Shelf-Stable Food Stocks Q3 Highlights: Mondelez (NASDAQ:MDLZ)

As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the shelf-stable food industry, including Mondelez (NASDAQ: MDLZ) and its peers.

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

The 20 shelf-stable food stocks we track reported a mixed Q3. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 5.7% below.

While some shelf-stable food stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 4.6% since the latest earnings results.

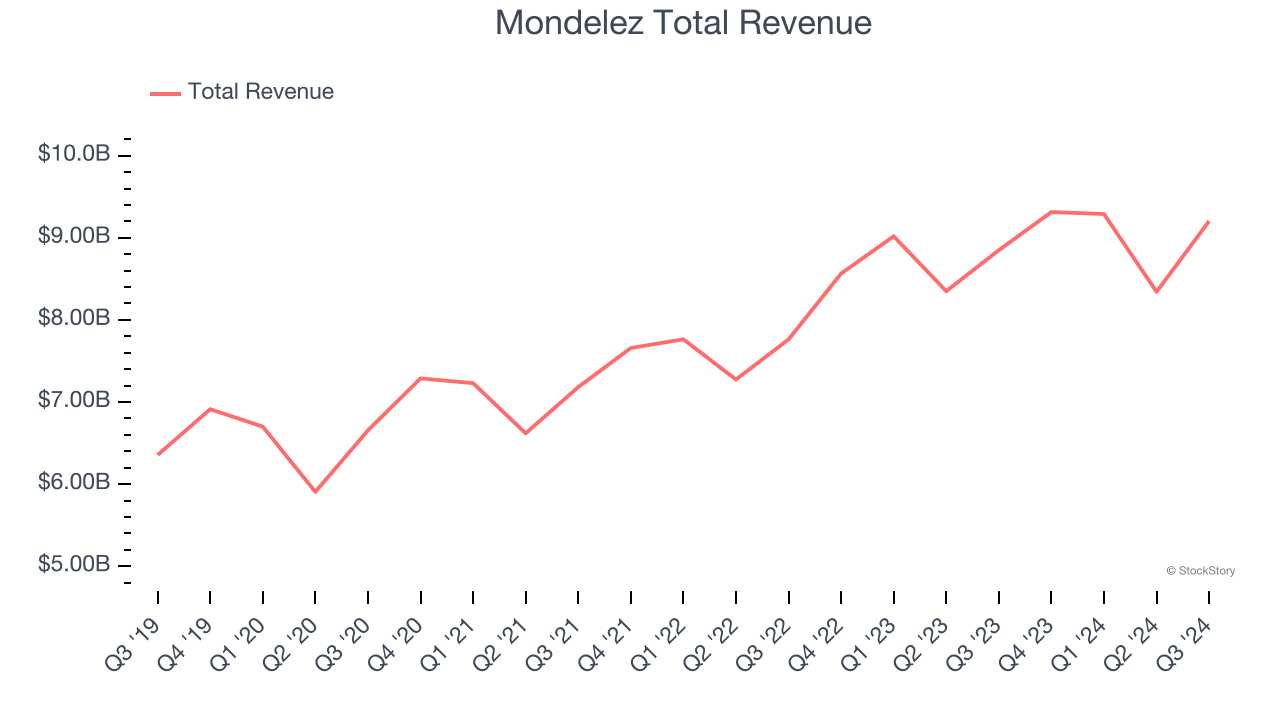

Mondelez (NASDAQ: MDLZ)

Founded as Nabisco in 1903, Mondelez (NASDAQ: MDLZ) is a packaged snacks powerhouse best known for its Oreo, Cadbury, Toblerone, Ritz, and Trident brands.

Mondelez reported revenues of $9.20 billion, up 4% year on year. This print exceeded analysts’ expectations by 0.9%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EBITDA estimates.

“We posted robust results for Q3, with accelerated top-line growth, strong earnings and attractive cash flow generation. These results were driven by our commitment to executing with excellence across our categories, markets and brands,” said Dirk Van de Put, Chair and Chief Executive Officer.

Unsurprisingly, the stock is down 13.2% since reporting and currently trades at $60.

Is now the time to buy Mondelez? Access our full analysis of the earnings results here, it’s free.

