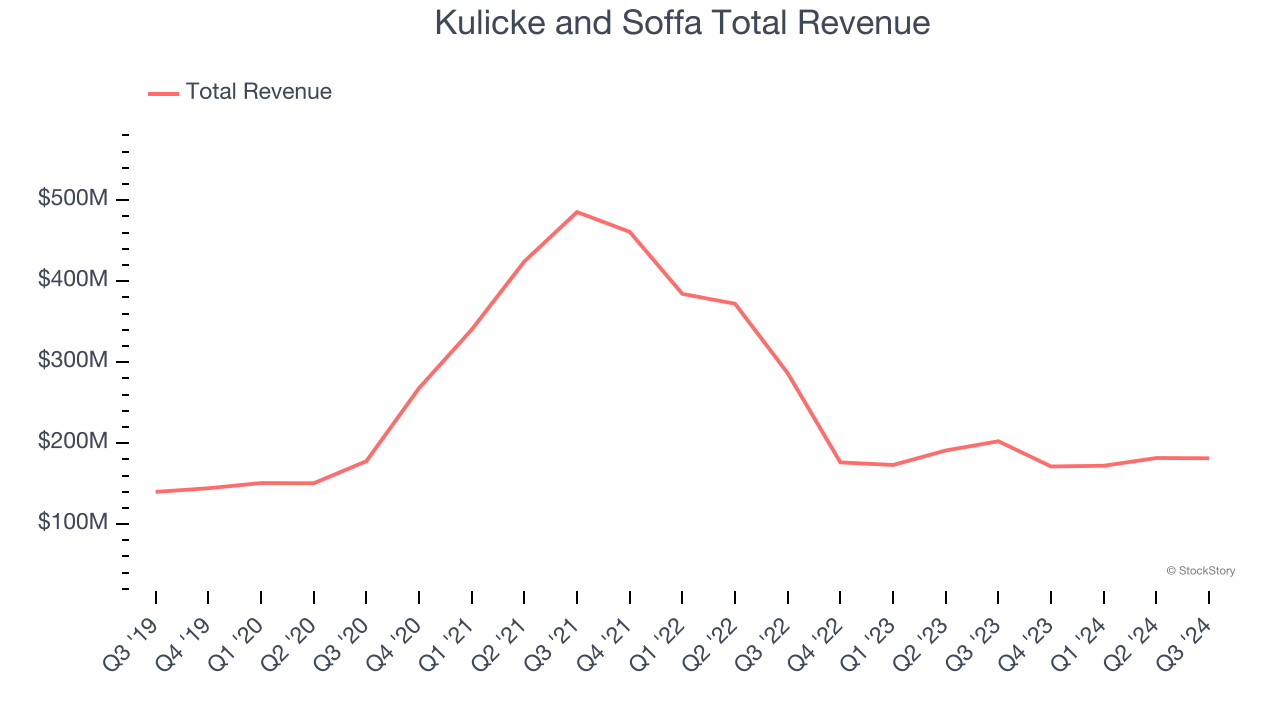

Headquartered in Singapore, Kulicke & Soffa (NASDAQ: KLIC) is a provider of production equipment and tools used to assemble semiconductor devices

Kulicke and Soffa reported revenues of $181.3 million, down 10.4% year on year. This print exceeded analysts’ expectations by 0.6%. Despite the top-line beat, it was still a softer quarter for the company with revenue guidance for next quarter missing analysts’ expectations.

Fusen Chen, Kulicke & Soffa's President and Chief Executive Officer, stated, "We continue to drive market adoption of our advanced packaging and assembly solutions including vertical wire, high-power interconnect (HPI), advanced dispense and fluxless thermo-compression (FTC). Demand for these solutions is anticipated to accelerate along with coordinated General Semiconductor and Automotive market recovery through fiscal year 2025."

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $47.03.

Read our full report on Kulicke and Soffa here, it’s free.

Best Q3: Marvell Technology (NASDAQ: MRVL)

