Merit Medical Systems’s (NASDAQ:MMSI) Q4 Sales Top Estimates

Medical device company Merit Medical Systems (NASDAQ: MMSI) beat Wall Street’s revenue expectations in Q4 CY2024, with sales up 9.4% year on year to $355.2 million. The company expects the full year’s revenue to be around $1.48 billion, close to analysts’ estimates. Its non-GAAP profit of $0.93 per share was 12.2% above analysts’ consensus estimates.

Is now the time to buy Merit Medical Systems? Find out by accessing our full research report, it’s free.

Merit Medical Systems (MMSI) Q4 CY2024 Highlights:

- Revenue: $355.2 million vs analyst estimates of $351.5 million (9.4% year-on-year growth, 1% beat)

- Adjusted EPS: $0.93 vs analyst estimates of $0.83 (12.2% beat)

- Adjusted EBITDA: $74.7 million vs analyst estimates of $77.21 million (21% margin, 3.3% miss)

- Management’s revenue guidance for the upcoming financial year 2025 is $1.48 billion at the midpoint, in line with analyst expectations and implying 9.1% growth (vs 7.9% in FY2024)

- Adjusted EPS guidance for the upcoming financial year 2025 is $3.64 at the midpoint, missing analyst estimates by 2.6%

- Operating Margin: 10.3%, in line with the same quarter last year

- Free Cash Flow Margin: 18.4%, up from 17% in the same quarter last year

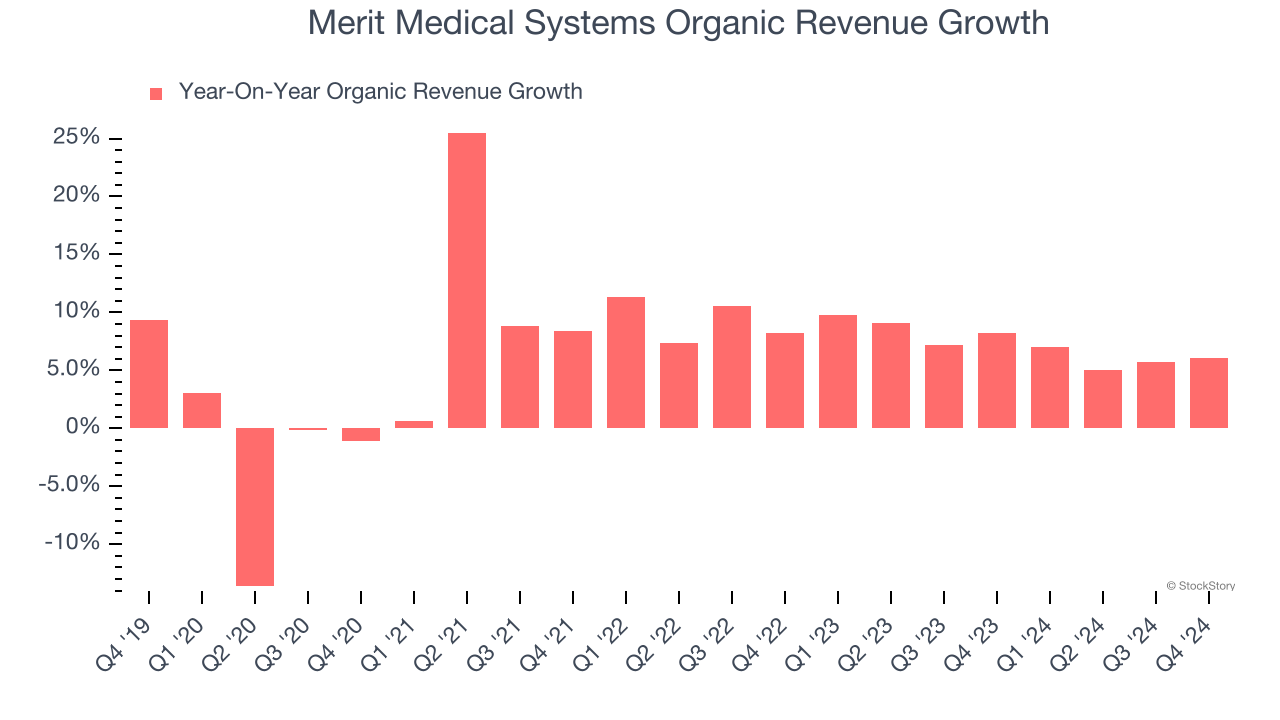

- Organic Revenue rose 6.1% year on year (8.3% in the same quarter last year)

