Dutch Bros (NYSE:BROS) Reports Strong Q4, Stock Jumps 26.9%

Coffee chain Dutch Bros (NYSE: BROS) reported Q4 CY2024 results topping the market’s revenue expectations, with sales up 34.9% year on year to $342.8 million. The company’s full-year revenue guidance of $1.57 billion at the midpoint came in 2.3% above analysts’ estimates. Its non-GAAP profit of $0.07 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Dutch Bros? Find out by accessing our full research report, it’s free.

Dutch Bros (BROS) Q4 CY2024 Highlights:

- Revenue: $342.8 million vs analyst estimates of $318.7 million (34.9% year-on-year growth, 7.6% beat)

- Adjusted EPS: $0.07 vs analyst estimates of $0.02 (significant beat)

- Adjusted EBITDA: $48.82 million vs analyst estimates of $37.96 million (14.2% margin, 28.6% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $1.57 billion at the midpoint, beating analyst estimates by 2.3% and implying 22.2% growth (vs 33.1% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $270 million at the midpoint, in line with analyst expectations

- Operating Margin: 4.6%, up from 0.9% in the same quarter last year

- Locations: 982 at quarter end, up from 831 in the same quarter last year

- Same-Store Sales rose 6.9% year on year (5% in the same quarter last year)

- Market Capitalization: $7.31 billion

Christine Barone, Chief Executive Officer and President of Dutch Bros, stated, “We delivered exceptional performance in the fourth quarter as we ended 2024 on a high note. In the quarter, we drove an impressive 35% revenue growth and system same shop sales growth of 6.9%. We believe our brand is resonating with customers, as we delivered 2.3% system same shop transaction growth, the largest year-over-year increase in over two years.”

Company Overview

Started in 1992 by two brothers as a single pushcart, Dutch Bros (NYSE: BROS) is a dynamic coffee chain that’s captured the hearts of coffee enthusiasts across the United States.

Traditional Fast Food

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years.

With $1.28 billion in revenue over the past 12 months, Dutch Bros is a mid-sized restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the other hand, it has an edge over smaller competitors with fewer resources and can still flex high growth rates because it’s working from a smaller revenue base.

