Automobile Manufacturing Stocks Q2 Teardown: THOR Industries (NYSE:THO) Vs The Rest

Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at THOR Industries (NYSE: THO) and its peers.

Much capital investment and technical know-how are needed to manufacture functional, safe, and aesthetically pleasing automobiles for the mass market. Barriers to entry are therefore high, and auto manufacturers with economies of scale can boast strong economic moats. However, this doesn’t insulate them from new entrants, as electric vehicles (EVs) have entered the market and are upending it. This has forced established manufacturers to not only contend with emerging EV-first competitors but also decide how much they want to invest in these disruptive technologies, which will likely cannibalize their legacy offerings.

The 7 automobile manufacturing stocks we track reported a slower Q2. As a group, revenues beat analysts’ consensus estimates by 2.6%.

Thankfully, share prices of the companies have been resilient as they are up 7.4% on average since the latest earnings results.

THOR Industries (NYSE: THO)

Created through the acquisition and merger of various RV manufacturers, THOR Industries manufactures and sells a range of recreational vehicles, including motorhomes and travel trailers, catering to consumers seeking the freedom and comfort of the RV lifestyle.

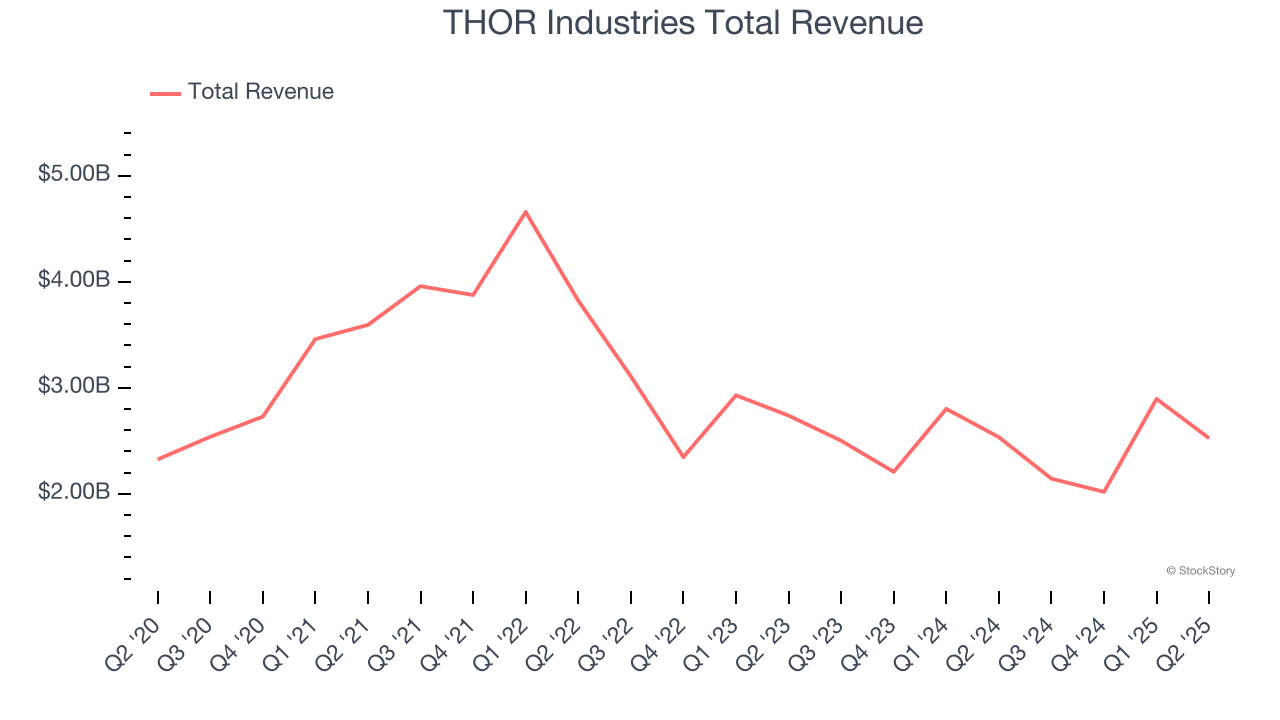

THOR Industries reported revenues of $2.52 billion, flat year on year. This print exceeded analysts’ expectations by 8.8%. Overall, it was a satisfactory quarter for the company with a beat of analysts’ EPS estimates but full-year revenue guidance missing analysts’ expectations significantly.

“We are very pleased with the results that our teams delivered amidst a highly volatile macroeconomic backdrop. Our performance is a testament to their hard work and dedication that has helped us navigate a challenging environment. Our annual Open House event has just kicked off, giving us an opportunity to connect with our customers and showcase the exciting new products we have to offer. As we continue to execute our strategic plan, we remain focused on improving our operational efficiency, gaining market share and driving long-term success,” stated Bob Martin, President and Chief Executive Officer of THOR Industries.

THOR Industries scored the biggest analyst estimates beat but had the weakest full-year guidance update of the whole group. Unsurprisingly, the stock is up 2.4% since reporting and currently trades at $104.83.

Is now the time to buy THOR Industries? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q2: Ford (NYSE: F)

Established to make automobiles accessible to a broader segment of the population, Ford (NYSE: F) designs, manufactures, and sells a variety of automobiles, trucks, and electric vehicles.