- Market Capitalization: $6.03 billion

“We finished 2024 with strong momentum by delivering better-than-expected financial results in the fourth quarter, reflecting continued strong execution,” said Fred P. Lampropoulos, Merit’s Chairman and Chief Executive Officer.

Company Overview

Founded in 1987, Merit Medical Systems (NASDAQ: MMSI) designs and manufactures medical devices used in interventional, diagnostic, and therapeutic procedures, with a focus on cardiology, radiology, and endoscopy.

Medical Devices & Supplies - Cardiology, Neurology, Vascular

The medical devices and supplies industry, particularly in the fields of cardiology, neurology, and vascular care, benefits from a business model that balances innovation with relatively predictable revenue streams. These companies focus on developing life-saving devices such as stents, pacemakers, neurostimulation implants, and vascular access tools, which address critical and often chronic conditions. The recurring need for these devices, coupled with growing global demand for advanced treatments, provides stability and opportunities for long-term growth. However, the industry faces hurdles such as high research and development costs, rigorous regulatory approval processes, and reliance on reimbursement from healthcare systems, which can exert downward pressure on pricing. Looking ahead, the industry is positioned to benefit from tailwinds such as aging populations (which tend to have higher rates of disease) and technological advancements like minimally invasive procedures and connected devices that improve patient monitoring and outcomes. Innovations in robotic-assisted surgery and AI-driven diagnostics are also expected to accelerate adoption and expand treatment capabilities. However, potential headwinds include pricing pressures stemming from value-based care models and continued complexity changing from navigating regulatory frameworks that may prioritize further lowering healthcare costs.