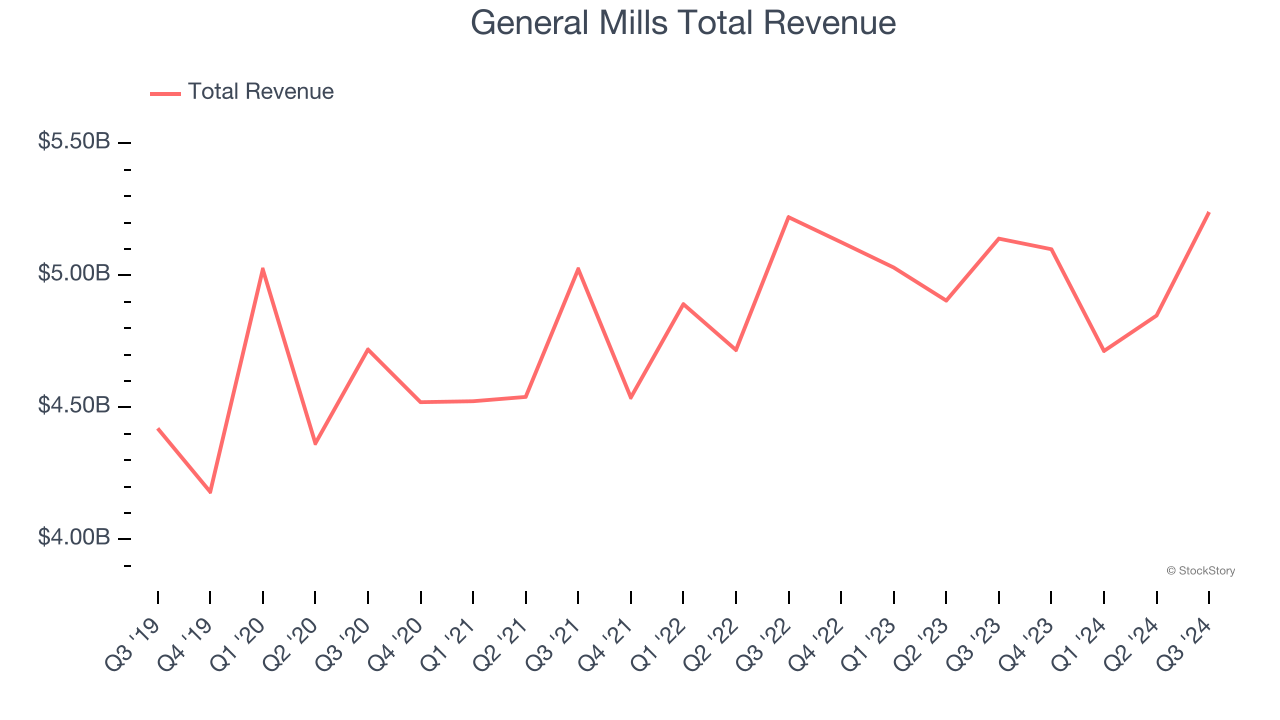

Best Q3: General Mills (NYSE: GIS)

Best known for its portfolio of powerhouse breakfast cereal brands, General Mills (NYSE: GIS) is a packaged foods company that has also made a mark in cereals, baking products, and snacks.

General Mills reported revenues of $5.24 billion, up 2% year on year, outperforming analysts’ expectations by 1.9%. The business had a very strong quarter with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ gross margin estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 3% since reporting. It currently trades at $63.95.

Is now the time to buy General Mills? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: J&J Snack Foods (NASDAQ: JJSF)

Best known for its SuperPretzel soft pretzels and ICEE frozen drinks, J&J Snack Foods (NASDAQ: JJSF) produces a range of snacks and beverages and distributes them primarily to supermarket and food service customers.

J&J Snack Foods reported revenues of $426.8 million, down 3.9% year on year, in line with analysts’ expectations. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and gross margin estimates.

As expected, the stock is down 11.8% since the results and currently trades at $152.86.

Read our full analysis of J&J Snack Foods’s results here.

Kellanova (NYSE: K)

With Corn Flakes as its first and most iconic product, Kellanova (NYSE: K) is a packaged foods company that is dominant in the cereal and snack categories.

Kellanova reported revenues of $3.23 billion, flat year on year. This number topped analysts’ expectations by 2.5%. Taking a step back, it was a satisfactory quarter as it also logged an impressive beat of analysts’ organic revenue estimates.

Kellanova scored the biggest analyst estimates beat among its peers. The stock is flat since reporting and currently trades at $81.21.

Read our full, actionable report on Kellanova here, it’s free.

BellRing Brands (NYSE: BRBR)

Spun out of Post Holdings in 2019, Bellring Brands (NYSE: BRBR) offers protein shakes, nutrition bars, and other products under the PowerBar, Premier Protein, and Dymatize brands.

BellRing Brands reported revenues of $555.8 million, up 17.6% year on year. This result topped analysts’ expectations by 2%. It was a strong quarter as it also logged full-year revenue guidance exceeding analysts’ expectations and a solid beat of analysts’ gross margin estimates.

BellRing Brands pulled off the fastest revenue growth and highest full-year guidance raise among its peers. The stock is up 2.4% since reporting and currently trades at $75.20.

Read our full, actionable report on BellRing Brands here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.