Synchrony Financial’s (NYSE:SYF) Q3: Beats On Revenue

Consumer financial services company Synchrony Financial (NYSE: SYF) reported revenue ahead of Wall Street’s expectations in Q3 CY2025, but sales were flat year on year at $3.82 billion. Its GAAP profit of $2.86 per share was 28.9% above analysts’ consensus estimates.

Is now the time to buy Synchrony Financial? Find out by accessing our full research report, it’s free for active Edge members.

Synchrony Financial (SYF) Q3 CY2025 Highlights:

- Net Interest Margin: 15.6% vs analyst estimates of 15.3% (27.2 basis point beat)

- Revenue: $3.82 billion vs analyst estimates of $3.79 billion (flat year on year, 0.9% beat)

- Efficiency Ratio: 32.6% vs analyst estimates of 32% (59.9 basis point miss)

- EPS (GAAP): $2.86 vs analyst estimates of $2.22 (28.9% beat)

- Tangible Book Value per Share: $37.93 vs analyst estimates of $38.19 (16.1% year-on-year growth, 0.7% miss)

- Market Capitalization: $27.1 billion

Company Overview

Powering over 73 million active accounts and partnerships with major brands like Amazon, PayPal, and Lowe's, Synchrony Financial (NYSE: SYF) provides credit cards, installment loans, and banking products through partnerships with retailers, healthcare providers, and digital platforms.

