Tilray’s (NASDAQ:TLRY) Q3: Beats On Revenue, Stock Jumps 17.1%

Cannabis company Tilray Brands (NASDAQ: TLRY) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 4.7% year on year to $209.5 million. Its non-GAAP loss of $0 per share increased from -$0.04 in the same quarter last year.

Is now the time to buy Tilray? Find out by accessing our full research report, it’s free for active Edge members.

Tilray (TLRY) Q3 CY2025 Highlights:

- Revenue: $209.5 million vs analyst estimates of $204 million (4.7% year-on-year growth, 2.7% beat)

- Adjusted EBITDA: $10.18 million vs analyst estimates of $10.29 million (4.9% margin, 1% miss)

- Operating Margin: 1%, up from -18.3% in the same quarter last year

- Free Cash Flow was -$10.86 million compared to -$42.02 million in the same quarter last year

- Market Capitalization: $1.90 billion

Irwin D. Simon, Chairman and Chief Executive Officer, stated, "As we enter fiscal 2026, Tilray’s first quarter results underscore the effectiveness of our strategic vision and disciplined execution. Achieving a record Q1 net revenue of $210 million, delivering net income, and fortifying our balance sheet are not just milestones, they are proof points of our commitment to building sustainable growth, operational excellence, and unlocking value for our shareholders. Our global platform positions Tilray Brands not just to participate in, but to lead, the evolution of the global cannabis, beverage, and wellness sectors."

Company Overview

Founded in 2013, Tilray Brands (NASDAQ: TLRY) engages in cannabis research, cultivation, and distribution, offering a range of medical and recreational cannabis products, hemp-based foods, and alcoholic beverages.

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $830.8 million in revenue over the past 12 months, Tilray is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

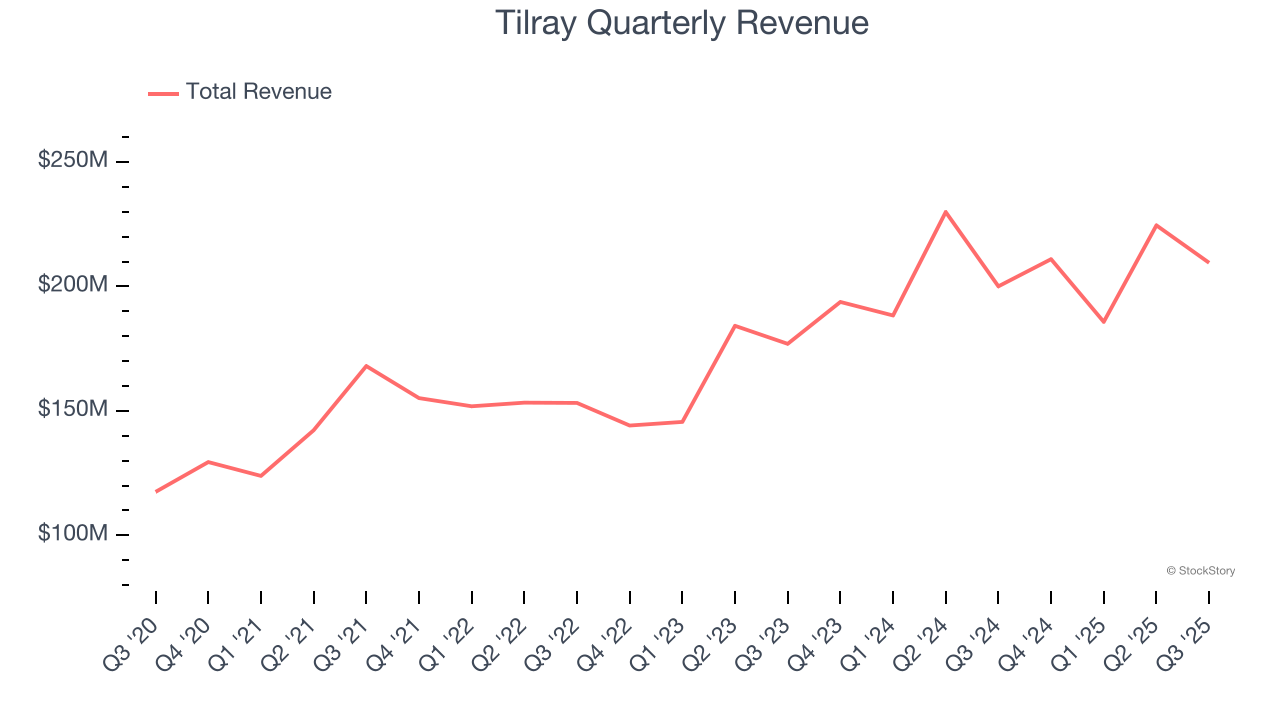

As you can see below, Tilray’s 10.6% annualized revenue growth over the last three years was decent. This shows its offerings generated slightly more demand than the average consumer staples company, a useful starting point for our analysis.

