A Look Back at E-commerce Software Stocks’ Q4 Earnings: GoDaddy (NYSE:GDDY) Vs The Rest Of The Pack

As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q4. Today, we are looking at e-commerce software stocks, starting with GoDaddy (NYSE: GDDY).

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of retail still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still ripe for online disruption. It is these large swathes of the retail where e-commerce has not yet taken hold that drives the demand for various e-commerce software solutions.

The 5 e-commerce software stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 0.9% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 7.1% since the latest earnings results.

GoDaddy (NYSE: GDDY)

Founded by Bob Parsons after selling his first company to Intuit, GoDaddy (NYSE: GDDY) provides small and mid-sized businesses with the ability to buy a web domain and tools to create and manage a website.

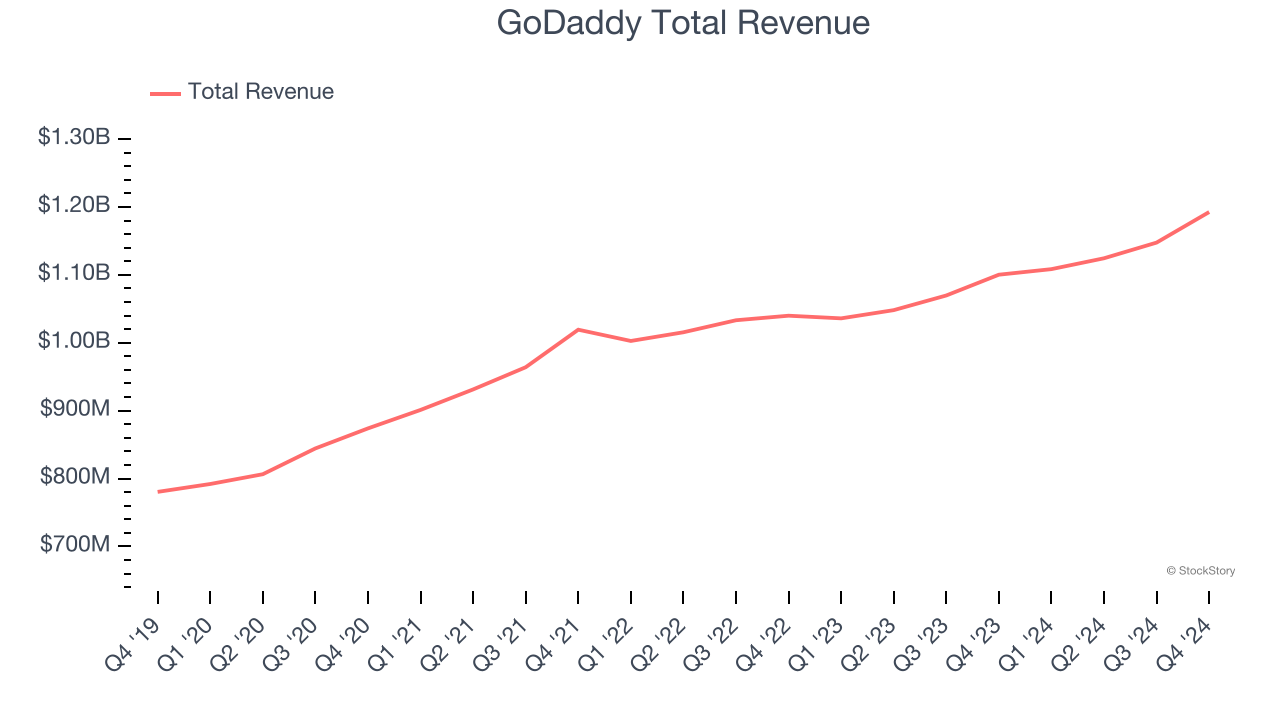

GoDaddy reported revenues of $1.19 billion, up 8.4% year on year. This print exceeded analysts’ expectations by 1.4%. Overall, it was a satisfactory quarter for the company with an impressive beat of analysts’ EBITDA estimates.

"GoDaddy demonstrated strong operational execution and financial performance in 2024, making significant progress across our key strategic initiatives," said GoDaddy CEO Aman Bhutani.

GoDaddy scored the highest full-year guidance raise of the whole group. Even though it had a relatively good quarter, the market seems discontent with the results. The stock is down 3.6% since reporting and currently trades at $174.10.

Is now the time to buy GoDaddy? Access our full analysis of the earnings results here, it’s free.