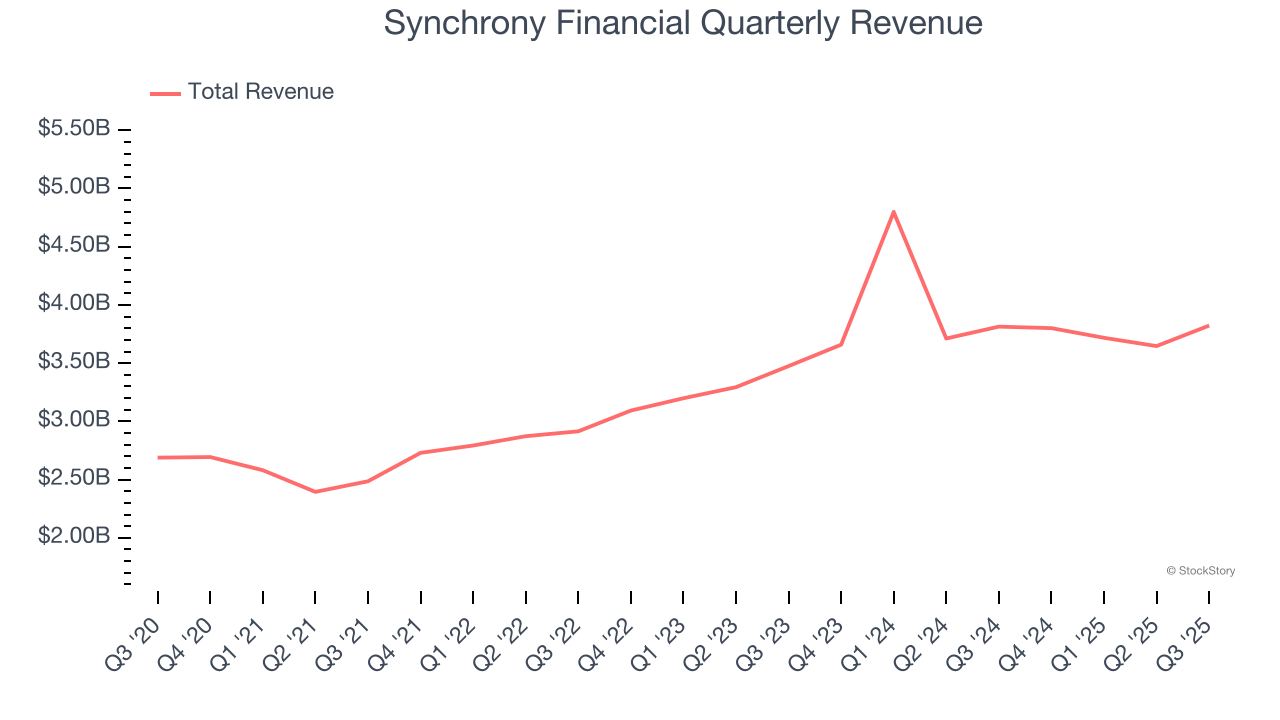

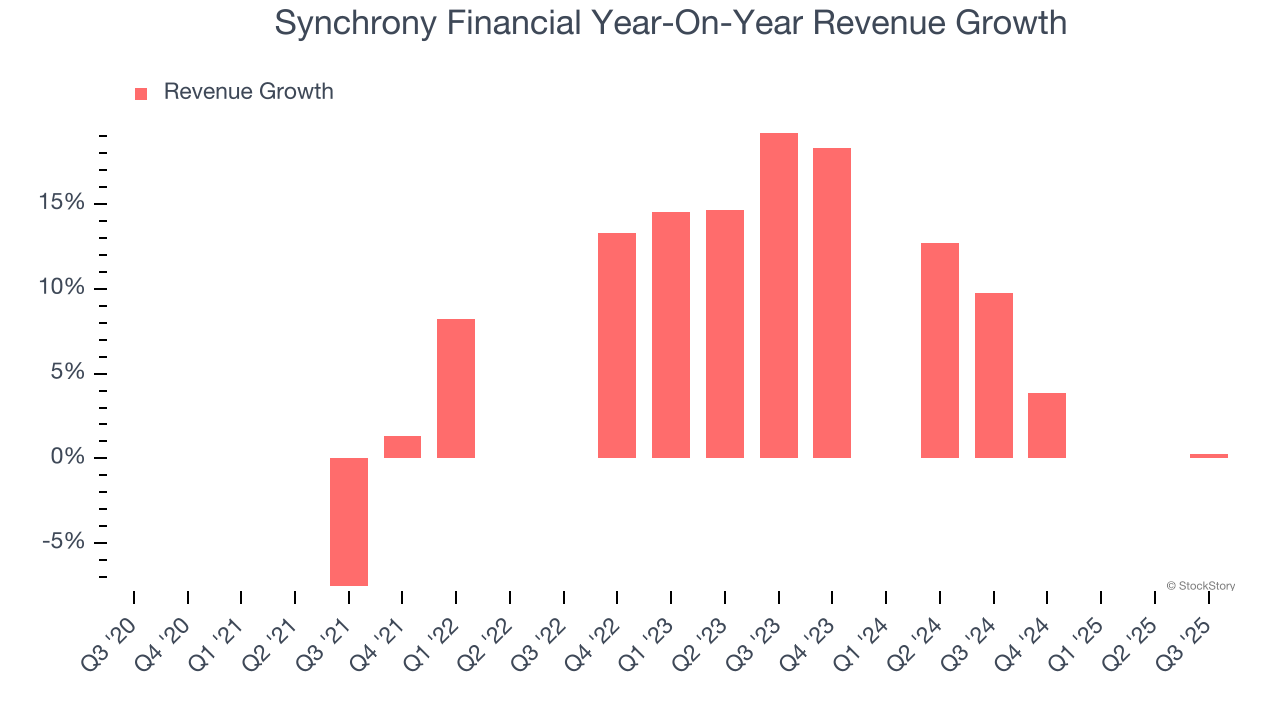

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Synchrony Financial’s 5.3% annualized revenue growth over the last five years was tepid. This wasn’t a great result compared to the rest of the financials sector, but there are still things to like about Synchrony Financial.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Synchrony Financial’s annualized revenue growth of 7.1% over the last two years is above its five-year trend, but we were still disappointed by the results.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Synchrony Financial’s $3.82 billion of revenue was flat year on year but beat Wall Street’s estimates by 0.9%.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

