Specialty Equipment Distributors Stocks Q2 Recap: Benchmarking Karat Packaging (NASDAQ:KRT)

Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at Karat Packaging (NASDAQ: KRT) and its peers.

Historically, specialty equipment distributors have boasted deep selection and expertise in sometimes narrow areas like single-use packaging or unique lighting equipment. Additionally, the industry has evolved to include more automated industrial equipment and machinery over the last decade, driving efficiencies and enabling valuable data collection. Specialty equipment distributors whose offerings keep up with these trends can take share in a still-fragmented market, but like the broader industrials sector, this space is at the whim of economic cycles that impact the capital spending and manufacturing propelling industry volumes.

The 8 specialty equipment distributors stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 3.2% while next quarter’s revenue guidance was 2.3% below.

In light of this news, share prices of the companies have held steady as they are up 2.3% on average since the latest earnings results.

Weakest Q2: Karat Packaging (NASDAQ: KRT)

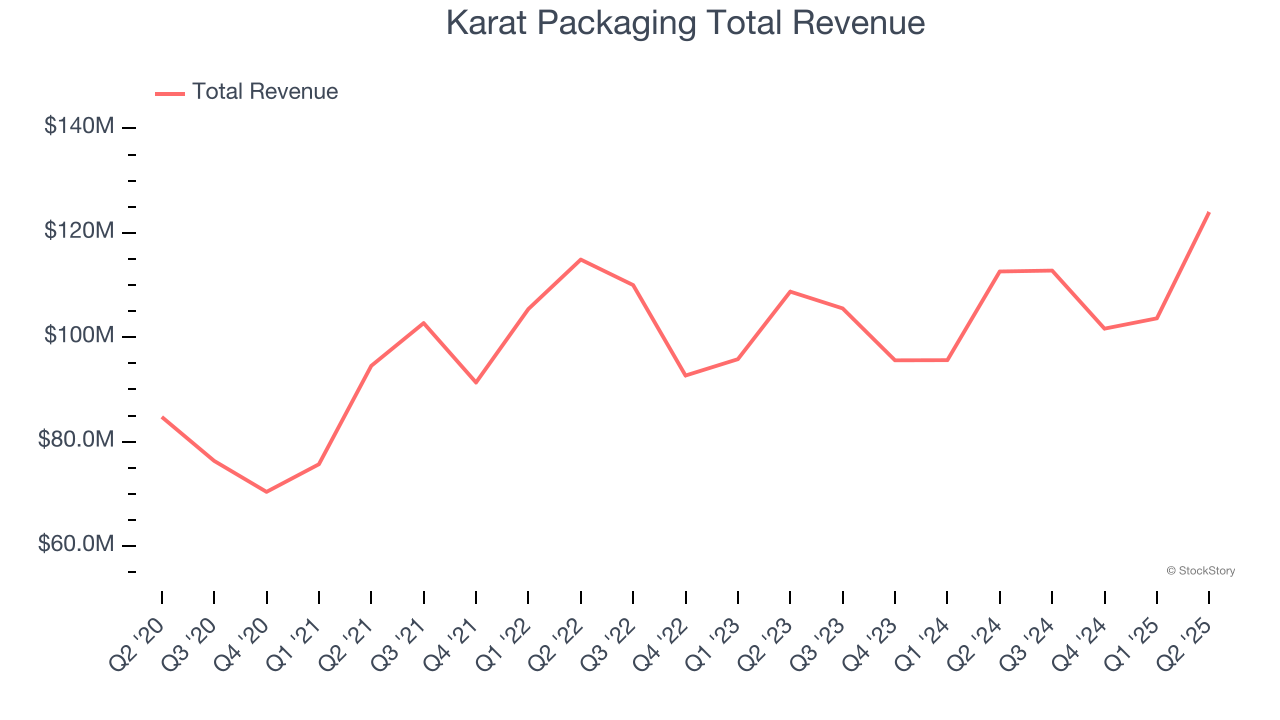

Founded as Lollicup, Karat Packaging (NASDAQ: KRT) distributes and manufactures environmentally-friendly disposable foodservice packaging solutions.

Karat Packaging reported revenues of $124 million, up 10.1% year on year. This print was in line with analysts’ expectations, but overall, it was a slower quarter for the company with a significant miss of analysts’ EPS estimates and revenue guidance for next quarter missing analysts’ expectations.

“Our record quarterly performance is a testimony to our nimble business model and resilient global supply chain, which allowed us to achieve early success in navigating the supply chain disruptions and trade uncertainty. We are swiftly diversifying our sourcing footprint, reducing sourcing from China to just 10 percent in the second quarter, while implementing plans to further expand across other Asian countries and Latin America to enhance supply chain resilience and flexibility,” said Alan Yu, Chief Executive Officer.

Unsurprisingly, the stock is down 5.3% since reporting and currently trades at $25.25.

Read our full report on Karat Packaging here, it’s free for active Edge members.

