Three Reasons to Avoid COIN and One Stock to Buy Instead

Coinbase’s 18.9% return over the past six months has outpaced the S&P 500 by 12.8%, and its stock price has climbed to $261.45 per share. This run-up might have investors contemplating their next move.

Is there a buying opportunity in Coinbase, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.We’re happy investors have made money, but we don't have much confidence in Coinbase. Here are three reasons why we avoid COIN and a stock we'd rather own.

Why Is Coinbase Not Exciting?

Regarded by many as the face of crypto, Coinbase (NASDAQ: COIN) is a digital exchange helping the world onboard into the blockchain ecosystem.

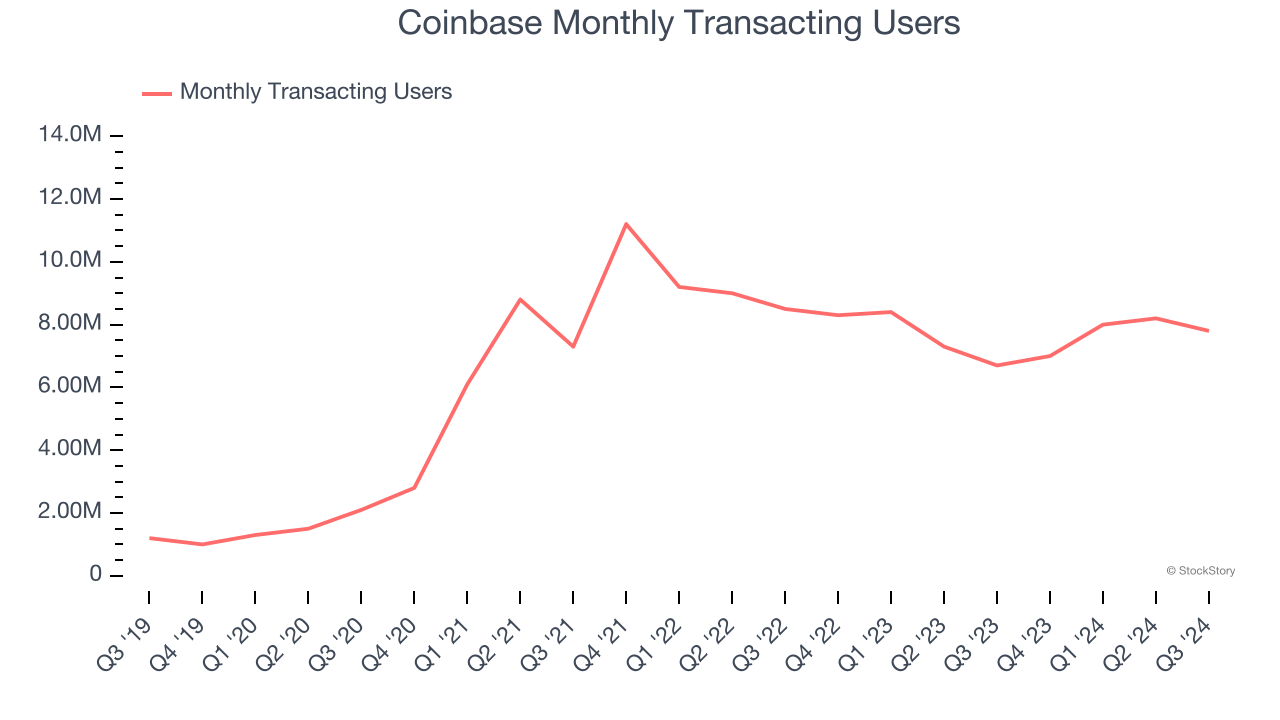

1. Declining Monthly Transacting Users Reflect Product Weakness

As a fintech company, Coinbase generates revenue growth by increasing both the number of users on its platform and the number of transactions they execute.

Coinbase struggled to engage its monthly transacting users over the last two years as they have declined by 8.3% annually to 7.8 million in the latest quarter. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If Coinbase wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

