2 Reasons to Watch YELP and 1 to Stay Cautious

Yelp has been treading water for the past six months, recording a small return of 1.8% while holding steady at $34.45. The stock also fell short of the S&P 500’s 22.9% gain during that period.

Given the weaker price action, is now a good time to buy YELP? Or should investors expect a bumpy road ahead? Find out in our full research report, it’s free for active Edge members.

Why Does Yelp Spark Debate?

Founded by PayPal alumni Jeremy Stoppelman and Russel Simmons, Yelp (NYSE: YELP) is an online platform that helps people discover local businesses through crowd-sourced reviews.

Two Positive Attributes:

1. Elite Gross Margin Powers Best-In-Class Business Model

A company’s gross profit margin has a significant impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors can determine the winner in a competitive market.

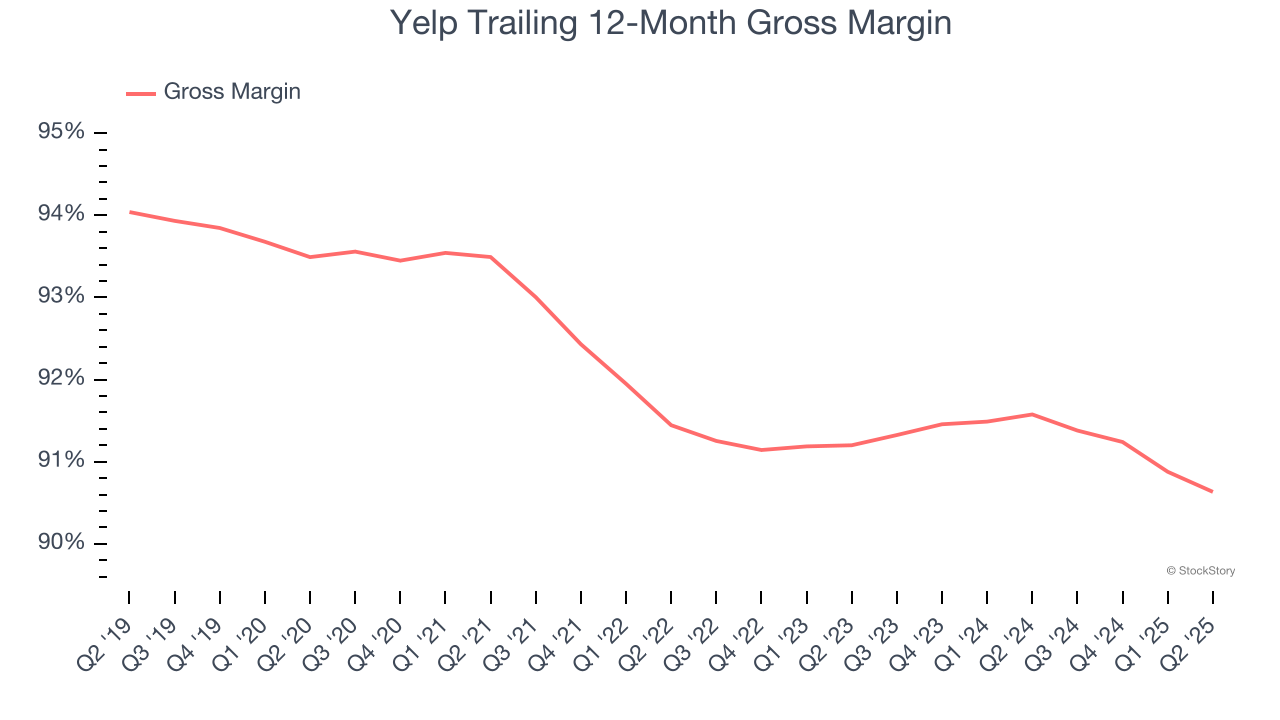

For social network businesses like Yelp, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include customer service, data center, and other infrastructure expenses.

Yelp’s gross margin is one of the highest in the consumer internet sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in product and marketing during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an elite 91.1% gross margin over the last two years. Said differently, roughly $91.09 was left to spend on selling, marketing, and R&D for every $100 in revenue.

