Q3 Earnings Roundup: Albany (NYSE:AIN) And The Rest Of The General Industrial Machinery Segment

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how general industrial machinery stocks fared in Q3, starting with Albany (NYSE: AIN).

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand for general industrial machinery companies. Those who innovate and create digitized solutions can spur sales and speed up replacement cycles, but all general industrial machinery companies are still at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 15 general industrial machinery stocks we track reported a mixed Q3. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 5.5% below.

In light of this news, share prices of the companies have held steady as they are up 2.5% on average since the latest earnings results.

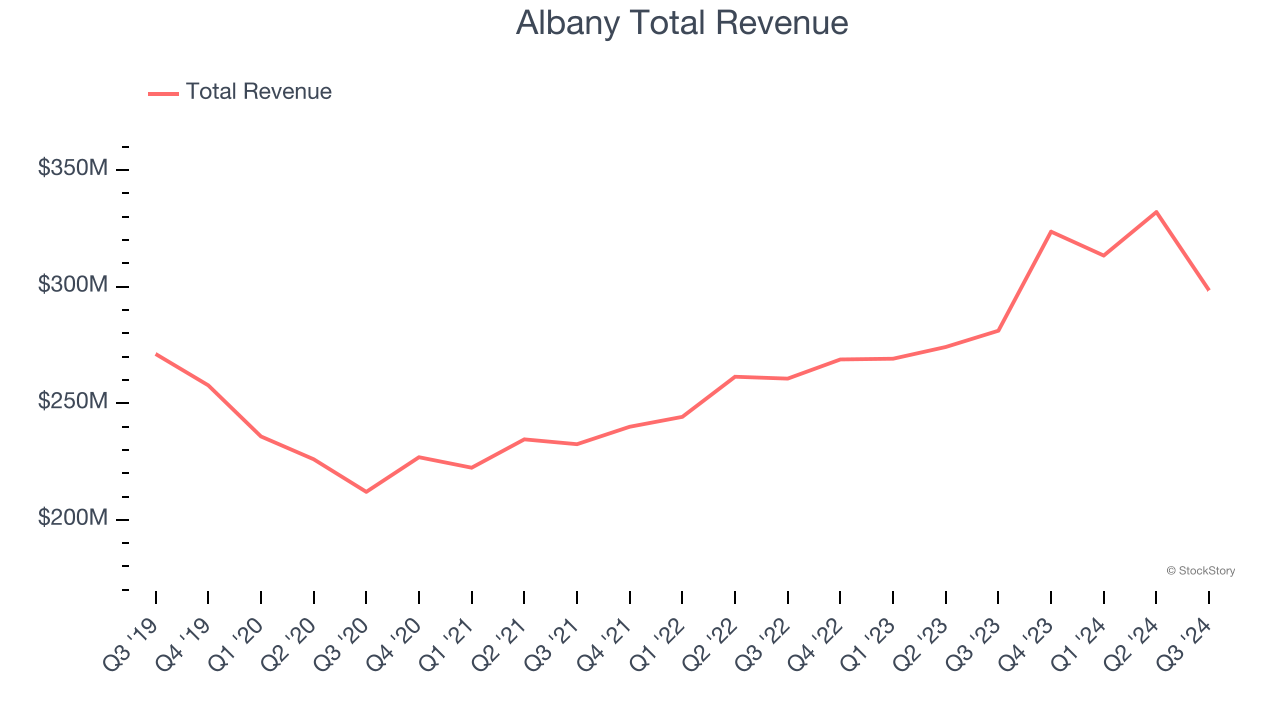

Albany (NYSE: AIN)

Founded in 1895, Albany (NYSE: AIN) is a global textiles and materials processing company, specializing in machine clothing for paper mills and engineered composite structures for aerospace and other industries.

Albany reported revenues of $298.4 million, up 6.1% year on year. This print was in line with analysts’ expectations, but overall, it was a slower quarter for the company with full-year EBITDA guidance missing analysts’ expectations.

"I am pleased with the overall results of the quarter as we focused on operational excellence evidenced by strong results at Machine Clothing and Free Cash Flow generation of $78 million year-to-date. We are addressing the issues announced earlier this month, with specific emphasis on our Salt Lake Facility. Revenues of $298 million was up $17 million or 6.1% over prior year," said President and CEO, Gunnar Kleveland.

Interestingly, the stock is up 12% since reporting and currently trades at $79.20.

Read our full report on Albany here, it’s free.