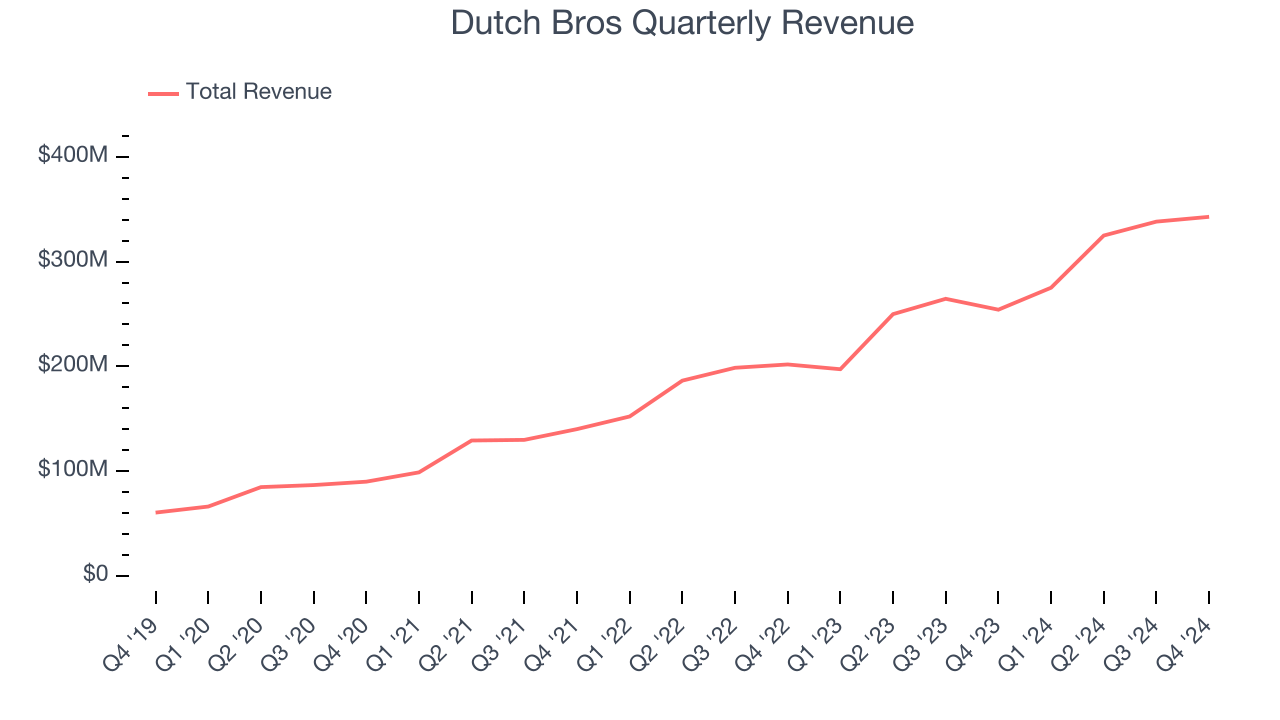

As you can see below, Dutch Bros’s sales grew at an incredible 40% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new restaurants and increased sales at existing, established dining locations.

This quarter, Dutch Bros reported wonderful year-on-year revenue growth of 34.9%, and its $342.8 million of revenue exceeded Wall Street’s estimates by 7.6%.

Looking ahead, sell-side analysts expect revenue to grow 19.4% over the next 12 months, a deceleration versus the last five years. Despite the slowdown, this projection is healthy and suggests the market sees success for its menu offerings.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Restaurant Performance

Number of Restaurants

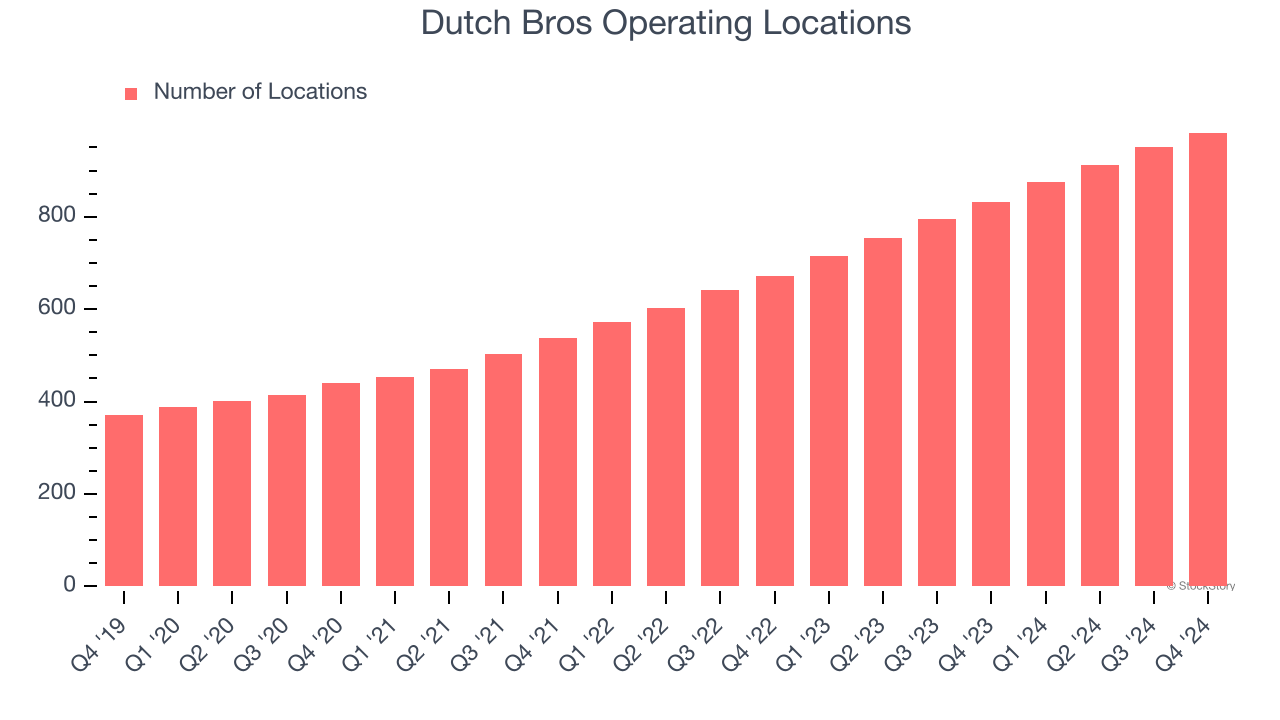

Dutch Bros operated 982 locations in the latest quarter. It has opened new restaurants at a rapid clip over the last two years, averaging 22.4% annual growth, much faster than the broader restaurant sector. This gives it a chance to become a large, scaled business over time.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Same-Store Sales