Sales Growth

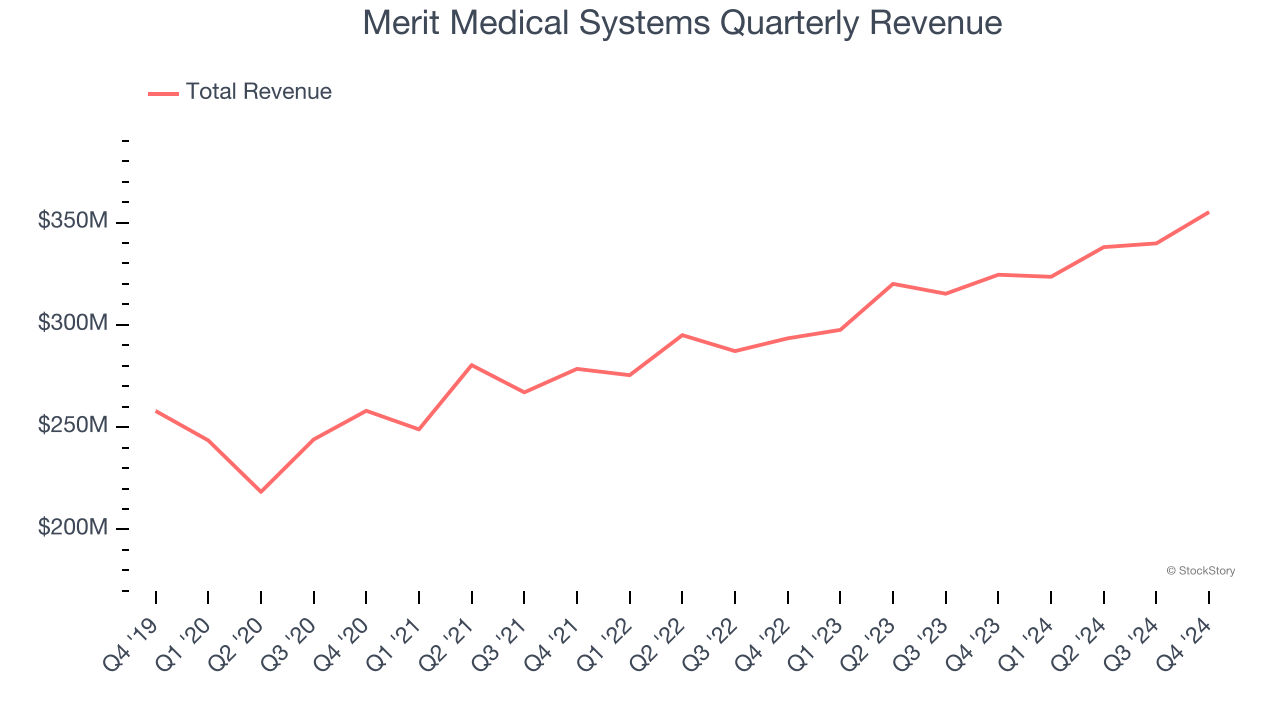

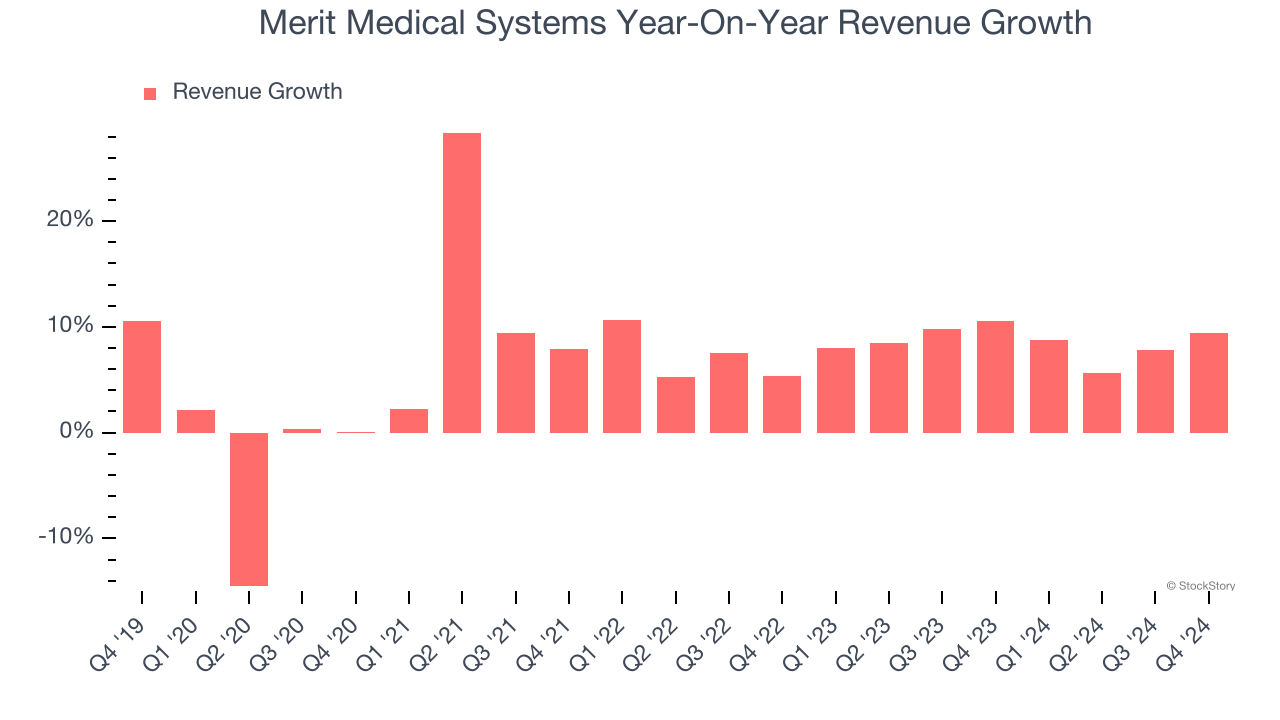

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Merit Medical Systems’s sales grew at a mediocre 6.4% compounded annual growth rate over the last five years. This fell short of our benchmark for the healthcare sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Merit Medical Systems’s annualized revenue growth of 8.6% over the last two years is above its five-year trend, suggesting some bright spots.