This quarter, Tilray reported modest year-on-year revenue growth of 4.7% but beat Wall Street’s estimates by 2.7%.

Looking ahead, sell-side analysts expect revenue to grow 3.9% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and indicates its products will face some demand challenges.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

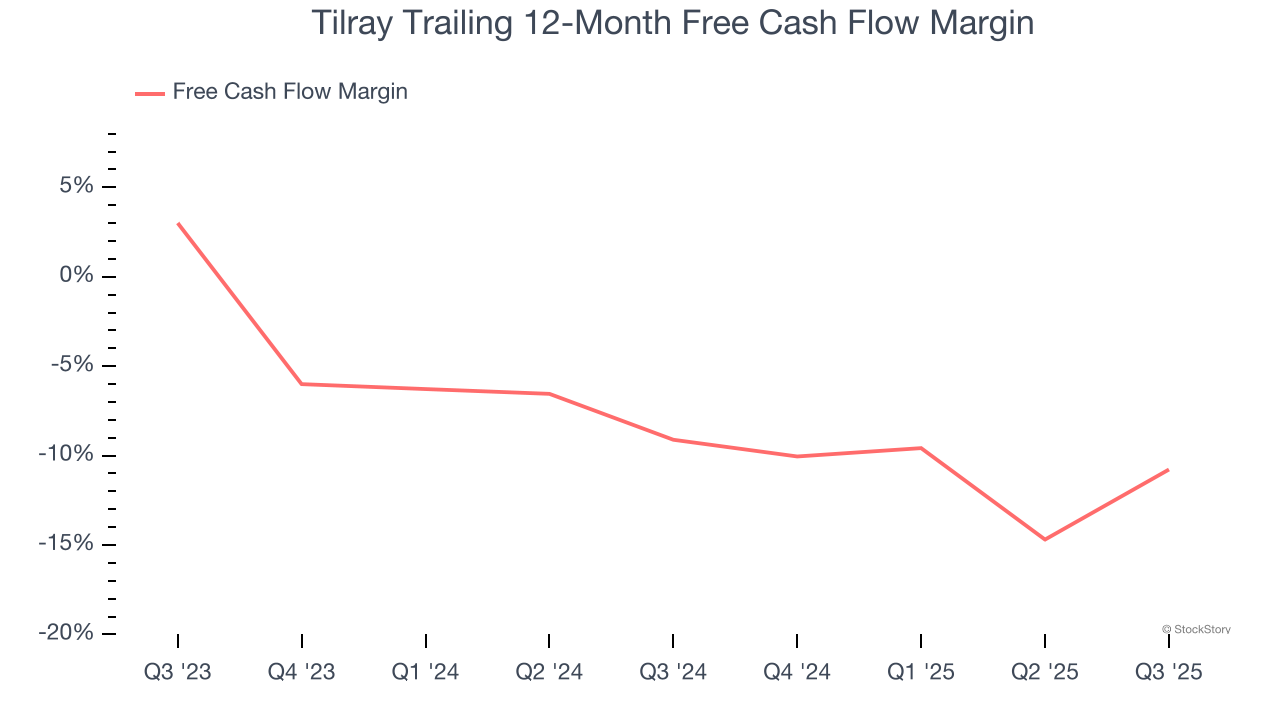

Tilray’s demanding reinvestments have drained its resources over the last two years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 10%, meaning it lit $9.96 of cash on fire for every $100 in revenue.

Taking a step back, we can see that Tilray’s margin dropped by 1.7 percentage points over the last year. Almost any movement in the wrong direction is undesirable because it is already burning cash. If the trend continues, it could signal it’s in the middle of an investment cycle.

Tilray burned through $10.86 million of cash in Q3, equivalent to a negative 5.2% margin. The company’s cash burn slowed from $42.02 million of lost cash in the same quarter last year.

Key Takeaways from Tilray’s Q3 Results

It was encouraging to see Tilray beat analysts’ revenue expectations this quarter. Profit margin also increased meaningfully from the same period last year. Zooming out, we think this was an encouraging quarter showing progress and profitable growth. The stock traded up 17.1% to $2.02 immediately after reporting.

Should you buy the stock or not? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.

More News

View MoreRecent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.