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing restaurants and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

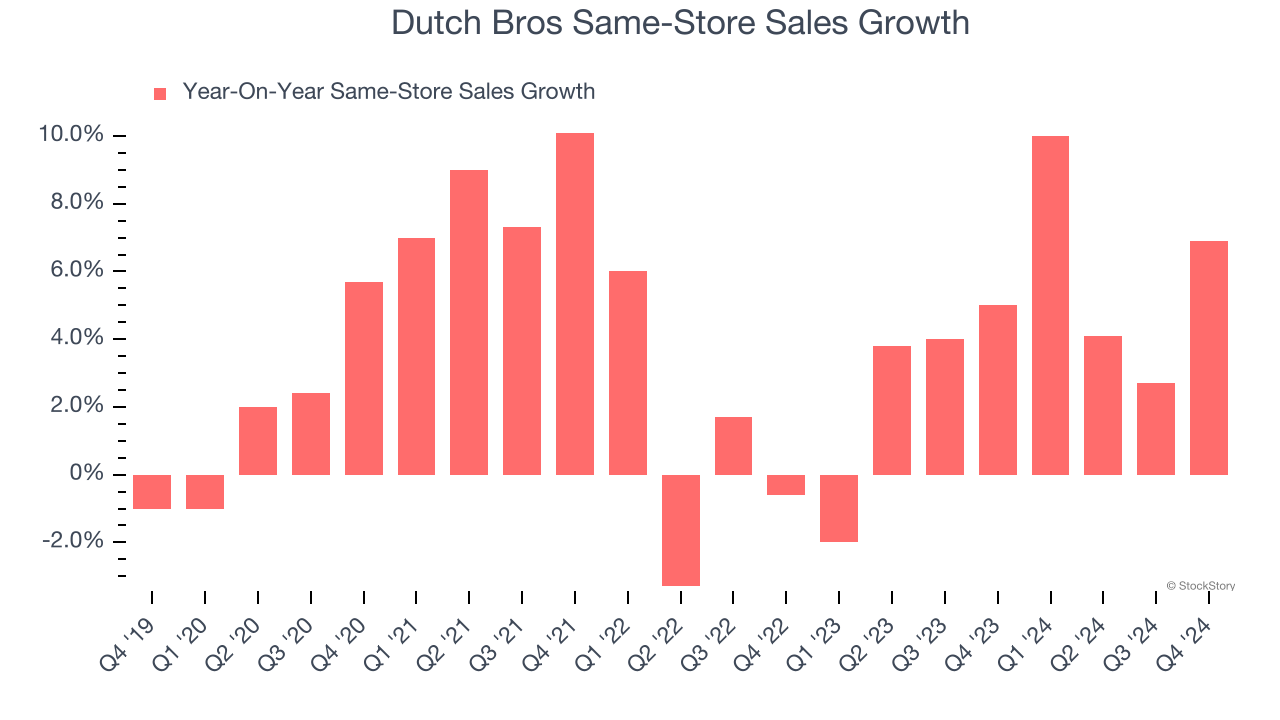

Dutch Bros’s demand has been spectacular for a restaurant chain over the last two years. On average, the company has increased its same-store sales by an impressive 4.3% per year. This performance along with its meaningful buildout of new restaurants suggest it’s playing some aggressive offense.

In the latest quarter, Dutch Bros’s same-store sales rose 6.9% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

Key Takeaways from Dutch Bros’s Q4 Results

We were impressed by how significantly Dutch Bros blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Looking ahead, revenue guidance for 2025 also came in ahead of expectations. Zooming out, we think this was a very good quarter. The stock traded up 27% to $82.19 immediately following the results.

Indeed, Dutch Bros had a rock-solid quarterly earnings result, but is this stock a good investment here? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.