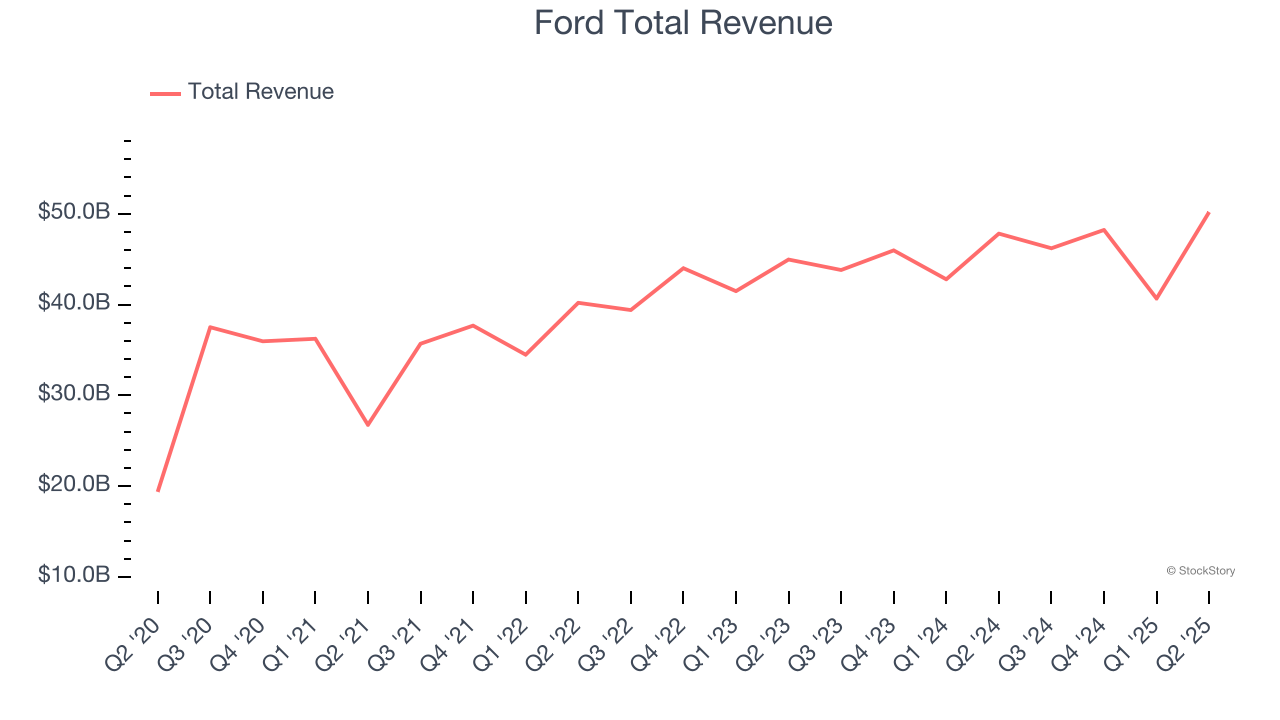

Ford reported revenues of $50.18 billion, up 5% year on year, outperforming analysts’ expectations by 7.8%. The business had an exceptional quarter with a solid beat of analysts’ adjusted operating income estimates and an impressive beat of analysts’ revenue estimates.

The market seems happy with the results as the stock is up 8% since reporting. It currently trades at $11.78.

Is now the time to buy Ford? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: Tesla (NASDAQ: TSLA)

Originally founded by Martin Eberhard and Marc Tarpenning in 2003, Tesla (NASDAQ: TSLA) is an electric vehicle company accelerating the world’s transition to sustainable energy.

Tesla reported revenues of $22.5 billion, down 11.8% year on year, falling short of analysts’ expectations by 1.1%. It was a disappointing quarter as it posted a slight miss of analysts’ revenue estimates and a miss of analysts’ revenue estimates, as the miss in Energy trumped the beat in Services and in-line print for Automotive.

Tesla delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 31.5% since the results and currently trades at $437.82.

Read our full analysis of Tesla’s results here.

Rivian (NASDAQ: RIVN)

The manufacturer of Amazon’s delivery trucks, Rivian (NASDAQ: RIVN) designs, manufactures, and sells electric vehicles and commercial delivery vans.

Rivian reported revenues of $1.30 billion, up 12.5% year on year. This result surpassed analysts’ expectations by 2%. However, it was a softer quarter as it logged full-year EBITDA guidance missing analysts’ expectations and a significant miss of analysts’ adjusted operating income estimates.

The stock is up 8.1% since reporting and currently trades at $13.16.

Read our full, actionable report on Rivian here, it’s free for active Edge members.

Lucid (NASDAQ: LCID)

Founded by a former Tesla Vice President, Lucid Group (NASDAQ: LCID) designs, manufactures, and sells luxury electric vehicles with long-range capabilities.

Lucid reported revenues of $259.4 million, up 29.3% year on year. This print met analysts’ expectations. More broadly, it was a softer quarter as it produced a significant miss of analysts’ adjusted operating income and EPS estimates.

Lucid scored the fastest revenue growth among its peers. The stock is down 7.4% since reporting and currently trades at $22.54.

Read our full, actionable report on Lucid here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.