Best Q4: Shopify (NYSE: SHOP)

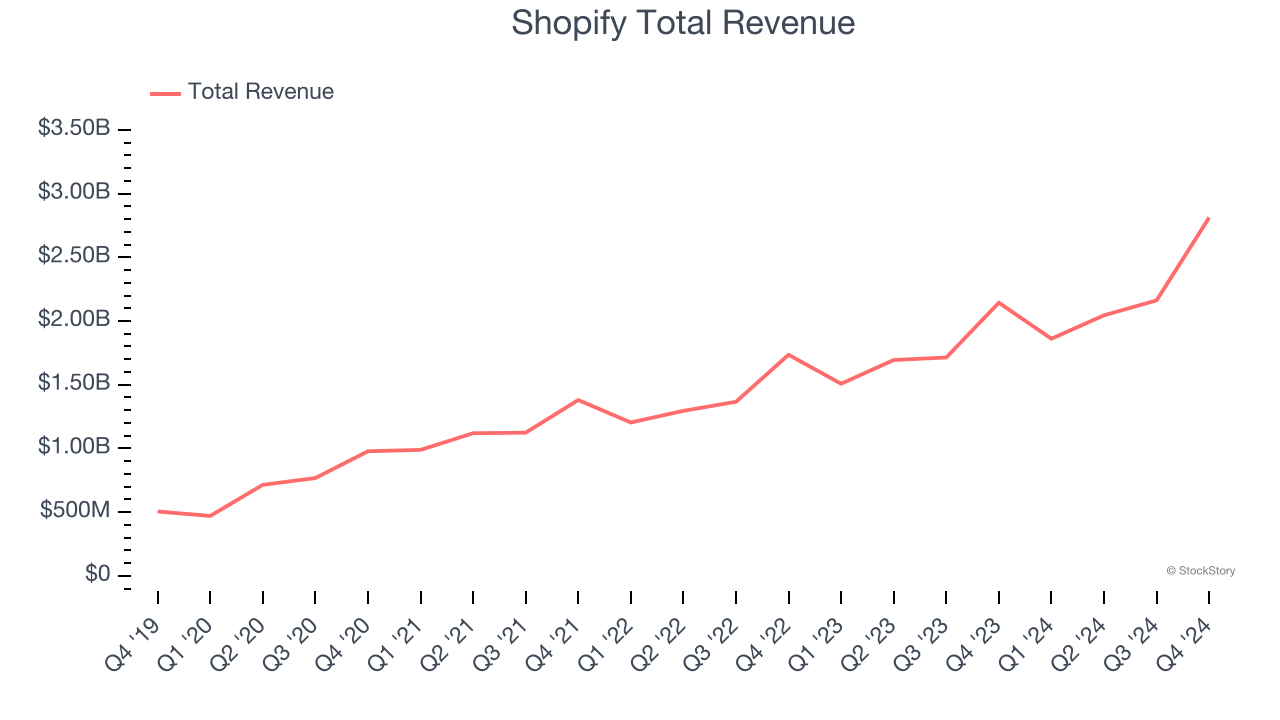

Originally created as an internal tool for a snowboarding company, Shopify (NYSE: SHOP) provides a software platform for building and operating e-commerce businesses.

Shopify reported revenues of $2.81 billion, up 31.2% year on year, outperforming analysts’ expectations by 3%. The business had a strong quarter with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ total payment volume estimates.

Shopify achieved the biggest analyst estimates beat and fastest revenue growth among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 3.6% since reporting. It currently trades at $115.66.

Is now the time to buy Shopify? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: VeriSign (NASDAQ: VRSN)

While the company is not a domain registrar and does not directly sell domain names to end users, Verisign (NASDAQ: VRSN) operates and maintains the infrastructure to support domain names such as .com and .net.

VeriSign reported revenues of $395.4 million, up 3.9% year on year, in line with analysts’ expectations. It was a mixed quarter due to its lackluster performance in other areas of the business.

The stock is up 5.4% since the results and currently trades at $231.88.

Read our full analysis of VeriSign’s results here.

BigCommerce (NASDAQ: BIGC)

Founded in Sydney, Australia in 2009 by Mitchell Harper and Eddie Machaalani, BigCommerce (NASDAQ: BIGC) provides software for businesses to easily create online stores.

BigCommerce reported revenues of $87.03 million, up 3.4% year on year. This result was in line with analysts’ expectations. However, it was a slower quarter as it produced full-year guidance of slowing revenue growth and a miss of analysts’ billings estimates.

BigCommerce had the slowest revenue growth among its peers. The stock is down 6.6% since reporting and currently trades at $6.26.

Read our full, actionable report on BigCommerce here, it’s free.

Wix (NASDAQ: WIX)

Founded in 2006 in Tel Aviv, Wix.com (NASDAQ: WIX) offers a free and easy to operate website building platform.

Wix reported revenues of $460.5 million, up 14% year on year. This number met analysts’ expectations. Zooming out, it was a mixed quarter: Wix's revenue and operating profit beat analysts' expectations. On the other hand, its full-year revenue guidance missed and its revenue guidance for next quarter also fell short of Wall Street’s estimates.

Wix had the weakest performance against analyst estimates and weakest full-year guidance update among its peers. The stock is down 12.8% since reporting and currently trades at $198.61.

Read our full, actionable report on Wix here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.