2. Outstanding Long-Term EPS Growth

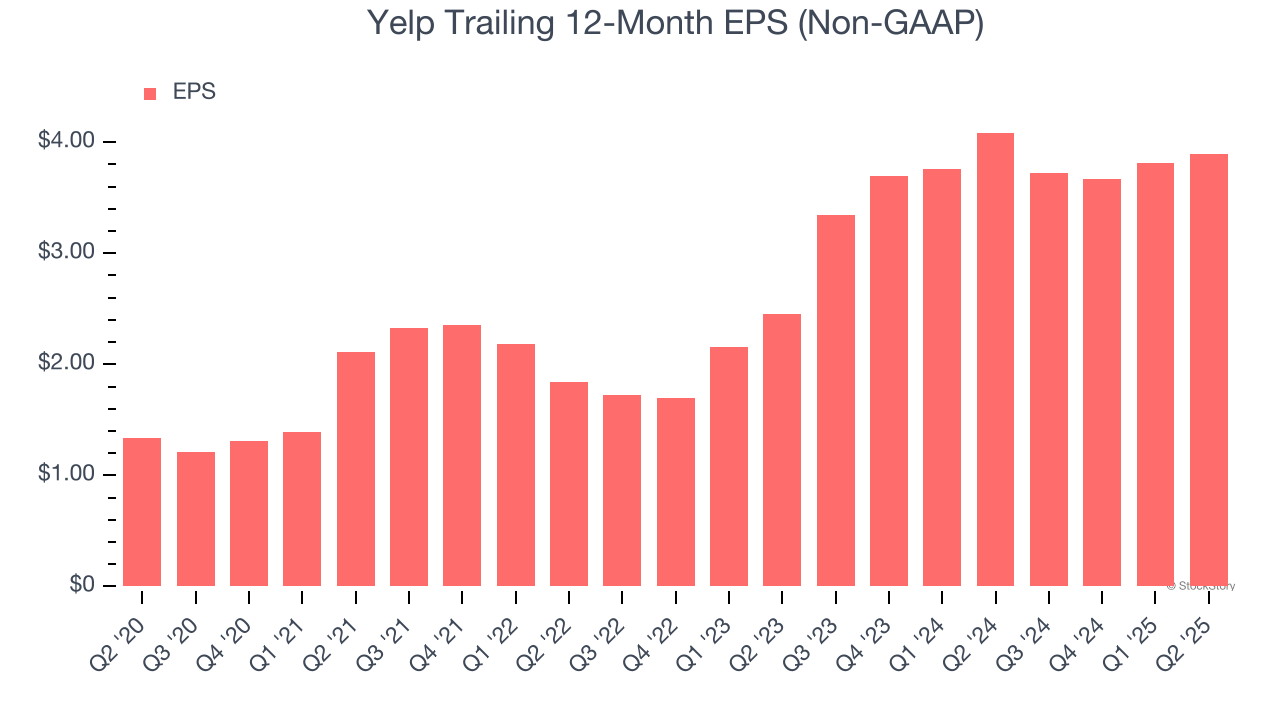

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Yelp’s EPS grew at an astounding 28.4% compounded annual growth rate over the last three years, higher than its 9.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Growth in Customer Spending Lags Peers

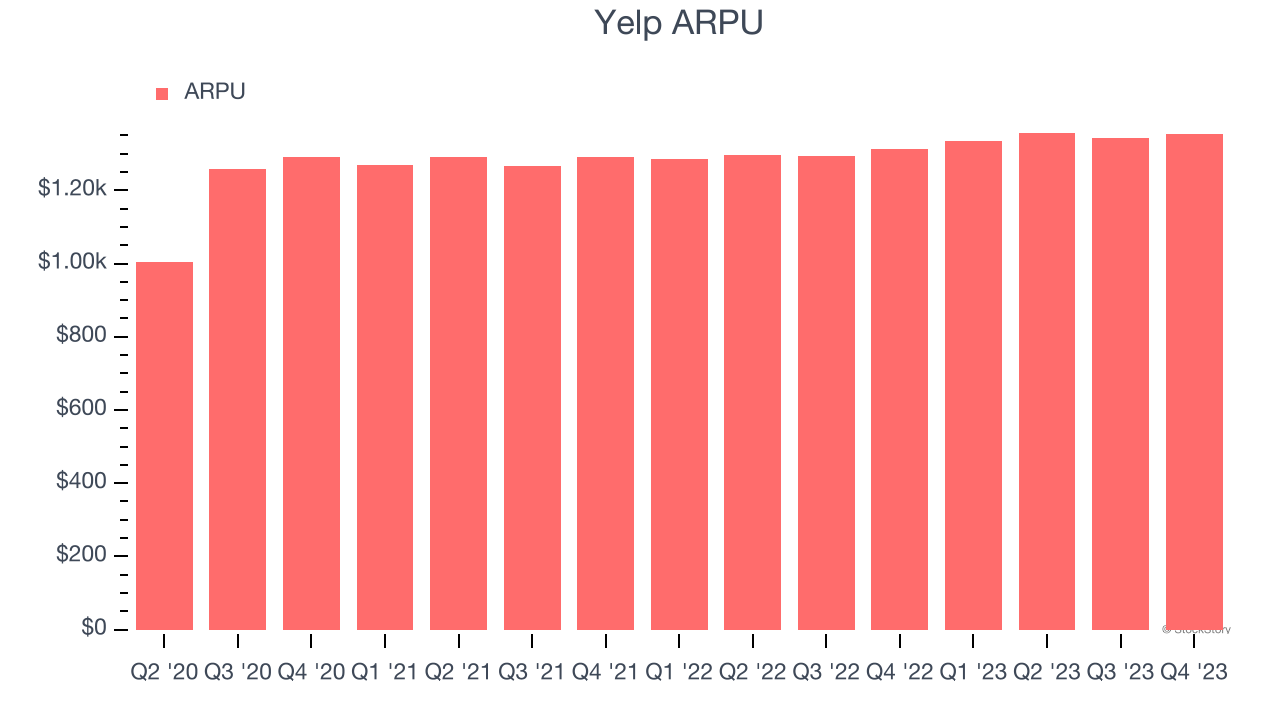

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns from the ads shown to its users. ARPU can also be a proxy for how valuable advertisers find Yelp’s audience and its ad-targeting capabilities.

Yelp’s ARPU growth has been mediocre over the last two years, averaging 3.5%. This raises questions about its platform’s health and ability to engage its users effectively.

Final Judgment

Yelp has huge potential even though it has some open questions. With its shares underperforming the market lately, the stock trades at 6.3× forward EV/EBITDA (or $34.45 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.