Paylocity (PCTY): Buy, Sell, or Hold Post Q3 Earnings?

The past six months have been a windfall for Paylocity’s shareholders. The company’s stock price has jumped 49.3%, hitting $198.99 per share. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy Paylocity, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.We’re glad investors have benefited from the price increase, but we don't have much confidence in Paylocity. Here are three reasons why we avoid PCTY and a stock we'd rather own.

Why Is Paylocity Not Exciting?

Founded by payroll software veteran Steve Sarowitz in 1997, Paylocity (NASDAQ: PCTY) is a provider of payroll and HR software for small and medium-sized enterprises.

1. Customer Churn Hurts Long-Term Outlook

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

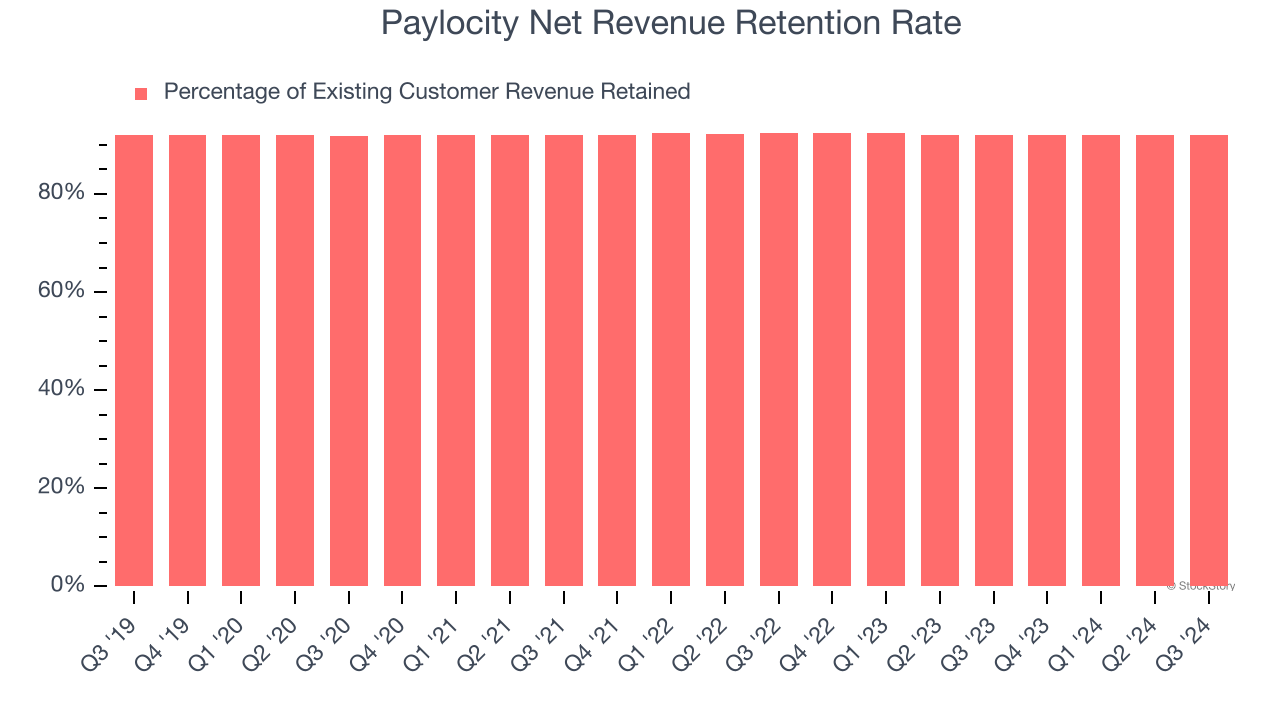

Paylocity’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 92% in Q3. This means Paylocity’s revenue would’ve decreased by 8% over the last 12 months if it didn’t win any new customers.