Best Q2: Richardson Electronics (NASDAQ: RELL)

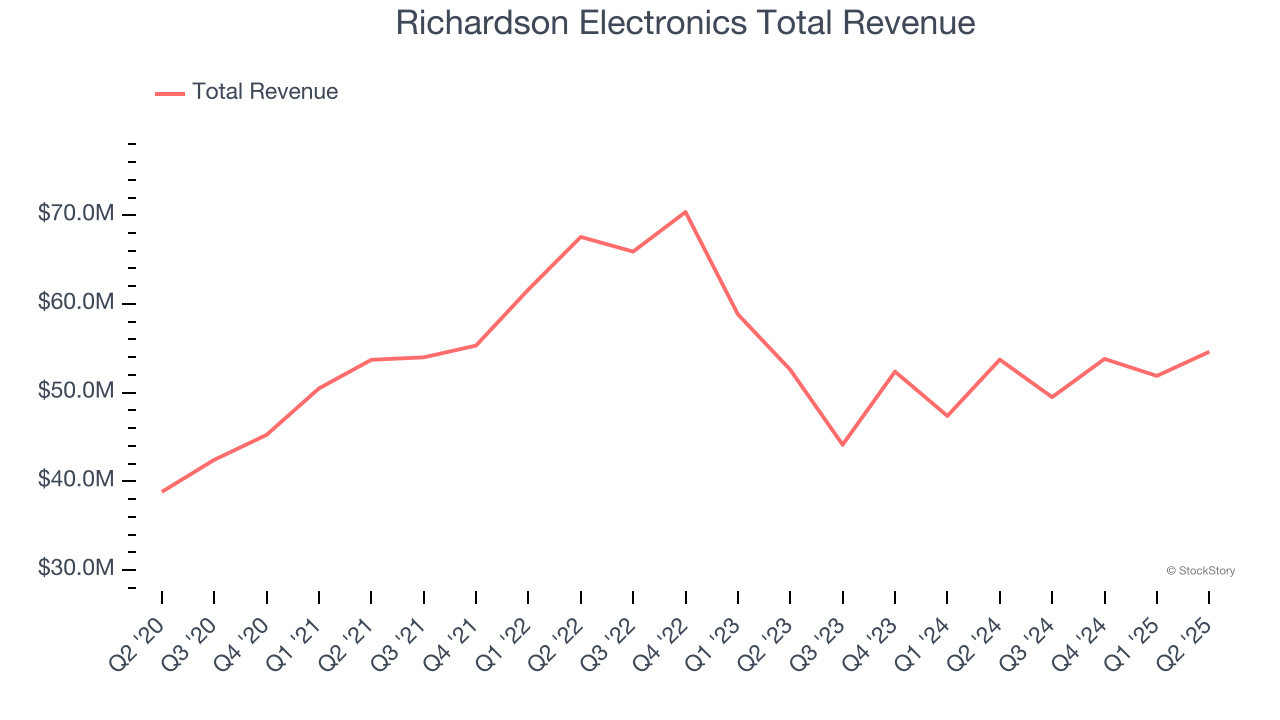

Founded in 1947, Richardson Electronics (NASDAQ: RELL) is a distributor of power grid and microwave tubes as well as consumables related to those products.

Richardson Electronics reported revenues of $54.61 million, up 1.6% year on year, outperforming analysts’ expectations by 6%. The business had an incredible quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 8.5% since reporting. It currently trades at $11.47.

Is now the time to buy Richardson Electronics? Access our full analysis of the earnings results here, it’s free for active Edge members.

Herc (NYSE: HRI)

Formerly a subsidiary of Hertz Corporation and with a logo that still bears some similarities to its former parent, Herc Holdings (NYSE: HRI) provides equipment rental and related services to a wide range of industries.

Herc reported revenues of $1.00 billion, up 18.2% year on year, exceeding analysts’ expectations by 6.9%. Still, it was a slower quarter as it posted full-year revenue guidance missing analysts’ expectations significantly and full-year EBITDA guidance missing analysts’ expectations.

Herc delivered the weakest full-year guidance update in the group. As expected, the stock is down 14.6% since the results and currently trades at $128.13.

Read our full analysis of Herc’s results here.

Hudson Technologies (NASDAQ: HDSN)

Founded in 1991, Hudson Technologies (NASDAQ: HDSN) specializes in refrigerant services and solutions, providing refrigerant sales, reclamation, and recycling.

Hudson Technologies reported revenues of $72.85 million, down 3.2% year on year. This number beat analysts’ expectations by 1.7%. Overall, it was a stunning quarter as it also produced a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Hudson Technologies had the slowest revenue growth among its peers. The stock is up 7.7% since reporting and currently trades at $8.95.

Read our full, actionable report on Hudson Technologies here, it’s free for active Edge members.

United Rentals (NYSE: URI)

Owning the largest rental fleet in the world, United Rentals (NYSE: URI) provides equipment rental and related services to construction, industrial, and infrastructure industries.

United Rentals reported revenues of $3.94 billion, up 4.5% year on year. This print topped analysts’ expectations by 0.8%. It was a strong quarter as it also recorded an impressive beat of analysts’ adjusted operating income estimates and full-year EBITDA guidance slightly topping analysts’ expectations.

The stock is up 24.9% since reporting and currently trades at $998.42.

Read our full, actionable report on United Rentals here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.