Coinbase (NASDAQ:COIN) Surprises With Strong Q4

Cryptocurrency exchange Coinbase (NASDAQ: COIN) beat Wall Street’s revenue expectations in Q4 CY2024, with sales up 138% year on year to $2.27 billion. Its GAAP profit of $4.68 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Coinbase? Find out by accessing our full research report, it’s free.

Coinbase (COIN) Q4 CY2024 Highlights:

- Revenue: $2.27 billion vs analyst estimates of $1.86 billion (138% year-on-year growth, 22% beat)

- EPS (GAAP): $4.68 vs analyst estimates of $2.13 (significant beat)

- Adjusted EBITDA: $1.29 billion vs analyst estimates of $846 million (56.7% margin, 52.4% beat)

- Operating Margin: 45.5%, up from 12.1% in the same quarter last year

- Free Cash Flow Margin: 42.5%, down from 57.8% in the previous quarter

- Market Capitalization: $68.82 billion

Company Overview

Regarded by many as the face of crypto, Coinbase (NASDAQ: COIN) is a digital exchange helping the world onboard into the blockchain ecosystem.

Financial Technology

Financial technology companies benefit from the increasing consumer demand for digital payments, banking, and finance. Tailwinds fueling this trend include e-commerce along with improvements in blockchain infrastructure and AI-driven credit underwriting, which make access to money faster and cheaper. Despite regulatory scrutiny and resistance from traditional financial institutions, fintechs are poised for long-term growth as they disrupt legacy systems by expanding financial services to underserved population segments.

Sales Growth

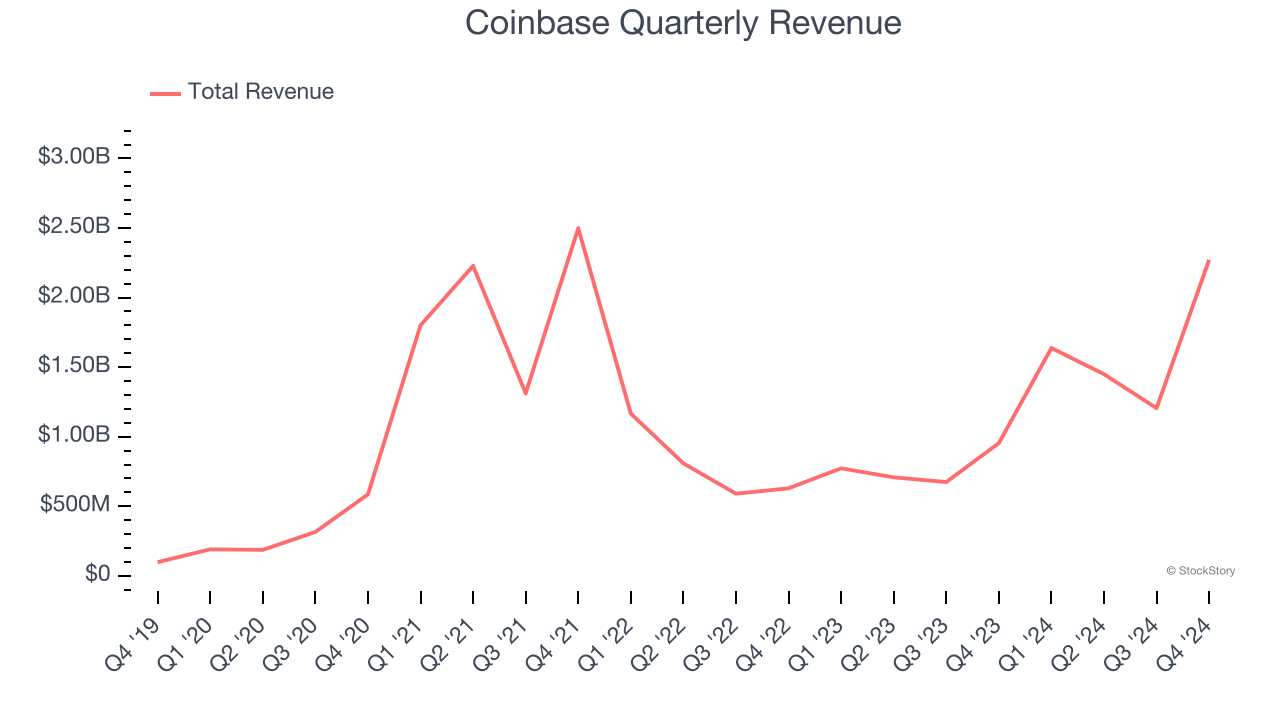

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Coinbase struggled to consistently generate demand over the last three years as its sales dropped at a 5.7% annual rate. This fell short of our benchmarks and is a sign of lacking business quality.