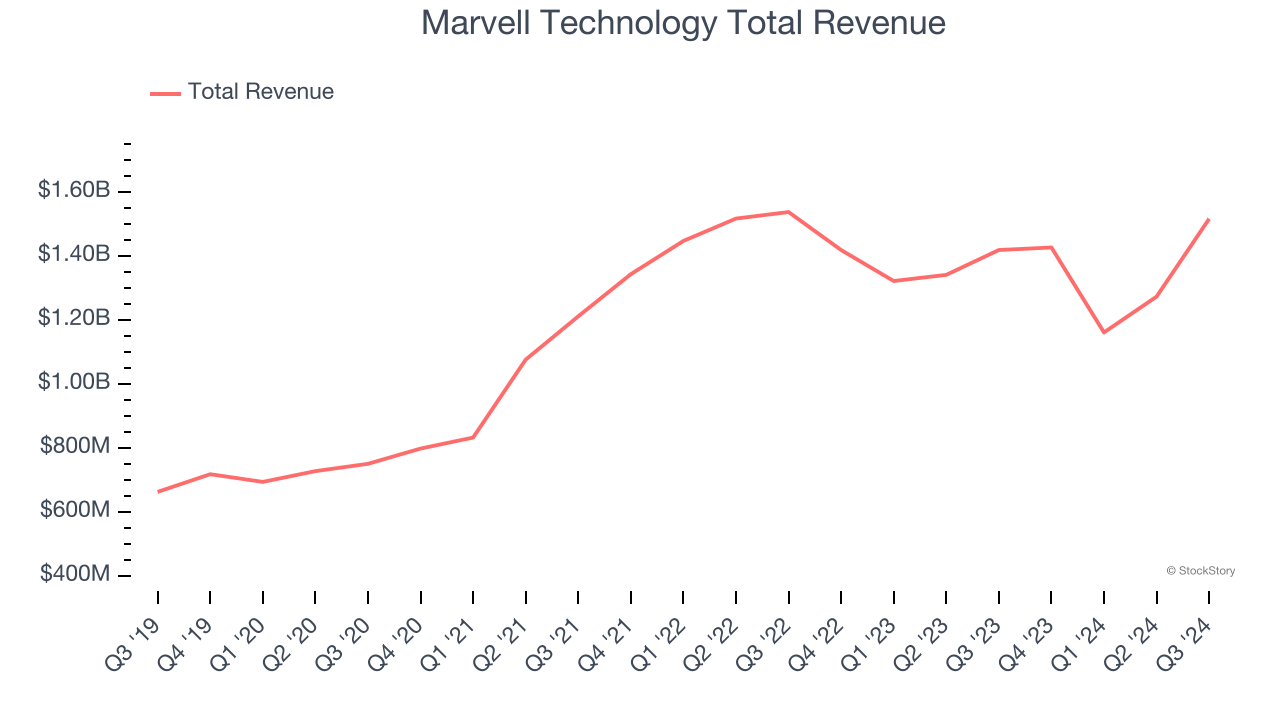

Moving away from a low margin storage device management chips in one of the biggest semiconductor business model pivots of the past decade, Marvell Technology (NASDAQ: MRVL) is a fabless designer of special purpose data processing and networking chips used by data centers, communications carriers, enterprises, and autos.

Marvell Technology reported revenues of $1.52 billion, up 6.9% year on year, outperforming analysts’ expectations by 4%. The business had an exceptional quarter with a significant improvement in its inventory levels and revenue guidance for next quarter exceeding analysts’ expectations.

The market seems happy with the results as the stock is up 18.8% since reporting. It currently trades at $114.02.

Is now the time to buy Marvell Technology? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Entegris (NASDAQ: ENTG)

With fabs representing the company’s largest customer type, Entegris (NASDAQ: ENTG) supplies products that purify, protect, and generally ensure the integrity of raw materials needed for advanced semiconductor manufacturing.

Entegris reported revenues of $807.7 million, down 9.1% year on year, falling short of analysts’ expectations by 3%. It was a disappointing quarter as it posted revenue guidance for next quarter missing analysts’ expectations significantly and a miss of analysts’ adjusted operating income estimates.

Entegris delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 9.3% since the results and currently trades at $97.24.

Read our full analysis of Entegris’s results here.

Photronics (NASDAQ: PLAB)

Sporting a global footprint of facilities, Photronics (NASDAQ: PLAB) is a manufacturer of photomasks, templates used to transfer patterns onto semiconductor wafers.

Photronics reported revenues of $222.6 million, down 2.1% year on year. This number topped analysts’ expectations by 2.1%. It was a very strong quarter as it also put up an impressive beat of analysts’ EPS estimates and revenue guidance for next quarter slightly topping analysts’ expectations.

The stock is down 3.8% since reporting and currently trades at $24.36.

Read our full, actionable report on Photronics here, it’s free.

IPG Photonics (NASDAQ: IPGP)

Both a designer and manufacturer of its products, IPG Photonics (NASDAQ: IPGP) is a provider of high-performance fiber lasers used for cutting, welding, and processing raw materials.

IPG Photonics reported revenues of $233.1 million, down 22.6% year on year. This result surpassed analysts’ expectations by 2.3%. Taking a step back, it was a slower quarter as it produced a significant miss of analysts’ adjusted operating income and EPS estimates.

IPG Photonics had the slowest revenue growth among its peers. The stock is down 8.2% since reporting and currently trades at $72.82.

Read our full, actionable report on IPG Photonics here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.