3 Reasons to Sell ATSG and 1 Stock to Buy Instead

The past six months have been a windfall for Air Transport Services’s shareholders. The company’s stock price has jumped 55.1%, hitting $22.09 per share. This performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Air Transport Services, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.We’re happy investors have made money, but we're sitting this one out for now. Here are three reasons why there are better opportunities than ATSG and a stock we'd rather own.

Why Do We Think Air Transport Services Will Underperform?

Founded in 1980, Air Transport Services Group (NASDAQ: ATSG) provides air cargo transportation and logistics solutions.

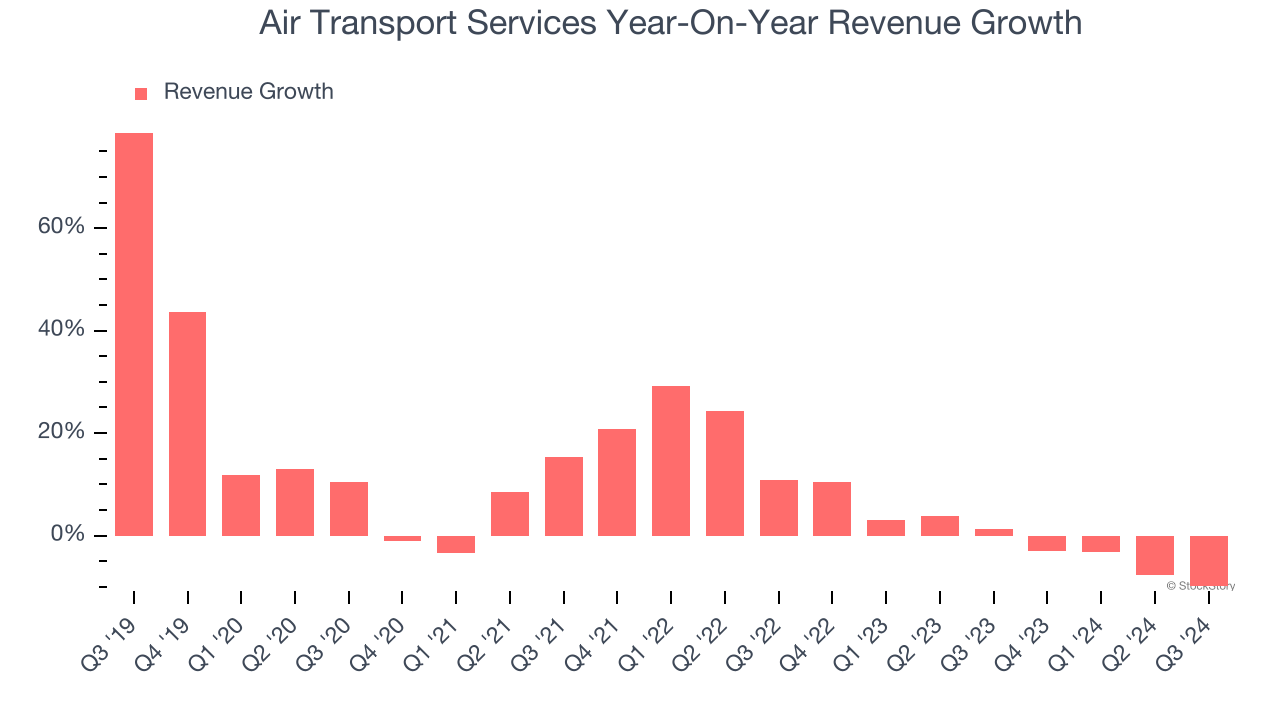

1. Revenue Growth Flatlining

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. Air Transport Services’s recent history shows its demand slowed as its revenue was flat over the last two years. We also note many other Air Freight and Logistics businesses have faced declining sales because of cyclical headwinds. While Air Transport Services’s growth wasn’t the best, it did perform better than its peers.