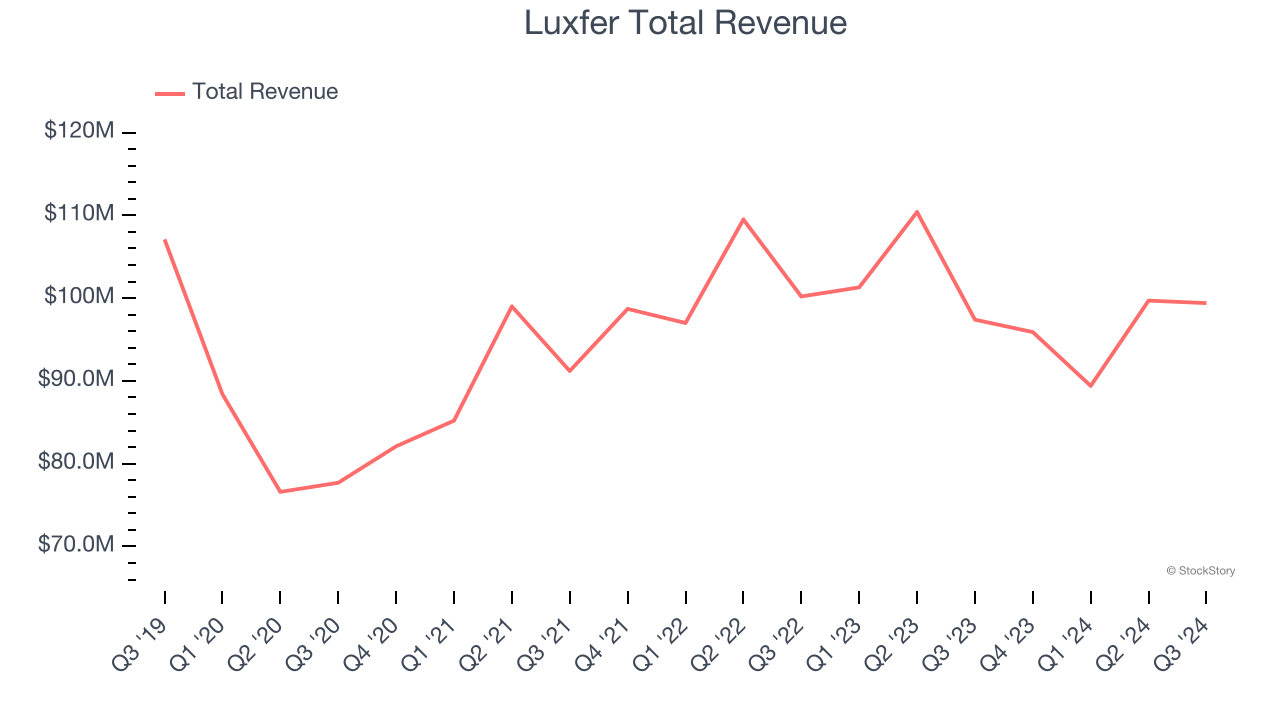

Best Q3: Luxfer (NYSE: LXFR)

With its magnesium alloys used in the construction of the famous Spirit of St. Louis aircraft, Luxfer (NYSE: LXFR) offers specialized materials, components, and gas containment devices to various industries.

Luxfer reported revenues of $99.4 million, up 2.1% year on year, outperforming analysts’ expectations by 15.9%. The business had an incredible quarter with a solid beat of analysts’ EPS and EBITDA estimates.

Luxfer achieved the biggest analyst estimates beat among its peers. The market seems content with the results as the stock is up 2.2% since reporting. It currently trades at $13.04.

Is now the time to buy Luxfer? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Icahn Enterprises (NASDAQ: IEP)

Founded in 1987, Icahn Enterprises (NASDAQ: IEP) is a diversified holding company primarily engaged in investment and asset management across various sectors.

Icahn Enterprises reported revenues of $2.22 billion, down 25.7% year on year, falling short of analysts’ expectations by 4.1%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

Icahn Enterprises delivered the slowest revenue growth in the group. As expected, the stock is down 30.6% since the results and currently trades at $8.95.

Read our full analysis of Icahn Enterprises’s results here.

Kadant (NYSE: KAI)

Headquartered in Massachusetts, Kadant (NYSE: KAI) is a global supplier of high-value, critical components and engineered systems used in process industries worldwide.

Kadant reported revenues of $271.6 million, up 11.2% year on year. This print beat analysts’ expectations by 2%. It was a strong quarter as it also produced an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ adjusted operating income estimates.

The stock is up 9.5% since reporting and currently trades at $351.49.

Read our full, actionable report on Kadant here, it’s free.

Columbus McKinnon (NASDAQ: CMCO)

With 19 different brands across the globe, Columbus McKinnon (NASDAQ: CMCO) offers material handling equipment for the construction, manufacturing, and transportation industries.

Columbus McKinnon reported revenues of $242.3 million, down 6.2% year on year. This result lagged analysts' expectations by 2.6%. Overall, it was a softer quarter as it also recorded a significant miss of analysts’ organic revenue and EBITDA estimates.

The stock is up 14.6% since reporting and currently trades at $36.94.

Read our full, actionable report on Columbus McKinnon here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.