Q4 Earnings Highs And Lows: Teledyne (NYSE:TDY) Vs The Rest Of The Inspection Instruments Stocks

As the Q4 earnings season wraps, let’s dig into this quarter’s best and worst performers in the inspection instruments industry, including Teledyne (NYSE: TDY) and its peers.

Measurement and inspection instrument companies may enjoy more steady demand because products such as water meters are non-discretionary and mandated for replacement at predictable intervals. In the last decade, digitization and data collection have driven innovation in the space, leading to incremental sales. But like the broader industrials sector, measurement and inspection instrument companies are at the whim of economic cycles. Interest rates, for example, can greatly impact civil, commercial, and residential construction projects that drive demand.

The 5 inspection instruments stocks we track reported a very strong Q4. As a group, revenues beat analysts’ consensus estimates by 2.3% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 5.3% on average since the latest earnings results.

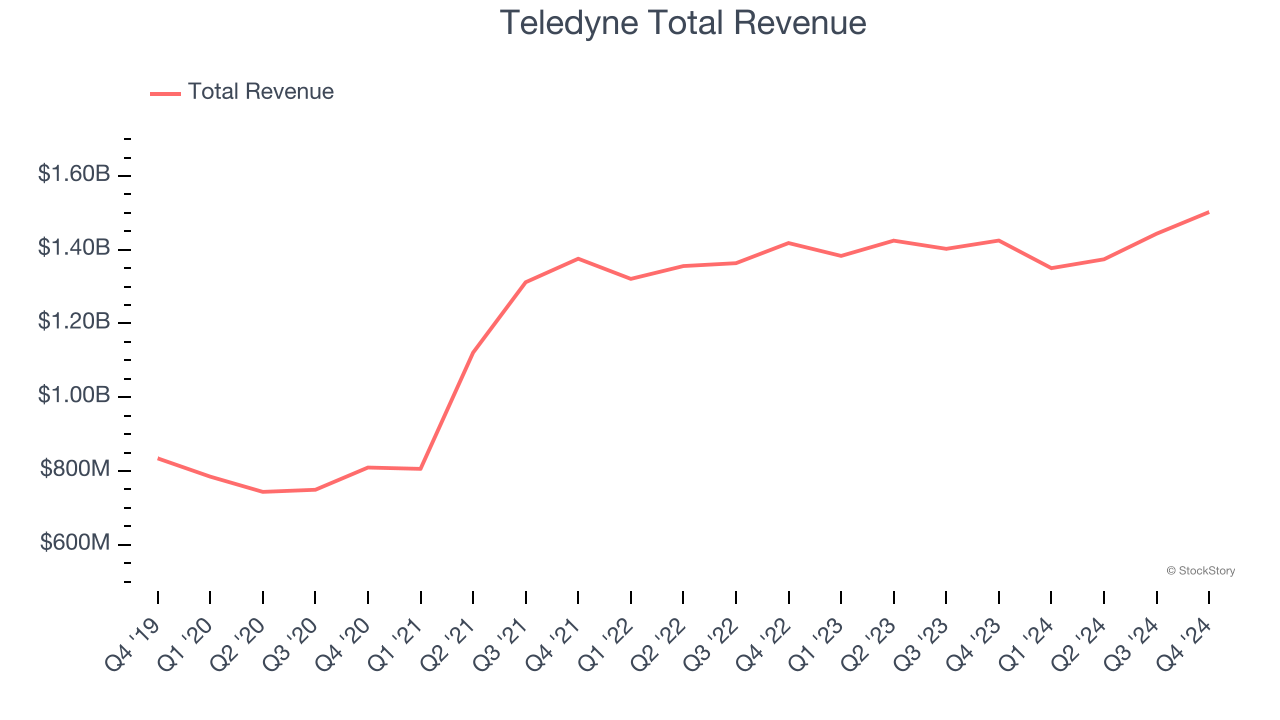

Teledyne (NYSE: TDY)

Playing a role in mapping the ocean floor as we know it today, Teledyne (NYSE: TDY) offers digital imaging and instrumentation products for various industries.

Teledyne reported revenues of $1.50 billion, up 5.4% year on year. This print exceeded analysts’ expectations by 3.6%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ EBITDA estimates.

“In the fourth quarter, we achieved all-time record sales and non-GAAP earnings per share,” said Robert Mehrabian, Executive Chairman.

Teledyne scored the biggest analyst estimates beat of the whole group. The stock is up 4.3% since reporting and currently trades at $500.86.

Is now the time to buy Teledyne? Access our full analysis of the earnings results here, it’s free.