Paylocity has a poor net retention rate, warning us that its customers are churning and that its products might not live up to expectations.

2. Low Gross Margin Hinders Flexibility

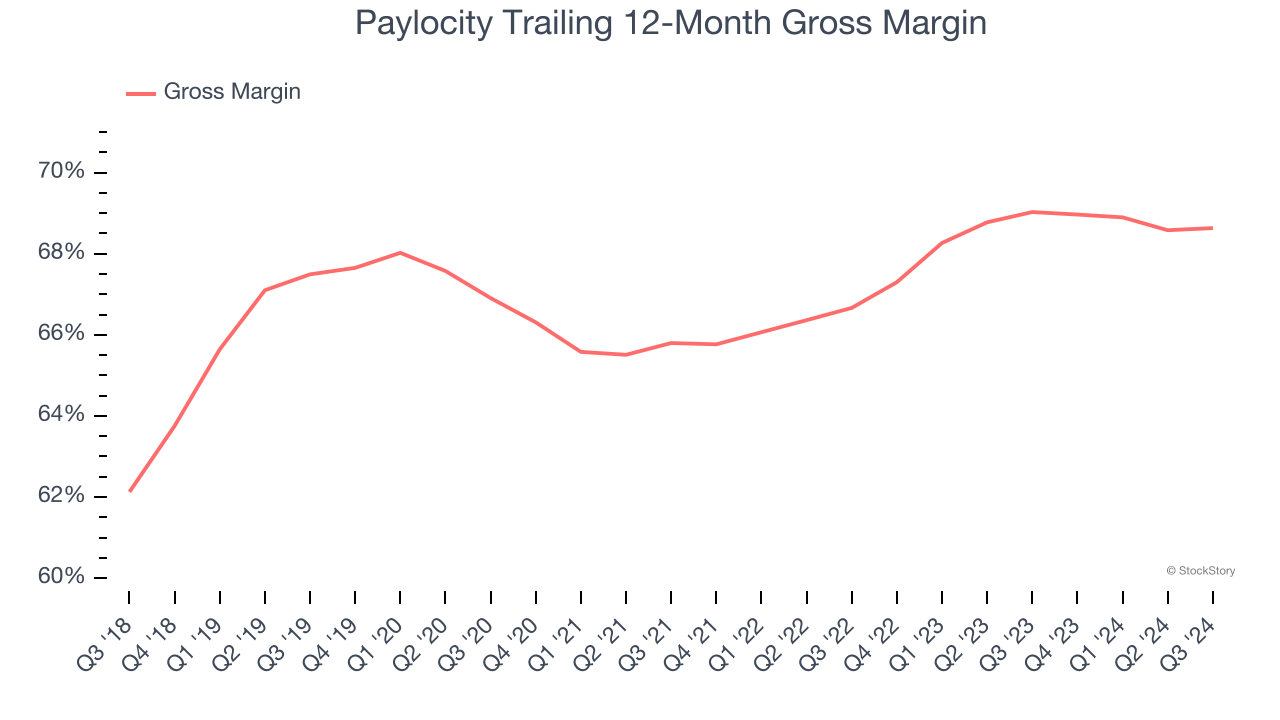

For software companies like Paylocity, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Paylocity’s gross margin is slightly below the average software company, giving it less room than its competitors to invest in areas such as product and sales. As you can see below, it averaged a 68.6% gross margin over the last year. Said differently, Paylocity had to pay a chunky $31.37 to its service providers for every $100 in revenue.

3. Cash Flow Margin Set to Decline

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Over the next year, analysts predict Paylocity’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 23.2% for the last 12 months will decrease to 21.1%.

Final Judgment

Paylocity isn’t a terrible business, but it doesn’t pass our bar. Following the recent rally, the stock trades at 7.1× forward price-to-sales (or $198.99 per share). Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're fairly confident there are better investments elsewhere. Let us point you toward TransDigm, a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than Paylocity

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.