Caesars Entertainment (NASDAQ:CZR) Reports Sales Below Analyst Estimates In Q4 Earnings

Hotel and casino entertainment company Caesars Entertainment (NASDAQ: CZR) fell short of the market’s revenue expectations in Q4 CY2024, with sales flat year on year at $2.80 billion. Its GAAP profit of $0.05 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Caesars Entertainment? Find out by accessing our full research report, it’s free.

Caesars Entertainment (CZR) Q4 CY2024 Highlights:

- Revenue: $2.80 billion vs analyst estimates of $2.83 billion (flat year on year, 1.1% miss)

- EPS (GAAP): $0.05 vs analyst estimates of -$0.12 (significant beat)

- Adjusted EBITDA: $882 million vs analyst estimates of $902 million (31.5% margin, 2.2% miss)

- Operating Margin: 23.9%, up from 19% in the same quarter last year

- Market Capitalization: $7.45 billion

Tom Reeg, Chief Executive Officer of Caesars Entertainment, Inc., commented, “Fourth quarter operating results reflect stable conditions in Las Vegas with continued high occupancy and strong ADRs; and competitive pressures regionally offset partially by the openings in New Orleans and Danville late in the quarter. Caesars Digital was negatively impacted by sports betting customer friendly outcomes in both October and December offset by over 60% growth in iGaming net revenues. As we look ahead to 2025, the brick and mortar operating environment remains stable and we are expecting another year of strong net revenue and Adjusted EBITDA growth in our Digital segment. When combined with lower capex and cash interest expense, 2025 is expected deliver significant free cash flow which we expect will be used to further reduce leverage.”

Company Overview

Formerly Eldorado Resorts, Caesars Entertainment (NASDAQ: CZR) is a global gaming and hospitality company operating numerous casinos, hotels, and resort properties.

Casino Operator

Casino operators enjoy limited competition because gambling is a highly regulated industry. These companies can also enjoy healthy margins and profits. Have you ever heard the phrase ‘the house always wins’? Regulation cuts both ways, however, and casinos may face stroke-of-the-pen risk that suddenly limits what they can or can't do and where they can do it. Furthermore, digitization is changing the game, pun intended. Whether it’s online poker or sports betting on your smartphone, innovation is forcing these players to adapt to changing consumer preferences, such as being able to wager anywhere on demand.