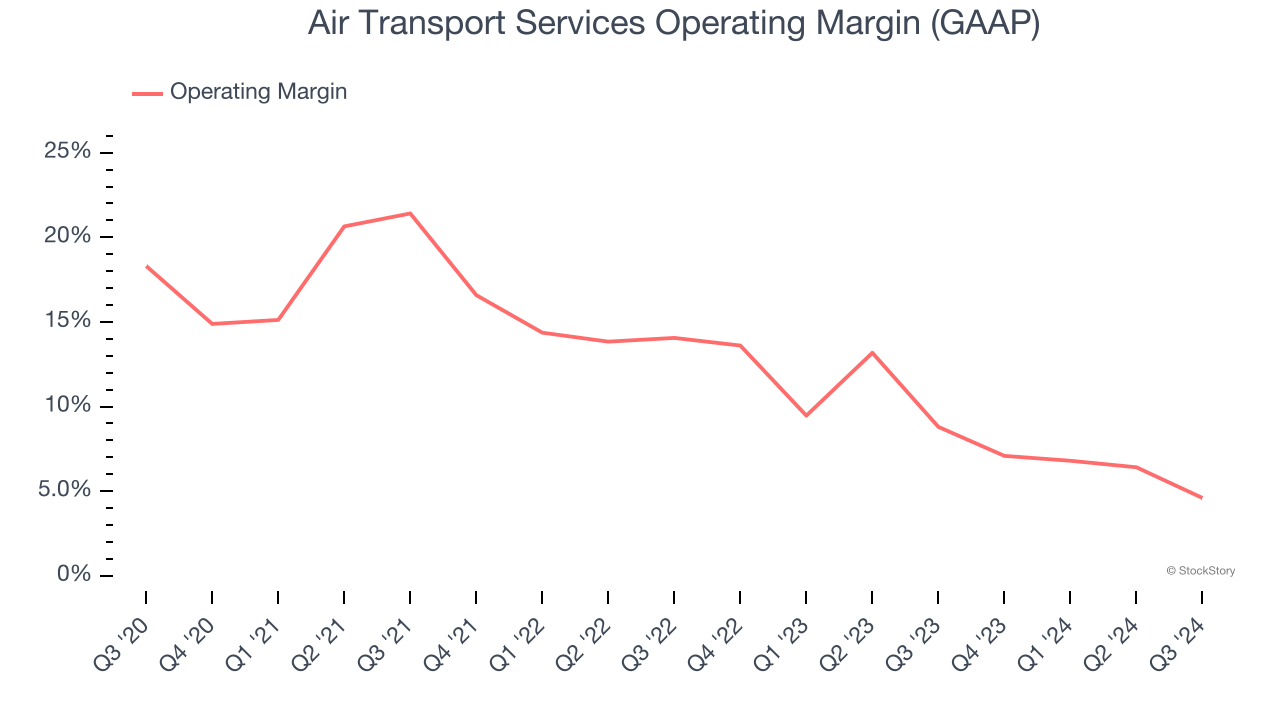

2. Operating Margin Falling

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Looking at the trend in its profitability, Air Transport Services’s operating margin decreased by 6.4 percentage points over the last five years. Even though its historical margin is high, shareholders will want to see Air Transport Services become more profitable in the future. Its operating margin for the trailing 12 months was 6.3%.

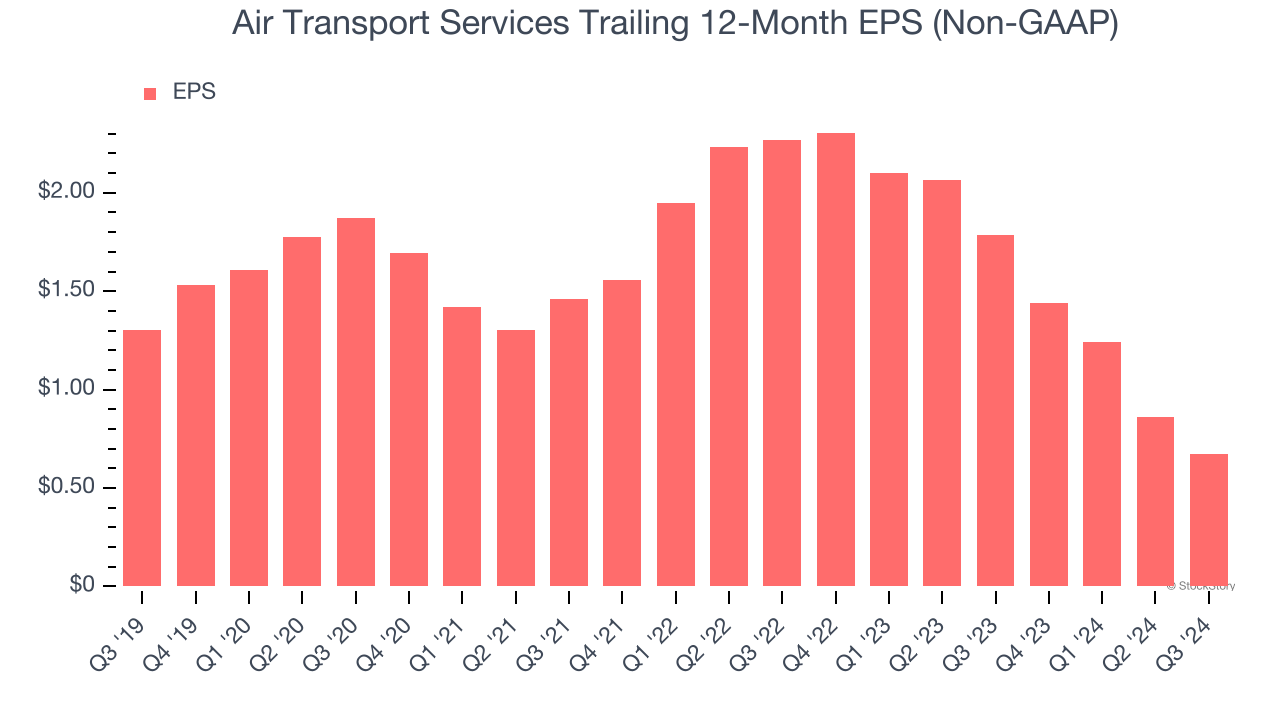

3. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Air Transport Services, its EPS declined by 12.4% annually over the last five years while its revenue grew by 8.1%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Air Transport Services falls short of our quality standards. Following the recent rally, the stock trades at 18.9× forward price-to-earnings (or $22.09 per share). While this valuation is reasonable, we don’t see a big opportunity at the moment. There are better investments elsewhere. We’d recommend looking at CrowdStrike, the most entrenched endpoint security platform.

Stocks We Would Buy Instead of Air Transport Services

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.