This quarter, Coinbase reported magnificent year-on-year revenue growth of 138%, and its $2.27 billion of revenue beat Wall Street’s estimates by 22%.

Looking ahead, sell-side analysts expect revenue to grow 3% over the next 12 months. While this projection indicates its newer products and services will fuel better top-line performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

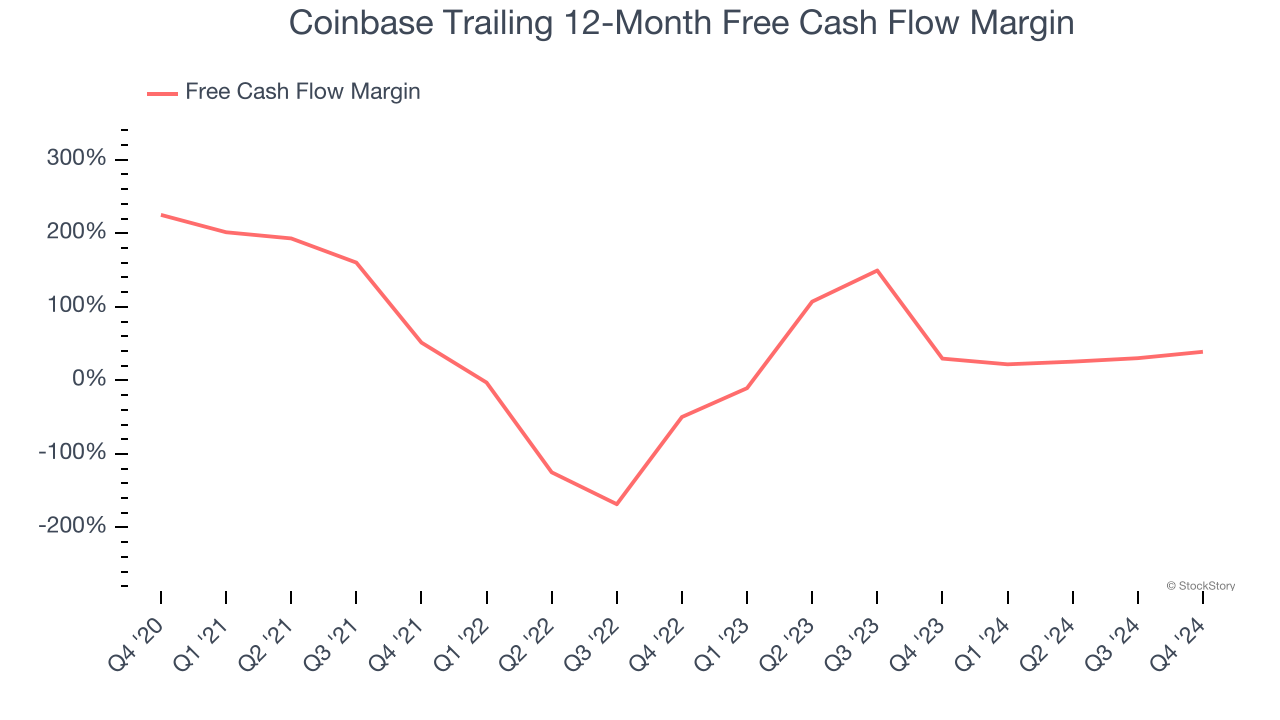

Coinbase has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the consumer internet sector, averaging an eye-popping 36% over the last two years.

Taking a step back, we can see that Coinbase’s margin dropped by 12.5 percentage points over the last few years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal higher capital intensity.

Coinbase’s free cash flow clocked in at $964.6 million in Q4, equivalent to a 42.5% margin. This result was good as its margin was 43 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

Key Takeaways from Coinbase’s Q4 Results

We were impressed by how significantly Coinbase blew past analysts’ revenue, EBITDA, and EPS expectations this quarter. Specifically, its subscription and services revenue, which is less volatile than transaction revenue, clocked in at $641 million vs management's guidance of $543 million at the midpoint ($580 million at the high end of the range). Zooming out, we think this quarter featured some important positives. The stock traded up 1.8% to $303.36 immediately after reporting.

Sure, Coinbase had a solid quarter, but if we look at the bigger picture, is this stock a buy? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.