Sales Growth

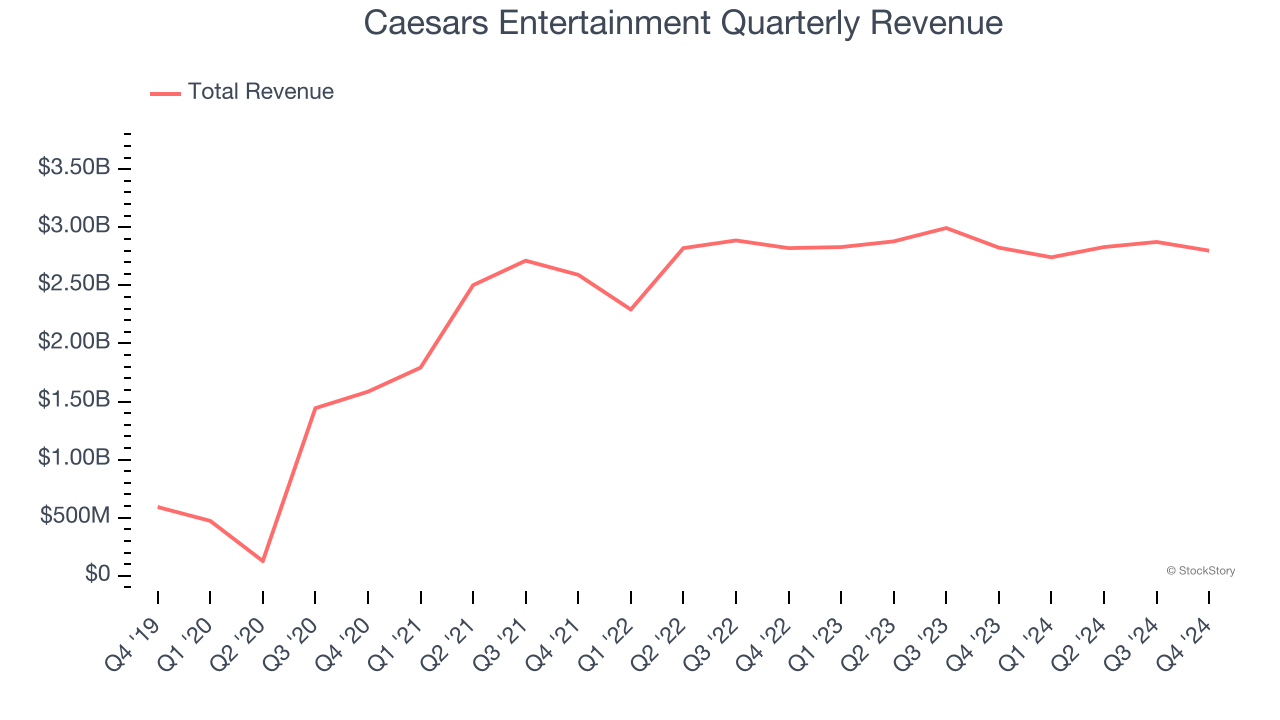

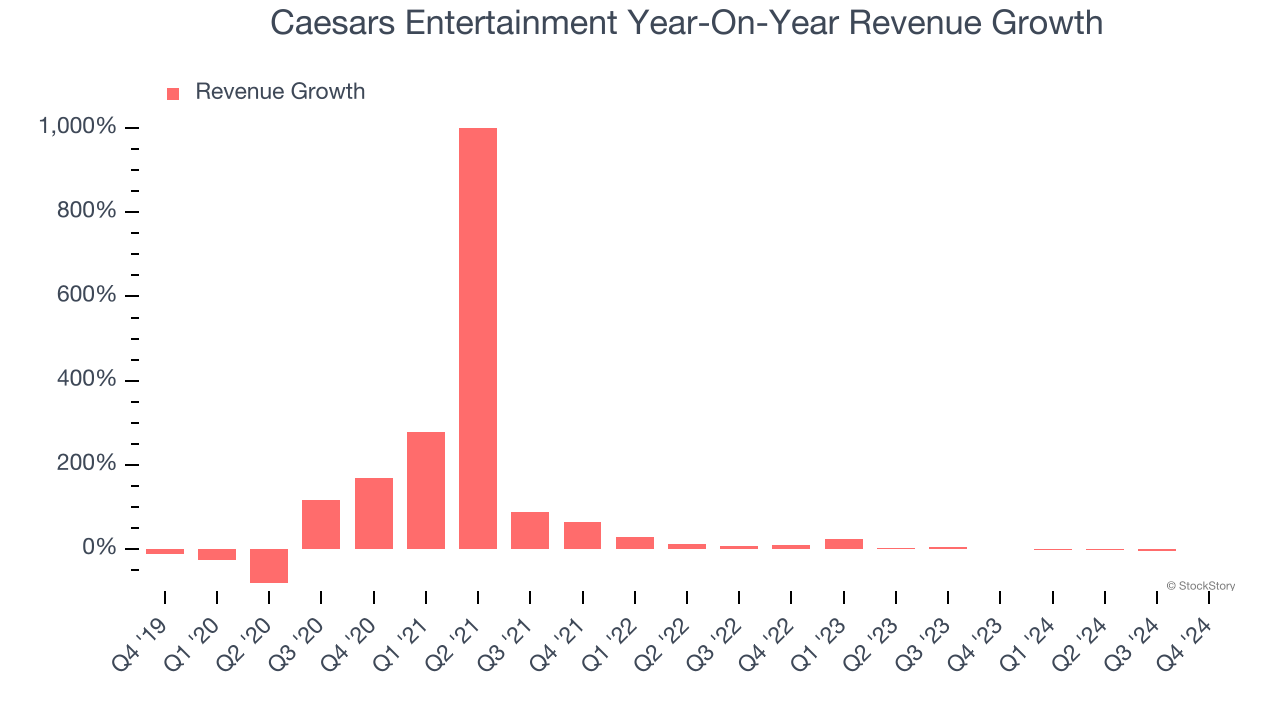

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Caesars Entertainment grew its sales at an incredible 34.8% compounded annual growth rate. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Caesars Entertainment’s recent history shows its demand slowed significantly as its annualized revenue growth of 1.9% over the last two years is well below its five-year trend. Note that COVID hurt Caesars Entertainment’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

Caesars Entertainment also breaks out the revenue for its most important segments, Casino and Hotel, which are 56.3% and 17.6% of revenue. Over the last two years, Caesars Entertainment’s Casino revenue (Poker, Blackjack) averaged 43.6% year-on-year growth. On the other hand, its Hotel revenue (overnight bookings) averaged 65.4% declines.