Merit Medical Systems also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Merit Medical Systems’s organic revenue averaged 7.3% year-on-year growth. Because this number aligns with its normal revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Merit Medical Systems reported year-on-year revenue growth of 9.4%, and its $355.2 million of revenue exceeded Wall Street’s estimates by 1%.

Looking ahead, sell-side analysts expect revenue to grow 9% over the next 12 months, similar to its two-year rate. This projection is admirable and implies the market is factoring in success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

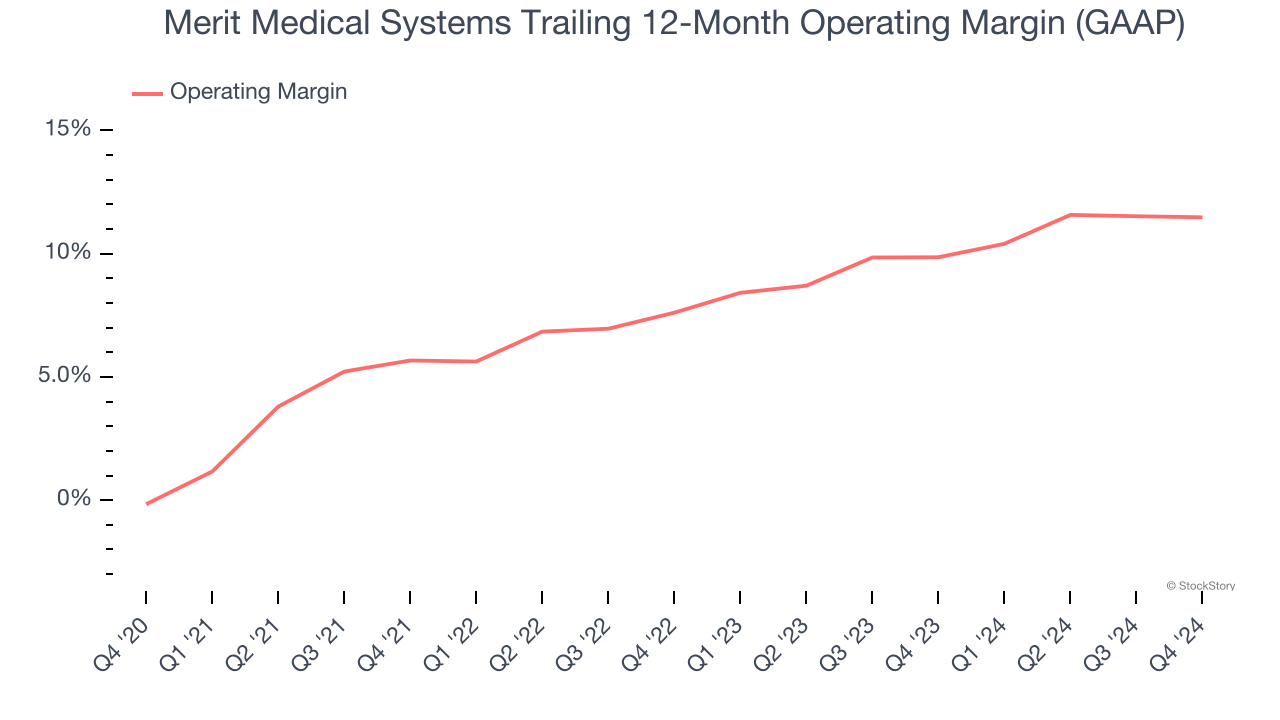

Merit Medical Systems was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.3% was weak for a healthcare business.