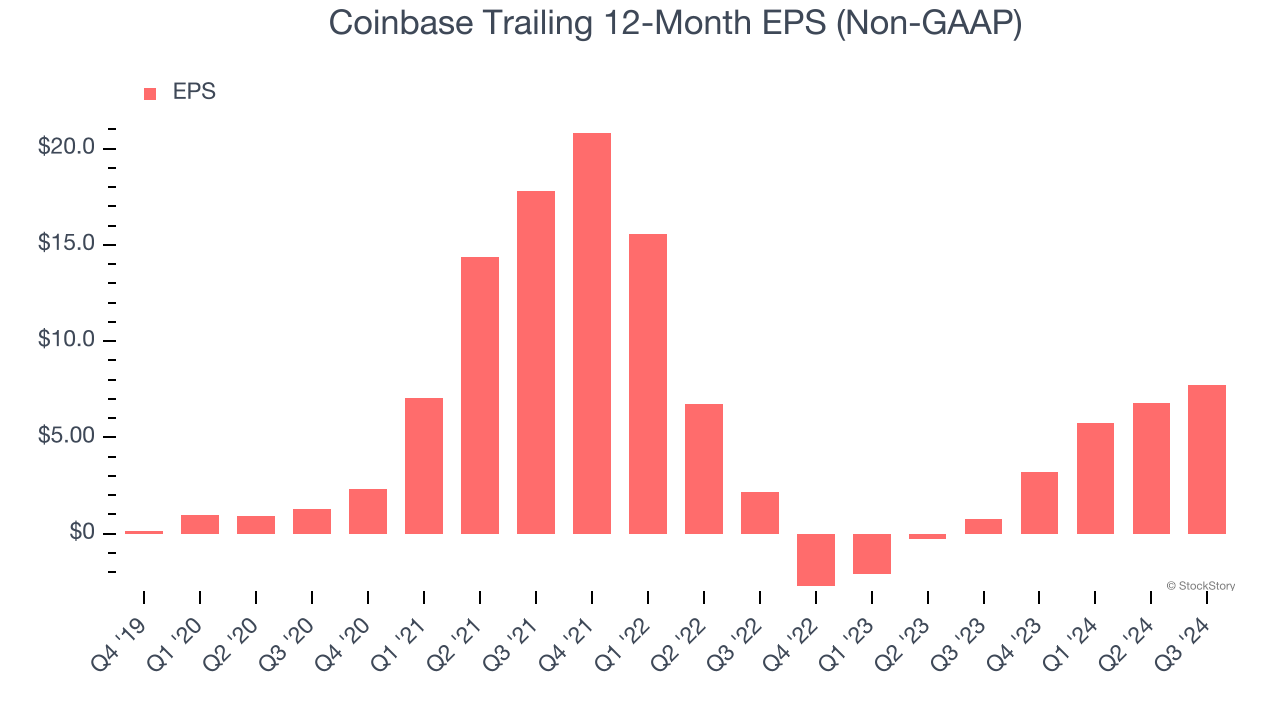

2. EPS Trending Down

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Coinbase, its EPS declined by more than its revenue over the last three years, dropping 24.4% annually. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

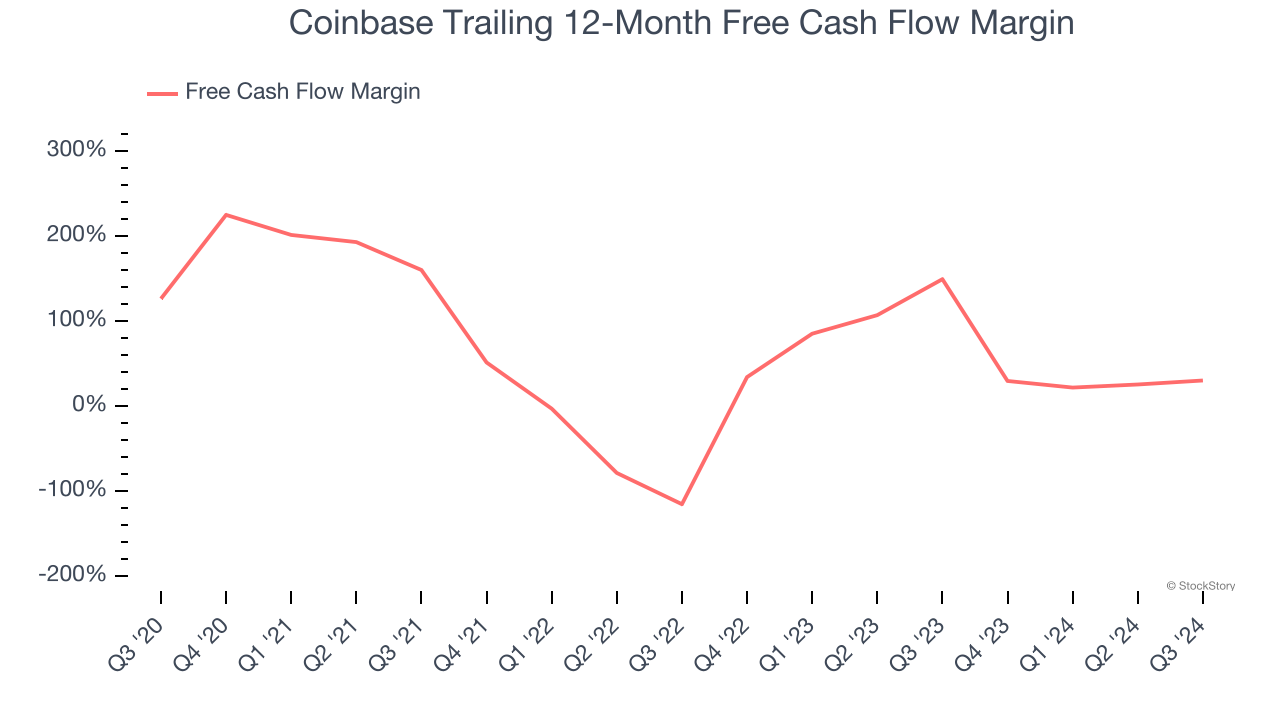

3. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Coinbase’s margin dropped meaningfully over the last few years. If its declines continue, it could signal higher capital intensity. Coinbase’s free cash flow margin for the trailing 12 months was 30.3%.

Final Judgment

Coinbase isn’t a terrible business, but it doesn’t pass our bar. With its shares topping the market in recent months, the stock trades at 25.5× forward EV-to-EBITDA (or $261.45 per share). This valuation tells us a lot of optimism is priced in - we think there are better investment opportunities out there. Let us point you toward Google, whose cloud computing and YouTube divisions are firing on all cylinders.

Stocks We Like More Than Coinbase

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.