This quarter, Caesars Entertainment missed Wall Street’s estimates and reported a rather uninspiring 0.9% year-on-year revenue decline, generating $2.80 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 4% over the next 12 months. While this projection implies its newer products and services will catalyze better top-line performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Cash Is King

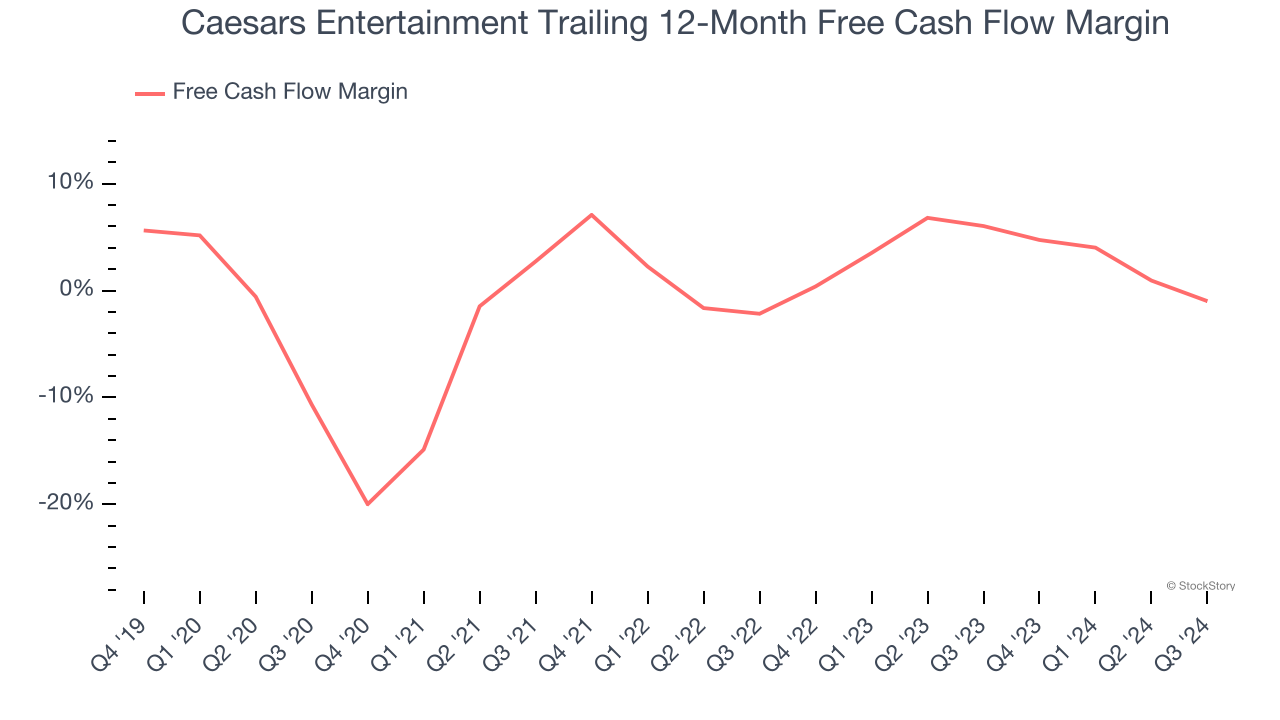

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Caesars Entertainment has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.5%, lousy for a consumer discretionary business. The divergence from its good operating margin stems from its capital-intensive business model, which requires Caesars Entertainment to make large cash investments in working capital and capital expenditures.

Key Takeaways from Caesars Entertainment’s Q4 Results

We were impressed by how significantly Caesars Entertainment blew past analysts’ EPS expectations this quarter. On the other hand, its revenue and EBITDA missed. Overall, this was a mixed quarter. The market seemed to focus on the negatives, and the stock traded down 2.2% to $34.10 immediately after reporting.

So should you invest in Caesars Entertainment right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.