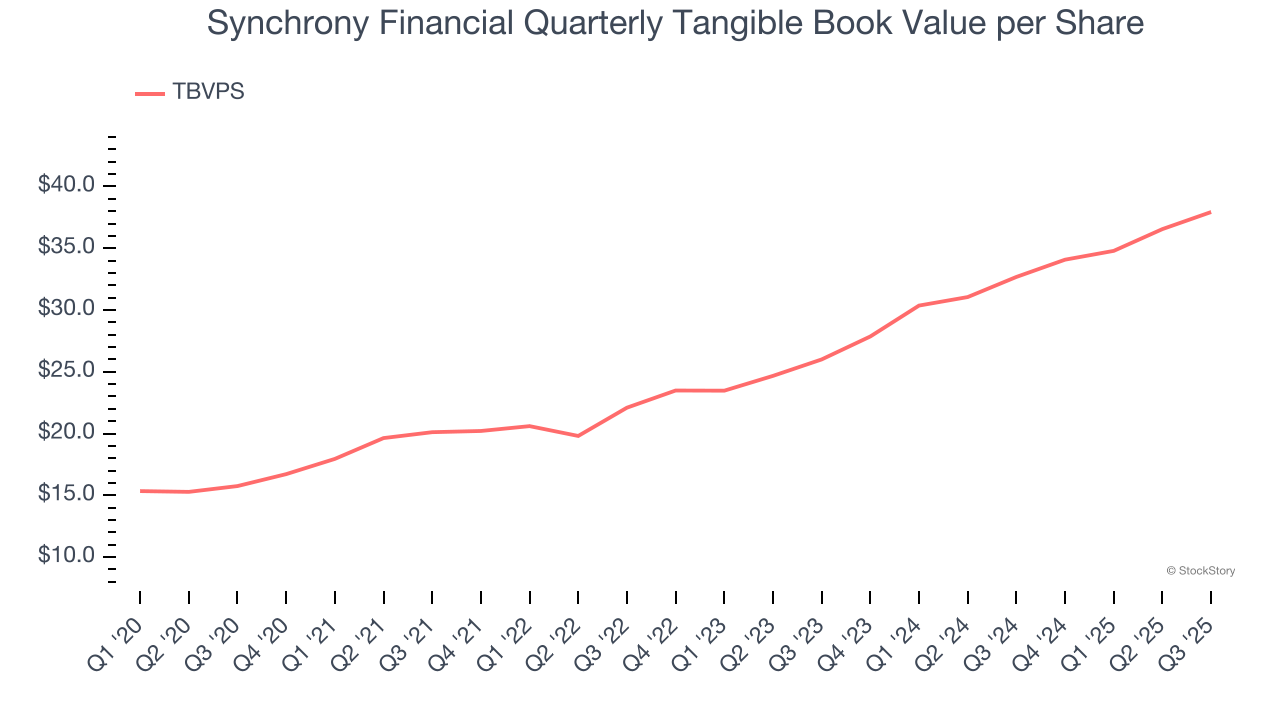

Tangible Book Value Per Share (TBVPS)

Financial firms are valued based on their balance sheet strength and ability to compound book value across diverse business lines.

This explains why tangible book value per share (TBVPS) is a premier metric for the sector. TBVPS provides concrete per-share net worth that investors can trust when evaluating companies with complex, multi-faceted business models. On the other hand, EPS is often distorted by the diverse nature of operations, mergers, and various accounting treatments across different business units. Book value provides clearer performance insights.

Synchrony Financial’s TBVPS grew at an exceptional 19.2% annual clip over the last five years. TBVPS growth has also accelerated recently, growing by 20.8% annually over the last two years from $26.00 to $37.93 per share.

Tangible Book Value Per Share (TBVPS)

Diversified financial companies operate across multiple business segments, from investment banking and trading to wealth management and specialized lending. Their valuations hinge on balance sheet quality and the ability to compound shareholder equity across these diverse operations.

This is why we consider tangible book value per share (TBVPS) an important metric for the sector. TBVPS represents the real net worth per share across all business segments, providing a clear measure of shareholder equity regardless of the complexity of operations. Traditional metrics like EPS are helpful but face distortion from the complexity of diversified operations, M&A activity, and various accounting rules that can obscure true performance across multiple business lines.

Synchrony Financial’s TBVPS grew at an exceptional 19.2% annual clip over the last five years. TBVPS growth has also accelerated recently, growing by 20.8% annually over the last two years from $26.00 to $37.93 per share.

Key Takeaways from Synchrony Financial’s Q3 Results

It was good to see Synchrony Financial beat analysts’ EPS expectations this quarter. We were also excited its net interest margin outperformed Wall Street’s estimates by a wide margin. On the other hand, efficiency ratio and tangible book value per share fell short. Zooming out, we think this quarter was mixed. The market seemed to be hoping for more, and the stock traded down 1.2% to $71.90 immediately following the results.

Should you buy the stock or not? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.