Unity’s (NYSE:U) Q4: Beats On Revenue But Stock Drops

Game engine maker Unity (NYSE: U) reported Q4 CY2024 results beating Wall Street’s revenue expectations, but sales fell by 25% year on year to $457.1 million. On the other hand, next quarter’s revenue guidance of $410 million was less impressive, coming in 5.6% below analysts’ estimates. Its GAAP loss of $0.30 per share was 18.6% above analysts’ consensus estimates.

Is now the time to buy Unity? Find out by accessing our full research report, it’s free.

Unity (U) Q4 CY2024 Highlights:

- Revenue: $457.1 million vs analyst estimates of $431.8 million (25% year-on-year decline, 5.9% beat)

- EPS (GAAP): -$0.30 vs analyst estimates of -$0.37 (18.6% beat)

- Adjusted EBITDA: $106.1 million vs analyst estimates of $85.23 million (23.2% margin, 24.5% beat)

- Revenue Guidance for Q1 CY2025 is $410 million at the midpoint, below analyst estimates of $434.3 million

- EBITDA guidance for Q1 CY2025 is $62.5 million at the midpoint, below analyst estimates of $91.99 million

- Operating Margin: -27.1%, up from -42.5% in the same quarter last year

- Free Cash Flow Margin: 23.1%, down from 25.8% in the previous quarter

- Market Capitalization: $8.65 billion

Company Overview

Started as a game studio by three friends in a Copenhagen apartment, Unity (NYSE: U) is a software as a service platform that makes it easier to develop and monetize new games and other visual digital experiences.

Design Software

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

Sales Growth

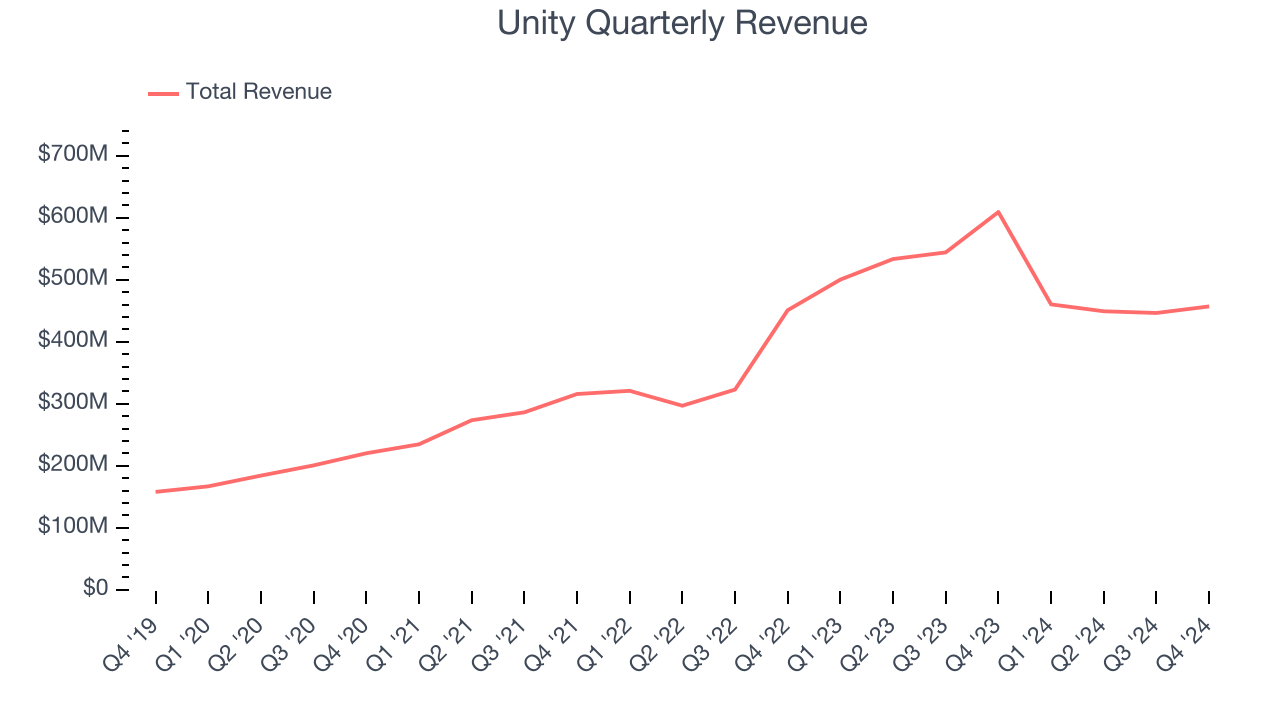

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Over the last three years, Unity grew its sales at a 17.8% annual rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our benchmark for the software sector, which enjoys a number of secular tailwinds.

This quarter, Unity’s revenue fell by 25% year on year to $457.1 million but beat Wall Street’s estimates by 5.9%. Company management is currently guiding for a 10.9% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 1.6% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and suggests its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Unity’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between Unity’s products and its peers.

Key Takeaways from Unity’s Q4 Results

We were impressed by how significantly Unity blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. On the other hand, its revenue and EBITDA guidance for next quarter fell well short of Wall Street’s estimates, making this a softer quarter. The stock traded down 9.7% to $19.41 immediately after reporting.

Unity underperformed this quarter, but does that create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.