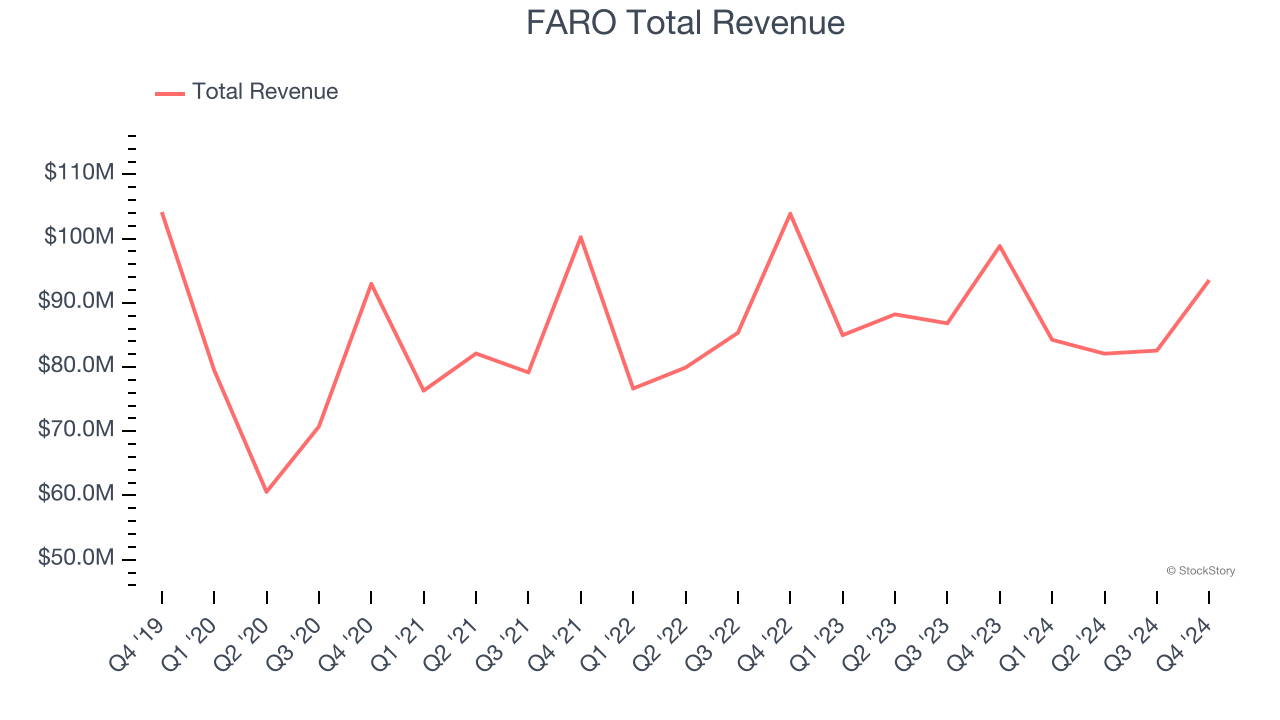

Best Q4: FARO (NASDAQ: FARO)

Launched by two PhD students in a garage, FARO (NASDAQ: FARO) provides 3D measurement and imaging systems for the manufacturing, construction, engineering, and public safety industries.

FARO reported revenues of $93.54 million, down 5.4% year on year, outperforming analysts’ expectations by 2.3%. The business had an exceptional quarter with EPS guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 15.5% since reporting. It currently trades at $31.30.

Is now the time to buy FARO? Access our full analysis of the earnings results here, it’s free.

Badger Meter (NYSE: BMI)

The developer of the world’s first frost-proof water meter in 1905, Badger Meter (NYSE: BMI) provides water control and measure equipment to various industries.

Badger Meter reported revenues of $205.2 million, up 12.5% year on year, exceeding analysts’ expectations by 2.3%. It was a satisfactory quarter as it also posted a solid beat of analysts’ adjusted operating income estimates but a significant miss of analysts’ EPS estimates.

As expected, the stock is down 1.3% since the results and currently trades at $205.86.

Read our full analysis of Badger Meter’s results here.

Keysight (NYSE: KEYS)

Spun off from Hewlett-Packard in 2014, Keysight (NYSE: KEYS) offers electronic measurement products for use in various sectors.

Keysight reported revenues of $1.30 billion, up 3.1% year on year. This number topped analysts’ expectations by 1.7%. More broadly, it was a satisfactory quarter as it also produced a solid beat of analysts’ EBITDA estimates but a miss of analysts’ backlog estimates.

Keysight had the weakest performance against analyst estimates among its peers. The stock is down 9.4% since reporting and currently trades at $156.01.

Read our full, actionable report on Keysight here, it’s free.

Itron (NASDAQ: ITRI)

Founded by a small group of engineers who wanted to build a more efficient way to read utility meters, Itron (NASDAQ: ITRI) offers energy and water management products for the utility industry, municipalities, and industrial customers.

Itron reported revenues of $612.9 million, up 6.2% year on year. This print beat analysts’ expectations by 1.7%. It was an exceptional quarter as it also produced EPS guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ EPS estimates.

The stock is up 17.3% since reporting and currently trades at $108.71.

Read our full, actionable report on Itron here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.