Q3 Earnings Roundup: Stratasys (NASDAQ:SSYS) And The Rest Of The Custom Parts Manufacturing Segment

The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Stratasys (NASDAQ: SSYS) and the rest of the custom parts manufacturing stocks fared in Q3.

Onshoring and inventory management–themes that grew in focus after COVID wreaked havoc on global supply chains–are tailwinds for companies that combine economies of scale with reliable service. Many in the space have adopted 3D printing to efficiently address the need for bespoke parts and components, but all companies are still at the whim of economic cycles. For example, consumer spending and interest rates can greatly impact the industrial production that drives demand for these companies’ offerings.

The 4 custom parts manufacturing stocks we track reported a satisfactory Q3. As a group, revenues missed analysts’ consensus estimates by 3.7% while next quarter’s revenue guidance was 1.1% below.

Thankfully, share prices of the companies have been resilient as they are up 6.7% on average since the latest earnings results.

Stratasys (NASDAQ: SSYS)

Born from the Founder’s idea of making a toy frog with a glue gun, Stratasys (NASDAQ: SSYS) offers 3D printers and related materials, software, and services to many industries.

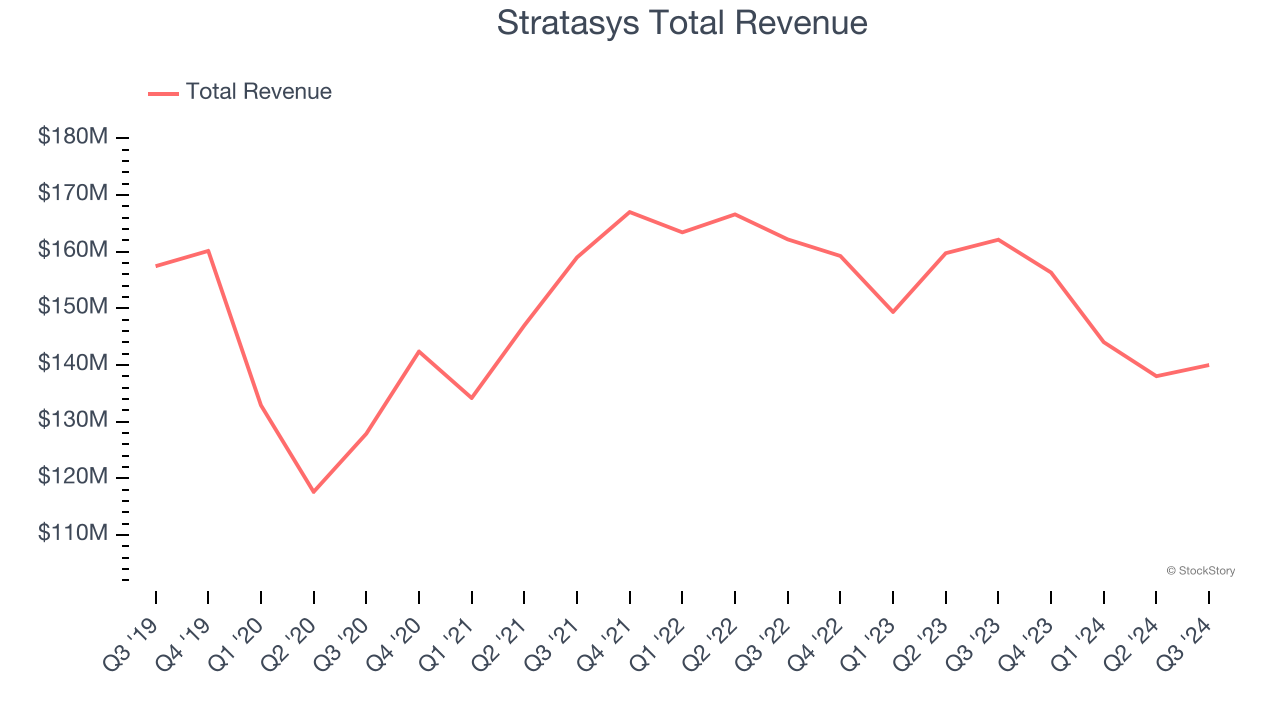

Stratasys reported revenues of $140 million, down 13.6% year on year. This print was in line with analysts’ expectations, and overall, it was an exceptional quarter for the company with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Dr. Yoav Zeif, Stratasys’ Chief Executive Officer, stated, "Our decisive actions to realign our business with current market realities are starting to yield results. We have successfully begun to transform the company through cost optimization and by focusing on higher-growth opportunities. Our flagship F3300 platform is gaining significant traction in the marketplace, while our expansion into our key target industries of Aerospace, Automotive and Healthcare continues to expand. Most importantly, we returned to non-GAAP profitability in the third quarter, overcoming ongoing revenue pressures, further demonstrating the effective execution of our business plan by our entire team.”