On the plus side, Merit Medical Systems’s operating margin rose by 11.6 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 3.9 percentage points on a two-year basis.

This quarter, Merit Medical Systems generated an operating profit margin of 10.3%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

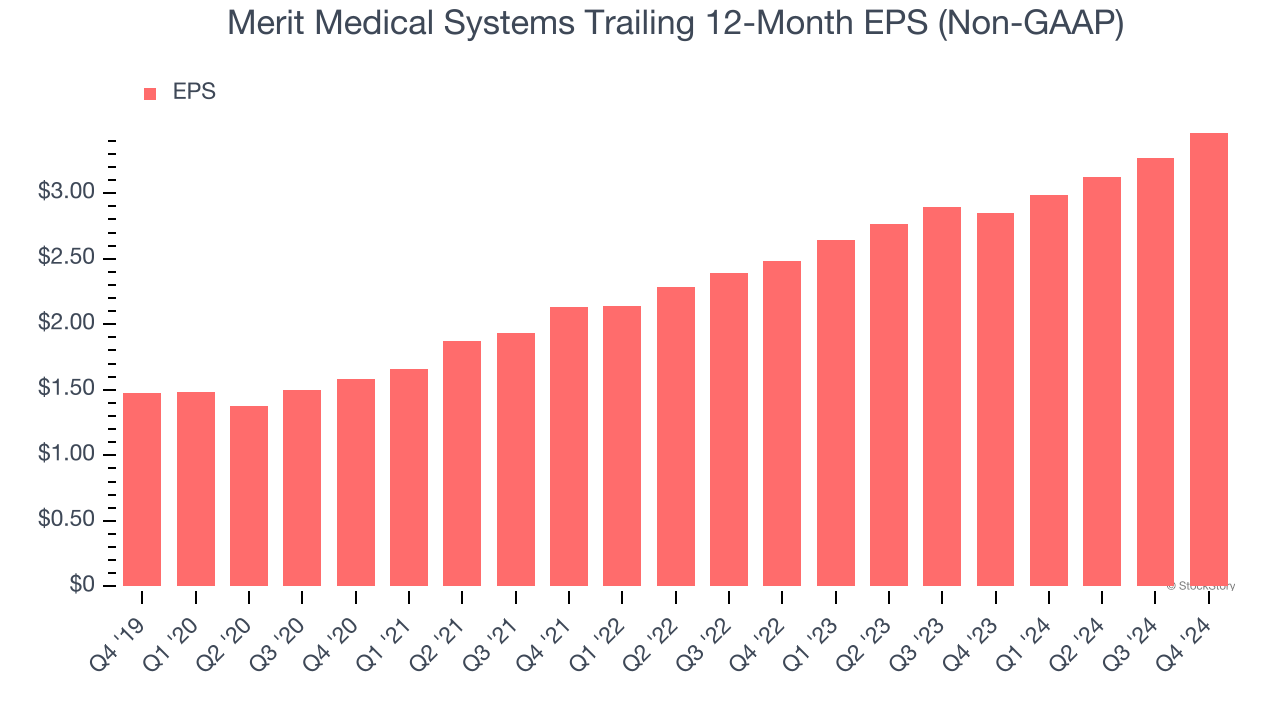

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Merit Medical Systems’s EPS grew at an astounding 18.6% compounded annual growth rate over the last five years, higher than its 6.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Merit Medical Systems’s earnings can give us a better understanding of its performance. As we mentioned earlier, Merit Medical Systems’s operating margin was flat this quarter but expanded by 11.6 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Merit Medical Systems reported EPS at $0.93, up from $0.74 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Merit Medical Systems’s full-year EPS of $3.46 to grow 8%.

Key Takeaways from Merit Medical Systems’s Q4 Results

It was encouraging to see Merit Medical Systems beat analysts’ EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance missed significantly. Overall, this quarter could have been better. The stock remained flat at $102 immediately after reporting.

So do we think Merit Medical Systems is an attractive buy at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.