3 Reasons to Sell ESNT and 1 Stock to Buy Instead

Even though Essent Group (currently trading at $62.57 per share) has gained 6.6% over the last six months, it has lagged the S&P 500’s 18.4% return during that period. This may have investors wondering how to approach the situation.

Is now the time to buy Essent Group, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Essent Group Not Exciting?

We're sitting this one out for now. Here are three reasons we avoid ESNT and a stock we'd rather own.

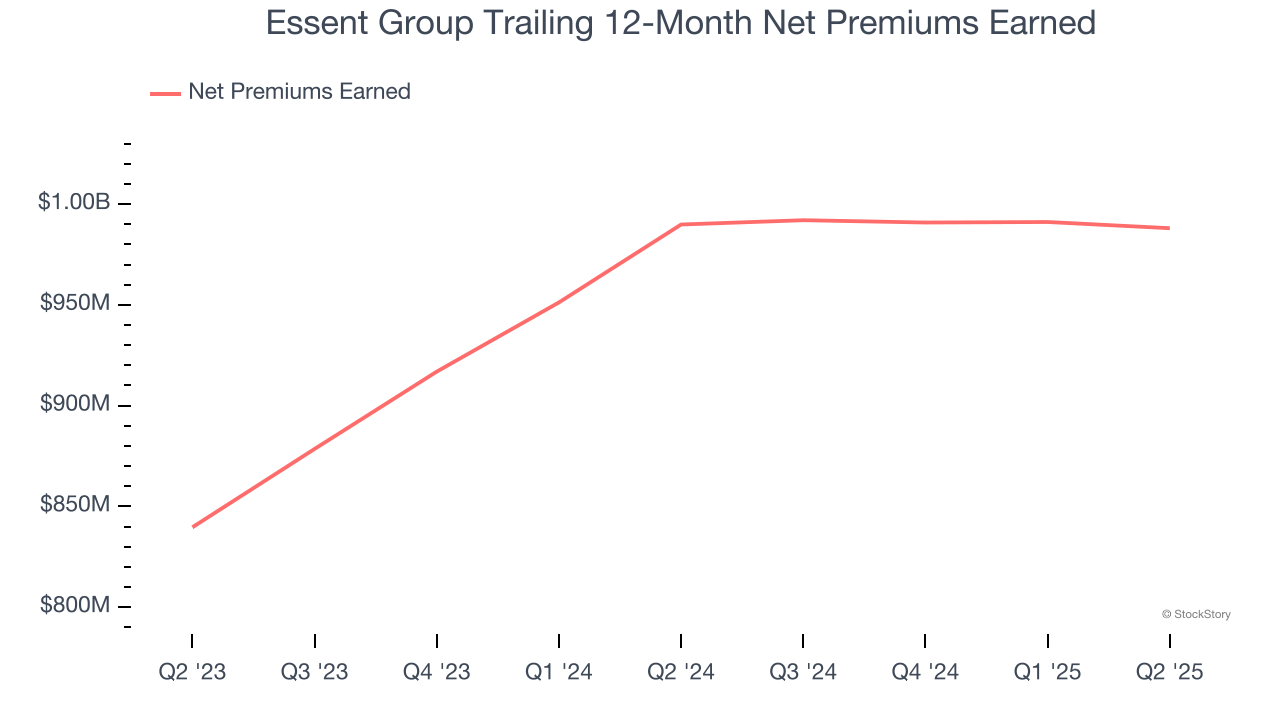

1. Net Premiums Earned Point to Soft Demand

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are therefore net of what’s ceded to reinsurers as a risk mitigation and transfer strategy.

Essent Group’s net premiums earned has grown at a 3.6% annualized rate over the last five years, worse than the broader insurance industry and slower than its total revenue.

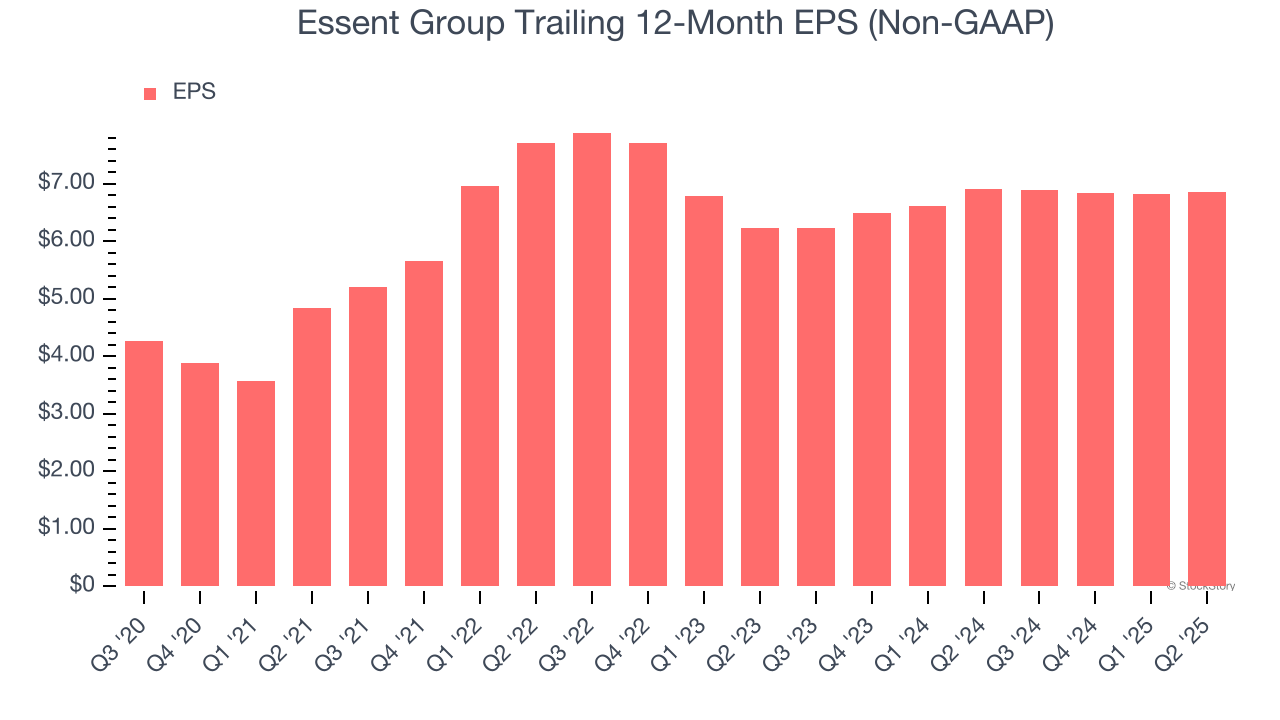

3. Recent EPS Growth Below Our Standards

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Essent Group’s EPS grew at a weak 4.9% compounded annual growth rate over the last two years, lower than its 12.2% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Essent Group’s business quality ultimately falls short of our standards. With its shares trailing the market in recent months, the stock trades at 1× forward P/B (or $62.57 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better stocks to buy right now. Let us point you toward one of our all-time favorite software stocks.

Stocks We Like More Than Essent Group

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.