Stratasys scored the highest full-year guidance raise but had the slowest revenue growth of the whole group. The stock is up 11.6% since reporting and currently trades at $9.36.

Is now the time to buy Stratasys? Access our full analysis of the earnings results here, it’s free.

Best Q3: Proto Labs (NYSE: PRLB)

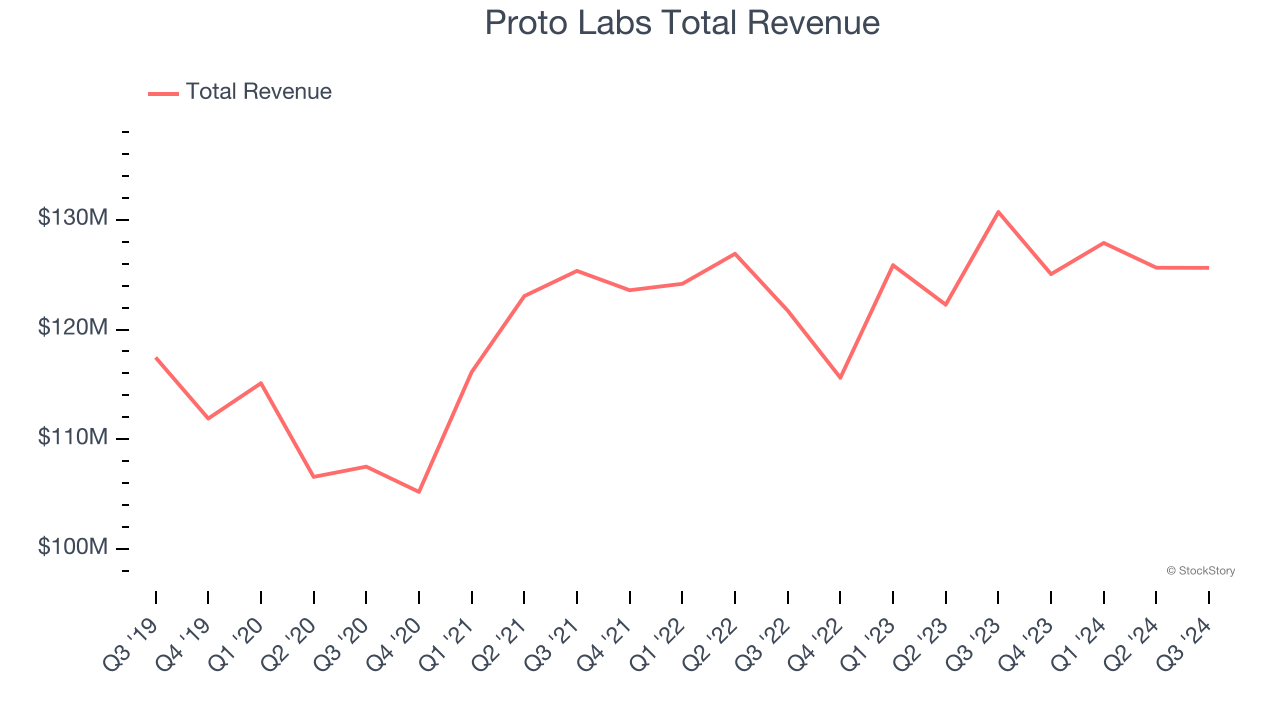

Pioneering the concept of online quoting and manufacturing for custom prototypes and low-volume production parts, Proto Labs (NYSE: PRLB) offers injection molding, 3D printing, and sheet metal fabrication for manufacturers in various industries.

Proto Labs reported revenues of $125.6 million, down 3.9% year on year, outperforming analysts’ expectations by 3.3%. The business had an exceptional quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Proto Labs pulled off the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 52.3% since reporting. It currently trades at $41.73.

Is now the time to buy Proto Labs? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: 3D Systems (NYSE: DDD)

Founded by the inventor of stereolithography, 3D Systems (NYSE: DDD) engineers, manufactures, and sells 3D printers and other related products to the aerospace, automotive, healthcare, and consumer goods industries.

3D Systems reported revenues of $112.9 million, down 8.8% year on year, falling short of analysts’ expectations by 1.7%. It was a softer quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

3D Systems delivered the weakest full-year guidance update in the group. The stock is flat since the results and currently trades at $3.37.

Read our full analysis of 3D Systems’s results here.

Markforged (NYSE: MKFG)

Beginning as a start-up at SolidWorks World–an annual design and engineering conference, Markforged (NYSE: MKFG) offers 3D printers and softwares to manufacturers of various industries.

Markforged reported revenues of $20.48 million, up 2% year on year. This number came in 16.6% below analysts' expectations. Overall, it was a softer quarter for the company.

Markforged scored the fastest revenue growth but had the weakest performance against analyst estimates among its peers. The stock is down 36.6% since reporting and currently trades at $2.83.

Read our full, actionable report on Markforged here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View MoreRecent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.